Today, where screens dominate our lives The appeal of tangible printed materials hasn't faded away. For educational purposes as well as creative projects or simply adding a personal touch to your home, printables for free have become an invaluable source. In this article, we'll take a dive into the sphere of "Income Tax Deduction For Housing Loan," exploring the benefits of them, where to locate them, and how they can add value to various aspects of your lives.

Get Latest Income Tax Deduction For Housing Loan Below

Income Tax Deduction For Housing Loan

Income Tax Deduction For Housing Loan - Income Tax Deduction For Housing Loan, Income Tax Deduction For Housing Loan Interest, Income Tax Exemption For Housing Loan, Income Tax Exemption For Housing Loan Interest 2022-23, Income Tax Exemption For Housing Loan Interest 2021-22, Income Tax Exemption For Housing Loan Under Construction, Income Tax Deduction Limit For Housing Loan Interest, Income Tax Deduction Housing Loan Principal, Income Tax Deduction For House Building Loan, Income Tax Exemption Limit For Housing Loan Principal

The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the year So if you have a mortgage keep good records

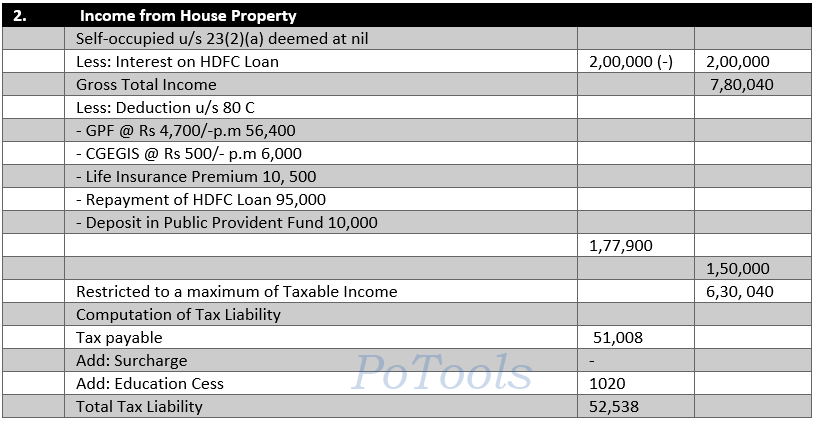

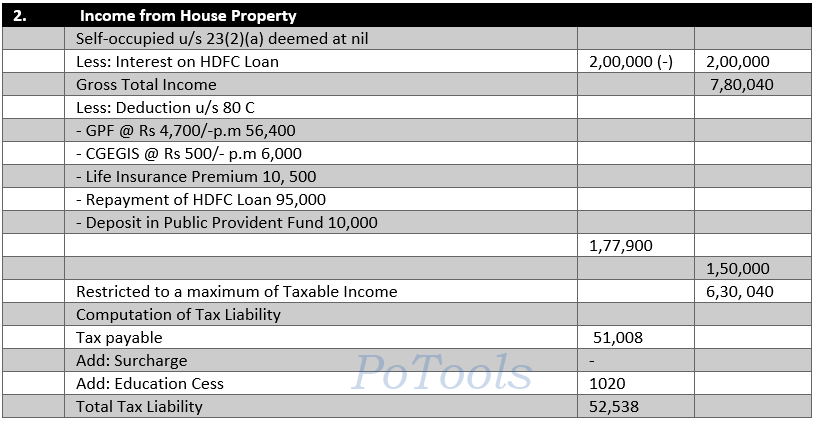

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24

Income Tax Deduction For Housing Loan offer a wide variety of printable, downloadable material that is available online at no cost. These materials come in a variety of kinds, including worksheets coloring pages, templates and more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Income Tax Deduction For Housing Loan

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

For single and married individuals filing taxes separately the standard deduction is 13 850 For married couples filing jointly the standard deduction is 27 700 For heads of households the standard

If you purchased your home before Dec 16 2017 and are a single or joint filer you can deduct interest paid on the first 1 million of your mortgage If you are

Income Tax Deduction For Housing Loan have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Flexible: The Customization feature lets you tailor printed materials to meet your requirements for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your home.

-

Educational Value: Printables for education that are free cater to learners from all ages, making them a useful tool for parents and teachers.

-

Affordability: instant access numerous designs and templates helps save time and effort.

Where to Find more Income Tax Deduction For Housing Loan

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

If your yearly salary is 120 000 you can use the mortgage interest you paid to reduce your taxable income to 100 000 This means you ll only pay taxes on 100 000

Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who

Since we've got your curiosity about Income Tax Deduction For Housing Loan Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection with Income Tax Deduction For Housing Loan for all motives.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- It is ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- These blogs cover a wide selection of subjects, including DIY projects to party planning.

Maximizing Income Tax Deduction For Housing Loan

Here are some unique ways how you could make the most of Income Tax Deduction For Housing Loan:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Deduction For Housing Loan are a treasure trove with useful and creative ideas that cater to various needs and interests. Their accessibility and versatility make them a valuable addition to any professional or personal life. Explore the wide world of Income Tax Deduction For Housing Loan today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes you can! You can download and print these documents for free.

-

Can I use free printouts for commercial usage?

- It depends on the specific terms of use. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables might have limitations on their use. Make sure to read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home with a printer or visit a local print shop for higher quality prints.

-

What program must I use to open printables that are free?

- Most PDF-based printables are available in PDF format. They can be opened using free software like Adobe Reader.

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Sec 80EEA Income Tax Deduction For Paid On Home Loan For Affordable

![]()

Check more sample of Income Tax Deduction For Housing Loan below

Income Tax Deductions For The FY 2019 20 ComparePolicy

Housing Loan And Interest Paid Thereon For Construction Of Rented House

Business Tax Deduction Worksheet

Section 80EE The Ultimate Guide To Income Tax Deduction For Home Loan

Income Tax Calculation For Interest On Housing Loan And Deduction U s

Relation Between Loan Amount And Tax Deduction

https://cleartax.in/s/home-loan-tax-benefits

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24

https://www.hdfc.com/blog/home-finance/home-loan-tax-benefit

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh

Section 80EE The Ultimate Guide To Income Tax Deduction For Home Loan

Housing Loan And Interest Paid Thereon For Construction Of Rented House

Income Tax Calculation For Interest On Housing Loan And Deduction U s

Relation Between Loan Amount And Tax Deduction

Section 80EE How First Time Home Buyers Can Save 50 000 On Their Taxes

A Singaporean s Guide How To Claim Income Tax Deduction For Work

A Singaporean s Guide How To Claim Income Tax Deduction For Work

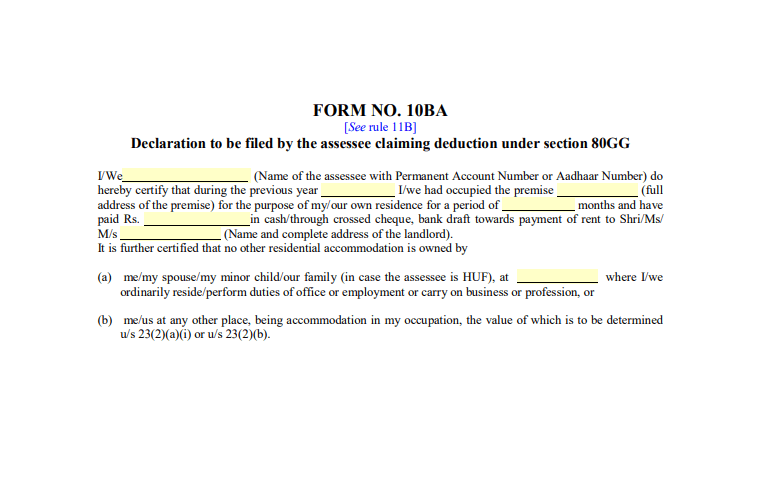

Deduction In Respect Of Rent Paid Sec 80GG Eligibility Calculation