In a world when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. If it's to aid in education and creative work, or simply to add some personal flair to your area, How To Claim Home Loan Interest In Itr For Under Construction Property have become a valuable resource. This article will take a dive into the world "How To Claim Home Loan Interest In Itr For Under Construction Property," exploring what they are, where you can find them, and how they can enhance various aspects of your life.

Get Latest How To Claim Home Loan Interest In Itr For Under Construction Property Below

How To Claim Home Loan Interest In Itr For Under Construction Property

How To Claim Home Loan Interest In Itr For Under Construction Property -

In order to claim Home Loan Tax Benefits on an under construction property the borrower must look for the Deductions section at the time of filing the income tax

If the loan is taken jointly then each of the loan holders can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment u s 80C up to Rs 1 5

Printables for free cover a broad assortment of printable, downloadable material that is available online at no cost. These resources come in many designs, including worksheets templates, coloring pages and more. The great thing about How To Claim Home Loan Interest In Itr For Under Construction Property is their flexibility and accessibility.

More of How To Claim Home Loan Interest In Itr For Under Construction Property

Is It Essential To File ITR To Avail Home Loan HDFC Sales Blog

Is It Essential To File ITR To Avail Home Loan HDFC Sales Blog

The value of the house property should be up to Rs 50 lakhs The home loan taken should be up to Rs 35 lakhs Section 80EE provides a deduction only for the interest portion of a house loan The house

The total home loan interest amount that you have paid during this period can be claimed as an under construction property tax benefit based on Section 24B

How To Claim Home Loan Interest In Itr For Under Construction Property have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Individualization There is the possibility of tailoring printed materials to meet your requirements whether it's making invitations for your guests, organizing your schedule or decorating your home.

-

Education Value The free educational worksheets cater to learners of all ages, which makes them an essential device for teachers and parents.

-

The convenience of You have instant access the vast array of design and templates reduces time and effort.

Where to Find more How To Claim Home Loan Interest In Itr For Under Construction Property

How To Include Home Loan Interest In ITR What Is Cost Of Acquisition

How To Include Home Loan Interest In ITR What Is Cost Of Acquisition

Income Heads Income Tax ITR 2 Last updated on February 7th 2023 The pre construction period is from the day of approval of home loan until the day of completion of

ITR filing How homebuyers can claim rebate on under construction flats 2 min read 28 Jan 2023 07 49 AM IST Join us Asit Manohar Income tax return Rebate on

Now that we've ignited your interest in printables for free, let's explore where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety and How To Claim Home Loan Interest In Itr For Under Construction Property for a variety needs.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing including flashcards, learning materials.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs are a vast variety of topics, all the way from DIY projects to party planning.

Maximizing How To Claim Home Loan Interest In Itr For Under Construction Property

Here are some fresh ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

How To Claim Home Loan Interest In Itr For Under Construction Property are an abundance of fun and practical tools that satisfy a wide range of requirements and pursuits. Their access and versatility makes them a fantastic addition to any professional or personal life. Explore the endless world that is How To Claim Home Loan Interest In Itr For Under Construction Property today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes you can! You can download and print these materials for free.

-

Do I have the right to use free printables to make commercial products?

- It's based on the rules of usage. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may have restrictions regarding their use. Always read the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- Print them at home using printing equipment or visit an area print shop for superior prints.

-

What program do I need to run printables at no cost?

- Many printables are offered in PDF format, which can be opened with free programs like Adobe Reader.

How To Claim Home Loan Deduction In ITR Or How To Claim Home Loan

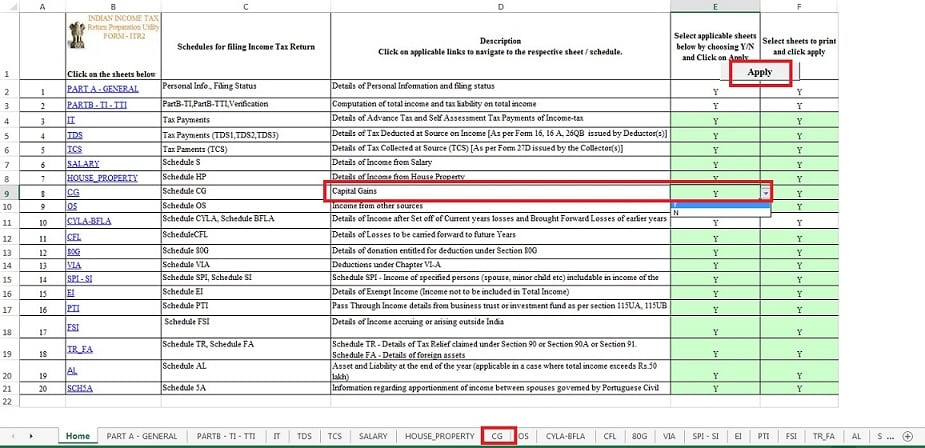

Customise ITR How To Remove Schedules Not Applicable To You

Check more sample of How To Claim Home Loan Interest In Itr For Under Construction Property below

Claim Home Loan Tax Benefits HRA Together For ITR Filing Telangana Today

How To Claim Home Office Expenses The Comic Accountant

Income Tax Return How To Claim Home Loan Tax Rebate In This Husband

Is It Essential To File ITR To Avail Home Loan HDFC Sales Blog

How To Claim Home Loan Tax Exemption Real Estate Sector Latest News

ITR 2 Form Eligibility Structure How To File ITR 2 Online

https://taxguru.in/income-tax/claim-deduction...

If the loan is taken jointly then each of the loan holders can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment u s 80C up to Rs 1 5

https://tax2win.in/guide/under-construction-property-tax-benefit

On the contrary constructing a home is a more economical option though it lacks the tax benefits associated with loan interest Nevertheless for self built homes

If the loan is taken jointly then each of the loan holders can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment u s 80C up to Rs 1 5

On the contrary constructing a home is a more economical option though it lacks the tax benefits associated with loan interest Nevertheless for self built homes

Is It Essential To File ITR To Avail Home Loan HDFC Sales Blog

How To Claim Home Office Expenses The Comic Accountant

How To Claim Home Loan Tax Exemption Real Estate Sector Latest News

ITR 2 Form Eligibility Structure How To File ITR 2 Online

ITR Filing How To Claim Home Loan Tax Benefit And HRA Exemption

How To Show F O Loss In ITR Which ITR You Should File ITR 3 Or 4

How To Show F O Loss In ITR Which ITR You Should File ITR 3 Or 4

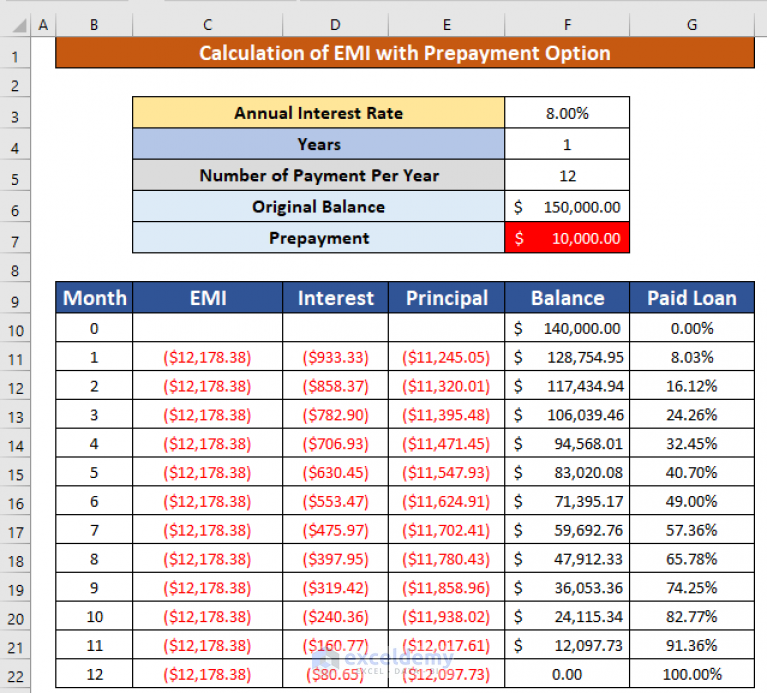

EMI Calculator With Prepayment Option In Excel Sheet with Easy Steps