In this age of electronic devices, where screens rule our lives it's no wonder that the appeal of tangible printed material hasn't diminished. Whatever the reason, whether for education for creative projects, simply to add personal touches to your home, printables for free are now a useful source. With this guide, you'll dive deeper into "Income Tax Exemption For Housing Loan Under Construction," exploring the benefits of them, where to find them and ways they can help you improve many aspects of your daily life.

Get Latest Income Tax Exemption For Housing Loan Under Construction Below

Income Tax Exemption For Housing Loan Under Construction

Income Tax Exemption For Housing Loan Under Construction - Income Tax Exemption For Housing Loan Under Construction, Income Tax Exemption For Home Loan Under Construction, Tax Exemption For House Loan Which Is Under Construction, Housing Loan Tax Exemption In India, Under Construction Home Loan Tax Benefits India, Is Home Loan Exempted From Income Tax

Under Construction Property Tax Benefit As Per IT Act 1961 Section 80EEA Section 80EEA of the Income Tax Act offers an extra under construction

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions till the construction of

The Income Tax Exemption For Housing Loan Under Construction are a huge collection of printable resources available online for download at no cost. They come in many styles, from worksheets to templates, coloring pages and much more. The appealingness of Income Tax Exemption For Housing Loan Under Construction is in their variety and accessibility.

More of Income Tax Exemption For Housing Loan Under Construction

REVISED HOME LOAN BENEFITS U S 80EEA Deduction On Interest For Housing

REVISED HOME LOAN BENEFITS U S 80EEA Deduction On Interest For Housing

Section 24 of the Income Tax Act for Under Construction Property Under section 24B of the Income Tax Act 1961 homeowners can claim a tax deduction of up

Section 54 and Section 54F offer tax exemption on LTCG if the following conditions are met A new residential property is purchased within one year in case of

Income Tax Exemption For Housing Loan Under Construction have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Customization: You can tailor printed materials to meet your requirements when it comes to designing invitations, organizing your schedule, or even decorating your home.

-

Educational Worth: Printables for education that are free provide for students of all ages, making them an invaluable resource for educators and parents.

-

It's easy: instant access many designs and templates can save you time and energy.

Where to Find more Income Tax Exemption For Housing Loan Under Construction

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Yes tax deduction under various sections of the income tax law is allowed for pre construction stage in home loan However there is a catch to this A borrower

In case of a Home Loan availed of to buy a ready to move in property one can claim tax exemption up to a maximum of Rs 2 Lakh per year under this section of

If we've already piqued your curiosity about Income Tax Exemption For Housing Loan Under Construction Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of objectives.

- Explore categories such as decorating your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing, flashcards, and learning materials.

- Great for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- The blogs covered cover a wide array of topics, ranging from DIY projects to party planning.

Maximizing Income Tax Exemption For Housing Loan Under Construction

Here are some ideas to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print free worksheets to aid in learning at your home as well as in the class.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Exemption For Housing Loan Under Construction are a treasure trove with useful and creative ideas that satisfy a wide range of requirements and interests. Their accessibility and versatility make them a fantastic addition to both professional and personal lives. Explore the endless world of Income Tax Exemption For Housing Loan Under Construction right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can print and download these materials for free.

-

Does it allow me to use free printables to make commercial products?

- It's contingent upon the specific conditions of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables could have limitations regarding their use. Make sure to read the terms and conditions offered by the creator.

-

How can I print printables for free?

- Print them at home with your printer or visit an in-store print shop to get premium prints.

-

What program must I use to open printables free of charge?

- The majority of printed documents are in PDF format, which can be opened using free software such as Adobe Reader.

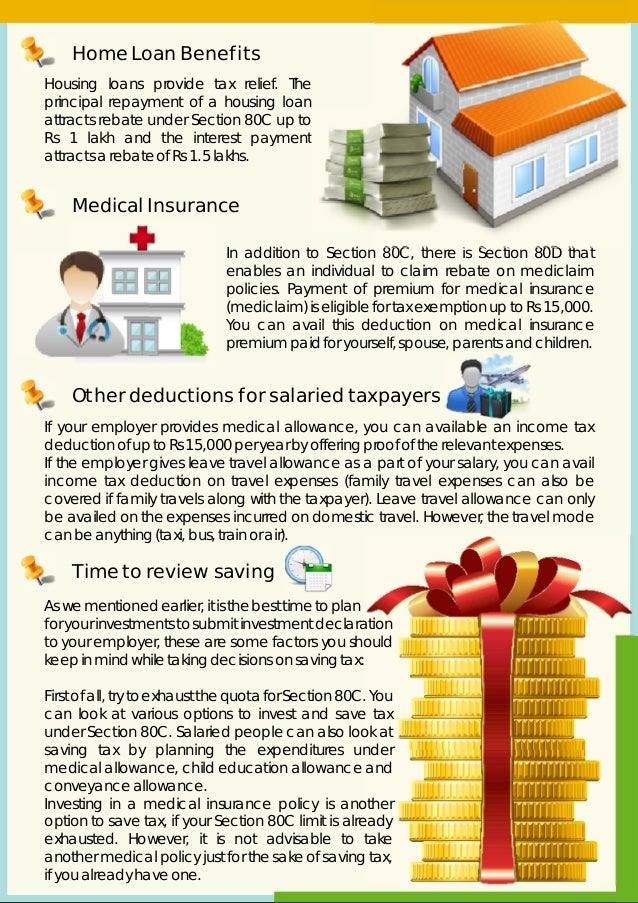

Home Loan Interest Exemption In Income Tax Home Sweet Home

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

Check more sample of Income Tax Exemption For Housing Loan Under Construction below

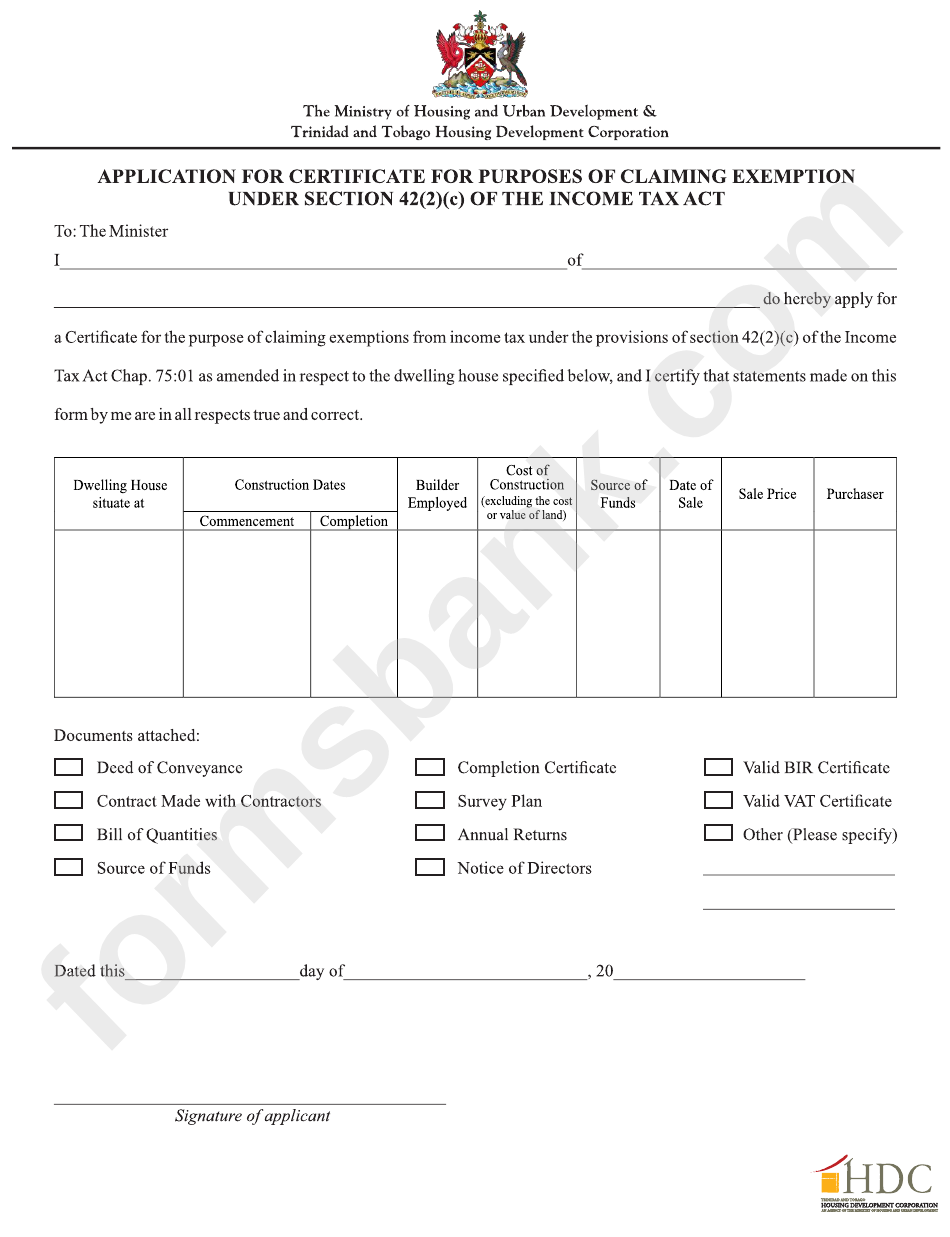

Application For Certificate For Purposes Of Claiming Exemption Under

How To Claim Home Loan Interest For Under Construction Property

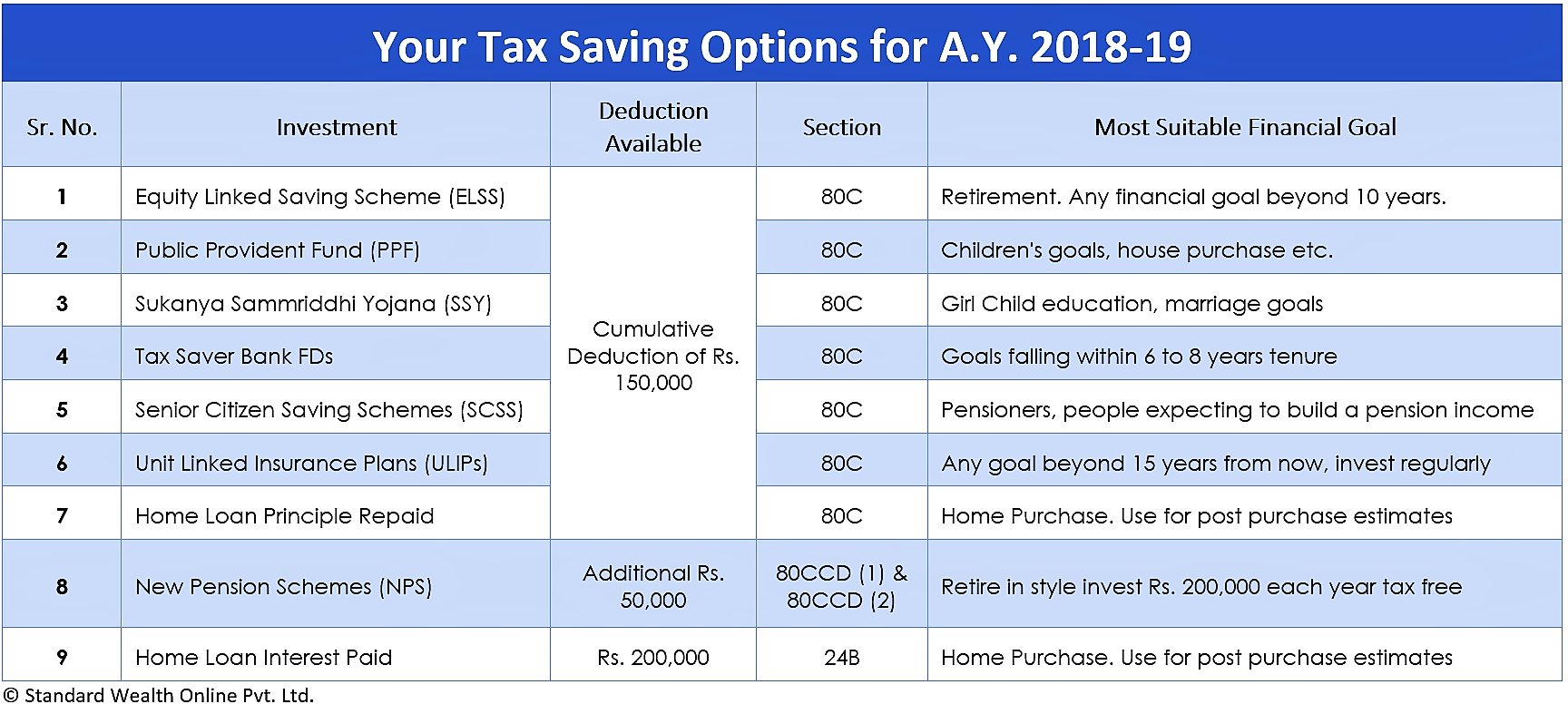

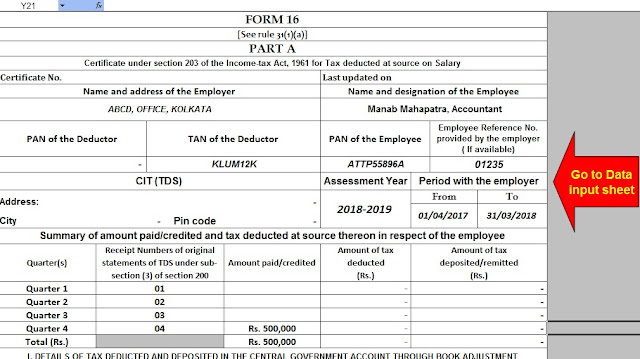

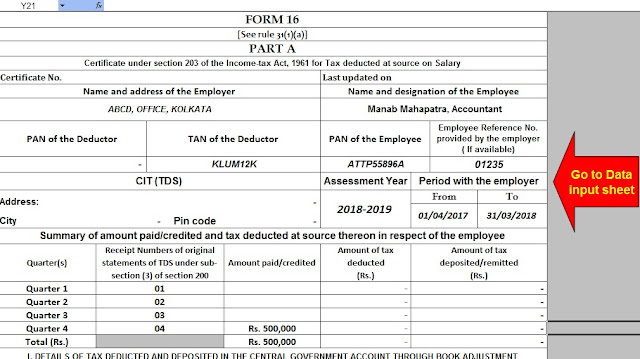

Housing Loan Tax Exemption Fy 2018 19 Tax Walls

TIPS TO REMEMBER ABOUT HOME LOAN FOR UNDER CONSTRUCTION PROJECTS Home

How HRA Tax Exemption Is Calculated U s 10 13A Calculation Guide

Housing Loan Tax Exemption Fy 2018 19 Tax Walls

https://cleartax.in/s/home-loan-tax-benefit

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions till the construction of

https://taxguru.in/income-tax/claim-deduction...

Tax deduction can be availed only if the construction of the housing property is completed within 5 years of taking home loan Any commission paid towards

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions till the construction of

Tax deduction can be availed only if the construction of the housing property is completed within 5 years of taking home loan Any commission paid towards

TIPS TO REMEMBER ABOUT HOME LOAN FOR UNDER CONSTRUCTION PROJECTS Home

How To Claim Home Loan Interest For Under Construction Property

How HRA Tax Exemption Is Calculated U s 10 13A Calculation Guide

Housing Loan Tax Exemption Fy 2018 19 Tax Walls

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Can You Take A Home Loan And Also Claim LTCG Tax Exemption