In the digital age, with screens dominating our lives The appeal of tangible, printed materials hasn't diminished. In the case of educational materials as well as creative projects or simply adding an extra personal touch to your space, Income Tax Section For Handicapped Dependent have become a valuable resource. Here, we'll dive through the vast world of "Income Tax Section For Handicapped Dependent," exploring what they are, how to locate them, and how they can enhance various aspects of your life.

Get Latest Income Tax Section For Handicapped Dependent Below

Income Tax Section For Handicapped Dependent

Income Tax Section For Handicapped Dependent -

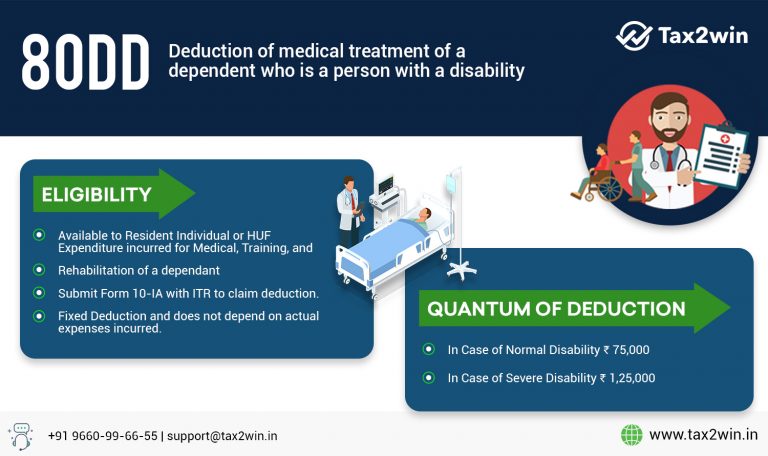

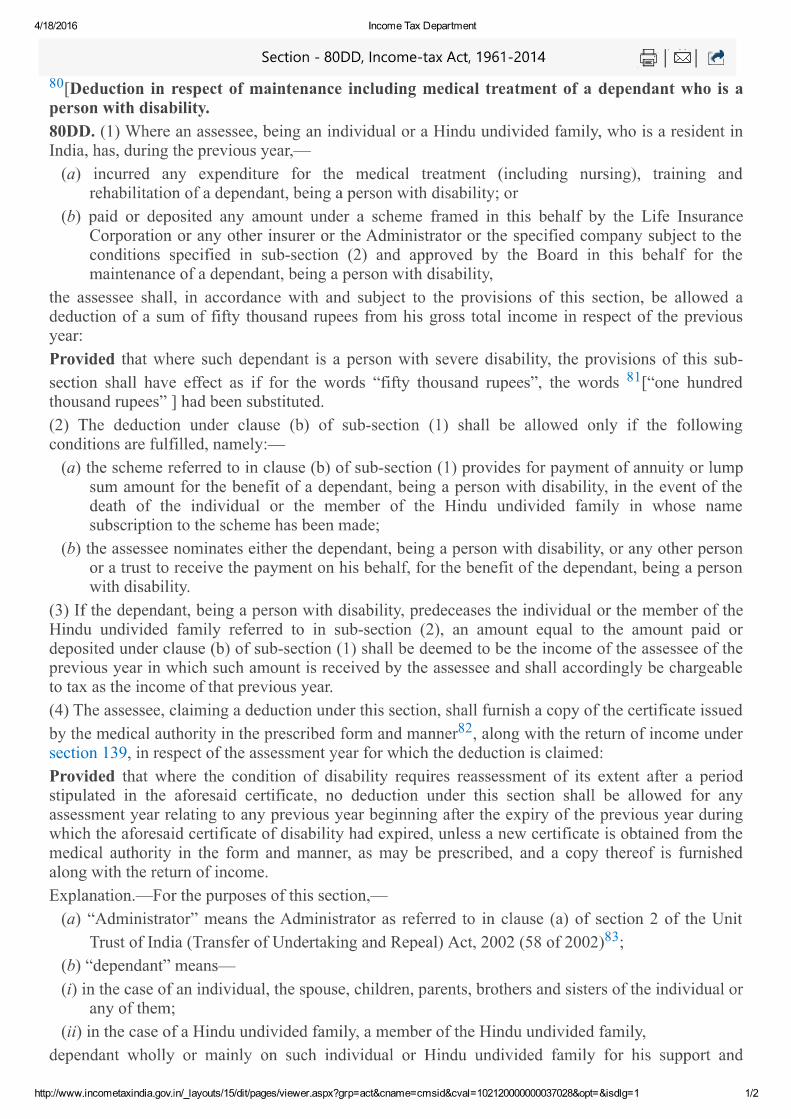

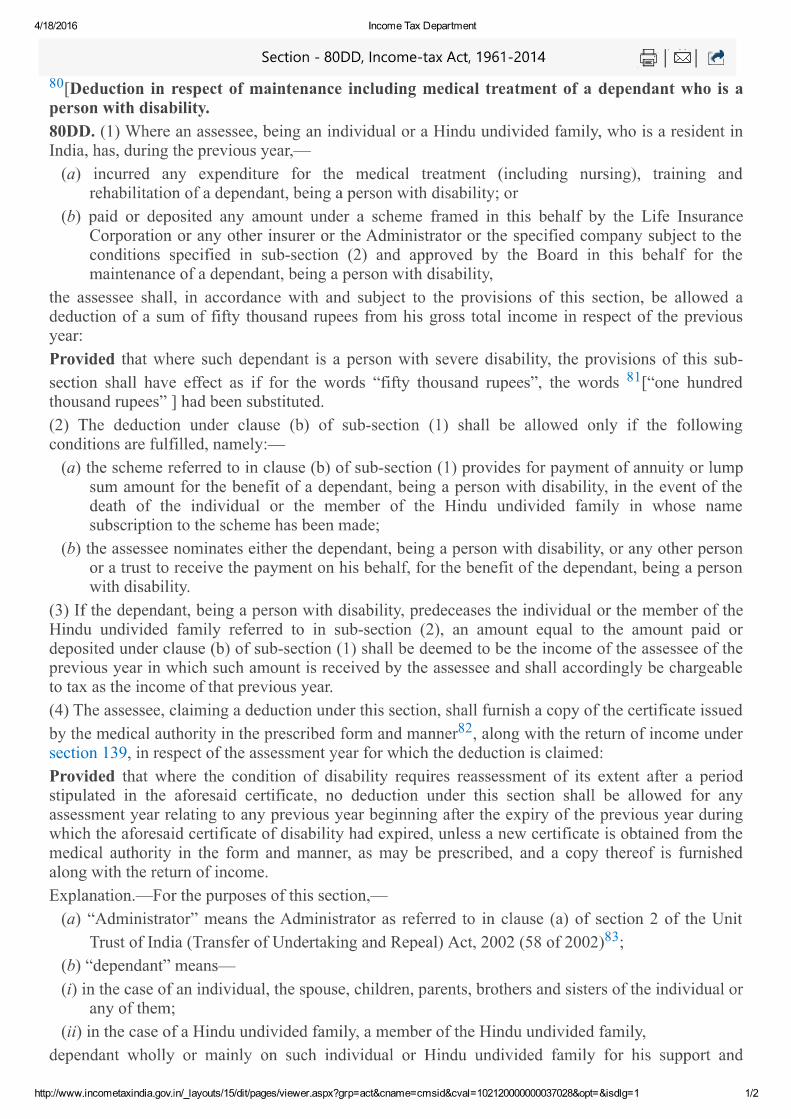

Section 80DD of the Income Tax Act 1961 focuses on the deduction for the medical expenditure of a dependent with disabilities or a differently abled person This section also includes premium payment towards an

Section 80U permits an individual certified as a person with a disability to claim the deduction for themselves Whereas Section 80DD allows for tax deductions if you incur medical expenses for a disabled dependent

Income Tax Section For Handicapped Dependent provide a diverse array of printable materials online, at no cost. These printables come in different formats, such as worksheets, coloring pages, templates and much more. The appeal of printables for free is in their variety and accessibility.

More of Income Tax Section For Handicapped Dependent

Income Tax Deduction For Handicapped Disable Person Section 80DD

Income Tax Deduction For Handicapped Disable Person Section 80DD

Section 80DD allows a deduction of up to Rs 75 000 a year and if the disability is severe up to Rs 1 25 000 a year Severe disability means a person with 80 per cent or more of the disability You can claim deduction if your fits into these categories

Section 80DD allows for tax deductions for anyone who pays for a disabled dependent Learn its meaning eligibility benefits limitations etc Section 80DD Deduction of the income tax offers a flat tax deduction irrespective of the amount of expenditure to the

Income Tax Section For Handicapped Dependent have risen to immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Individualization You can tailor the design to meet your needs when it comes to designing invitations or arranging your schedule or decorating your home.

-

Educational Benefits: Printing educational materials for no cost cater to learners from all ages, making the perfect instrument for parents and teachers.

-

An easy way to access HTML0: instant access various designs and templates reduces time and effort.

Where to Find more Income Tax Section For Handicapped Dependent

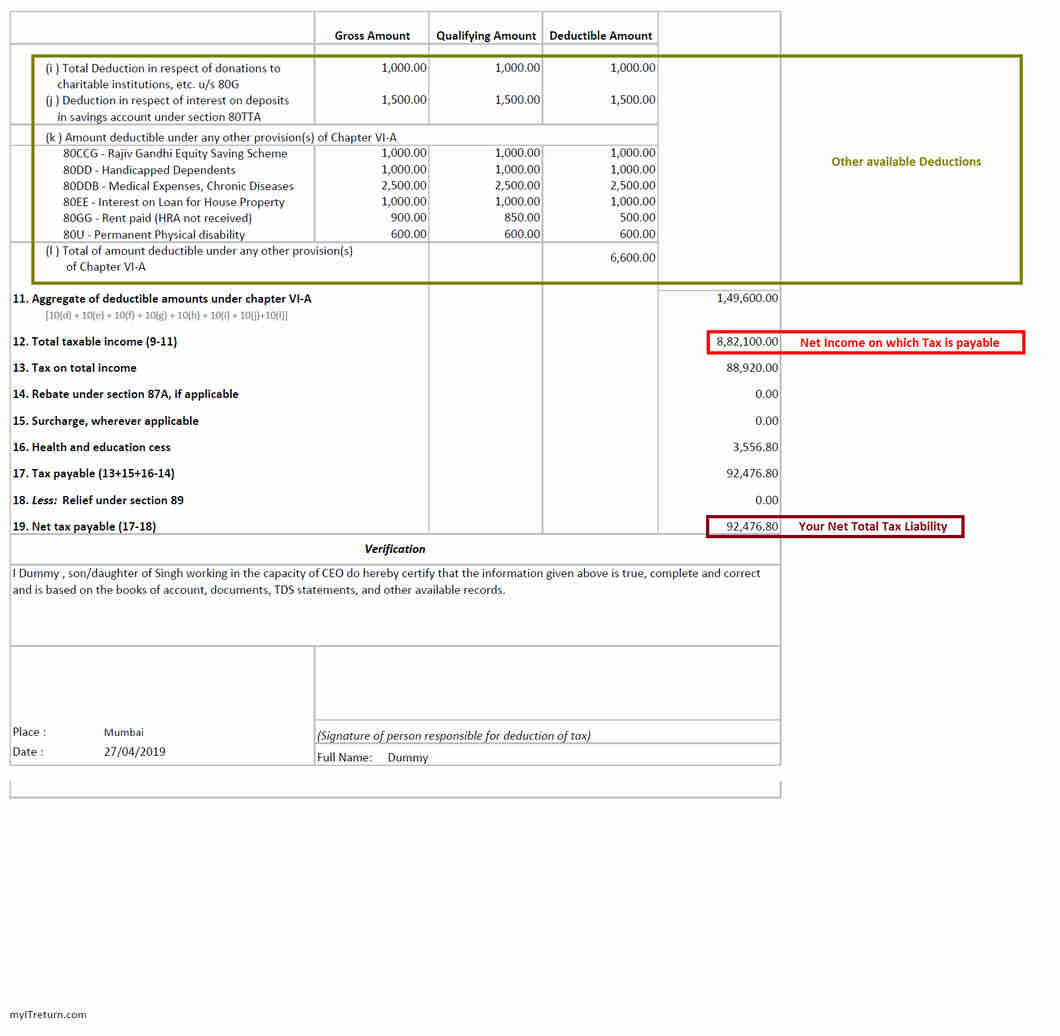

Claim Deduction Under Section 80DD Learn By Quicko

Claim Deduction Under Section 80DD Learn By Quicko

A person who has been certified as disabled may be eligible for tax benefits under Section 80U of the Income Tax Act A family member who pays for a disabled dependent s medical care may claim a tax

Section 80DD of the Income Tax Act allows flat deductions irrespective of the amount of expenditure incurred during the year but it should not be nil However the amount of deduction depends upon the

Since we've got your interest in Income Tax Section For Handicapped Dependent and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Income Tax Section For Handicapped Dependent suitable for many reasons.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets along with flashcards, as well as other learning tools.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a broad range of topics, that range from DIY projects to planning a party.

Maximizing Income Tax Section For Handicapped Dependent

Here are some unique ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Income Tax Section For Handicapped Dependent are a treasure trove of innovative and useful resources which cater to a wide range of needs and needs and. Their access and versatility makes they a beneficial addition to every aspect of your life, both professional and personal. Explore the plethora of Income Tax Section For Handicapped Dependent right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Section For Handicapped Dependent truly gratis?

- Yes you can! You can print and download these files for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's all dependent on the conditions of use. Always consult the author's guidelines before using any printables on commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables could have limitations on use. Always read these terms and conditions as set out by the designer.

-

How do I print Income Tax Section For Handicapped Dependent?

- You can print them at home with either a printer or go to the local print shops for premium prints.

-

What software is required to open printables at no cost?

- Many printables are offered in the PDF format, and can be opened using free software like Adobe Reader.

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

Alliance Tax Experts Income Tax Section 143 1

Check more sample of Income Tax Section For Handicapped Dependent below

SciELO Brasil Myelin Oligodendrocyte Glycoprotein Antibody

Vehicle Belongs To Persons With Disability Get Tax Exemption INDIAN

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Exemption From The Routine Train Of Switch rotational Switch Railway

Income Tax Section Upload Form 16

PDF Income Tax Department Exemption Physically Handicapped Dependent

https://cleartax.in/s/who-can-claim-deduction-under-section-80dd

Section 80U permits an individual certified as a person with a disability to claim the deduction for themselves Whereas Section 80DD allows for tax deductions if you incur medical expenses for a disabled dependent

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents and dependent siblings The diseases eligible for this deduction are outlined in Rule 11DD of

Section 80U permits an individual certified as a person with a disability to claim the deduction for themselves Whereas Section 80DD allows for tax deductions if you incur medical expenses for a disabled dependent

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents and dependent siblings The diseases eligible for this deduction are outlined in Rule 11DD of

Exemption From The Routine Train Of Switch rotational Switch Railway

Vehicle Belongs To Persons With Disability Get Tax Exemption INDIAN

Income Tax Section Upload Form 16

PDF Income Tax Department Exemption Physically Handicapped Dependent

Section 143 Of Income Tax Sections 143 1 2 3

How You Can Get Tax Breaks For Hiring The Handicapped Business

How You Can Get Tax Breaks For Hiring The Handicapped Business

Income Tax Section 79 Set Off And Carry Forward Of Losses IndiaFilings