Today, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons, creative projects, or simply adding the personal touch to your area, Room Rent Exemption In Income Tax are a great resource. This article will take a dive into the sphere of "Room Rent Exemption In Income Tax," exploring what they are, where you can find them, and how they can enrich various aspects of your lives.

Get Latest Room Rent Exemption In Income Tax Below

Room Rent Exemption In Income Tax

Room Rent Exemption In Income Tax -

Verkko 6 huhtik 2023 nbsp 0183 32 Claiming rent a room relief income under 163 7 500 If your lodger pays less than 163 7 500 you ll be automatically exempt from tax for this income and you don t need to do anything except keep a record of the income

Verkko 6 hein 228 k 2018 nbsp 0183 32 Rent a room relief gives an exemption from income tax on profits of up to 163 7 500 to individuals who let furnished accommodation in their only or main residence Rent a room relief

Room Rent Exemption In Income Tax provide a diverse array of printable materials online, at no cost. They are available in a variety of forms, like worksheets templates, coloring pages and many more. One of the advantages of Room Rent Exemption In Income Tax lies in their versatility as well as accessibility.

More of Room Rent Exemption In Income Tax

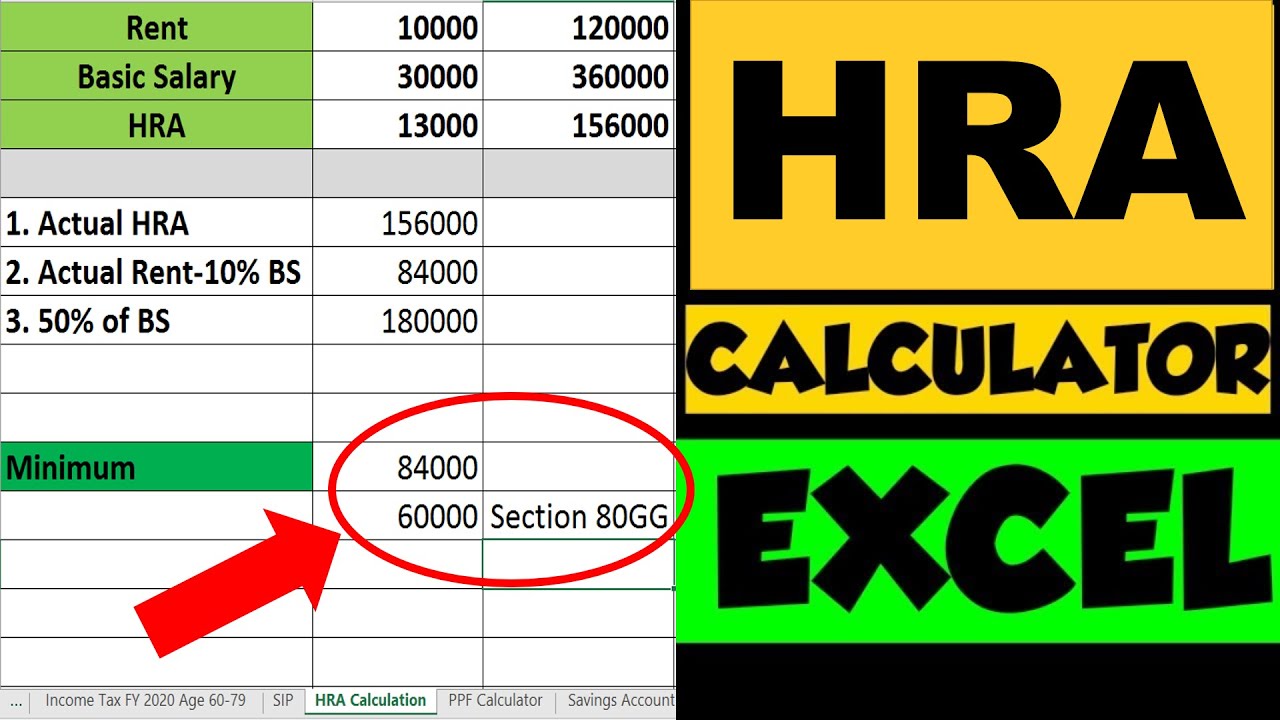

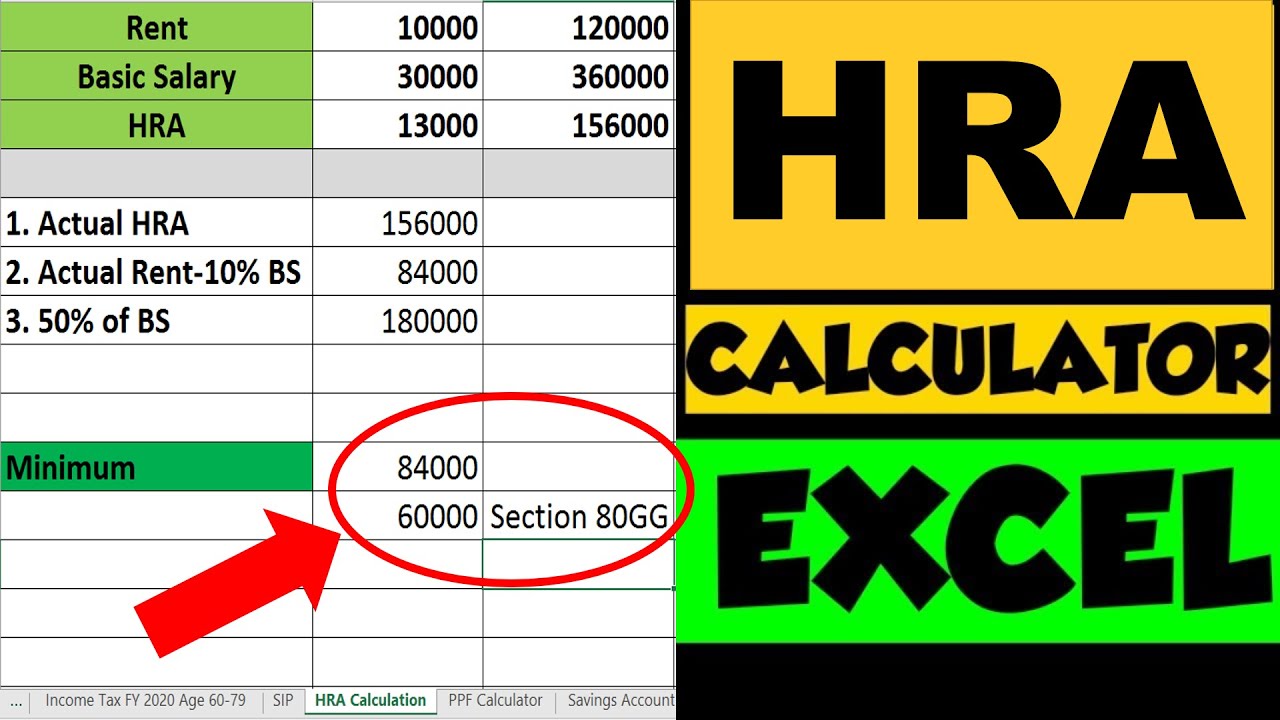

HRA Exemption Calculator In Excel House Rent Allowance Calculation

HRA Exemption Calculator In Excel House Rent Allowance Calculation

Verkko 16 elok 2012 nbsp 0183 32 Rental income is usually taxable under the Federal tax laws But there is an exception if you rent out a home that you use as a home and the home is rented less than 15 days during the year The exception is that rental income and rental expenses are not reported on your return at all

Verkko 24 maalisk 2022 nbsp 0183 32 You can fully deduct any expenses incurred to rent out a room in your home So if you were to remodel the room or install a new bathroom to make it more attractive for your tenants those

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Customization: There is the possibility of tailoring printed materials to meet your requirements in designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value These Room Rent Exemption In Income Tax can be used by students of all ages. This makes these printables a powerful instrument for parents and teachers.

-

The convenience of immediate access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Room Rent Exemption In Income Tax

HRA What Is House Rent Allowance HRA Exemption Deduction Taxwink

HRA What Is House Rent Allowance HRA Exemption Deduction Taxwink

Verkko 22 syysk 2022 nbsp 0183 32 You will have to be living in a rented accommodation to claim HRA tax exemption The entire HRA paid to you cannot be claimed as an exemption The lowest of annual rent actually paid minus 10 of basic salary HRA paid by the employer and 40 50 of salary depending on where you stay can only be claimed

Verkko 31 hein 228 k 2023 nbsp 0183 32 What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section 80GG towards rent that you pay Learn more

After we've peaked your interest in Room Rent Exemption In Income Tax, let's explore where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Room Rent Exemption In Income Tax suitable for many objectives.

- Explore categories like furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free or flashcards as well as learning materials.

- The perfect resource for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- The blogs are a vast variety of topics, that range from DIY projects to party planning.

Maximizing Room Rent Exemption In Income Tax

Here are some innovative ways ensure you get the very most use of Room Rent Exemption In Income Tax:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Room Rent Exemption In Income Tax are an abundance of creative and practical resources designed to meet a range of needs and needs and. Their accessibility and flexibility make they a beneficial addition to the professional and personal lives of both. Explore the vast array of Room Rent Exemption In Income Tax now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes you can! You can download and print these items for free.

-

Can I utilize free printouts for commercial usage?

- It's based on the terms of use. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues in Room Rent Exemption In Income Tax?

- Some printables could have limitations regarding usage. Be sure to read the terms and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home with either a printer at home or in an area print shop for better quality prints.

-

What program do I require to open printables that are free?

- The majority of printed documents are in PDF format. They can be opened with free software, such as Adobe Reader.

House Is Rent Exemption In Income Tax

How To Show HRA Not Accounted By The Employer In ITR

Check more sample of Room Rent Exemption In Income Tax below

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

HRA Exemption Calculator EXCEL House Rent Allowance Calculation To

Income Tax Savings HRA

HRA Exemption In Income Tax

CA Sumit Jain House Rent Allowance HRA Calculation Exemption

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

https://www.gov.uk/government/publications/income-tax-rent-a-room...

Verkko 6 hein 228 k 2018 nbsp 0183 32 Rent a room relief gives an exemption from income tax on profits of up to 163 7 500 to individuals who let furnished accommodation in their only or main residence Rent a room relief

https://www.orangetax.com/tax-blog/tax-news/2020-09-22-tax-rules-on...

Verkko 22 syysk 2020 nbsp 0183 32 To enable tax free rental the so called landlord exemption has been created This means that up to an amount of 5 506 you do not need to pay taxes on received rent as a house owner This exemption can be used on three conditions

Verkko 6 hein 228 k 2018 nbsp 0183 32 Rent a room relief gives an exemption from income tax on profits of up to 163 7 500 to individuals who let furnished accommodation in their only or main residence Rent a room relief

Verkko 22 syysk 2020 nbsp 0183 32 To enable tax free rental the so called landlord exemption has been created This means that up to an amount of 5 506 you do not need to pay taxes on received rent as a house owner This exemption can be used on three conditions

HRA Exemption In Income Tax

HRA Exemption Calculator EXCEL House Rent Allowance Calculation To

CA Sumit Jain House Rent Allowance HRA Calculation Exemption

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

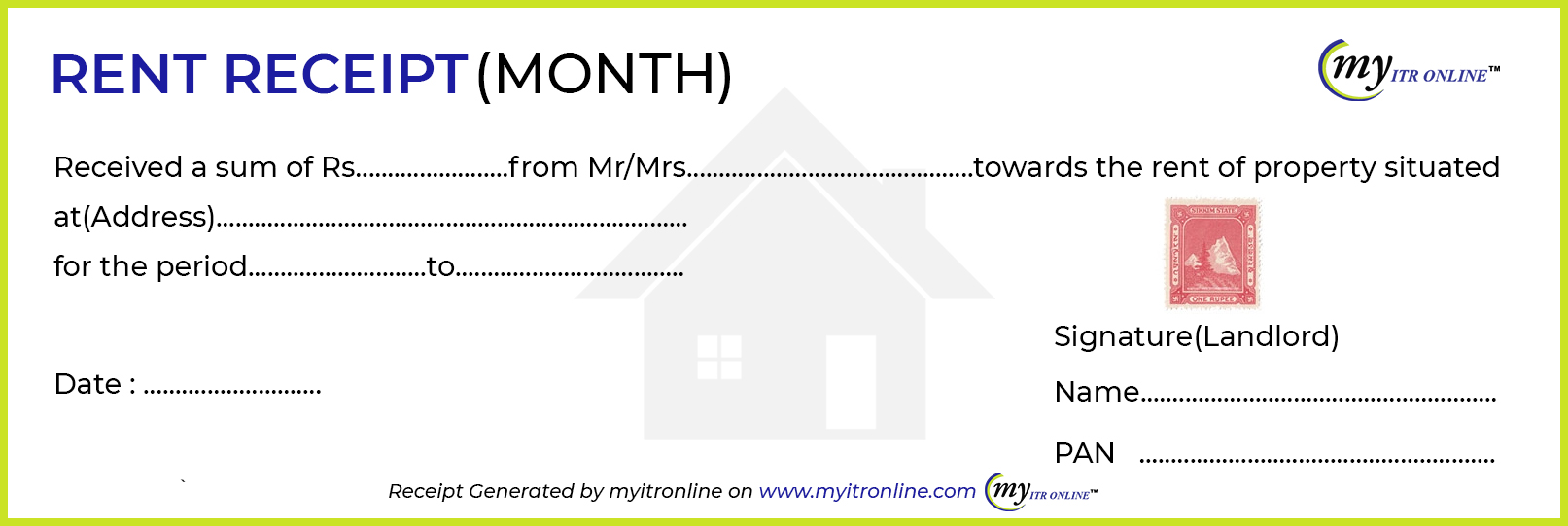

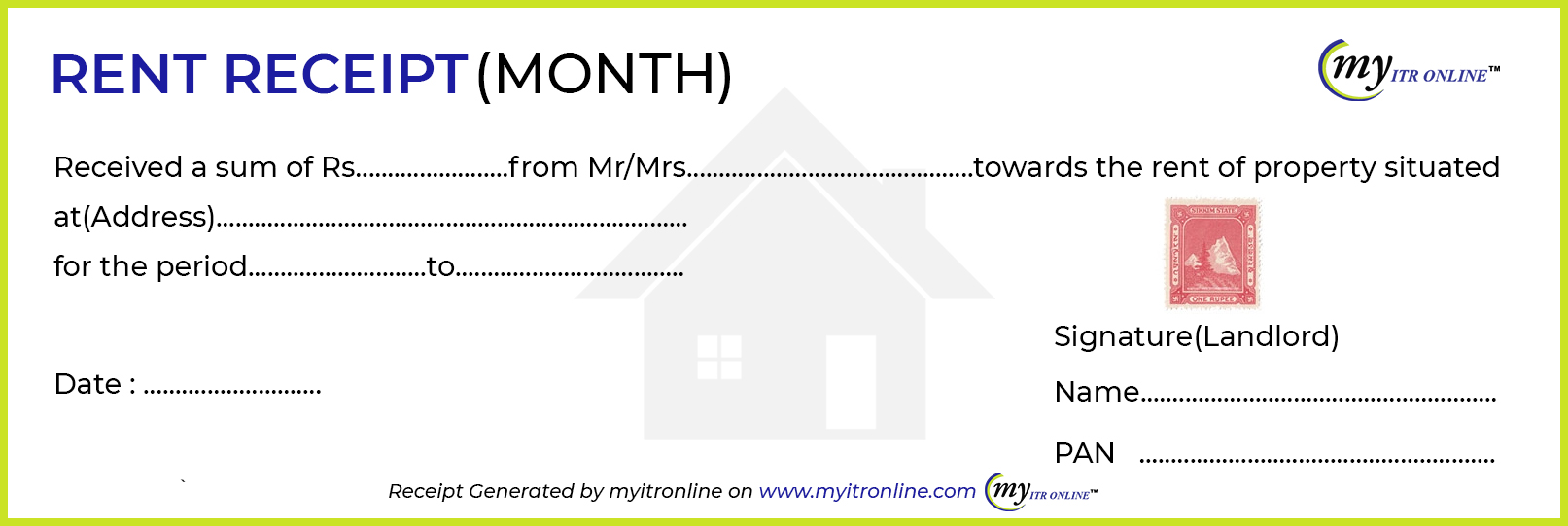

Free Rent Receipt Generator Online House Rent Receipt Generator With

Free Rent Receipt Generator Online House Rent Receipt Generator With

Rent Receipt For Income Tax Deductions Under HRA