In this age of electronic devices, where screens have become the dominant feature of our lives but the value of tangible printed objects isn't diminished. For educational purposes such as creative projects or simply to add an element of personalization to your home, printables for free can be an excellent resource. We'll dive deeper into "Is Medical Reimbursement Taxable," exploring what they are, how they are available, and the ways that they can benefit different aspects of your daily life.

Get Latest Is Medical Reimbursement Taxable Below

Is Medical Reimbursement Taxable

Is Medical Reimbursement Taxable - Is Medical Reimbursement Taxable, Is Medical Reimbursement Taxable Income, Is Medical Reimbursement Taxable In India, Is Medical Reimbursement Taxable For Central Government Employees, Is Medical Reimbursement Taxable In New Tax Regime, Is Medical Reimbursement Taxable Or Not, Is Medical Reimbursement Taxable For Pensioners, Is Medical Reimbursement Taxable In Singapore, Are Reimbursement Taxable, Is Medical Expenses Reimbursement Taxable

If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in

In case of salaried person who is provided with medical allowance the whole amount will be taxable The medical facility in India provided to the employee or his dependent relative i e children spouse

The Is Medical Reimbursement Taxable are a huge assortment of printable, downloadable materials that are accessible online for free cost. These resources come in various types, like worksheets, coloring pages, templates and more. The great thing about Is Medical Reimbursement Taxable is in their variety and accessibility.

More of Is Medical Reimbursement Taxable

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

What Are Employee Expense Reimbursements and Are They Taxable Are employee reimbursement expenses taxable income How do you qualify Learn more about IRS rules and accountable reimbursement plans

Employers are allowed to claim a tax deduction for the reimbursements they make through these plans and reimbursement dollars received by employees are generally tax free Key Takeaways

Is Medical Reimbursement Taxable have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Flexible: It is possible to tailor the templates to meet your individual needs such as designing invitations making your schedule, or even decorating your house.

-

Educational value: Education-related printables at no charge can be used by students of all ages, which makes the perfect tool for parents and teachers.

-

Simple: The instant accessibility to numerous designs and templates, which saves time as well as effort.

Where to Find more Is Medical Reimbursement Taxable

Is Tuition Reimbursement Taxable A Guide ClearDegree

Is Tuition Reimbursement Taxable A Guide ClearDegree

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t

Is an HRA reimbursement taxable Under Internal Revenue Service IRS rules 1 employers can reimburse their employees for health insurance and qualifying medical expenses in a tax

We've now piqued your interest in Is Medical Reimbursement Taxable Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Is Medical Reimbursement Taxable for various objectives.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- Perfect for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a broad range of interests, all the way from DIY projects to party planning.

Maximizing Is Medical Reimbursement Taxable

Here are some fresh ways create the maximum value of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home also in the classes.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Is Medical Reimbursement Taxable are an abundance with useful and creative ideas that can meet the needs of a variety of people and interest. Their access and versatility makes them a wonderful addition to both personal and professional life. Explore the world that is Is Medical Reimbursement Taxable today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes, they are! You can download and print these documents for free.

-

Can I download free printables for commercial purposes?

- It's all dependent on the terms of use. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables could be restricted on their use. Check the terms and condition of use as provided by the designer.

-

How do I print Is Medical Reimbursement Taxable?

- You can print them at home with either a printer or go to any local print store for top quality prints.

-

What software do I require to view printables at no cost?

- The majority of printables are in PDF format. They can be opened using free software such as Adobe Reader.

Is Employee Mileage Reimbursement Taxable

Is Mileage Reimbursement Taxable

Check more sample of Is Medical Reimbursement Taxable below

What Is Healthcare Reimbursement Insurance Noon

Vehicle Programs Is Mileage Reimbursement Taxable Motus

Is Health Insurance Reimbursement Taxable

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Is Work From Home Reimbursement Taxable

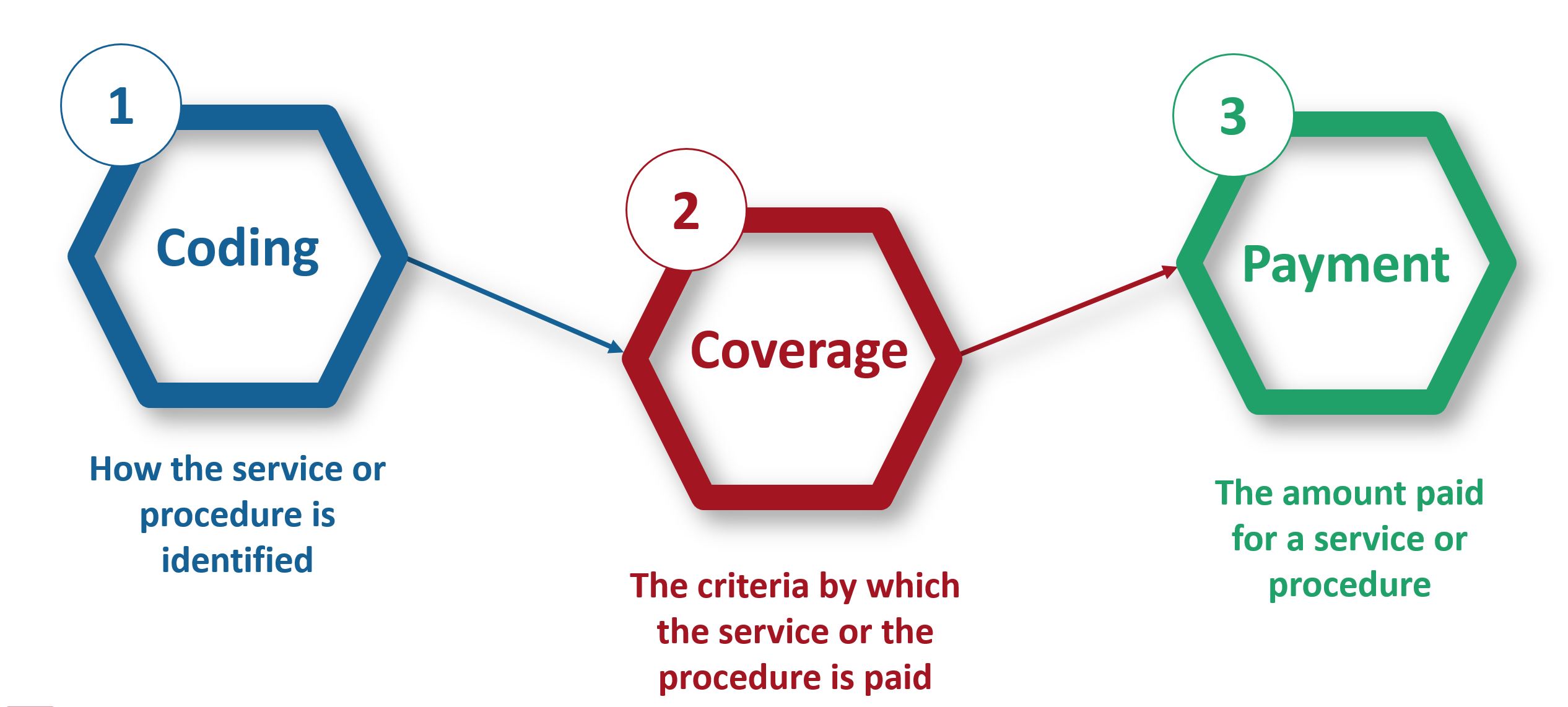

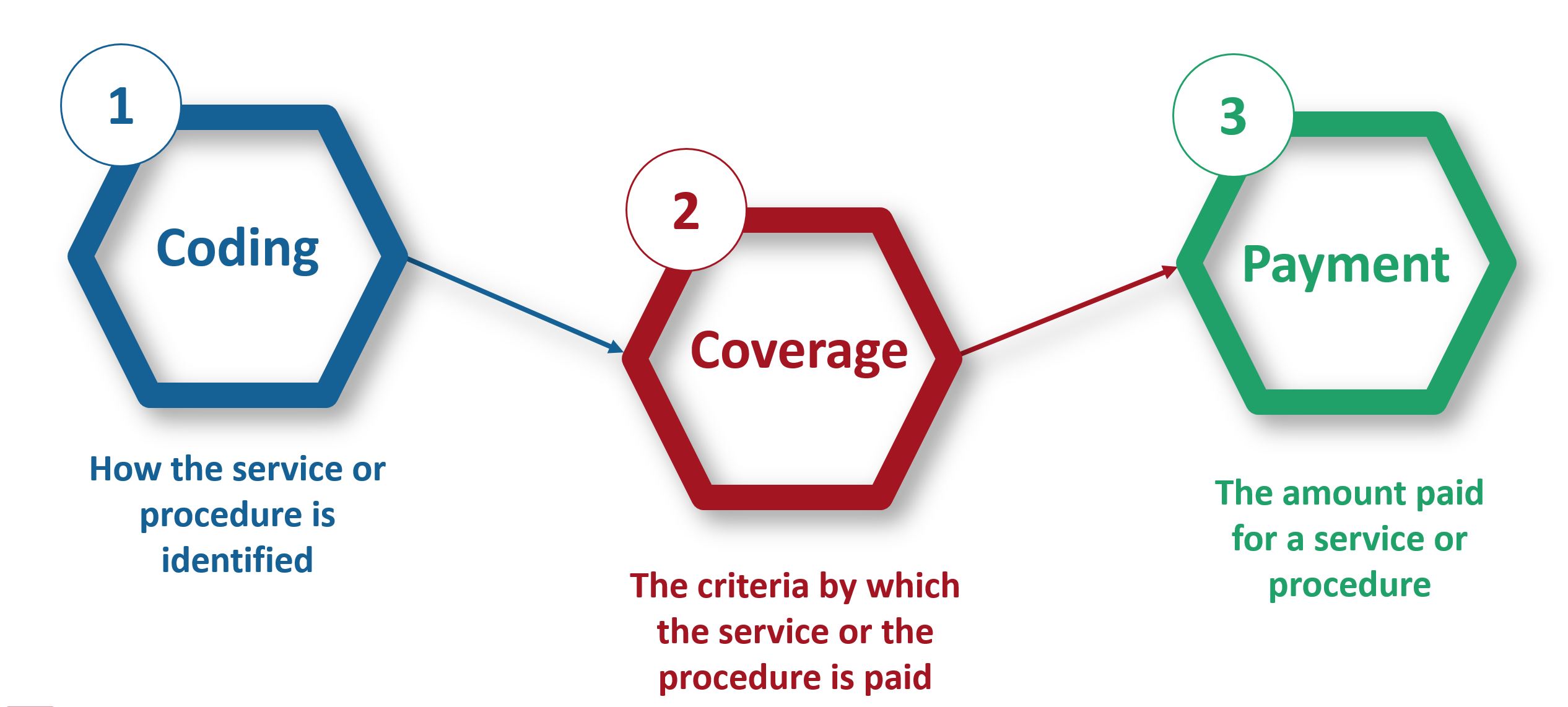

Understanding Reimbursement For Medical Devices Coding Coverage

https://taxguru.in/income-tax/taxability-m…

In case of salaried person who is provided with medical allowance the whole amount will be taxable The medical facility in India provided to the employee or his dependent relative i e children spouse

https://learn.quicko.com/medical-allowance-reimbursement

Medical Reimbursement is tax free perquisites under Section 17 2 till INR 15000 However the employee can incur an amount higher than INR 15 000 on medical

In case of salaried person who is provided with medical allowance the whole amount will be taxable The medical facility in India provided to the employee or his dependent relative i e children spouse

Medical Reimbursement is tax free perquisites under Section 17 2 till INR 15000 However the employee can incur an amount higher than INR 15 000 on medical

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Vehicle Programs Is Mileage Reimbursement Taxable Motus

Is Work From Home Reimbursement Taxable

Understanding Reimbursement For Medical Devices Coding Coverage

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

What Is Pre Tax Commuter Benefit