In this age of electronic devices, where screens rule our lives, the charm of tangible printed material hasn't diminished. For educational purposes as well as creative projects or simply adding personal touches to your area, House Rent Deduction In Income Tax Section Limit are now a vital resource. Through this post, we'll dive deeper into "House Rent Deduction In Income Tax Section Limit," exploring their purpose, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest House Rent Deduction In Income Tax Section Limit Below

House Rent Deduction In Income Tax Section Limit

House Rent Deduction In Income Tax Section Limit -

If you don t receive HRA you can now claim upto Rs 60 000 deduction under Section 80GG Click here to calculate your tax as per Budget 2024 If you receive HRA you can use this calculator File your Income Tax Returns now Every filer wins exclusive rewards from top brands Start your Tax Return

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

House Rent Deduction In Income Tax Section Limit encompass a wide assortment of printable content that can be downloaded from the internet at no cost. They are available in numerous formats, such as worksheets, templates, coloring pages and many more. One of the advantages of House Rent Deduction In Income Tax Section Limit is in their variety and accessibility.

More of House Rent Deduction In Income Tax Section Limit

House Rent Deduction U s 80GG Form 10BA How To Claim Rent Paid

House Rent Deduction U s 80GG Form 10BA How To Claim Rent Paid

For example if your basic salary including Dearness Allowance is INR 50 000 month you receive a HRA of INR 12 000 month and the actual rent paid is Rs 15 000 month the exemption that you would be allowed to claim would be calculated as follows You would thus be able to avail of an exemption of INR 1 2 lakhs every financial year

The actual HRA received rent paid annually reduced by 10 of salary 50 of your basic salary if you live in a metro city and 40 of your basic salary if you live in a non metro city Remember that the least amount from the above four options is taken into consideration for tax exemption

House Rent Deduction In Income Tax Section Limit have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Customization: There is the possibility of tailoring the design to meet your needs in designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Use: Educational printables that can be downloaded for free provide for students of all ages. This makes the perfect source for educators and parents.

-

Accessibility: You have instant access a myriad of designs as well as templates reduces time and effort.

Where to Find more House Rent Deduction In Income Tax Section Limit

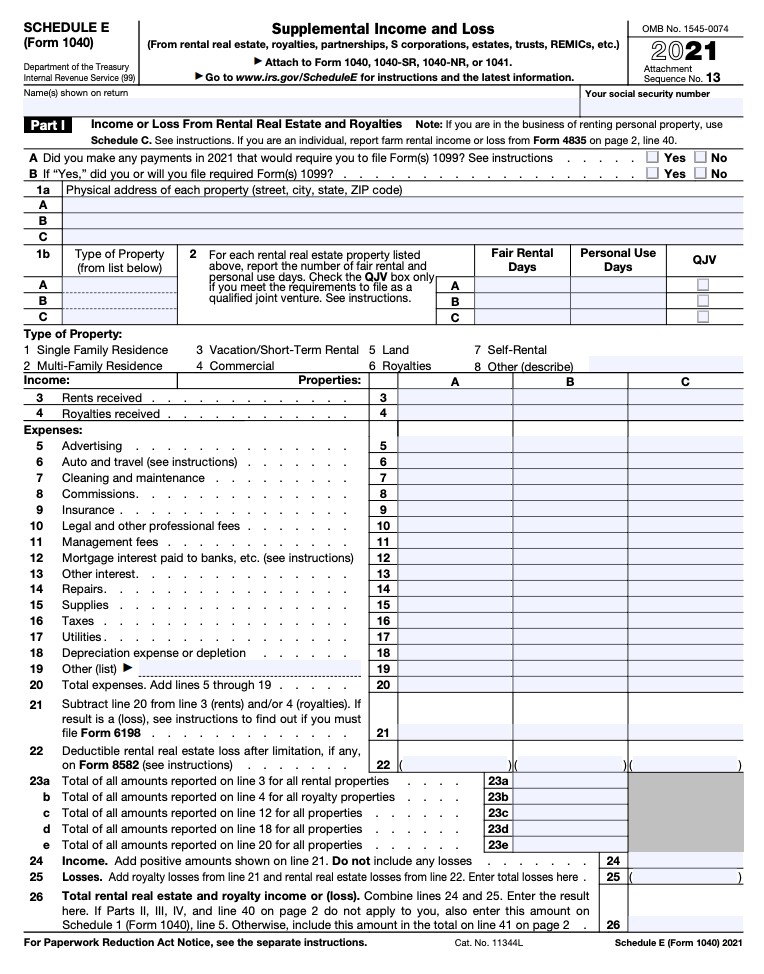

Schedule E Tax Form Survival Guide For Rental Properties 2021 Tax Year

Schedule E Tax Form Survival Guide For Rental Properties 2021 Tax Year

Income Tax Department Tax Tools House rent allowance calculator As amended upto Finance Act 2023 HOUSE RENT ALLOWANCE Basic salary DA forming part of salary Commission as of turnover achieved by

1 Actual House Rent Allowance HRA received from your employer 2 Actual house rent paid by you minus 10 of your basic salary 3 50 of your basic salary if you live in a metro or 40 of your basic salary if you live in a non metro This minimum of above is allowed as income tax exemption on house rent allowance

Now that we've piqued your curiosity about House Rent Deduction In Income Tax Section Limit, let's explore where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of House Rent Deduction In Income Tax Section Limit to suit a variety of needs.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- It is ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a wide array of topics, ranging from DIY projects to planning a party.

Maximizing House Rent Deduction In Income Tax Section Limit

Here are some innovative ways in order to maximize the use of House Rent Deduction In Income Tax Section Limit:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home as well as in the class.

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

House Rent Deduction In Income Tax Section Limit are a treasure trove of practical and innovative resources which cater to a wide range of needs and interests. Their availability and versatility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the vast array that is House Rent Deduction In Income Tax Section Limit today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes they are! You can print and download these materials for free.

-

Are there any free printables in commercial projects?

- It's determined by the specific rules of usage. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright violations with House Rent Deduction In Income Tax Section Limit?

- Certain printables could be restricted in their usage. Check the terms of service and conditions provided by the creator.

-

How can I print House Rent Deduction In Income Tax Section Limit?

- You can print them at home using an printer, or go to an area print shop for higher quality prints.

-

What program do I need in order to open printables free of charge?

- The majority of printed documents are in PDF format. These can be opened with free software such as Adobe Reader.

How To Calculate Standard Deduction In Income Tax Act Scripbox

Section 24 Deduction Income From House Property

Check more sample of House Rent Deduction In Income Tax Section Limit below

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

House Rent Deduction Raised From Rs 24 000 To Rs 60 000 Hindustan Times

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

Section 80GG Of Income Tax Act House Rent Deduction In Income Tax

House Rent Allowance HRA Exemption Rules Tax Deductions Tax2win

House Rent Deduction HRA

https:// taxguru.in /income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

https:// cleartax.in /s/hra-house-rent-allowance

Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section of the income tax does HRA come under

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

Salaried employees who receive house rent allowance as a part of salary and pay rent can claim HRA exemption to reduce their taxable salary wholly or partially Which section of the income tax does HRA come under

Section 80GG Of Income Tax Act House Rent Deduction In Income Tax

House Rent Deduction Raised From Rs 24 000 To Rs 60 000 Hindustan Times

House Rent Allowance HRA Exemption Rules Tax Deductions Tax2win

House Rent Deduction HRA

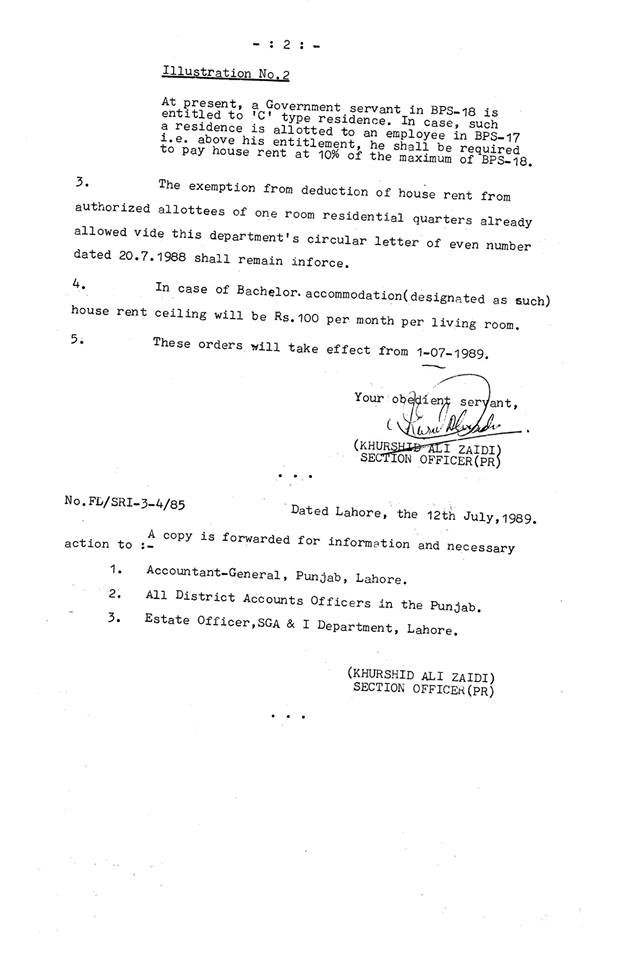

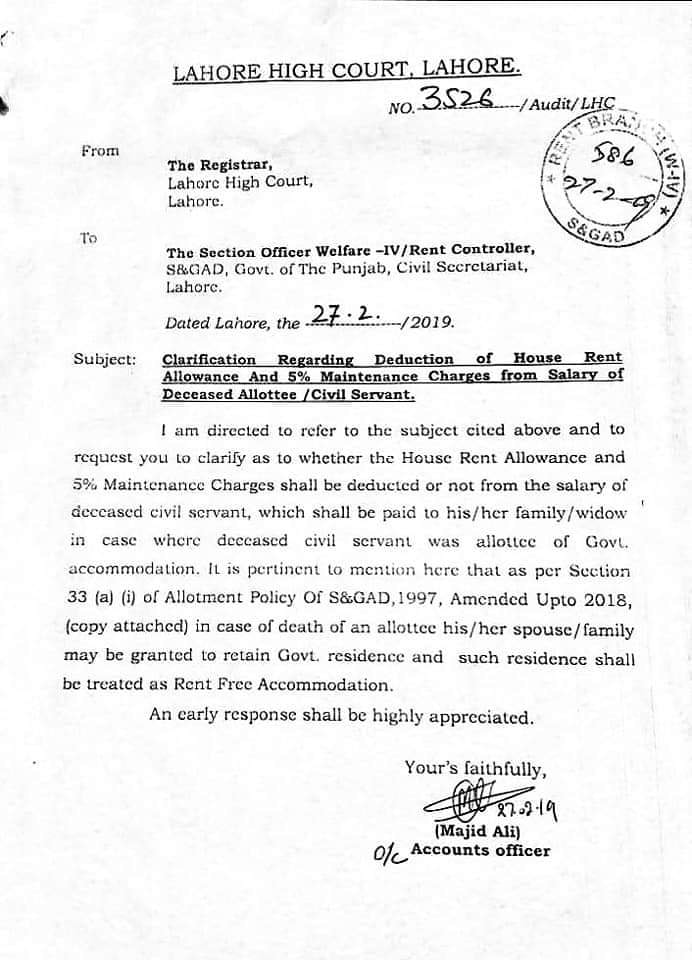

House Rent Deduction Letters Dated 12 7 1999 19 04 2013 27 2 2019

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

House Rent Deduction Letters Dated 12 7 1999 19 04 2013 27 2 2019