Today, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses, creative projects, or simply to add an element of personalization to your area, House Rent Received Deduction In Income Tax Section can be an excellent resource. The following article is a dive into the world "House Rent Received Deduction In Income Tax Section," exploring what they are, how to find them, and how they can be used to enhance different aspects of your daily life.

Get Latest House Rent Received Deduction In Income Tax Section Below

House Rent Received Deduction In Income Tax Section

House Rent Received Deduction In Income Tax Section -

Verkko 17 hein 228 k 2018 nbsp 0183 32 House rent allowance HRA is received by the salaried class A deduction is permissible under Section 10 13A of the Income Tax Act in accordance with Rule 2A of the Income Tax Rules You can claim exemption on your HRA under the Income Tax Act if you stay in a rented house and get a HRA from your employer

Verkko 31 hein 228 k 2023 nbsp 0183 32 What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section 80GG towards rent that you pay Learn more

Printables for free cover a broad collection of printable items that are available online at no cost. They come in many formats, such as worksheets, templates, coloring pages, and more. The benefit of House Rent Received Deduction In Income Tax Section is in their variety and accessibility.

More of House Rent Received Deduction In Income Tax Section

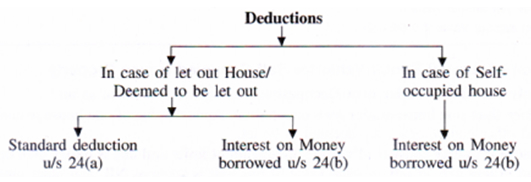

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

Verkko 26 hein 228 k 2023 nbsp 0183 32 Under the Income Tax Act rental income is taxed under Section 24 in the hands of the owner under the head income from house property However the rent earned by letting out vacant land is not taxed under this category but is taxed under income from other sources

Verkko 9 helmik 2023 nbsp 0183 32 Under Section 80GG the deduction is allowed to an individual who pays rent without receiving any House Rent Allowance from an employer Hence check your Salary Slip to see if you are receiving any House Rent Allowance If you do you can t claim a deduction for rent paid under section 80GG

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization: Your HTML0 customization options allow you to customize printables to your specific needs whether it's making invitations, organizing your schedule, or even decorating your house.

-

Education Value Printing educational materials for no cost offer a wide range of educational content for learners of all ages, which makes them a useful instrument for parents and teachers.

-

Convenience: instant access a plethora of designs and templates saves time and effort.

Where to Find more House Rent Received Deduction In Income Tax Section

Section 24 Deduction Income From House Property

Section 24 Deduction Income From House Property

Verkko 27 helmik 2023 nbsp 0183 32 If you don t receive HRA House Rent Allowance but pay rent you can still get a tax deduction on the rent paid under Section 80 GG of the Income Tax Act 1961 The maximum deduction permitted under Section 80 GG is Rs 60 000 per annum Rs 5 000 per month

Verkko 12 lokak 2021 nbsp 0183 32 The unrealized rent is deducted from the actual rent receivable from the property before computing income from that property subject to fulfilment of following conditions prescribed under Rule 4 of the Income Tax Rules 1962

Since we've got your interest in printables for free We'll take a look around to see where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection and House Rent Received Deduction In Income Tax Section for a variety objectives.

- Explore categories like interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- The blogs are a vast selection of subjects, including DIY projects to party planning.

Maximizing House Rent Received Deduction In Income Tax Section

Here are some new ways how you could make the most use of House Rent Received Deduction In Income Tax Section:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

House Rent Received Deduction In Income Tax Section are an abundance of practical and imaginative resources that meet a variety of needs and interests. Their accessibility and versatility make them a fantastic addition to the professional and personal lives of both. Explore the vast world that is House Rent Received Deduction In Income Tax Section today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are House Rent Received Deduction In Income Tax Section really free?

- Yes you can! You can download and print these resources at no cost.

-

Can I download free printouts for commercial usage?

- It's dependent on the particular usage guidelines. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables may be subject to restrictions regarding their use. Be sure to check the terms and regulations provided by the creator.

-

How can I print House Rent Received Deduction In Income Tax Section?

- Print them at home using printing equipment or visit the local print shops for better quality prints.

-

What program will I need to access printables that are free?

- Most printables come in PDF format, which can be opened with free software such as Adobe Reader.

Does My Corporation Qualify For The Dividends Received Deduction

Is Your Corporation Eligible For The Dividends received Deduction

Check more sample of House Rent Received Deduction In Income Tax Section below

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Is Your Corporation Eligible For The Dividends received Deduction

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

Does Your Business Qualify For The Dividends Received Deduction

Make Optimum Use Of The Dividend Received Deduction DRD KBC Banking

Section 80GG Of Income Tax Act Tax Deduction On Rent Paid

https://cleartax.in/s/claim-deduction-under-section-80gg-for-rent-paid

Verkko 31 hein 228 k 2023 nbsp 0183 32 What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section 80GG towards rent that you pay Learn more

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Verkko 22 syysk 2022 nbsp 0183 32 You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable The calculation of HRA deduction depends on multiple factors such as Your salary HRA received Actual rent paid City of residence 2 Eligibility Criteria To Claim Tax Deduction On HRA

Verkko 31 hein 228 k 2023 nbsp 0183 32 What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section 80GG towards rent that you pay Learn more

Verkko 22 syysk 2022 nbsp 0183 32 You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable The calculation of HRA deduction depends on multiple factors such as Your salary HRA received Actual rent paid City of residence 2 Eligibility Criteria To Claim Tax Deduction On HRA

Does Your Business Qualify For The Dividends Received Deduction

Is Your Corporation Eligible For The Dividends received Deduction

Make Optimum Use Of The Dividend Received Deduction DRD KBC Banking

Section 80GG Of Income Tax Act Tax Deduction On Rent Paid

In Each Of The Following Independent Situations Determine The

Maximum Corporate Tax Rates And The Dividends Received Deduction 1984

Maximum Corporate Tax Rates And The Dividends Received Deduction 1984

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c