In the age of digital, with screens dominating our lives yet the appeal of tangible printed objects hasn't waned. Whether it's for educational purposes or creative projects, or simply to add an extra personal touch to your home, printables for free are now a useful source. We'll take a dive deep into the realm of "Income Tax Rebate For Housing Loan," exploring what they are, how they are available, and how they can improve various aspects of your daily life.

Get Latest Income Tax Rebate For Housing Loan Below

Income Tax Rebate For Housing Loan

Income Tax Rebate For Housing Loan - Income Tax Rebate For Housing Loan, Income Tax Exemption For Housing Loan Interest 2022-23, Income Tax Deduction For Housing Loan, Income Tax Exemption For Housing Loan Principal And Interest, Income Tax Exemption For Housing Loan Interest 2021-22, Income Tax Exemption For Housing Loan Under Construction, Income Tax Return For Housing Loan, Income Tax Rebate On House Rent, Income Tax Rebate On Second Housing Loan Interest, How Housing Loan Is Calculated In Income Tax

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

Income Tax Rebate For Housing Loan offer a wide variety of printable, downloadable material that is available online at no cost. They are available in a variety of types, like worksheets, templates, coloring pages, and more. The benefit of Income Tax Rebate For Housing Loan is their flexibility and accessibility.

More of Income Tax Rebate For Housing Loan

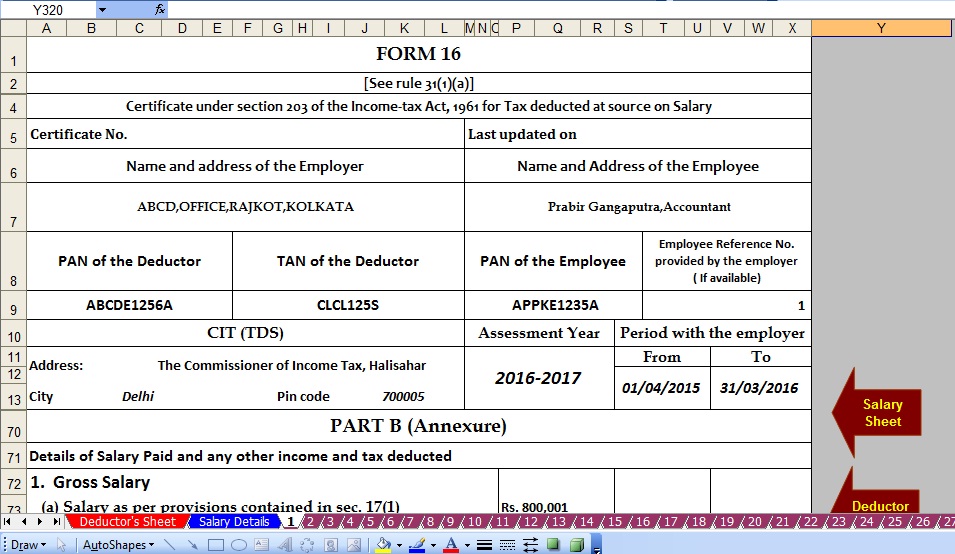

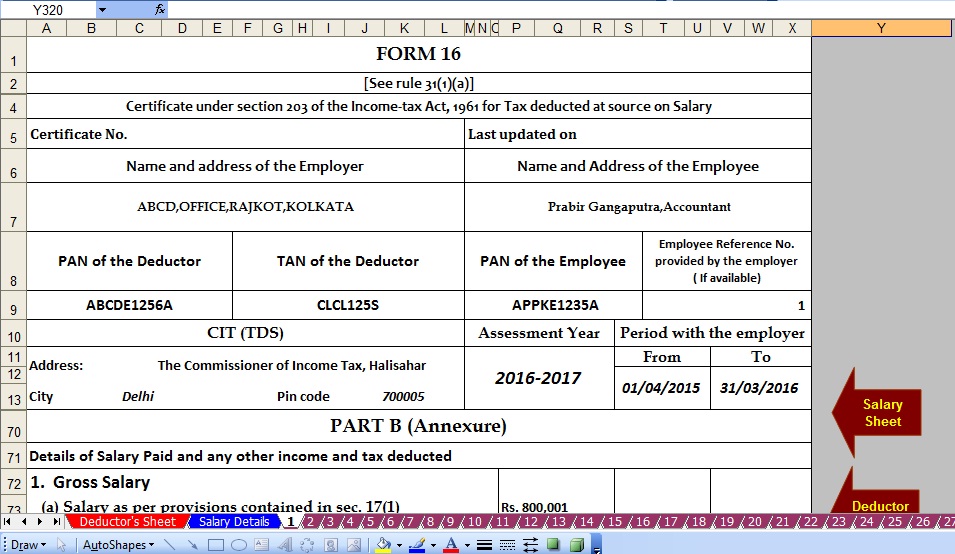

How To Calculate Tax Rebate On Home Loan Grizzbye

How To Calculate Tax Rebate On Home Loan Grizzbye

Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home

Web Yes you will definitely get income tax benefit on home loan under section 80 C D Regardless of the number of property there are associated benefits of filing income tax return Be sure to check with a professional about

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Modifications: They can make printables to your specific needs for invitations, whether that's creating them for your guests, organizing your schedule or decorating your home.

-

Educational Use: Education-related printables at no charge are designed to appeal to students of all ages. This makes them a vital tool for parents and educators.

-

Affordability: instant access various designs and templates is time-saving and saves effort.

Where to Find more Income Tax Rebate For Housing Loan

Latest Income Tax Rebate On Home Loan 2023

Latest Income Tax Rebate On Home Loan 2023

Web 19 avr 2021 nbsp 0183 32 For interest on home loans the tax benefit is available under Section 24 b For a maximum of two self occupied properties taken together you can claim upto Rs 2

Web Income Tax Rebate Remaining Amount Taxable Income Tax Amount 18 lakh per annum 3 50 000 Housing Loan Principal Interest Rs 14 50 000 Rs 14 50 000

After we've peaked your interest in Income Tax Rebate For Housing Loan, let's explore where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and Income Tax Rebate For Housing Loan for a variety applications.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs are a vast selection of subjects, ranging from DIY projects to party planning.

Maximizing Income Tax Rebate For Housing Loan

Here are some innovative ways for you to get the best use of Income Tax Rebate For Housing Loan:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to build your knowledge at home as well as in the class.

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate For Housing Loan are a treasure trove of practical and innovative resources that cater to various needs and needs and. Their availability and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the plethora of Income Tax Rebate For Housing Loan right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes you can! You can download and print these free resources for no cost.

-

Can I use the free printables in commercial projects?

- It's based on specific terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with Income Tax Rebate For Housing Loan?

- Some printables could have limitations on their use. Be sure to read the terms and conditions set forth by the creator.

-

How can I print Income Tax Rebate For Housing Loan?

- You can print them at home using an printer, or go to any local print store for superior prints.

-

What program do I need to open printables that are free?

- The majority of PDF documents are provided in PDF format. These can be opened using free software such as Adobe Reader.

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Home Loan Tax Benefit Calculator FrankiSoumya

Check more sample of Income Tax Rebate For Housing Loan below

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

Property Tax Rebate Application Printable Pdf Download

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

https://www.livemint.com/money/personal-finance/new-income-tax-rules...

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

https://www.hdfc.com/blog/home-finance/home-loan-tax-benefit

Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Property Tax Rebate Application Printable Pdf Download

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

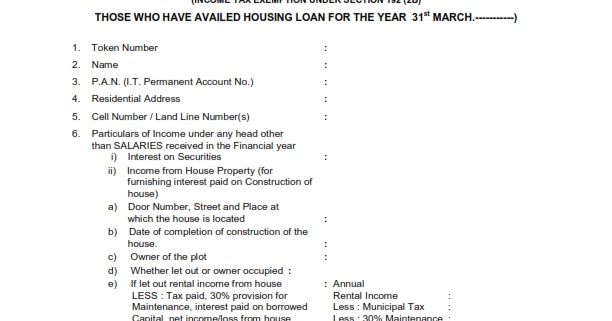

Housing Loans Joint Declaration Form For Housing Loan

Housing Loans Joint Declaration Form For Housing Loan

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada