In a world where screens rule our lives, the charm of tangible printed items hasn't gone away. Whatever the reason, whether for education or creative projects, or simply to add a personal touch to your home, printables for free are now an essential resource. For this piece, we'll dive into the sphere of "House Rent Paid Deduction In Income Tax," exploring what they are, how to find them and how they can add value to various aspects of your daily life.

Get Latest House Rent Paid Deduction In Income Tax Below

House Rent Paid Deduction In Income Tax

House Rent Paid Deduction In Income Tax - House Rent Paid Deduction In Income Tax, House Rent Allowance Deduction In Income Tax, House Rent Allowance Deduction In Income Tax Section, House Rent Received Deduction In Income Tax, House Rent Received Deduction In Income Tax Section, House Rent Paid Rebate In Income Tax, House Rent Allowance Rebate In Income Tax, House Rent Paid Deduction Under Income Tax, Deduction For House Rent Paid, Deduction From House Rent Income

Salaried individuals who live in a rented house can claim this exemption and bring down their taxes HRA can be fully or partially exempt from tax Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable

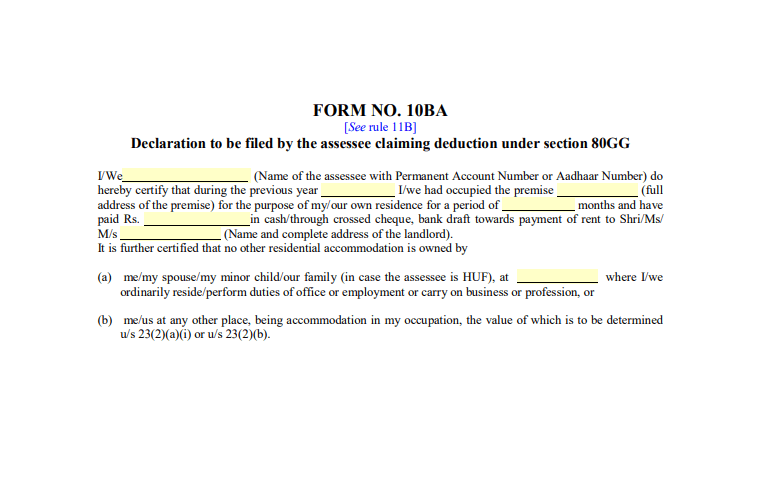

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied property no deduction under section 80GG is allowed You will be required to file Form 10BA with details of the payment of rent

House Rent Paid Deduction In Income Tax offer a wide selection of printable and downloadable materials available online at no cost. These resources come in various forms, including worksheets, templates, coloring pages and many more. The value of House Rent Paid Deduction In Income Tax is in their variety and accessibility.

More of House Rent Paid Deduction In Income Tax

HRA Calculation In Salary How To Claim Rent Paid Deduction 80GG

HRA Calculation In Salary How To Claim Rent Paid Deduction 80GG

Let us understand the HRA component that would be exempt from income tax during FY 2023 24 As per the given data calculate the following HRA would be the lowest of the following HRA received Rs 1 lakh 50 of basic salary and DA Rs 1 62 000 50 Rs 25 000 Rs 2 000 12 months Rent paid minus 10 of salary Rs 1 47 600

The rate for capital income tax is 30 up to 30 000 and it rises to 34 for amounts exceeding the 30 000 threshold How to report the income and pay the tax Instructions for informing the Tax Administration of your rental income and for paying the tax What can you deduct See complete list of deductions Temporary and occasional rentals

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

The ability to customize: The Customization feature lets you tailor the templates to meet your individual needs for invitations, whether that's creating them and schedules, or even decorating your house.

-

Educational value: Free educational printables are designed to appeal to students of all ages. This makes them an essential tool for teachers and parents.

-

Affordability: Access to various designs and templates will save you time and effort.

Where to Find more House Rent Paid Deduction In Income Tax

Material Requirement Form House Rent Deduction In Income Tax Section

Material Requirement Form House Rent Deduction In Income Tax Section

You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable The calculation of HRA deduction depends on multiple factors such as Your salary HRA received Actual rent paid City of residence 2 Eligibility Criteria To Claim Tax Deduction On HRA

INDEX What is House Rent Allowance HRA Exemption Rules and Calculation Can a taxpayer claim both deductions on Home Loan HRA What if you don t receive HRA FAQs What is House Rent Allowance HRA House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation

Now that we've piqued your interest in House Rent Paid Deduction In Income Tax and other printables, let's discover where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of House Rent Paid Deduction In Income Tax to suit a variety of uses.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- The blogs are a vast variety of topics, ranging from DIY projects to party planning.

Maximizing House Rent Paid Deduction In Income Tax

Here are some creative ways to make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

House Rent Paid Deduction In Income Tax are an abundance of creative and practical resources that meet a variety of needs and interests. Their accessibility and versatility make they a beneficial addition to any professional or personal life. Explore the endless world of House Rent Paid Deduction In Income Tax today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes they are! You can print and download these items for free.

-

Can I utilize free printables for commercial purposes?

- It's determined by the specific conditions of use. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may contain restrictions in their usage. Make sure to read the terms and conditions provided by the designer.

-

How can I print House Rent Paid Deduction In Income Tax?

- Print them at home using either a printer or go to an area print shop for high-quality prints.

-

What software do I need to run House Rent Paid Deduction In Income Tax?

- The majority are printed as PDF files, which can be opened using free software such as Adobe Reader.

Deduction In Income For House Rent Paid Under 80GG YouTube

Rent Paid Deduction In Hindi

Check more sample of House Rent Paid Deduction In Income Tax below

Section 80GG Of Income Tax Act House Rent Deduction In Income Tax

80GG Rent Paid Deduction Every Businessman Saves Tax shorts YouTube

Rent Paid Deduction In Hindi

Income Tax Deduction For Rent Paid Section 80GG IndiaFilings

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cleartax.in/s/claim-deduction-under-section-80gg-for-rent-paid

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied property no deduction under section 80GG is allowed You will be required to file Form 10BA with details of the payment of rent

https://www.vero.fi/en/individuals/property/rental...

How to report the ongoing year s rental income in 2024 There are two alternative ways to report rental income and pay tax on it in advance before the year has ended One option is to ask for a revised tax card on which the Tax Administration will adjust your withholding rate by reference to your estimated rental income and expenses

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied property no deduction under section 80GG is allowed You will be required to file Form 10BA with details of the payment of rent

How to report the ongoing year s rental income in 2024 There are two alternative ways to report rental income and pay tax on it in advance before the year has ended One option is to ask for a revised tax card on which the Tax Administration will adjust your withholding rate by reference to your estimated rental income and expenses

Income Tax Deduction For Rent Paid Section 80GG IndiaFilings

80GG Rent Paid Deduction Every Businessman Saves Tax shorts YouTube

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

How To Calculate Standard Deduction In Income Tax Act Scripbox

Deduction In Respect Of Rent Paid Sec 80GG Eligibility Calculation

Section 80GG Of Income Tax Act Tax Deduction On Rent Paid

Section 80GG Of Income Tax Act Tax Deduction On Rent Paid

Deduction In Income Tax For Rent Paid Thetaxtalk