In this digital age, in which screens are the norm but the value of tangible printed objects hasn't waned. In the case of educational materials for creative projects, simply adding an element of personalization to your home, printables for free can be an excellent source. Through this post, we'll take a dive deeper into "How Can I Claim My Home Loan Interest In Itr," exploring what they are, where to locate them, and how they can improve various aspects of your daily life.

Get Latest How Can I Claim My Home Loan Interest In Itr Below

How Can I Claim My Home Loan Interest In Itr

How Can I Claim My Home Loan Interest In Itr -

How to Claim House Loan Interest in ITR Conclusion What is Home Loan Interest Deduction u s 80EE Section 80EE of the Income Tax Act introduced in

How can I fill my home loan interest in ITR So let s understand where to Show Housing loan Interest in ITR 1 As we have

How Can I Claim My Home Loan Interest In Itr cover a large selection of printable and downloadable resources available online for download at no cost. These resources come in many kinds, including worksheets coloring pages, templates and much more. The benefit of How Can I Claim My Home Loan Interest In Itr is in their variety and accessibility.

More of How Can I Claim My Home Loan Interest In Itr

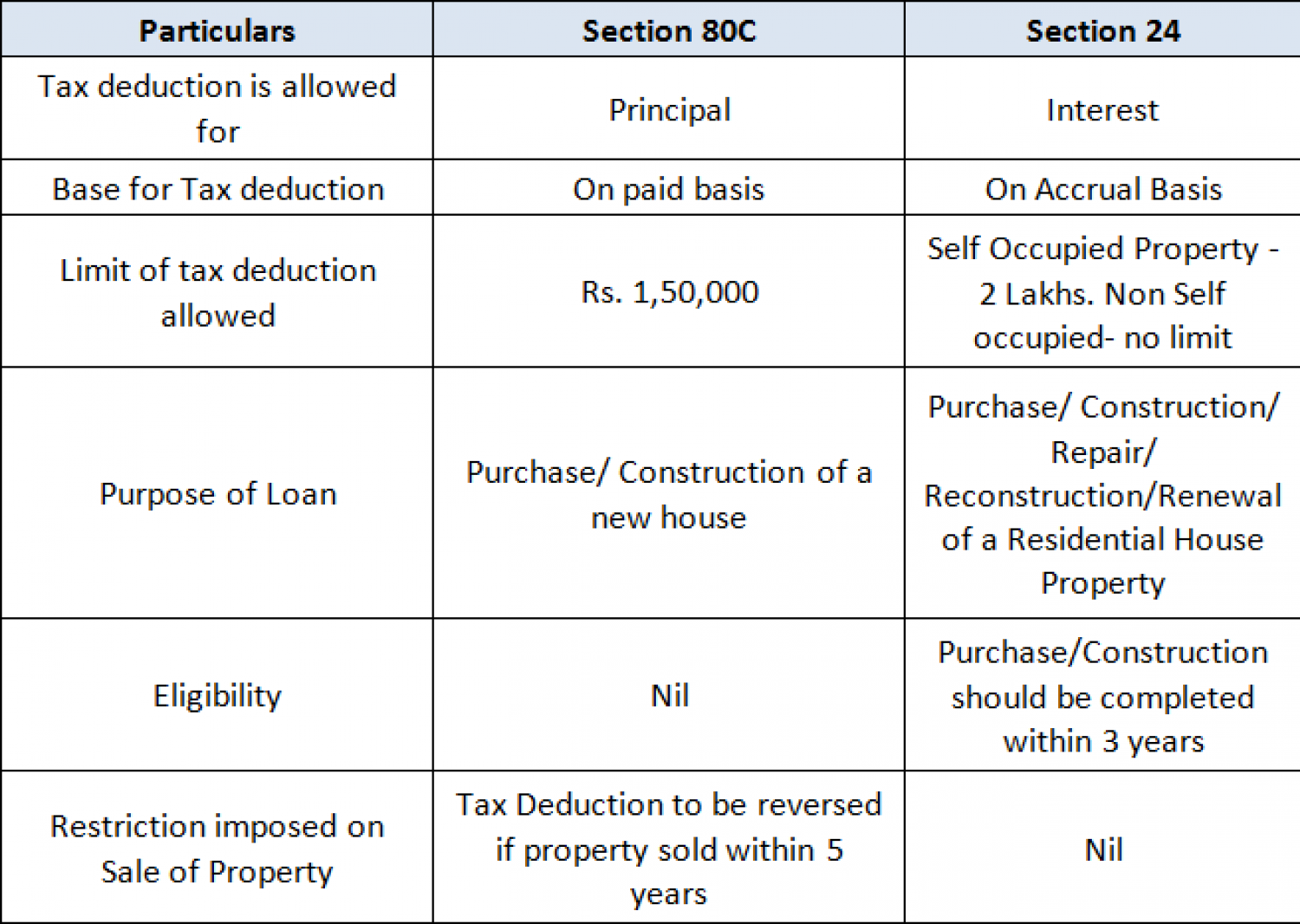

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

However you can claim tax benefits for the interest component of your second home 3 How can I claim my home loan interest in ITR You can claim your

Here s a step by step guide to help you claim the house loan interest in your ITR Collect Loan Documents Gather all the relevant documents related to your housing loan This includes the loan

How Can I Claim My Home Loan Interest In Itr have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Customization: It is possible to tailor the templates to meet your individual needs in designing invitations, organizing your schedule, or decorating your home.

-

Educational Impact: Downloads of educational content for free can be used by students of all ages. This makes them a useful tool for parents and educators.

-

Convenience: Access to a plethora of designs and templates will save you time and effort.

Where to Find more How Can I Claim My Home Loan Interest In Itr

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to possession can be claimed over the next 5

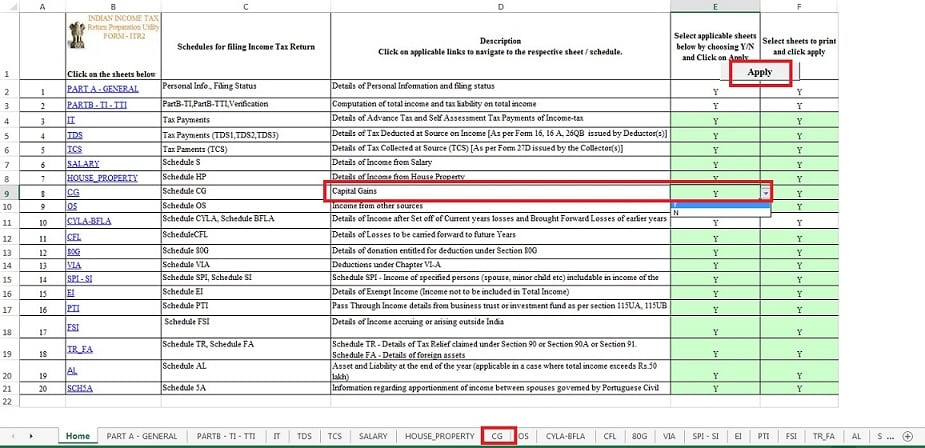

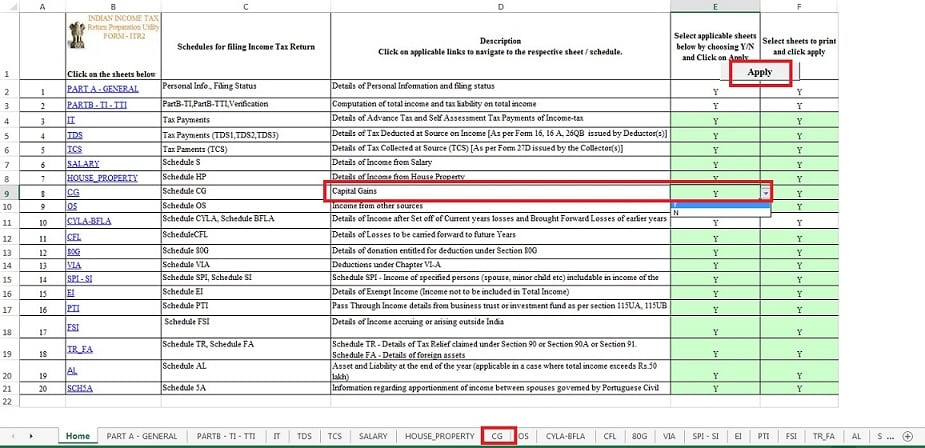

How to fill home loan Interest and Capital in ITR Portal How to Claim Tax Benefits on Home Loans Rakibhusain tech s SurgeonThe new e filing portal www

If we've already piqued your curiosity about How Can I Claim My Home Loan Interest In Itr Let's find out where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of How Can I Claim My Home Loan Interest In Itr suitable for many applications.

- Explore categories such as decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets with flashcards and other teaching tools.

- The perfect resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a wide selection of subjects, including DIY projects to planning a party.

Maximizing How Can I Claim My Home Loan Interest In Itr

Here are some innovative ways create the maximum value of How Can I Claim My Home Loan Interest In Itr:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home and in class.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

How Can I Claim My Home Loan Interest In Itr are a treasure trove with useful and creative ideas which cater to a wide range of needs and desires. Their availability and versatility make them an essential part of both personal and professional life. Explore the many options of How Can I Claim My Home Loan Interest In Itr and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes you can! You can download and print these files for free.

-

Can I download free printables in commercial projects?

- It's contingent upon the specific usage guidelines. Always read the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may have restrictions in their usage. You should read the terms and conditions set forth by the designer.

-

How can I print printables for free?

- You can print them at home with your printer or visit the local print shops for superior prints.

-

What program is required to open printables for free?

- Most printables come in the PDF format, and is open with no cost software, such as Adobe Reader.

How To Fill Home Loan In Income Tax Return ITR Home Loan Tax

Tax Benefits On Home Loan Know More At Taxhelpdesk

Check more sample of How Can I Claim My Home Loan Interest In Itr below

Is It Essential To File ITR To Avail Home Loan HDFC Sales Blog

How To Include Home Loan Interest In ITR What Is Cost Of Acquisition

Claim Home Loan Tax Benefits HRA Together For ITR Filing Telangana Today

Customise ITR How To Remove Schedules Not Applicable To You

How To Claim Home Loan Deduction In ITR Or How To Claim Home Loan

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

https://financialcontrol.in/where-to-show-housing...

How can I fill my home loan interest in ITR So let s understand where to Show Housing loan Interest in ITR 1 As we have

https://www.youtube.com/watch?v=fsH4KCbarw4

HowTo Declaring Home Loan Interest in the ITR 1 While Filing the Income Tax Returns using ITR 1 form how do you declare the home loan interest is explained more

How can I fill my home loan interest in ITR So let s understand where to Show Housing loan Interest in ITR 1 As we have

HowTo Declaring Home Loan Interest in the ITR 1 While Filing the Income Tax Returns using ITR 1 form how do you declare the home loan interest is explained more

Customise ITR How To Remove Schedules Not Applicable To You

How To Include Home Loan Interest In ITR What Is Cost Of Acquisition

How To Claim Home Loan Deduction In ITR Or How To Claim Home Loan

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Is It Essential To File ITR To Avail Home Loan HDFC Sales Blog

Income Tax Return Filing Last Date Revised ITR Deadline For Taxpayers

Income Tax Return Filing Last Date Revised ITR Deadline For Taxpayers

Section 80EE Income Tax Deduction For Interest On Home Loan