In this age of electronic devices, where screens dominate our lives it's no wonder that the appeal of tangible printed material hasn't diminished. Be it for educational use in creative or artistic projects, or just adding an element of personalization to your space, Ppf Exemption From Income Tax Section have become an invaluable resource. This article will take a dive in the world of "Ppf Exemption From Income Tax Section," exploring the benefits of them, where they are available, and how they can improve various aspects of your daily life.

Get Latest Ppf Exemption From Income Tax Section Below

Ppf Exemption From Income Tax Section

Ppf Exemption From Income Tax Section - Ppf Exemption From Income Tax Section, Is Ppf Exempted From Income Tax, Exemption Of Ppf Interest Section, Ppf Eligibility For Tax Exemption

Tax benefit PPF investment comes under the EEE Exempt Exempt Exempt category This means the amount invested interest earned and maturity amount are tax free Partial withdrawal It has a lock in period of 15 years but it also comes with a partial withdrawal facility upto some specified limit 7 Tax Benefits of PPF

Contribution to the PPF scheme is governed by Section 2 11 of the Income Tax Act According to Section 10 11 any sum relating to contribution made in provident fund constituted by the central government is exempted

Printables for free cover a broad collection of printable materials available online at no cost. They are available in numerous styles, from worksheets to templates, coloring pages, and many more. The beauty of Ppf Exemption From Income Tax Section lies in their versatility and accessibility.

More of Ppf Exemption From Income Tax Section

Income Tax Slab For FY 2022 23 What You Need To Know

Income Tax Slab For FY 2022 23 What You Need To Know

The income tax department allows taxpayers to claim deductions i e reducing the taxable income if taxpayer makes certain investments or eligible expenditures allowed under Chapter VI A 80C allows a deduction for the investment made in PPF EPF LIC premium Equity linked saving scheme principal amount payment towards home

Public Provident Fund PPF is considered as most important and safe amongst all tax saving investments schemes This scheme is falls under the EEE category i e Exempt Exempt and Exempt which means if you invest in it you will get a deduction u s 80C on your income

The Ppf Exemption From Income Tax Section have gained huge popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Personalization It is possible to tailor printables to your specific needs whether you're designing invitations or arranging your schedule or decorating your home.

-

Education Value Printing educational materials for no cost cater to learners of all ages. This makes them an essential tool for teachers and parents.

-

The convenience of You have instant access numerous designs and templates, which saves time as well as effort.

Where to Find more Ppf Exemption From Income Tax Section

Income Tax Section 10 Exemption Under Section 10 Exemption From

Income Tax Section 10 Exemption Under Section 10 Exemption From

Income tax exemptions are applicable on the principal amount invested in a PPF as an account The entire value of investment can be claimed for tax waiver under section 80C of the Income Tax Act of 1961

PPF investments qualify for tax deduction benefits under Section 80C of the Income Tax Act which allows you to claim deductions up to Rs 1 5 lakh for the principal amount invested The second exemption is applicable to the interest earned from a PPF account which is also tax free

Now that we've piqued your curiosity about Ppf Exemption From Income Tax Section We'll take a look around to see where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection with Ppf Exemption From Income Tax Section for all reasons.

- Explore categories like decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs are a vast variety of topics, that includes DIY projects to party planning.

Maximizing Ppf Exemption From Income Tax Section

Here are some ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Print free worksheets to enhance your learning at home and in class.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Ppf Exemption From Income Tax Section are a treasure trove of useful and creative resources that satisfy a wide range of requirements and desires. Their accessibility and versatility make them an essential part of the professional and personal lives of both. Explore the vast array of Ppf Exemption From Income Tax Section now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes, they are! You can print and download these tools for free.

-

Do I have the right to use free printables to make commercial products?

- It's determined by the specific conditions of use. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may contain restrictions regarding usage. You should read the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- You can print them at home with printing equipment or visit the local print shop for high-quality prints.

-

What program do I need to open printables for free?

- Many printables are offered as PDF files, which can be opened with free software, such as Adobe Reader.

PPF Tax Exemption In Hindi

PPF Tax Exemption What Does It Mean Investment Simplified

Check more sample of Ppf Exemption From Income Tax Section below

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

EXEMPTION FROM INCOME TAX FOREIGN EMPLOYMENT INCOME FHBC

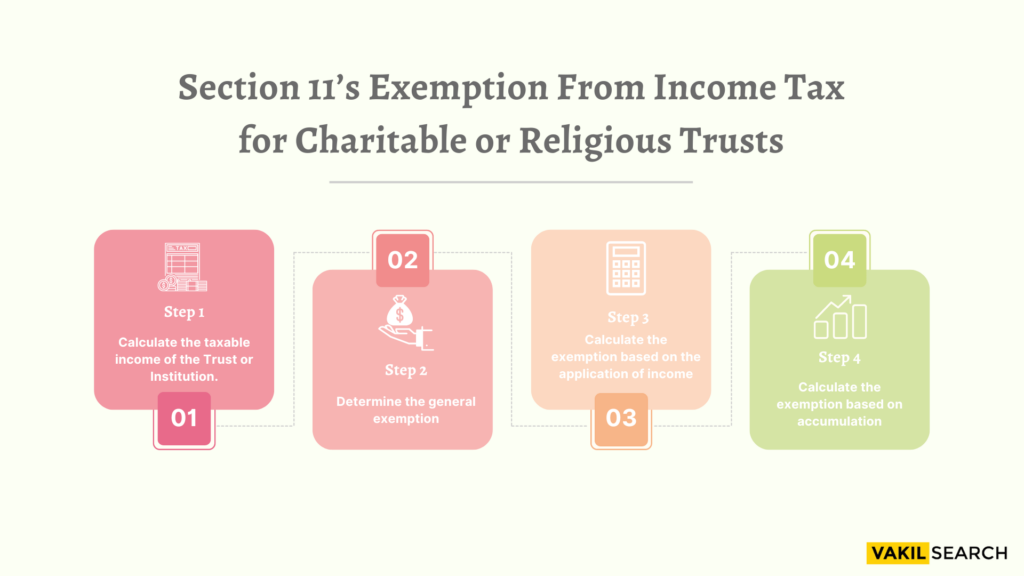

Section 11 Income Tax Act Exemptions For Charitable Trusts

We Got 12A Exemption Registration Under Income Tax

Section 80C Deductions List To Save Income Tax FinCalC Blog

Nitin On Twitter RT tigerAkD It s A Section That Is Specifically

https://www.taxscan.in/article/taxability-of...

Contribution to the PPF scheme is governed by Section 2 11 of the Income Tax Act According to Section 10 11 any sum relating to contribution made in provident fund constituted by the central government is exempted

https://cleartax.in/s/80C-Deductions

In Budget 2021 update unpaid PF contributions by employer can t be deducted Section 80C offers tax saving investment options including ELSS funds which provide higher returns than FDs with a 3 year lock in period Other options include PPF EPF NPS NSC ULIP and Sukanya Samriddhi Yojana

Contribution to the PPF scheme is governed by Section 2 11 of the Income Tax Act According to Section 10 11 any sum relating to contribution made in provident fund constituted by the central government is exempted

In Budget 2021 update unpaid PF contributions by employer can t be deducted Section 80C offers tax saving investment options including ELSS funds which provide higher returns than FDs with a 3 year lock in period Other options include PPF EPF NPS NSC ULIP and Sukanya Samriddhi Yojana

We Got 12A Exemption Registration Under Income Tax

EXEMPTION FROM INCOME TAX FOREIGN EMPLOYMENT INCOME FHBC

Section 80C Deductions List To Save Income Tax FinCalC Blog

Nitin On Twitter RT tigerAkD It s A Section That Is Specifically

Tax Savings Tax Exemption Can Be Availed With Higher Returns By

Tax Savings Tax Exemption Can Be Availed With Higher Returns By

All About Deduction Under Section 80C Of The Income Tax Act Ebizfiling