In the age of digital, with screens dominating our lives and the appeal of physical printed materials isn't diminishing. No matter whether it's for educational uses, creative projects, or just adding the personal touch to your space, Income Tax Deduction Handicapped Person are now a useful resource. Through this post, we'll take a dive in the world of "Income Tax Deduction Handicapped Person," exploring their purpose, where you can find them, and what they can do to improve different aspects of your daily life.

Get Latest Income Tax Deduction Handicapped Person Below

Income Tax Deduction Handicapped Person

Income Tax Deduction Handicapped Person -

AS A PERSON WITH A DISABILITY you may qualify for some of the following tax deductions income exclusions and credits More detailed information may be found in the IRS publications referenced Standard Deduction If you are legally blind you may be entitled to a higher standard deduction on your tax return

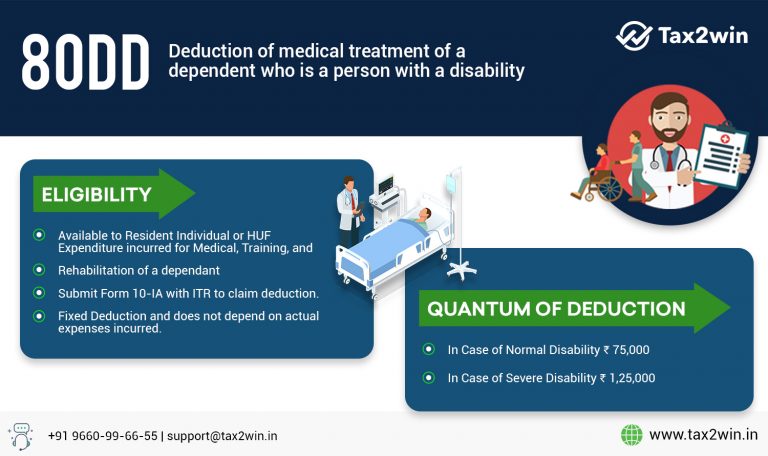

Section 80U of Income Tax Act provides tax benefits to those with disabilities in India A resident with at least 40 disability can claim Rs 75 000 deduction under 80U while severe disabilities yield Rs 1 25 000

Income Tax Deduction Handicapped Person include a broad array of printable resources available online for download at no cost. They are available in numerous kinds, including worksheets coloring pages, templates and many more. The value of Income Tax Deduction Handicapped Person is their flexibility and accessibility.

More of Income Tax Deduction Handicapped Person

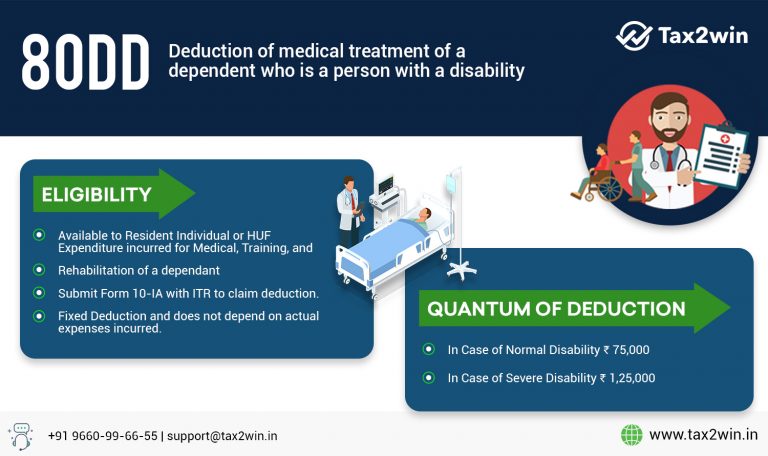

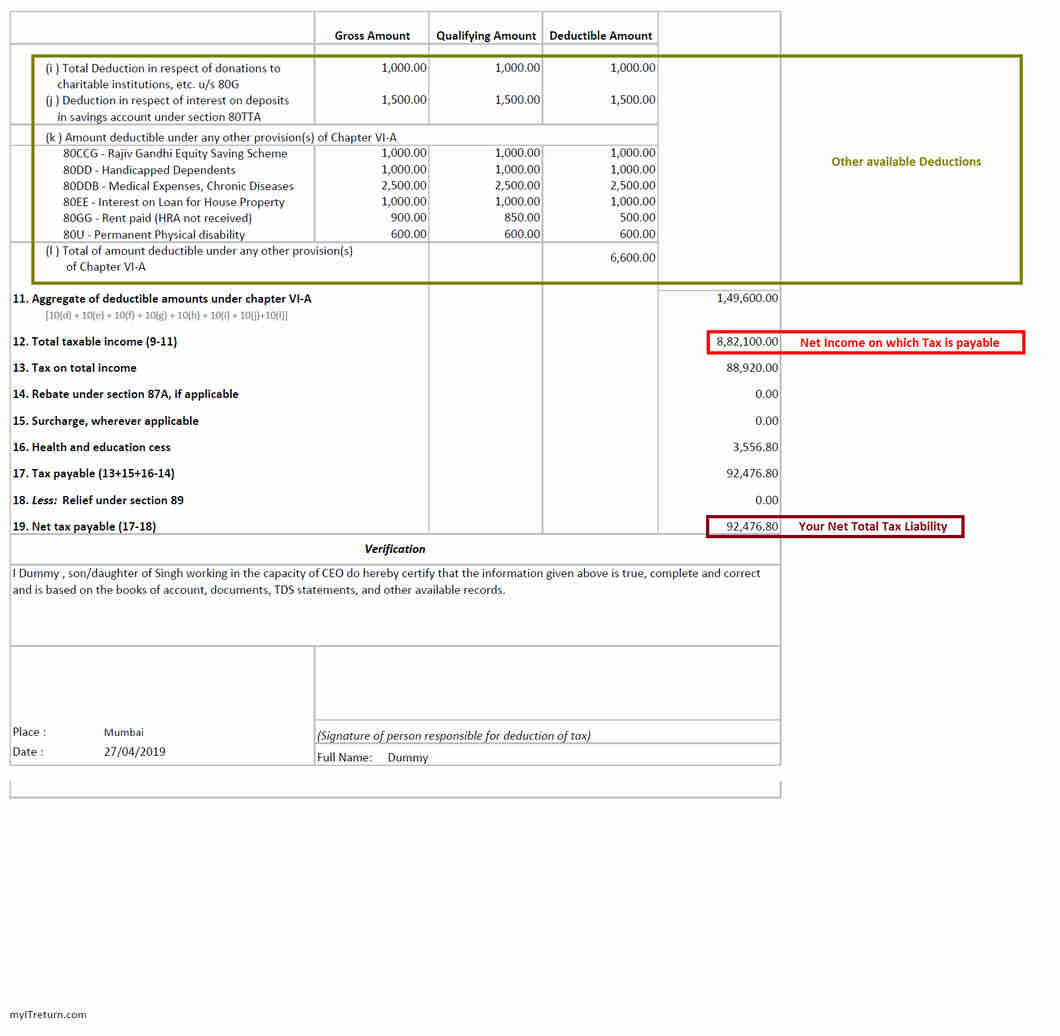

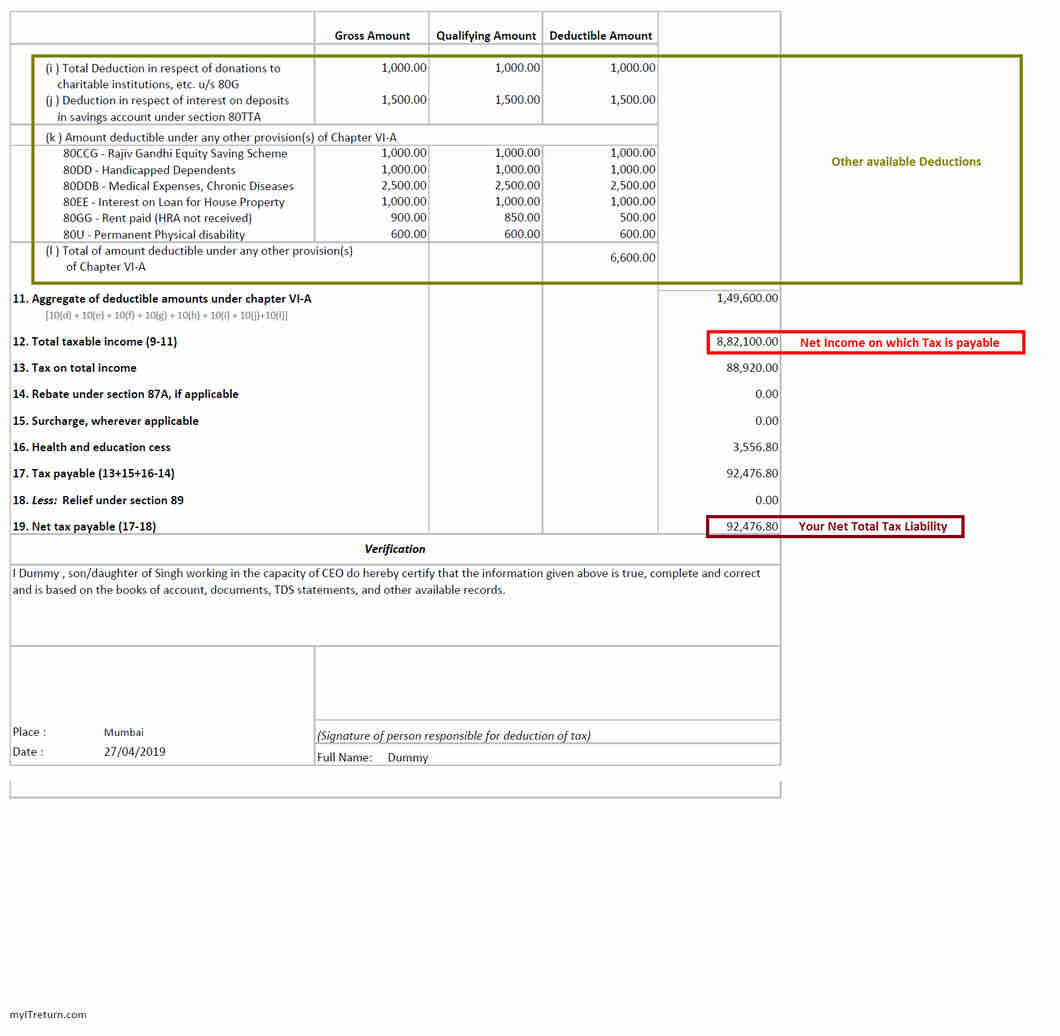

Income Tax Deduction For Handicapped Disable Person Section 80DD

Income Tax Deduction For Handicapped Disable Person Section 80DD

If you have a disability that limits your ability to work or substantially limits a major life activity such as walking breathing learning or using your hands the IRS allows you to deduct your impairment related work expenses IRWE from any employment income or self employment income

Use Deductions to Reduce Taxes Increased standard tax deduction A higher standard tax deduction may be available to you if you are blind or visually impaired Medical deductions If you itemize you can deduct medical costs if they exceed 7 5 percent of your adjusted gross income

Printables for free have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization There is the possibility of tailoring printables to your specific needs be it designing invitations and schedules, or decorating your home.

-

Educational Use: Educational printables that can be downloaded for free are designed to appeal to students from all ages, making them an invaluable aid for parents as well as educators.

-

Convenience: Fast access various designs and templates saves time and effort.

Where to Find more Income Tax Deduction Handicapped Person

DEDUCTION FOR TREATMENT OF HANDICAPPED Planning Deductions Exemptions

DEDUCTION FOR TREATMENT OF HANDICAPPED Planning Deductions Exemptions

If you re disabled you are entitled to an array of tax credits and deductions These may not only eliminate your income tax liability they may also result in the IRS sending you money You are disabled if you have a physical or mental disability for example blindness or deafness that functionally limits your being employed or

The elderly and disabled can receive a tax credit that could reduce and even potentially eliminate the tax they owe for the entire year Here s how to figure out if you qualify

In the event that we've stirred your curiosity about Income Tax Deduction Handicapped Person Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection with Income Tax Deduction Handicapped Person for all uses.

- Explore categories like decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- The blogs are a vast array of topics, ranging from DIY projects to party planning.

Maximizing Income Tax Deduction Handicapped Person

Here are some unique ways of making the most of Income Tax Deduction Handicapped Person:

1. Home Decor

- Print and frame beautiful art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to build your knowledge at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Deduction Handicapped Person are a treasure trove filled with creative and practical information which cater to a wide range of needs and preferences. Their accessibility and versatility make them a fantastic addition to each day life. Explore the vast array of Income Tax Deduction Handicapped Person today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes you can! You can download and print these tools for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's based on the terms of use. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright issues when you download Income Tax Deduction Handicapped Person?

- Some printables may have restrictions on their use. Always read the conditions and terms of use provided by the designer.

-

How do I print Income Tax Deduction Handicapped Person?

- Print them at home using any printer or head to a print shop in your area for superior prints.

-

What software do I require to view printables free of charge?

- Many printables are offered in the PDF format, and is open with no cost software, such as Adobe Reader.

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

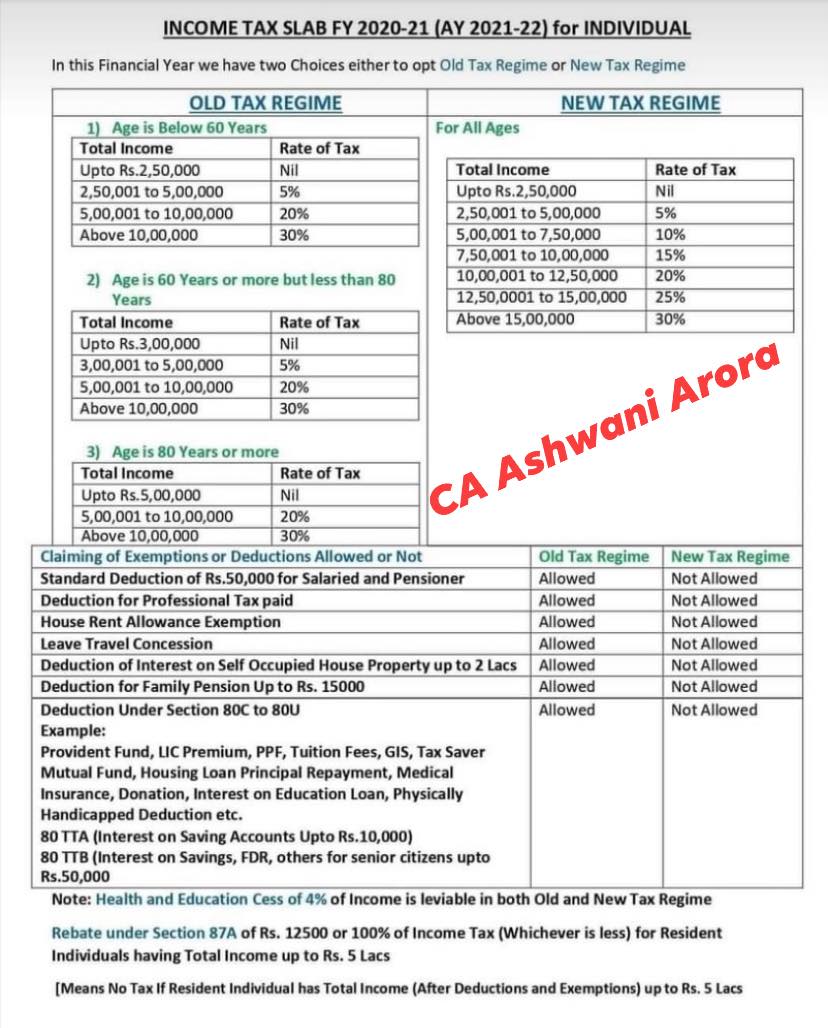

Income Tax Slab Rate For Financial Year 2020 2021 Assessment Year 2021

Check more sample of Income Tax Deduction Handicapped Person below

2022 Federal Tax Brackets And Standard Deduction Printable Form

Claim Deduction Under Section 80DD Learn By Quicko

Disabled Person Can Claim Up To Rs 1 25 000 Tax Deduction

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

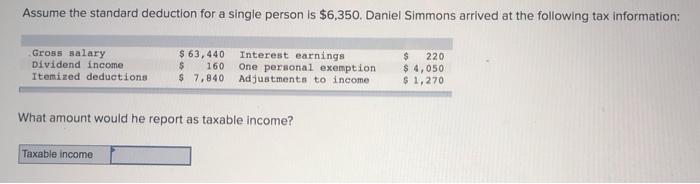

Solved Assume The Standard Deduction For A Single Person Is Chegg

https://cleartax.in/s/section-80u-deduction

Section 80U of Income Tax Act provides tax benefits to those with disabilities in India A resident with at least 40 disability can claim Rs 75 000 deduction under 80U while severe disabilities yield Rs 1 25 000

https://www.irs.gov/publications/p907

The Volunteer Income Tax Assistance VITA program offers free tax help to people with low to moderate incomes persons with disabilities and limited English speaking taxpayers who need help preparing their own tax returns

Section 80U of Income Tax Act provides tax benefits to those with disabilities in India A resident with at least 40 disability can claim Rs 75 000 deduction under 80U while severe disabilities yield Rs 1 25 000

The Volunteer Income Tax Assistance VITA program offers free tax help to people with low to moderate incomes persons with disabilities and limited English speaking taxpayers who need help preparing their own tax returns

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Claim Deduction Under Section 80DD Learn By Quicko

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

Solved Assume The Standard Deduction For A Single Person Is Chegg

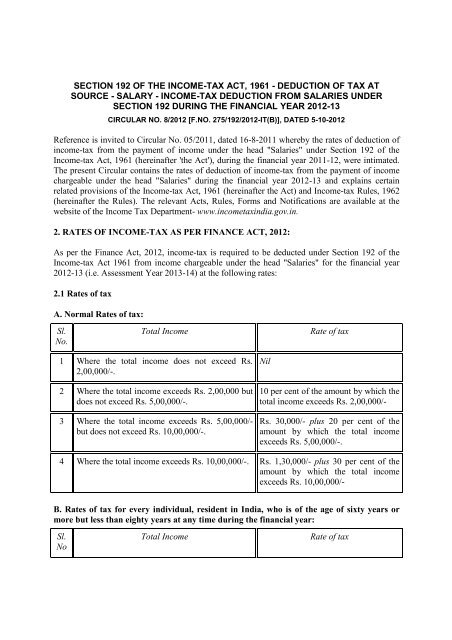

Income tax Deduction From Salaries Under Section

Update Tax Deduction Privileges

Update Tax Deduction Privileges

Income Tax 80c Deduction Fy 2021 22 TAX