In this digital age, with screens dominating our lives The appeal of tangible printed objects hasn't waned. No matter whether it's for educational uses as well as creative projects or simply to add the personal touch to your area, Income Tax Rebate On Salary can be an excellent resource. The following article is a dive in the world of "Income Tax Rebate On Salary," exploring the benefits of them, where they can be found, and how they can enrich various aspects of your life.

Get Latest Income Tax Rebate On Salary Below

Income Tax Rebate On Salary

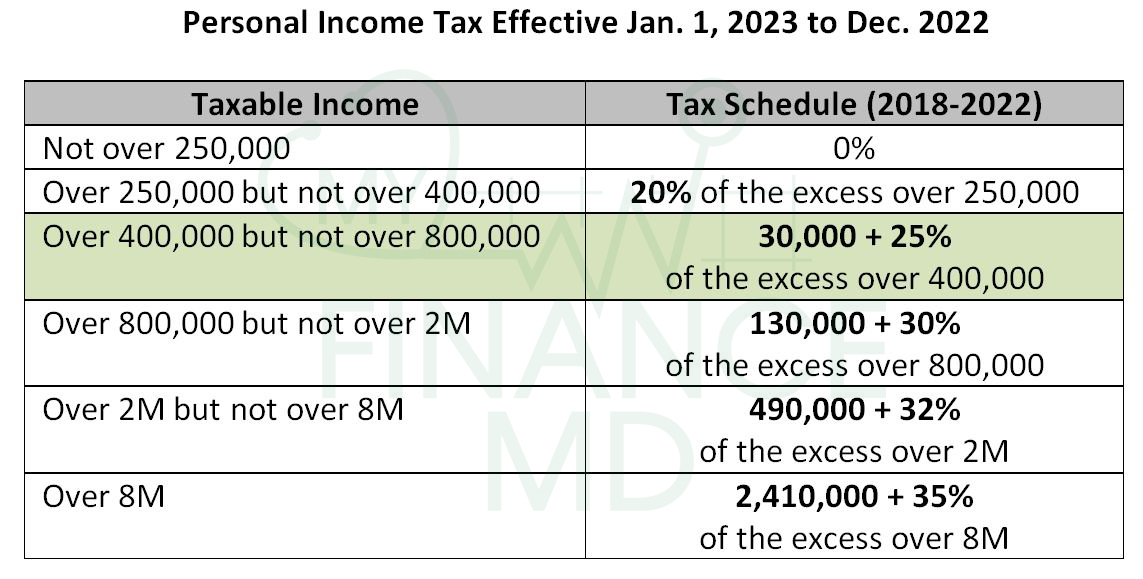

Income Tax Rebate On Salary - Income Tax Rebate On Salary, Income Tax Rebate On Salary Arrears, Income Tax Deduction On Salary, Income Tax Deduction On Salary In Pakistan 2022-23, Income Tax Deduction On Salary Calculator, Income Tax Deduction On Salary 2022-23, Income Tax Deduction On Salary In Pakistan 2021-22, Income Tax Deduction On Salary 2023-24, Income Tax Deduction On Salary In India, Income Tax Deduction On Salary Slab

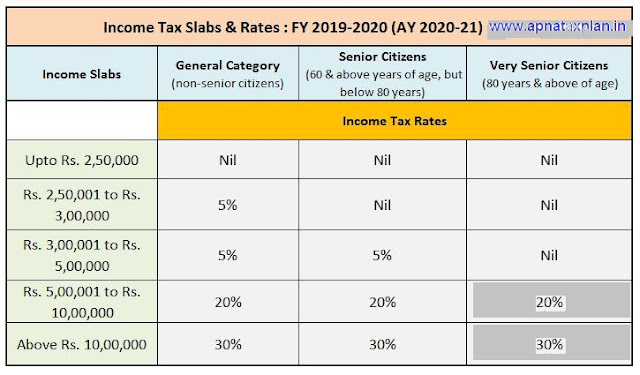

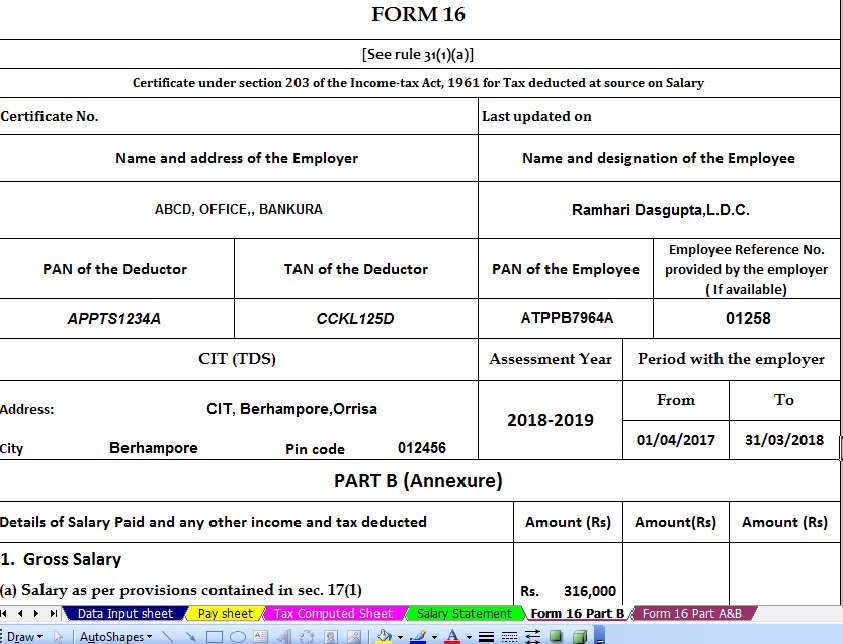

Web 4 avr 2023 nbsp 0183 32 Net income from salary 3 10 000 Income from other sources Interest on savings account 12 000 Gross total income 3 22 000 Taxable income 3 22 000 Income tax thereon 0 Rs

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Printables for free include a vast selection of printable and downloadable content that can be downloaded from the internet at no cost. These resources come in various types, like worksheets, templates, coloring pages, and more. The appeal of printables for free is in their variety and accessibility.

More of Income Tax Rebate On Salary

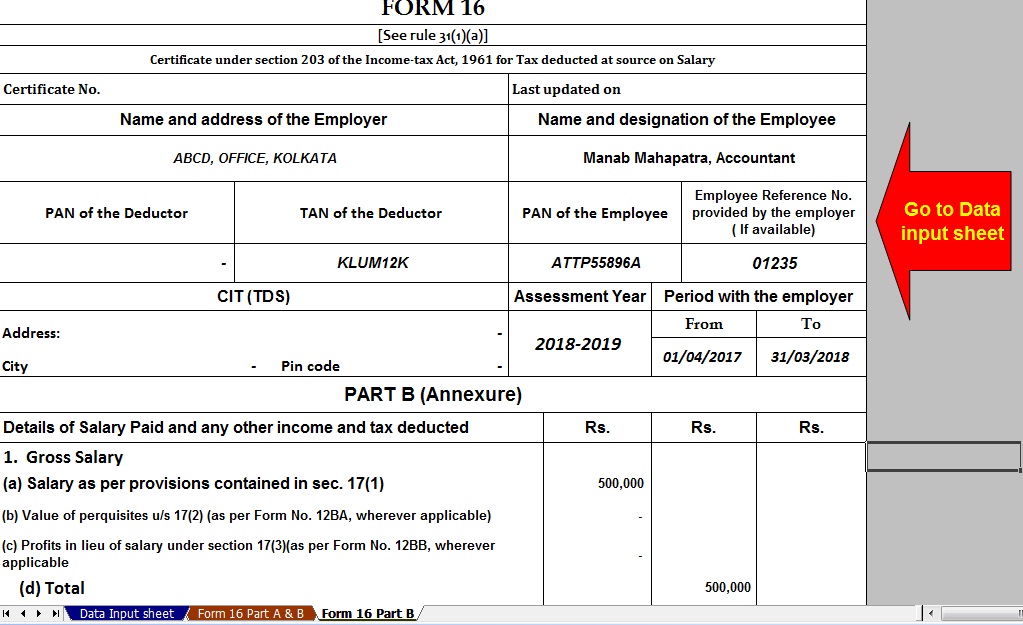

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Web 27 d 233 c 2022 nbsp 0183 32 For salaried employees Section 10 of the Income Tax details a wide range of allowances that can be used to reduce their tax outgo Let us examine some allowances on which you can claim income

Web 11 avr 2023 nbsp 0183 32 Exclude income that is exempt or not included in the total income calculation Apply the rebate If your total income is equal to or less than Rs 5 lakh you

Income Tax Rebate On Salary have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization: This allows you to modify printables to fit your particular needs such as designing invitations making your schedule, or even decorating your house.

-

Educational Value Educational printables that can be downloaded for free provide for students of all ages. This makes them a great resource for educators and parents.

-

Simple: Quick access to a plethora of designs and templates helps save time and effort.

Where to Find more Income Tax Rebate On Salary

How To Calculate Income Tax On Salary With Example

How To Calculate Income Tax On Salary With Example

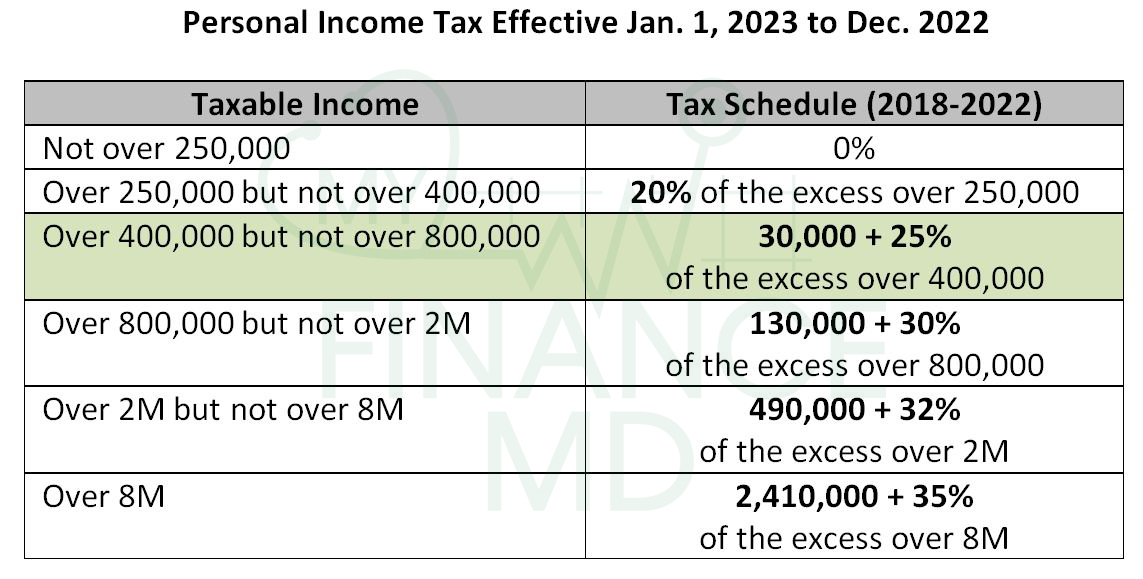

Web rebate shall be 100 of income tax or Rs 12 500 whichever is less The Rates for Charging Income Tax for Financial Year 2020 21 i e AY 2021 22 Other than Senior

Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

Now that we've ignited your curiosity about Income Tax Rebate On Salary we'll explore the places they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Income Tax Rebate On Salary to suit a variety of goals.

- Explore categories like the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- These blogs cover a wide range of topics, ranging from DIY projects to party planning.

Maximizing Income Tax Rebate On Salary

Here are some fresh ways how you could make the most of Income Tax Rebate On Salary:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Rebate On Salary are an abundance of innovative and useful resources catering to different needs and passions. Their accessibility and versatility make they a beneficial addition to each day life. Explore the vast collection of Income Tax Rebate On Salary to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes you can! You can download and print these resources at no cost.

-

Are there any free printables in commercial projects?

- It is contingent on the specific usage guidelines. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions regarding their use. Make sure you read the terms of service and conditions provided by the author.

-

How do I print printables for free?

- Print them at home with an printer, or go to an in-store print shop to get superior prints.

-

What software is required to open printables free of charge?

- Many printables are offered in the format of PDF, which is open with no cost software, such as Adobe Reader.

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

How To Calculate Income Tax On Salary With Example

Check more sample of Income Tax Rebate On Salary below

Income Tax Rates TDS On Salaries And Rebate Under Section 87A

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Interim Budget 2019 20 The Talk Of The Town Trade Brains

2007 Tax Rebate Tax Deduction Rebates

How To Compute And File The 2nd Quarter Income Tax Return TRAIN

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://www.bankbazaar.com/tax/tax-rebate.html

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

https://www.gov.uk/estimate-income-tax

Web 5 avr 2017 nbsp 0183 32 Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2023 to 5 April 2024 This tells you your

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Web 5 avr 2017 nbsp 0183 32 Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2023 to 5 April 2024 This tells you your

2007 Tax Rebate Tax Deduction Rebates

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

How To Compute And File The 2nd Quarter Income Tax Return TRAIN

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

When Tax Rebate 2020 QATAX

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Income Tax Rebate Rs 2500 U s 87A Tdstaxindia