In this age of technology, where screens have become the dominant feature of our lives however, the attraction of tangible printed material hasn't diminished. No matter whether it's for educational uses, creative projects, or simply to add a personal touch to your space, Income Tax Handicapped Dependent are now a useful source. With this guide, you'll dive deep into the realm of "Income Tax Handicapped Dependent," exploring the benefits of them, where to locate them, and how they can improve various aspects of your daily life.

Get Latest Income Tax Handicapped Dependent Below

Income Tax Handicapped Dependent

Income Tax Handicapped Dependent - Income Tax Handicapped Dependent, Income Tax Disabled Dependent, Income Tax Exemption Handicapped Dependent, Income Tax Rebate Disabled Dependent, Income Tax Section For Handicapped Dependent, Income Tax For Handicapped Person, Income Tax Deduction Handicapped Person, Income Tax Exemption For Physically Handicapped Dependent Pdf, Is There A Tax Credit For Disabled Dependents, Tax Deductions For Disabled Dependents

Learn about tax credits and deductions you can take when you claim a qualifying disabled child or relative on your tax return with help from the experts at H R Block

Dependents You may be able to claim your child as a dependent regardless of age if they are permanently and totally disabled Permanently and totally disabled He or she

The Income Tax Handicapped Dependent are a huge range of downloadable, printable materials available online at no cost. These resources come in various styles, from worksheets to coloring pages, templates and many more. One of the advantages of Income Tax Handicapped Dependent is in their versatility and accessibility.

More of Income Tax Handicapped Dependent

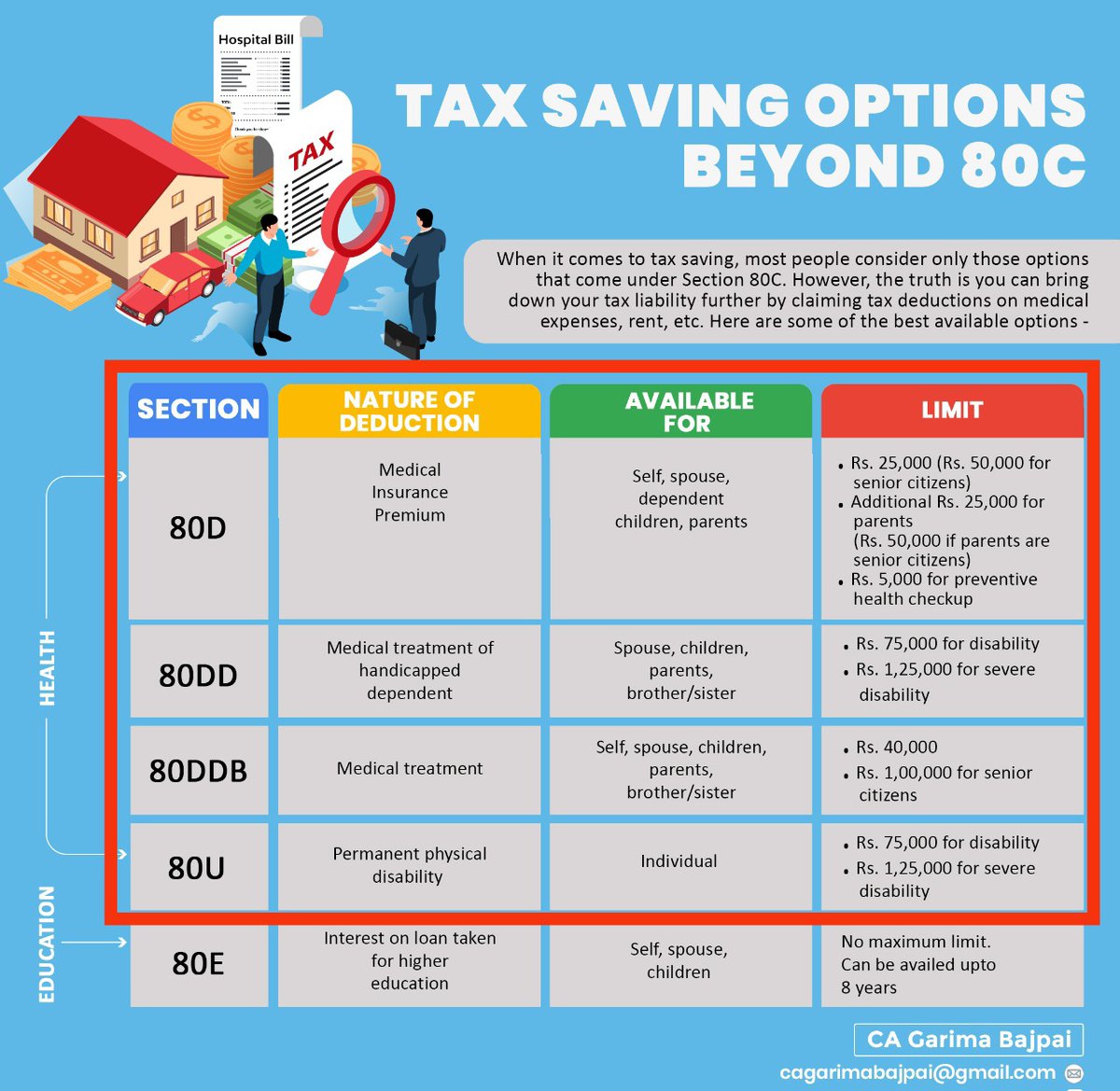

Income Tax Exemption For Physically Handicapped A Complete Guideline

Income Tax Exemption For Physically Handicapped A Complete Guideline

Remember that regardless if the child is claimed as a dependent the individual may need to file their own tax return depending on the amount of income

Do you care for a totally disabled relative Find out if you can claim them as a dependent on your taxes Get tax answers from H R Block

The Income Tax Handicapped Dependent have gained huge popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Customization: There is the possibility of tailoring printing templates to your own specific requirements whether it's making invitations making your schedule, or decorating your home.

-

Educational Benefits: Downloads of educational content for free offer a wide range of educational content for learners from all ages, making them a useful device for teachers and parents.

-

The convenience of Access to various designs and templates reduces time and effort.

Where to Find more Income Tax Handicapped Dependent

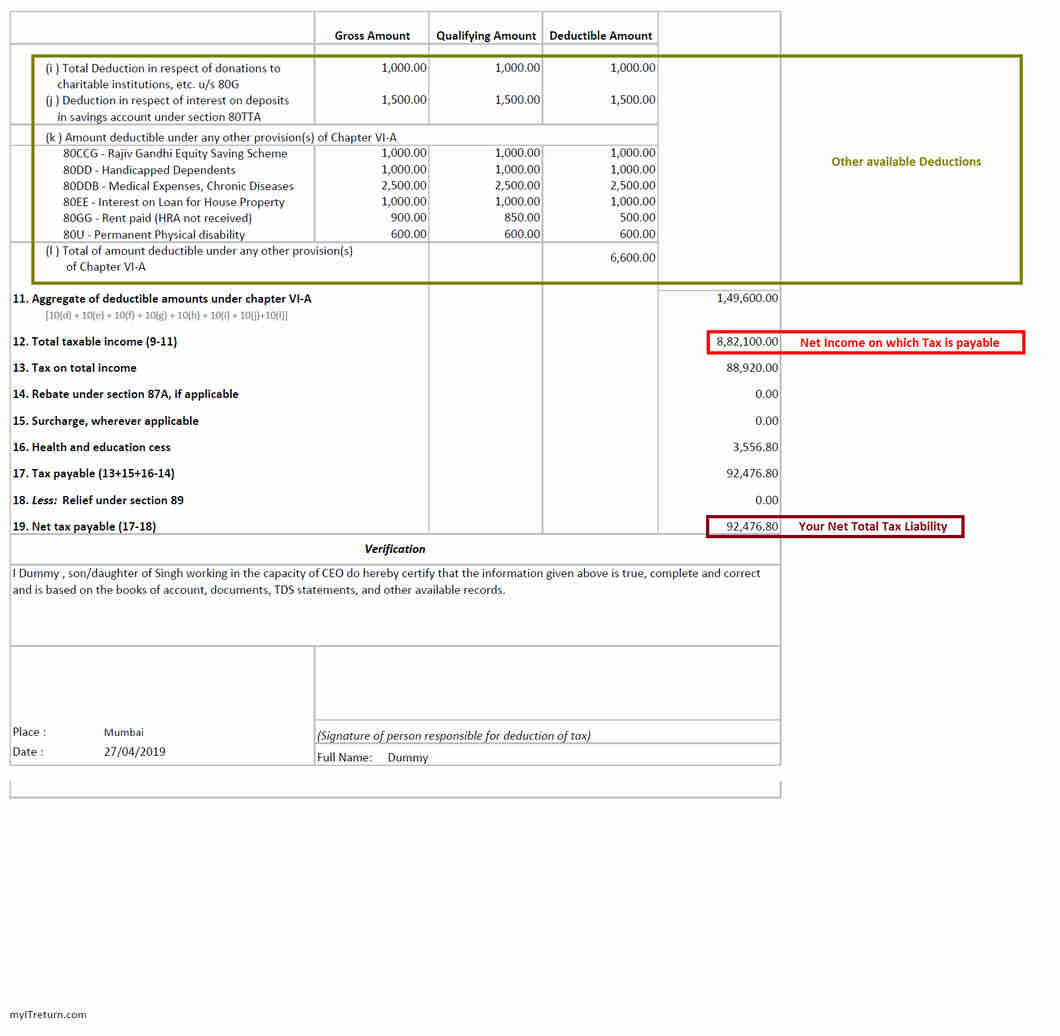

Claim Deduction Under Section 80DD Learn By Quicko

Claim Deduction Under Section 80DD Learn By Quicko

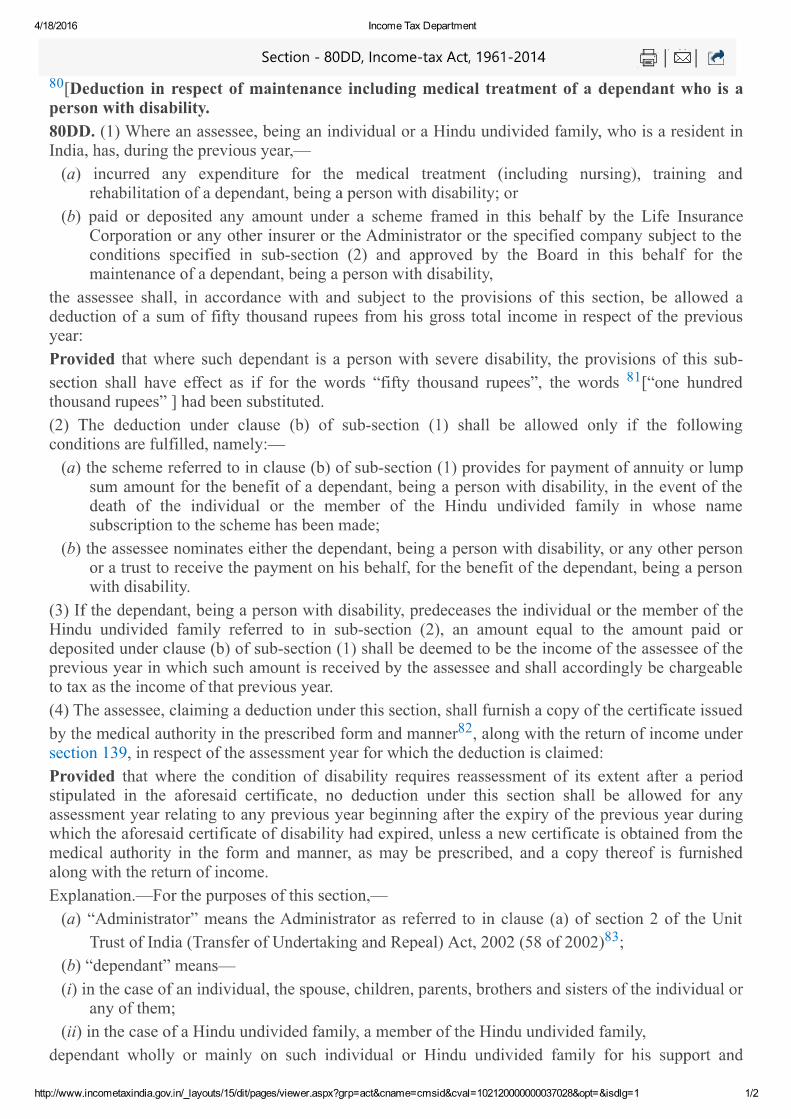

Section 80DD of the Income Tax Act allows residents whether individuals or HUFs to claim a deduction for a dependent who is differently abled and completely

A member of a HUF who is dependent and has a disability is taken into account in the context of Section 80DD Section 80DD allows for tax deductions for anyone who pays

After we've peaked your curiosity about Income Tax Handicapped Dependent We'll take a look around to see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Income Tax Handicapped Dependent for various needs.

- Explore categories like decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Perfect for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs covered cover a wide selection of subjects, including DIY projects to party planning.

Maximizing Income Tax Handicapped Dependent

Here are some inventive ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to reinforce learning at home or in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Income Tax Handicapped Dependent are an abundance of useful and creative resources that can meet the needs of a variety of people and interest. Their accessibility and flexibility make these printables a useful addition to both professional and personal life. Explore the many options of Income Tax Handicapped Dependent and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I use the free printables in commercial projects?

- It's dependent on the particular terms of use. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues with Income Tax Handicapped Dependent?

- Certain printables could be restricted on use. Make sure you read the terms and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home using printing equipment or visit a print shop in your area for high-quality prints.

-

What program do I require to view printables at no cost?

- Most PDF-based printables are available in PDF format. These can be opened with free programs like Adobe Reader.

Income Tax Deductions Related To Health Deduction For Medical

PDF Income Tax Department Exemption Physically Handicapped Dependent

Check more sample of Income Tax Handicapped Dependent below

SciELO Brasil Myelin Oligodendrocyte Glycoprotein Antibody

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

Vehicle Belongs To Persons With Disability Get Tax Exemption INDIAN

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

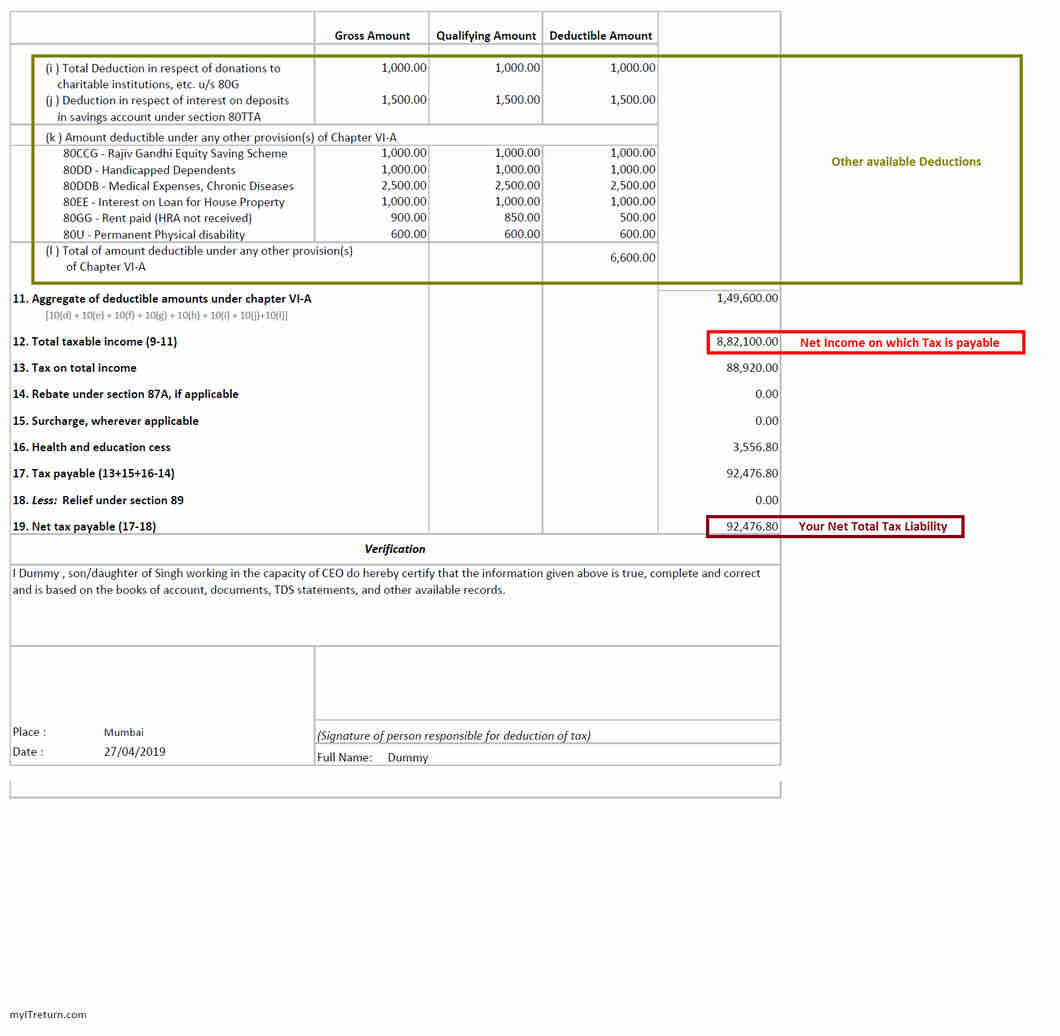

Income Tax Calculation Example 2 For Salary Employees 2023 24

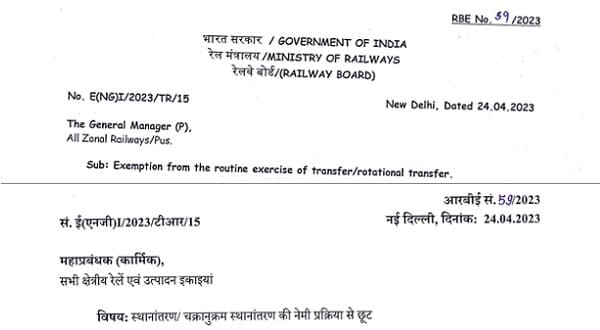

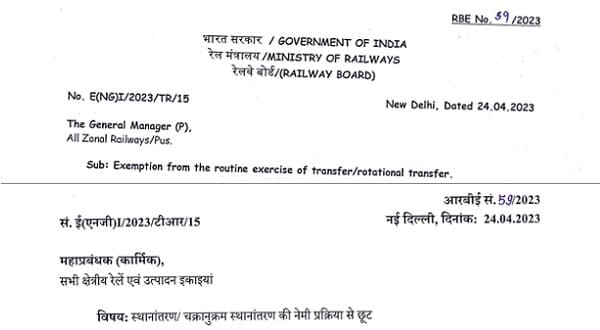

Exemption From The Routine Train Of Switch rotational Switch Railway

https://www.irs.gov/pub/irs-pdf/p3966.pdf

Dependents You may be able to claim your child as a dependent regardless of age if they are permanently and totally disabled Permanently and totally disabled He or she

https://cleartax.in/s/who-can-claim-deduction-under-section-80dd

Deduction under Section 80DD of the income tax act is allowed to Resident Individuals or HUFs for a dependent who is differently abled and is wholly dependent

Dependents You may be able to claim your child as a dependent regardless of age if they are permanently and totally disabled Permanently and totally disabled He or she

Deduction under Section 80DD of the income tax act is allowed to Resident Individuals or HUFs for a dependent who is differently abled and is wholly dependent

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

Income Tax Calculation Example 2 For Salary Employees 2023 24

Exemption From The Routine Train Of Switch rotational Switch Railway

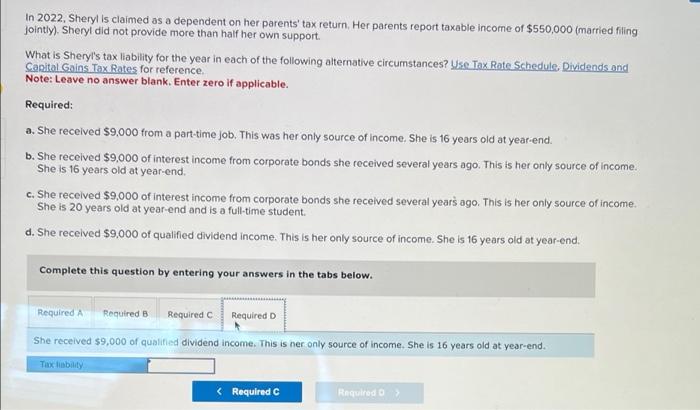

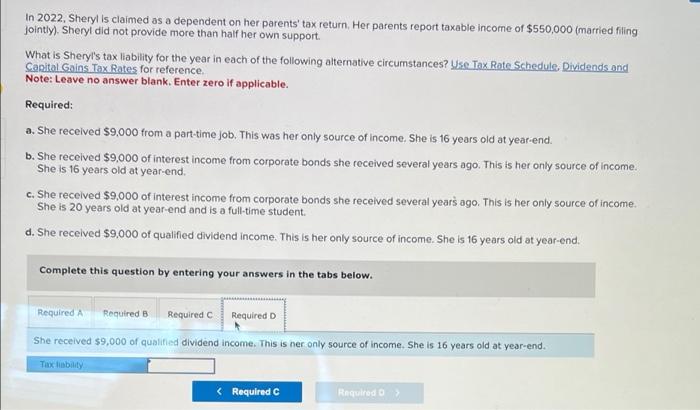

If A Student s Parents Do Not Claim Him As A Dependent On Their Income

Solved I Need Help In 2022 Sheryl Is Claimed As A Depend

Solved I Need Help In 2022 Sheryl Is Claimed As A Depend

Karnataka Government Employee s News By VijayMK Tax Handicapped Duty Late