In this age of technology, where screens have become the dominant feature of our lives and the appeal of physical printed products hasn't decreased. No matter whether it's for educational uses project ideas, artistic or simply to add an extra personal touch to your space, House Rent Allowance Deduction In Income Tax can be an excellent source. In this article, we'll dive in the world of "House Rent Allowance Deduction In Income Tax," exploring the different types of printables, where you can find them, and the ways that they can benefit different aspects of your life.

Get Latest House Rent Allowance Deduction In Income Tax Below

House Rent Allowance Deduction In Income Tax

House Rent Allowance Deduction In Income Tax - House Rent Allowance Deduction In Income Tax, House Rent Allowance Rebate In Income Tax, House Rent Allowance Exemption In Income Tax, House Rent Exemption In Income Tax, House Rent Exemption In Income Tax Section, House Rent Exemption In Income Tax Calculator, House Rent Paid Exemption In Income Tax, Room Rent Exemption In Income Tax, House Rent Allowance Deduction Under Section, House Rent Paid Deduction In Income Tax

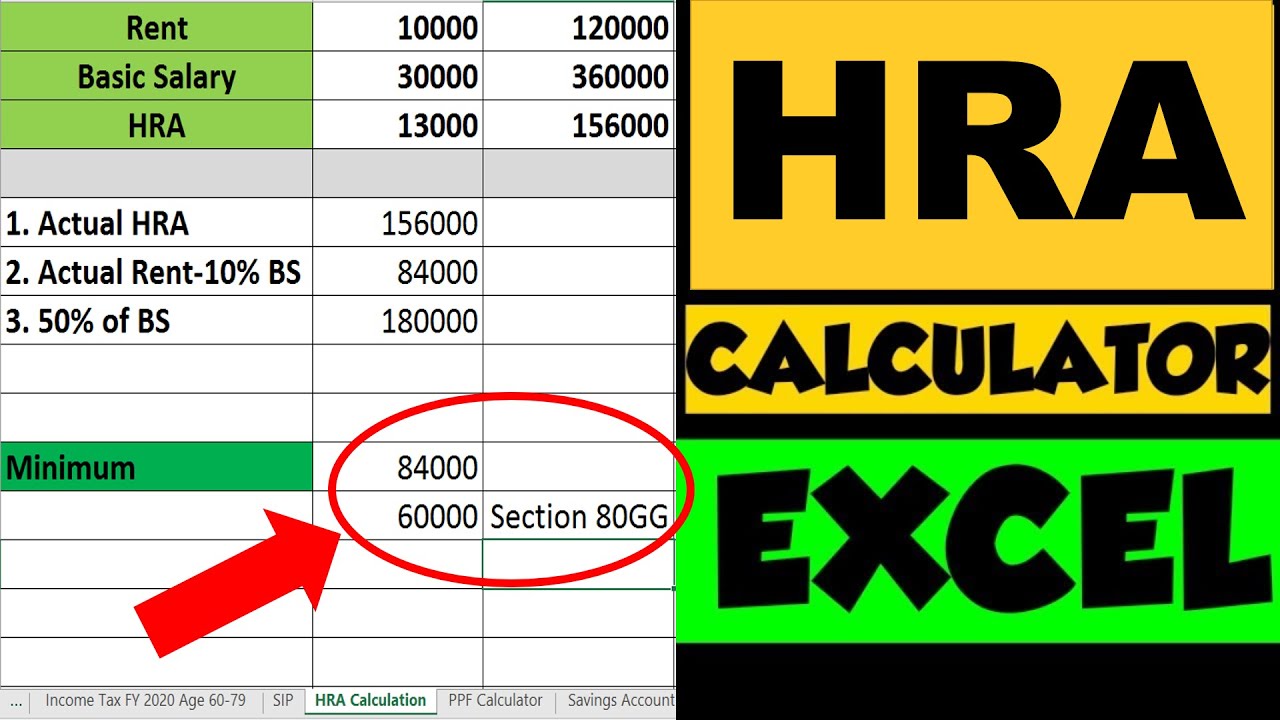

As per Section 80GG of income tax rules self employed individuals who do not receive a house rent allowance from the employer can claim a deduction for the rent paid However the maximum amount that can be claimed under this section is up to Rs 60 000 Rs 5 000 per month

1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent paid exceeds 10 of

House Rent Allowance Deduction In Income Tax include a broad array of printable resources available online for download at no cost. These printables come in different formats, such as worksheets, coloring pages, templates and much more. The great thing about House Rent Allowance Deduction In Income Tax is in their variety and accessibility.

More of House Rent Allowance Deduction In Income Tax

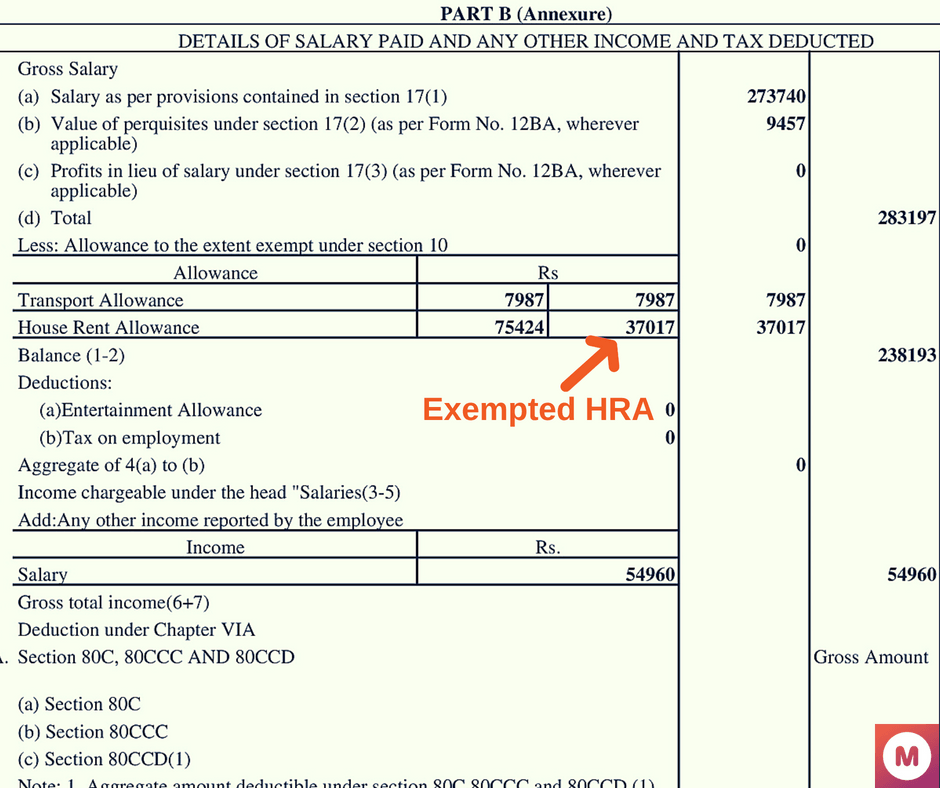

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

To avail HRA benefit the least of the following amount yearly is exempted rest is taxable i Actual HRA received Rs 96 000 8000 x 12 ii 50 of salary metro city Rs 1 20 000 50 of Rs 20 000 x 12 2 40 000 iii Excess of rent paid annually over 10 of annual salary Rs 96 000 Rs 1 20 000 10 of Rs 2 40 000

Dearness allowance What you get HRA exempted HRA taxable Select tax slab 5 10 15 20 25 30 If you don t receive HRA you can still claim upto 60 000 deduction U S 80GG Maximize your tax savings Save upto 78 000 in taxes with ET Money Save taxes now HRA calculator How to Use HRA Calculator HRA tax exemption calculation

House Rent Allowance Deduction In Income Tax have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Modifications: There is the possibility of tailoring designs to suit your personal needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value: These House Rent Allowance Deduction In Income Tax can be used by students of all ages. This makes these printables a powerful tool for teachers and parents.

-

Convenience: You have instant access many designs and templates will save you time and effort.

Where to Find more House Rent Allowance Deduction In Income Tax

House Rent Allowance HRA Exemption Rules Its Tax Benefits Chandan

House Rent Allowance HRA Exemption Rules Its Tax Benefits Chandan

House Rent Allowance HRA is a vital part of employees salaries offering tax benefits To qualify individuals must be salaried employees living in rented accommodations The exempt HRA amount

Actual HRA received from the employer Annual rent paid minus 10 of the salary 50 of the employees basic salary for employees residing in metro cities or 40 of basic salary for non metro cities Proof of rent payment To be eligible for tax exemption on HRA the employee must furnish documentary evidence of rent payment

Now that we've ignited your interest in House Rent Allowance Deduction In Income Tax Let's see where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of needs.

- Explore categories like the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets, flashcards, and learning tools.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs covered cover a wide array of topics, ranging that includes DIY projects to party planning.

Maximizing House Rent Allowance Deduction In Income Tax

Here are some ideas how you could make the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets for teaching at-home for the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

House Rent Allowance Deduction In Income Tax are a treasure trove of creative and practical resources for a variety of needs and interests. Their access and versatility makes these printables a useful addition to your professional and personal life. Explore the vast collection that is House Rent Allowance Deduction In Income Tax today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes, they are! You can print and download these items for free.

-

Can I utilize free printables in commercial projects?

- It's determined by the specific usage guidelines. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns with House Rent Allowance Deduction In Income Tax?

- Certain printables could be restricted in use. You should read the terms of service and conditions provided by the author.

-

How can I print House Rent Allowance Deduction In Income Tax?

- Print them at home using your printer or visit the local print shop for the highest quality prints.

-

What software will I need to access printables free of charge?

- A majority of printed materials are in PDF format. They can be opened using free software like Adobe Reader.

Know The Tax Benefits Of House Rent

HOW TO SAVE TAX ON HOUSE RENT ALLOWANCE

Check more sample of House Rent Allowance Deduction In Income Tax below

HRA Exemption Excel Calculator For Salaried Employees House Rent

How To Claim HRA Allowance House Rent Allowance Exemption

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

Taxation Of House Rent Allowance HRA Hum Fauji Initiatives

Material Requirement Form House Rent Deduction In Income Tax Section

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

https://taxguru.in/income-tax/house-rent-allowance...

1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent paid exceeds 10 of

https://taxguru.in/income-tax/house-rent-allowance...

1 Actual House Rent Allowance HRA received from your employer 2 Actual house rent paid by you minus 10 of your basic salary 3 50 of your basic salary if you live in a metro or 40 of your basic salary if you live in a non metro This minimum of above is allowed as income tax exemption on house rent allowance

1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent paid exceeds 10 of

1 Actual House Rent Allowance HRA received from your employer 2 Actual house rent paid by you minus 10 of your basic salary 3 50 of your basic salary if you live in a metro or 40 of your basic salary if you live in a non metro This minimum of above is allowed as income tax exemption on house rent allowance

Taxation Of House Rent Allowance HRA Hum Fauji Initiatives

How To Claim HRA Allowance House Rent Allowance Exemption

Material Requirement Form House Rent Deduction In Income Tax Section

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

HRA Or House Rent Allowance Deduction Calculation