In this age of technology, where screens dominate our lives however, the attraction of tangible, printed materials hasn't diminished. Whatever the reason, whether for education such as creative projects or simply adding an extra personal touch to your home, printables for free have become a valuable source. We'll dive into the world "Is Ppf Exempted From Income Tax," exploring their purpose, where they are available, and how they can enhance various aspects of your life.

Get Latest Is Ppf Exempted From Income Tax Below

Is Ppf Exempted From Income Tax

Is Ppf Exempted From Income Tax - Is Ppf Exempted From Income Tax, Is Ppf Fully Exempted From Income Tax, Ppf Exemption From Income Tax Section, Is Ppf Taxable, What Is The Tax Exemption For Ppf, Is Ppf Income Taxable

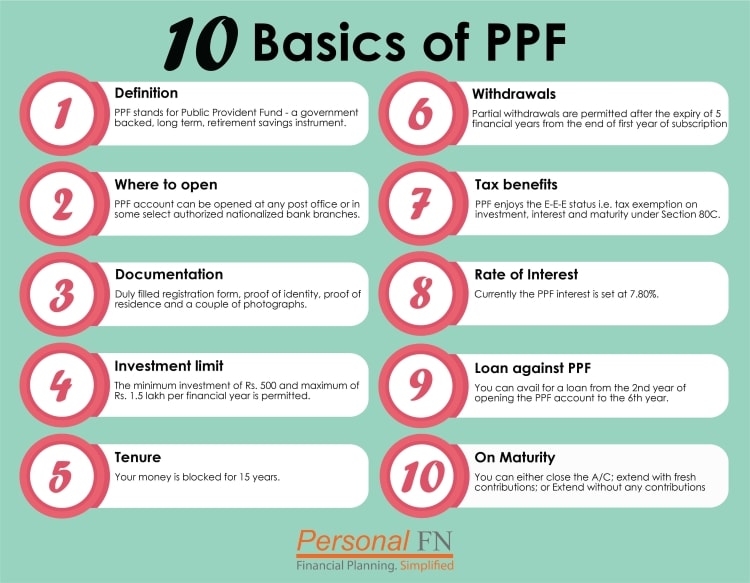

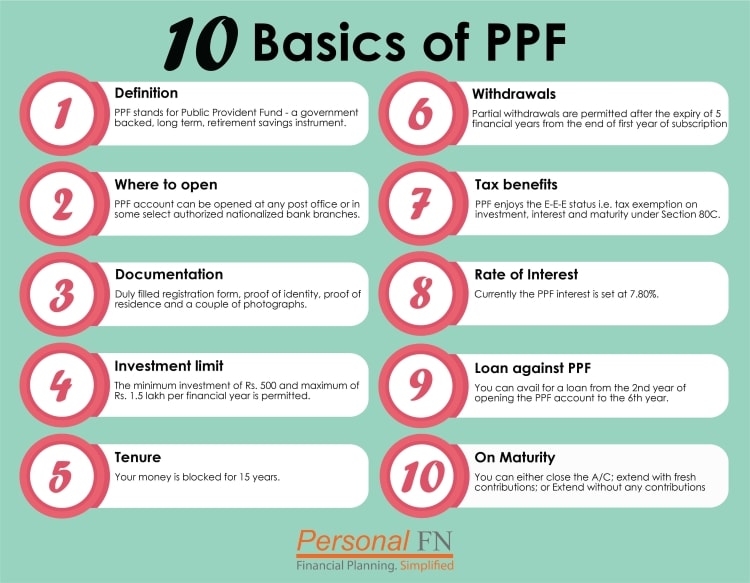

One of the investment plans the Public Provident Fund PPF is a safe option for risk averse investors who are looking to save on taxes Under Section 80C you can avail tax exemption of up to Rs 1 50 lakh in a single financial year

You get tax exemption at the time of investment accrual and withdrawal It offers up to Rs 1 5 lakh deduction on investment made in each financial year under section 80C of the Income tax Act 1961 The interest earned each year is also tax exempt

Is Ppf Exempted From Income Tax encompass a wide collection of printable documents that can be downloaded online at no cost. These printables come in different kinds, including worksheets templates, coloring pages and much more. The attraction of printables that are free is in their variety and accessibility.

More of Is Ppf Exempted From Income Tax

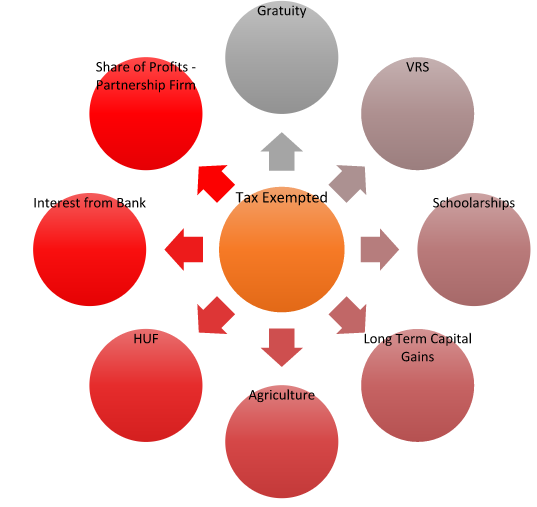

Tax Exemption In Salary Everything That You Need To Know

Tax Exemption In Salary Everything That You Need To Know

In simple words you get a tax deduction under Section 80C for the amount you invest every year in the PPF account In addition to that the interest on the amount invested is also tax exempt

PPF enjoys an EEE or exempt exempt exempt status It means the PPF account offers subscribers triple exemption benefit tax free returns deduction on deposits and no wealth

Is Ppf Exempted From Income Tax have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Personalization You can tailor the design to meet your needs be it designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Worth: These Is Ppf Exempted From Income Tax can be used by students of all ages. This makes them a useful tool for parents and teachers.

-

Easy to use: You have instant access the vast array of design and templates will save you time and effort.

Where to Find more Is Ppf Exempted From Income Tax

Perquisites Exempted FromTax For All Employees And Not Added In Salary

Perquisites Exempted FromTax For All Employees And Not Added In Salary

Interest on PPF is completely tax free without any limit It is not taxable at the time of accrual nor at the time of receipt under Section 10 11 Maturity as well as premature withdrawal is also exempt from tax under Section 10 11

You should also know that PPF investments fall under the Exempt Exempt Exempt EEE category This means The amount you invest in PPF is exempt from tax The interest you earn on PPF is exempt from tax The final corpus at the time of withdrawal is also exempt from tax

We hope we've stimulated your interest in printables for free Let's see where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection with Is Ppf Exempted From Income Tax for all motives.

- Explore categories such as decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets with flashcards and other teaching tools.

- This is a great resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs are a vast selection of subjects, starting from DIY projects to party planning.

Maximizing Is Ppf Exempted From Income Tax

Here are some innovative ways that you can make use of Is Ppf Exempted From Income Tax:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets for free for teaching at-home for the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Is Ppf Exempted From Income Tax are an abundance with useful and creative ideas that cater to various needs and preferences. Their accessibility and versatility make they a beneficial addition to your professional and personal life. Explore the endless world of Is Ppf Exempted From Income Tax today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is Ppf Exempted From Income Tax really for free?

- Yes you can! You can print and download these files for free.

-

Does it allow me to use free printables to make commercial products?

- It's dependent on the particular terms of use. Be sure to read the rules of the creator before using printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables may be subject to restrictions regarding usage. You should read the terms and conditions offered by the creator.

-

How do I print printables for free?

- You can print them at home using the printer, or go to a local print shop for more high-quality prints.

-

What software do I require to open printables at no cost?

- The majority are printed in the format of PDF, which can be opened with free programs like Adobe Reader.

What Is PPF Account Its Benefits Interest Rate In SBI ICICI Other

This Is The Portion Of Your Salary Exempted Deductible From Tax

Check more sample of Is Ppf Exempted From Income Tax below

Income That Is Non taxable Is Called As Exempt Income Section 10 Of

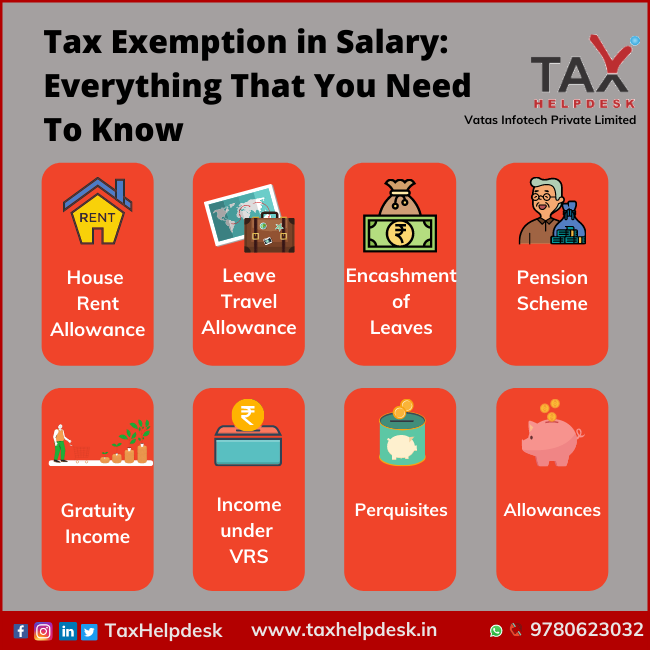

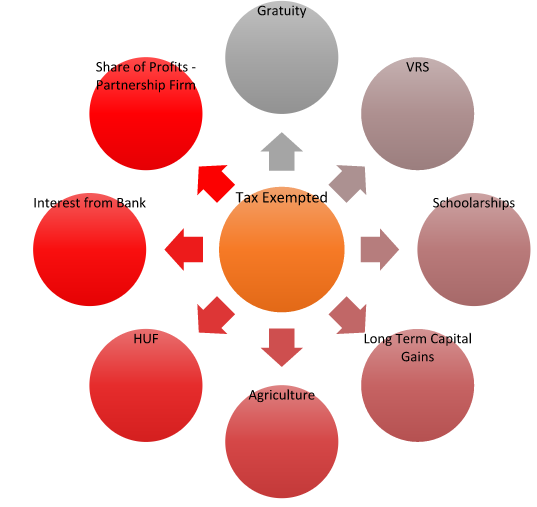

Exemption Income Tax Income Tax Deduction Agriculture Income Non

Canara Bank On Twitter Invest In Public Provident Fund Save Big And

Exempt Incomes And Allowances For Income Tax Filing

Provident Funds Types Income Tax Implications

All You Need To Know On Exempted Income In Income Tax Ebizfiling

https://economictimes.indiatimes.com/wealth/invest/...

You get tax exemption at the time of investment accrual and withdrawal It offers up to Rs 1 5 lakh deduction on investment made in each financial year under section 80C of the Income tax Act 1961 The interest earned each year is also tax exempt

https://www.taxscan.in/article/taxability-of...

Contribution to the PPF scheme is governed by Section 2 11 of the Income Tax Act According to Section 10 11 any sum relating to contribution made in provident fund constituted by the central government is exempted

You get tax exemption at the time of investment accrual and withdrawal It offers up to Rs 1 5 lakh deduction on investment made in each financial year under section 80C of the Income tax Act 1961 The interest earned each year is also tax exempt

Contribution to the PPF scheme is governed by Section 2 11 of the Income Tax Act According to Section 10 11 any sum relating to contribution made in provident fund constituted by the central government is exempted

Exempt Incomes And Allowances For Income Tax Filing

Exemption Income Tax Income Tax Deduction Agriculture Income Non

Provident Funds Types Income Tax Implications

All You Need To Know On Exempted Income In Income Tax Ebizfiling

2023

PUBLIC PROVIDENT FUND PPF SCHEME INCOME TAX BENEFIT INVESTMENT LIMIT

PUBLIC PROVIDENT FUND PPF SCHEME INCOME TAX BENEFIT INVESTMENT LIMIT

PPF Account The Complete Guide 2023