In the age of digital, where screens dominate our lives and the appeal of physical printed objects hasn't waned. For educational purposes in creative or artistic projects, or just adding personal touches to your space, How To Claim Home Loan Interest In Itr are a great source. We'll take a dive deep into the realm of "How To Claim Home Loan Interest In Itr," exploring what they are, how to get them, as well as how they can add value to various aspects of your life.

Get Latest How To Claim Home Loan Interest In Itr Below

How To Claim Home Loan Interest In Itr

How To Claim Home Loan Interest In Itr - How To Claim Home Loan Interest In Itr, How To Claim Home Loan Interest In Itr 2, How To Claim Home Loan Interest In Itr 3, How To Claim Home Loan Interest In Itr For Under Construction Property, How To Claim Home Loan Interest In Itr1, How To Declare Home Loan Interest In Itr, How To Declare Housing Loan Interest In Itr 1, How To Claim Deduction On Home Loan Interest In Itr 2, How To Claim Home Loan Interest And Principal In Itr, How Can I Claim My Home Loan Interest In Itr

How can I claim my home loan interest in ITR You can claim your home loan interest under section 24B while filing ITR Section 24B deals with the deduction of the interest component of your home loan of up to Rs 2 Lakhs

How to claim housing loan interest in ITR 1 You can claim deductions for both the interest on a home loan and principal repayment under Section 80C of the Income Tax Act by submitting the required documents to your employer

The How To Claim Home Loan Interest In Itr are a huge assortment of printable materials that are accessible online for free cost. They come in many formats, such as worksheets, templates, coloring pages, and more. The beauty of How To Claim Home Loan Interest In Itr is in their variety and accessibility.

More of How To Claim Home Loan Interest In Itr

How To Fill Home Loan In Income Tax Return ITR Home Loan Tax

How To Fill Home Loan In Income Tax Return ITR Home Loan Tax

Even under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for home loan One can treat only two houses as self occupied and

How to Claim House Loan Interest in ITR To claim the deduction for house loan interest in the ITR follow these steps Download the relevant ITR form from the income tax e filing portal Fill in the required personal and financial details

How To Claim Home Loan Interest In Itr have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Modifications: There is the possibility of tailoring designs to suit your personal needs in designing invitations to organize your schedule or decorating your home.

-

Educational Worth: Printing educational materials for no cost cater to learners of all ages, making them a valuable instrument for parents and teachers.

-

Simple: immediate access a myriad of designs as well as templates will save you time and effort.

Where to Find more How To Claim Home Loan Interest In Itr

Claim Home Loan Tax Benefits HRA Together For ITR Filing Telangana Today

Claim Home Loan Tax Benefits HRA Together For ITR Filing Telangana Today

Under Section 24 of the Income Tax Act a taxable individual can claim deduction on payment of interest for a home loan The property must be self occupied and maximum deduction allowed is Rs 2 lakhs

How to claim housing loan interest in ITR 1 You can claim deductions for both the interest on a home loan and principal repayment under Section 80C of the Income Tax Act by submitting the required documents to your employer

After we've peaked your interest in printables for free Let's find out where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of How To Claim Home Loan Interest In Itr for various goals.

- Explore categories such as decorations for the home, education and the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets as well as flashcards and other learning materials.

- This is a great resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- These blogs cover a broad spectrum of interests, starting from DIY projects to planning a party.

Maximizing How To Claim Home Loan Interest In Itr

Here are some unique ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Print out free worksheets and activities to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

How To Claim Home Loan Interest In Itr are an abundance with useful and creative ideas that meet a variety of needs and preferences. Their accessibility and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the plethora that is How To Claim Home Loan Interest In Itr today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are How To Claim Home Loan Interest In Itr truly available for download?

- Yes you can! You can download and print these documents for free.

-

Can I make use of free templates for commercial use?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables could be restricted concerning their use. Be sure to review the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home with any printer or head to an area print shop for the highest quality prints.

-

What software do I need to run How To Claim Home Loan Interest In Itr?

- Many printables are offered in the PDF format, and is open with no cost software, such as Adobe Reader.

How To Include Home Loan Interest In ITR What Is Cost Of Acquisition

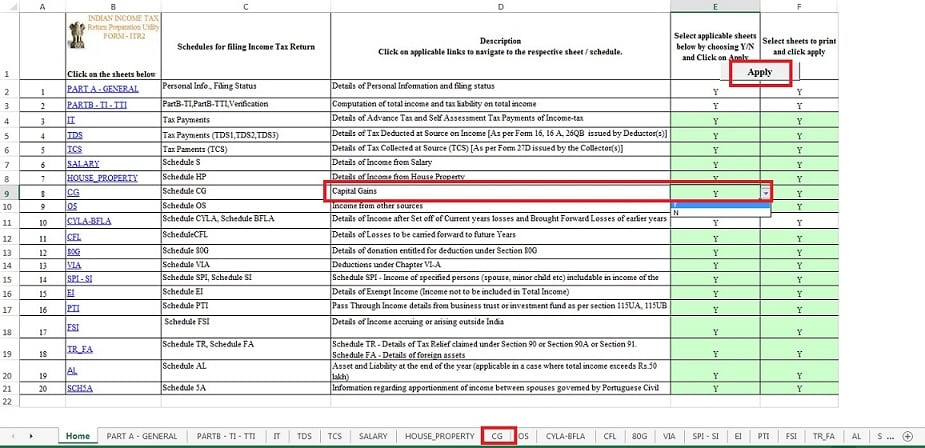

Customise ITR How To Remove Schedules Not Applicable To You

Check more sample of How To Claim Home Loan Interest In Itr below

How To Claim Home Office Expenses The Comic Accountant

How To Claim Home Loan Deduction In ITR Or How To Claim Home Loan

Income Tax Return How To Claim Home Loan Tax Rebate In This Husband

How To Claim Tax Benefits On Home Loan Bleu Finance

Is It Essential To File ITR To Avail Home Loan HDFC Sales Blog

How To Claim Home Loan Tax Exemption Real Estate Sector Latest News

https://cleartax.in/s/e-file-itr1-with-house-property-loan

How to claim housing loan interest in ITR 1 You can claim deductions for both the interest on a home loan and principal repayment under Section 80C of the Income Tax Act by submitting the required documents to your employer

https://cleartax.in/s/home-loan-tax-benefit

File your ITR to claim deduction on interest on home loan and principal repayment Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions for interest portion till the construction of the house is completed

How to claim housing loan interest in ITR 1 You can claim deductions for both the interest on a home loan and principal repayment under Section 80C of the Income Tax Act by submitting the required documents to your employer

File your ITR to claim deduction on interest on home loan and principal repayment Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions for interest portion till the construction of the house is completed

How To Claim Tax Benefits On Home Loan Bleu Finance

How To Claim Home Loan Deduction In ITR Or How To Claim Home Loan

Is It Essential To File ITR To Avail Home Loan HDFC Sales Blog

How To Claim Home Loan Tax Exemption Real Estate Sector Latest News

ITR Filing How To Claim Home Loan Tax Benefit And HRA Exemption

ITR 2 Form Eligibility Structure How To File ITR 2 Online

ITR 2 Form Eligibility Structure How To File ITR 2 Online

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint