In this age of technology, where screens have become the dominant feature of our lives, the charm of tangible, printed materials hasn't diminished. Whether it's for educational purposes for creative projects, simply to add a personal touch to your area, Is Medical Reimbursement Taxable In India can be an excellent resource. For this piece, we'll dive deeper into "Is Medical Reimbursement Taxable In India," exploring what they are, how they are available, and what they can do to improve different aspects of your daily life.

Get Latest Is Medical Reimbursement Taxable In India Below

Is Medical Reimbursement Taxable In India

Is Medical Reimbursement Taxable In India -

Yes in India Medical Reimbursements are exempted from Income Tax but only up to Rs 15000 in a year However if the amount exceeds the exemption limit then

3 Income Tax treatment in case of medical insurance reimbursement under mediclaim policy for both salaried as well as non salaried people Money received through a claim under a medical policy

Is Medical Reimbursement Taxable In India encompass a wide array of printable content that can be downloaded from the internet at no cost. They are available in numerous forms, like worksheets templates, coloring pages, and many more. The beauty of Is Medical Reimbursement Taxable In India is in their variety and accessibility.

More of Is Medical Reimbursement Taxable In India

Is Crowdfunding Taxable In India No Know The TAX BENEFITS

Is Crowdfunding Taxable In India No Know The TAX BENEFITS

As per section 17 2 of the income tax act reimbursement against medical expenses of Rs 15 000 in a year is exempt from tax Who is Eligible to Claim Medical

Medical Allowance is fully taxable and employee is not required to furnish any bills to employer to get the medical allowance 1B Medical Reimbursement It means the

Is Medical Reimbursement Taxable In India have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Flexible: Your HTML0 customization options allow you to customize the templates to meet your individual needs be it designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Use: Printables for education that are free offer a wide range of educational content for learners of all ages. This makes them a valuable tool for parents and educators.

-

Simple: Fast access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Is Medical Reimbursement Taxable In India

Is Employee Mileage Reimbursement Taxable

Is Employee Mileage Reimbursement Taxable

Also reimbursement of medical expenses by employers to the salaries employees does not come under the tax ambit Applicability for Medical Reimbursement The following are the eligibility criteria to avail medical

However from FY 2018 19 the standard deduction was introduced in lieu of transport allowance and medical reimbursements If these two allowances are still part of your salary components then the

Now that we've piqued your interest in Is Medical Reimbursement Taxable In India Let's take a look at where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in Is Medical Reimbursement Taxable In India for different reasons.

- Explore categories like home decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning materials.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- These blogs cover a broad variety of topics, starting from DIY projects to planning a party.

Maximizing Is Medical Reimbursement Taxable In India

Here are some ways of making the most use of Is Medical Reimbursement Taxable In India:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home and in class.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Is Medical Reimbursement Taxable In India are an abundance of innovative and useful resources designed to meet a range of needs and interest. Their access and versatility makes these printables a useful addition to both personal and professional life. Explore the wide world of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is Medical Reimbursement Taxable In India really free?

- Yes you can! You can print and download these tools for free.

-

Can I download free printouts for commercial usage?

- It's contingent upon the specific terms of use. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may contain restrictions in their usage. Make sure to read the terms and conditions set forth by the creator.

-

How can I print printables for free?

- Print them at home using the printer, or go to an area print shop for better quality prints.

-

What software do I require to view printables free of charge?

- Most PDF-based printables are available as PDF files, which can be opened using free software like Adobe Reader.

Is Mileage Reimbursement Taxable

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

Check more sample of Is Medical Reimbursement Taxable In India below

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Salary Reimbursement Of Seconded Employees Not Taxable In The Hands Of

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

What Is Healthcare Reimbursement Insurance Noon

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

What Is Pre Tax Commuter Benefit

https://taxguru.in/income-tax/taxability-m…

3 Income Tax treatment in case of medical insurance reimbursement under mediclaim policy for both salaried as well as non salaried people Money received through a claim under a medical policy

https://www.financialexpress.com/money/are-medical...

While Medical Reimbursement on any disease was tax free up to Rs 15 000 u s 17 2 of the Income Tax Act till last year Medical Allowance was fully taxable

3 Income Tax treatment in case of medical insurance reimbursement under mediclaim policy for both salaried as well as non salaried people Money received through a claim under a medical policy

While Medical Reimbursement on any disease was tax free up to Rs 15 000 u s 17 2 of the Income Tax Act till last year Medical Allowance was fully taxable

What Is Healthcare Reimbursement Insurance Noon

Salary Reimbursement Of Seconded Employees Not Taxable In The Hands Of

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

What Is Pre Tax Commuter Benefit

Is Tuition Reimbursement Taxable A Guide ClearDegree

GST Reimbursement Of Toll Charge Liable To Include In The Value Of

GST Reimbursement Of Toll Charge Liable To Include In The Value Of

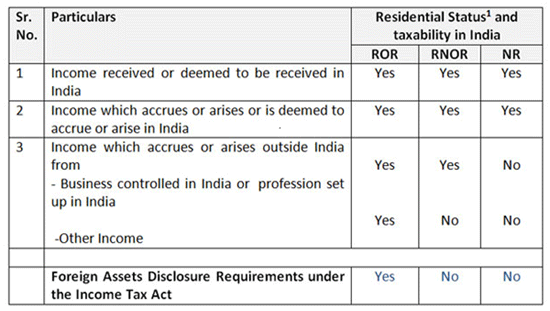

Income Tax Deductions To NRI In India India Financial Cons