In the age of digital, when screens dominate our lives and the appeal of physical, printed materials hasn't diminished. No matter whether it's for educational uses as well as creative projects or simply to add a personal touch to your space, House Rent Allowance Deduction In Income Tax Section have become a valuable resource. This article will take a dive into the world of "House Rent Allowance Deduction In Income Tax Section," exploring the different types of printables, where to locate them, and how they can be used to enhance different aspects of your daily life.

Get Latest House Rent Allowance Deduction In Income Tax Section Below

House Rent Allowance Deduction In Income Tax Section

House Rent Allowance Deduction In Income Tax Section - House Rent Allowance Deduction In Income Tax Section, House Rent Exemption In Income Tax Section, House Rent Allowance Deduction Under Section, House Rent Deduction In Income Tax Section, House Rent Deduction In Income Tax Section Limit, House Rent Allowance Deduction In Income Tax

House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied

House Rent Allowance Deduction In Income Tax Section include a broad variety of printable, downloadable resources available online for download at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages and many more. The appealingness of House Rent Allowance Deduction In Income Tax Section lies in their versatility and accessibility.

More of House Rent Allowance Deduction In Income Tax Section

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

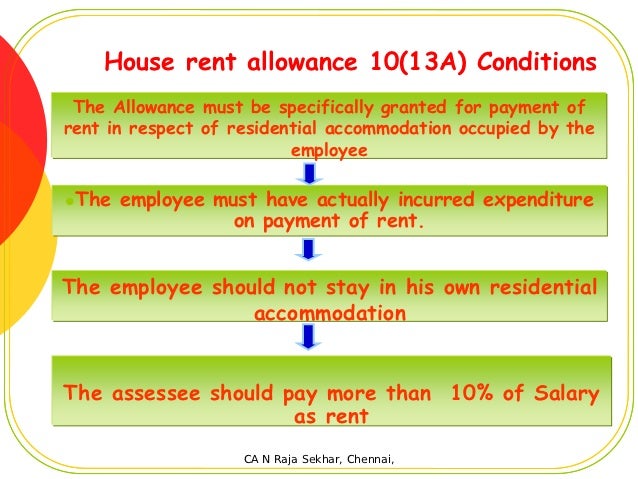

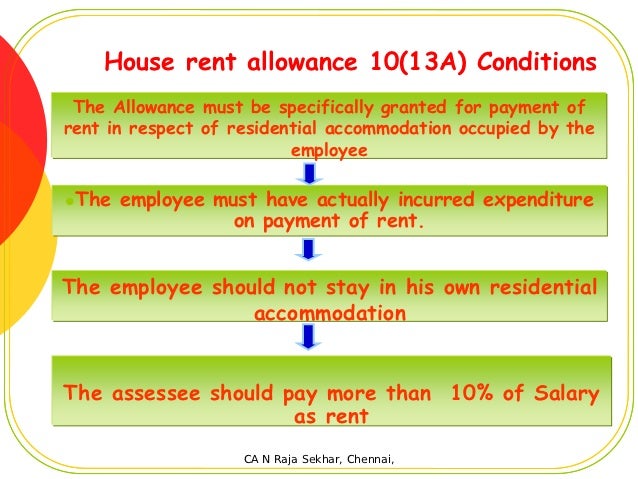

The best part Salaried individuals who live in a rented house can claim tax exemption on HRA under Section 10 13A of the Income Tax Act HRA is subject to full or partial tax deductions An employee

HRA or House Rent Allowance is a wage given by employers to staff members to cover housing costs associated with leasing a home The HRA is a crucial part of a person s pay Both salaried and self employed

The House Rent Allowance Deduction In Income Tax Section have gained huge popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Flexible: There is the possibility of tailoring printing templates to your own specific requirements, whether it's designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value Downloads of educational content for free offer a wide range of educational content for learners of all ages, making them an invaluable resource for educators and parents.

-

It's easy: Fast access a variety of designs and templates reduces time and effort.

Where to Find more House Rent Allowance Deduction In Income Tax Section

Material Requirement Form House Rent Deduction In Income Tax Section

Material Requirement Form House Rent Deduction In Income Tax Section

Section 10 13A of the Income Tax Act allows salaried individuals to claim exemptions for House Rent Allowance HRA Given that HRA constitutes a substantial

HRA Tax Deduction Under Section 80GG To claim a deduction under Section 80GG of the Income Tax Act individuals need to consider the following and

After we've peaked your curiosity about House Rent Allowance Deduction In Income Tax Section Let's see where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of House Rent Allowance Deduction In Income Tax Section designed for a variety objectives.

- Explore categories such as interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets as well as flashcards and other learning materials.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- These blogs cover a broad array of topics, ranging starting from DIY projects to party planning.

Maximizing House Rent Allowance Deduction In Income Tax Section

Here are some unique ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge for teaching at-home also in the classes.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

House Rent Allowance Deduction In Income Tax Section are a treasure trove filled with creative and practical information which cater to a wide range of needs and passions. Their accessibility and flexibility make them a wonderful addition to both professional and personal life. Explore the wide world of House Rent Allowance Deduction In Income Tax Section to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes, they are! You can download and print these items for free.

-

Can I use free printables in commercial projects?

- It's contingent upon the specific conditions of use. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Are there any copyright problems with House Rent Allowance Deduction In Income Tax Section?

- Certain printables could be restricted on their use. Be sure to read these terms and conditions as set out by the author.

-

How do I print House Rent Allowance Deduction In Income Tax Section?

- You can print them at home with a printer or visit an in-store print shop to get more high-quality prints.

-

What software will I need to access House Rent Allowance Deduction In Income Tax Section?

- The majority of PDF documents are provided in the format PDF. This can be opened with free software, such as Adobe Reader.

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Section 24 Deduction Income From House Property

Check more sample of House Rent Allowance Deduction In Income Tax Section below

Income Tax Savings HRA

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

House Rent Allowance Deduction Calculation YouTube

HRA Or House Rent Allowance Deduction Calculation

Incometax Slide shankar Bose iit

https://cleartax.in/s/claim-deduction-under-section-80gg-for-rent-paid

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied

https://taxguru.in/income-tax/deduction-under...

House rent allowance HRA is received by the salaried class A deduction is permissible under Section 10 13A of the Income Tax Act in accordance with

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied

House rent allowance HRA is received by the salaried class A deduction is permissible under Section 10 13A of the Income Tax Act in accordance with

House Rent Allowance Deduction Calculation YouTube

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

HRA Or House Rent Allowance Deduction Calculation

Incometax Slide shankar Bose iit

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

HRA Tax Exemption Calculator House Rent Deduction In Income Tax