In this age of technology, when screens dominate our lives but the value of tangible printed objects isn't diminished. If it's to aid in education and creative work, or simply to add the personal touch to your space, How To Claim Deduction On Home Loan Interest In Itr 2 are now an essential source. In this article, we'll take a dive into the sphere of "How To Claim Deduction On Home Loan Interest In Itr 2," exploring the benefits of them, where they are, and how they can be used to enhance different aspects of your daily life.

Get Latest How To Claim Deduction On Home Loan Interest In Itr 2 Below

How To Claim Deduction On Home Loan Interest In Itr 2

How To Claim Deduction On Home Loan Interest In Itr 2 -

Under the income tax laws there are no restrictions on the number of

Option to avail benefit u s 115BAC is provided in ITRs For assessee opting under

How To Claim Deduction On Home Loan Interest In Itr 2 offer a wide collection of printable documents that can be downloaded online at no cost. They are available in a variety of designs, including worksheets coloring pages, templates and much more. The appealingness of How To Claim Deduction On Home Loan Interest In Itr 2 is their versatility and accessibility.

More of How To Claim Deduction On Home Loan Interest In Itr 2

YouTube

YouTube

To claim the deduction under Section 80EE individuals must meet the

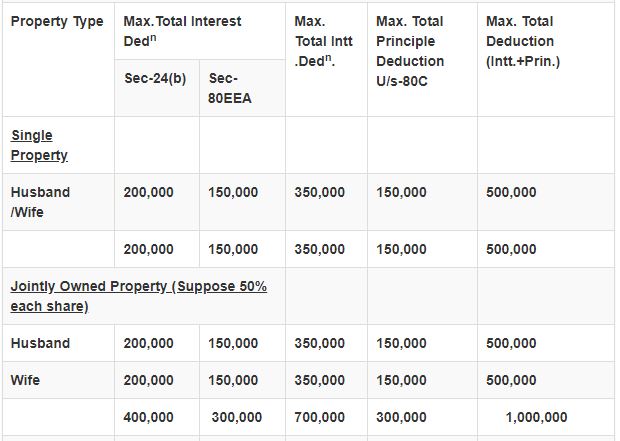

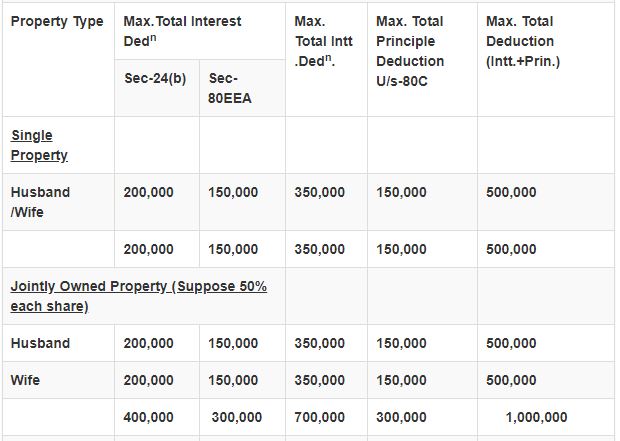

Government introduces further deduction of home loan 2021 budget to boost real estate sector and provide additional deduction to the taxpayer Following are the conditions to be satisfied for availing

How To Claim Deduction On Home Loan Interest In Itr 2 have garnered immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: There is the possibility of tailoring the design to meet your needs whether you're designing invitations to organize your schedule or even decorating your home.

-

Educational Use: Printables for education that are free are designed to appeal to students from all ages, making the perfect tool for parents and teachers.

-

An easy way to access HTML0: Access to many designs and templates is time-saving and saves effort.

Where to Find more How To Claim Deduction On Home Loan Interest In Itr 2

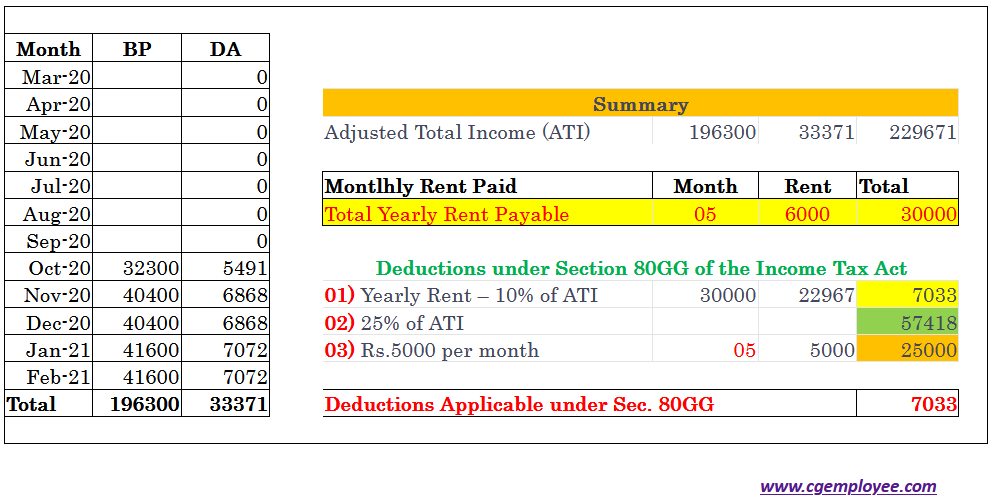

How To Claim Deduction Under Section 80GG Of Income Tax Act For Rent

How To Claim Deduction Under Section 80GG Of Income Tax Act For Rent

Section 80EE of the Income Tax Act deals with deductions on interest

Individuals can claim tax deductions up to a maximum of Rs 1 5 lakh

In the event that we've stirred your interest in How To Claim Deduction On Home Loan Interest In Itr 2, let's explore where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of How To Claim Deduction On Home Loan Interest In Itr 2 to suit a variety of goals.

- Explore categories like design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free or flashcards as well as learning materials.

- Perfect for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- These blogs cover a wide spectrum of interests, starting from DIY projects to planning a party.

Maximizing How To Claim Deduction On Home Loan Interest In Itr 2

Here are some innovative ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets from the internet for teaching at-home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

How To Claim Deduction On Home Loan Interest In Itr 2 are a treasure trove of practical and imaginative resources that can meet the needs of a variety of people and needs and. Their accessibility and versatility make them a wonderful addition to both professional and personal lives. Explore the many options of How To Claim Deduction On Home Loan Interest In Itr 2 today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I download free printouts for commercial usage?

- It is contingent on the specific terms of use. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables could be restricted on their use. Be sure to read the terms of service and conditions provided by the creator.

-

How do I print How To Claim Deduction On Home Loan Interest In Itr 2?

- You can print them at home with the printer, or go to the local print shop for more high-quality prints.

-

What software do I require to open printables for free?

- A majority of printed materials are in PDF format, which can be opened using free software like Adobe Reader.

How To Fill Home Loan In Income Tax Return ITR Home Loan Tax

How To Include Home Loan Interest In ITR What Is Cost Of Acquisition

Check more sample of How To Claim Deduction On Home Loan Interest In Itr 2 below

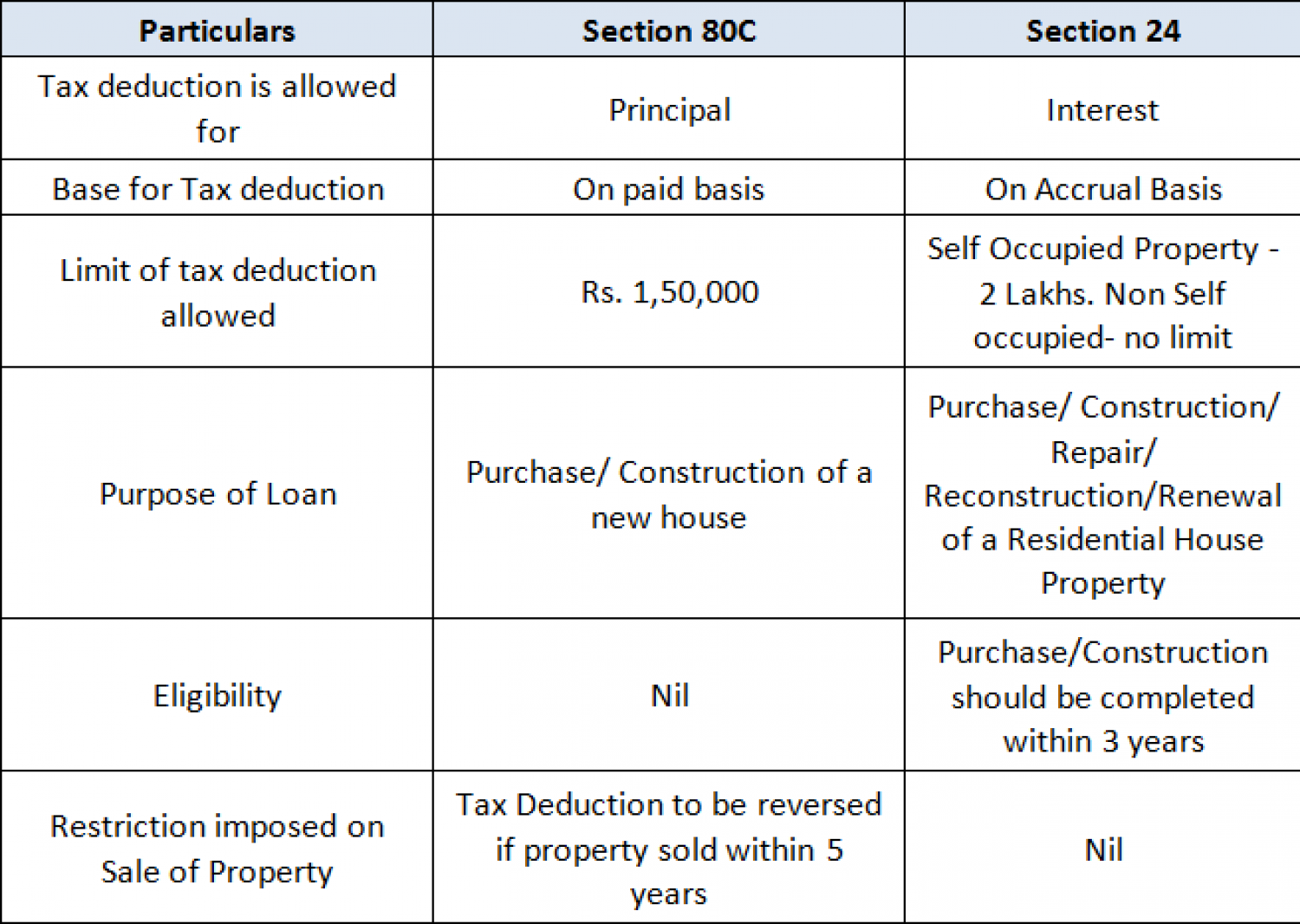

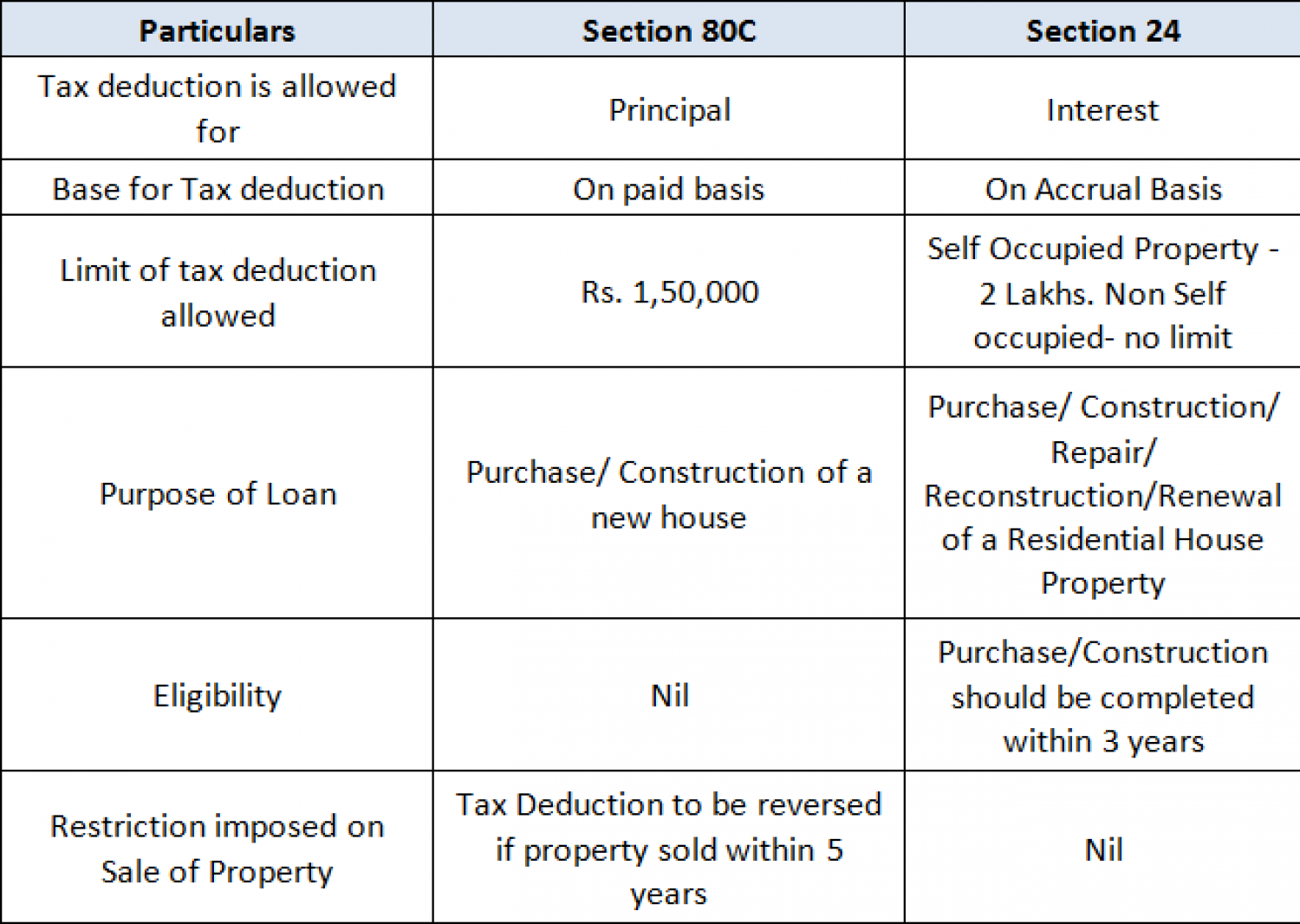

How To Claim Deduction In 80C incometax taxdeductions 80c

How To Claim Home Loan Deduction In ITR Or How To Claim Home Loan

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

Section 80EE Of Income Tax Act Deduction On Home Loan

Planning To Claim Deduction On Home Loan Get Loan Before March 31

Under construction House How To Claim Tax Deduction On Home Loan

https://www.incometax.gov.in/iec/foportal/sites/...

Option to avail benefit u s 115BAC is provided in ITRs For assessee opting under

https://tax2win.in/guide/section-80ee

For claiming deductions under this section the loan must have been sanctioned between 01 04 16 to 31 03 17 Eligibility for

Option to avail benefit u s 115BAC is provided in ITRs For assessee opting under

For claiming deductions under this section the loan must have been sanctioned between 01 04 16 to 31 03 17 Eligibility for

Section 80EE Of Income Tax Act Deduction On Home Loan

How To Claim Home Loan Deduction In ITR Or How To Claim Home Loan

Planning To Claim Deduction On Home Loan Get Loan Before March 31

Under construction House How To Claim Tax Deduction On Home Loan

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Section 80EE Income Tax Deduction For Interest On Home Loan