Today, in which screens are the norm it's no wonder that the appeal of tangible printed products hasn't decreased. If it's to aid in education in creative or artistic projects, or simply adding personal touches to your space, Income Tax Deduction On Salary 2023 24 are now a vital resource. In this article, we'll dive into the world of "Income Tax Deduction On Salary 2023 24," exploring what they are, where they are available, and what they can do to improve different aspects of your daily life.

Get Latest Income Tax Deduction On Salary 2023 24 Below

Income Tax Deduction On Salary 2023 24

Income Tax Deduction On Salary 2023 24 -

Tax Deduction and Documentation for Salary AY 2023 24 Affluence Advisory Private Limited 23 Feb 2023 65 760 Views 0 comment Print Income Tax Articles Maximize Tax Savings AY 2023 24 Essential Documentation for Salary Deductions A concise guide to documents required for claiming deductions

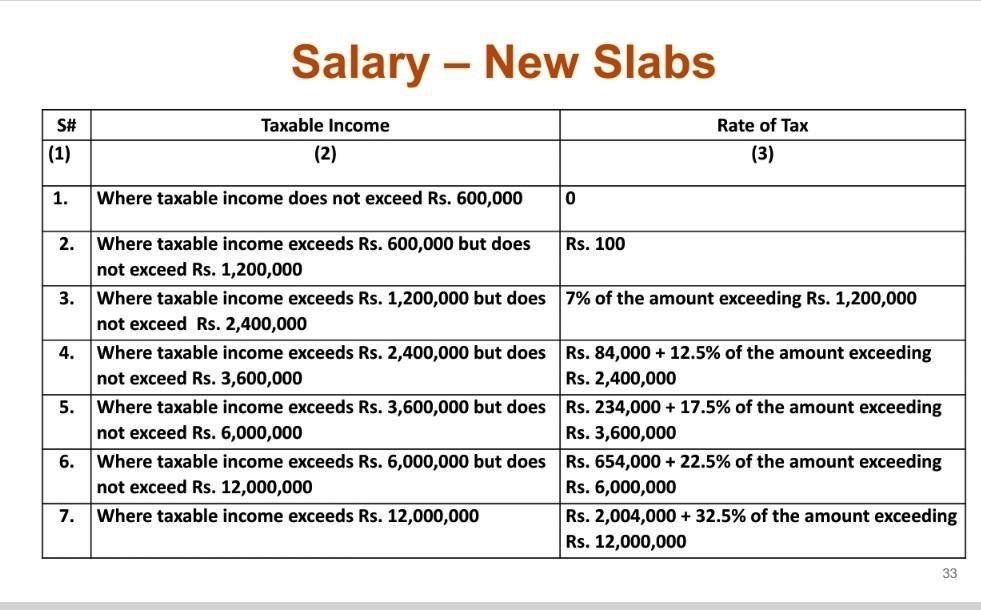

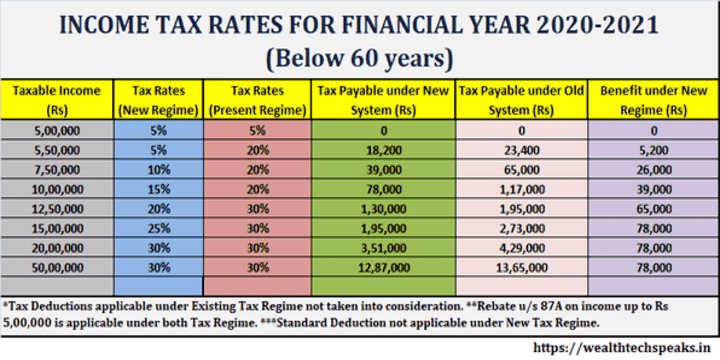

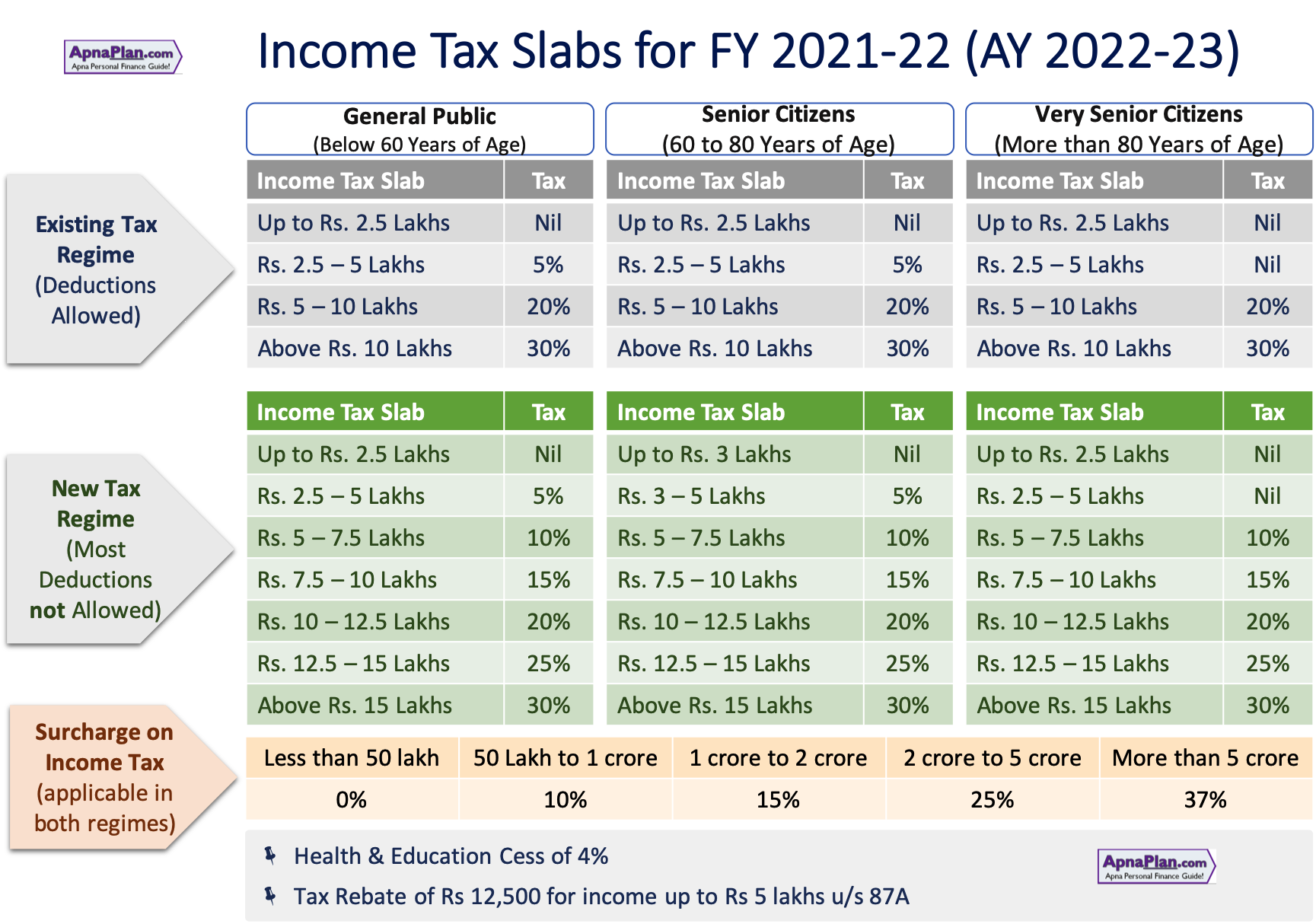

Tax Slabs for AY 2023 24 Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Tax Regime

Income Tax Deduction On Salary 2023 24 offer a wide assortment of printable resources available online for download at no cost. They are available in numerous forms, like worksheets templates, coloring pages and many more. The beauty of Income Tax Deduction On Salary 2023 24 lies in their versatility and accessibility.

More of Income Tax Deduction On Salary 2023 24

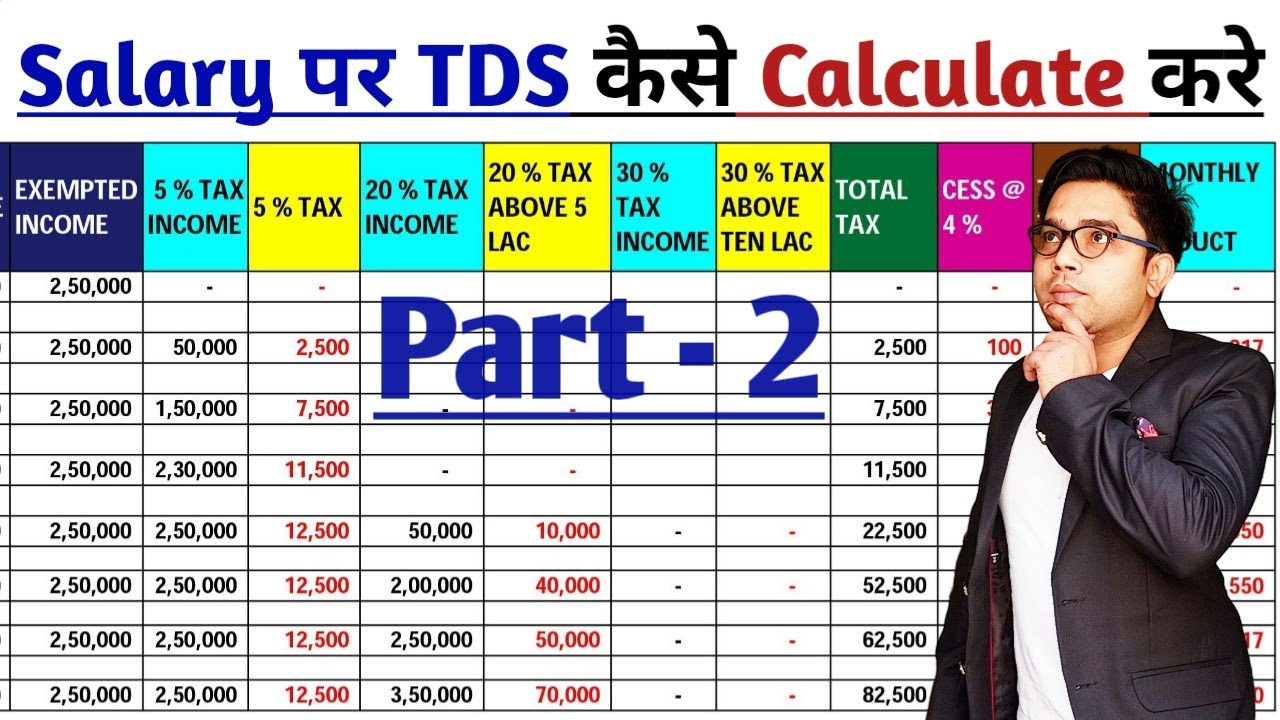

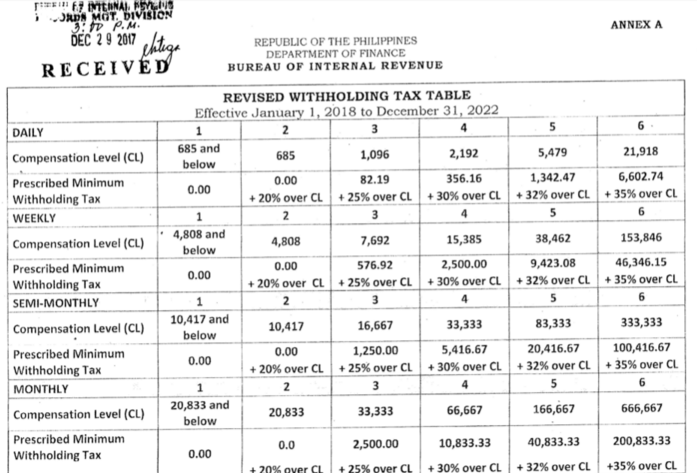

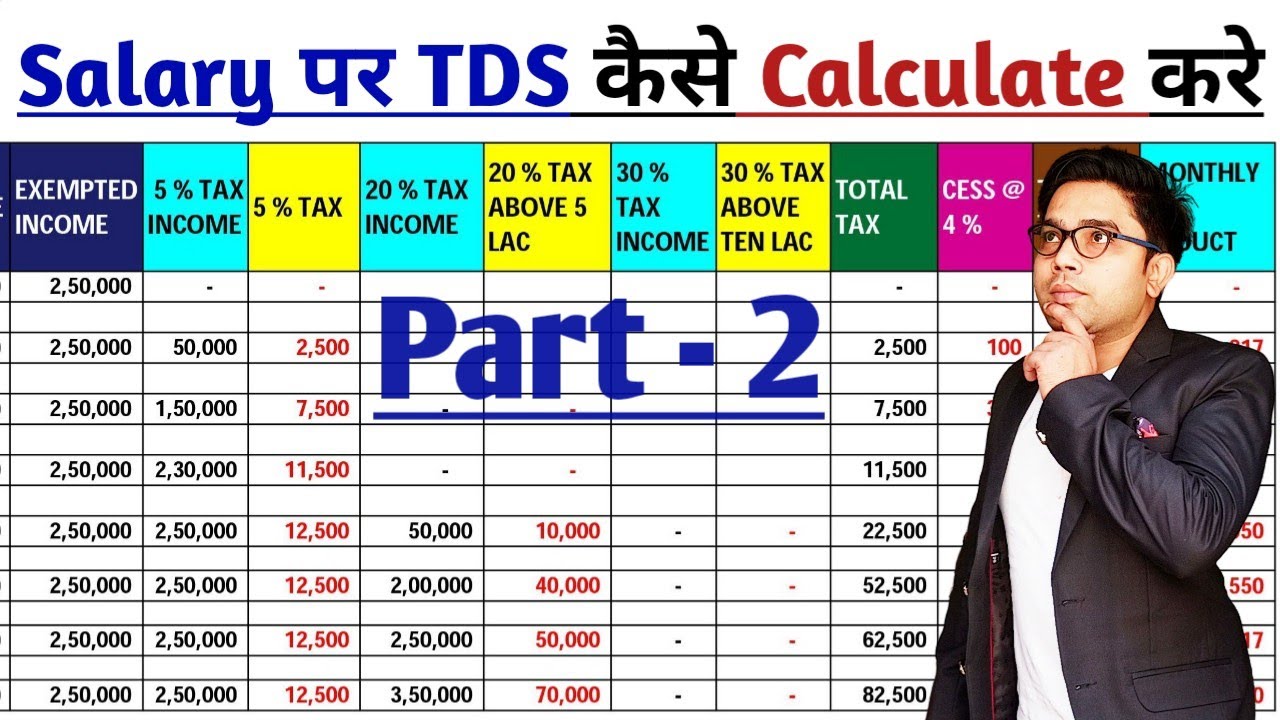

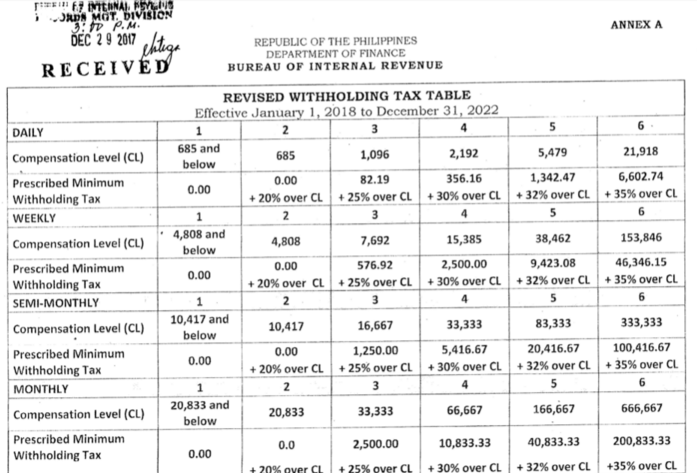

How To Calculate TDS On Salary TDS Deduction On Salary Calculation In

How To Calculate TDS On Salary TDS Deduction On Salary Calculation In

If your total income is less than 2 5 lakhs then you do not need to pay any income tax under the old tax regime Budget 2023 24 makes the new tax regime a default regime According to the new tax regime a tax rebate of up to 3 lakhs is applicable Beyond this limit you are liable to pay income tax according to your salary slab

Before downloading excel based income tax calculator let s get acquainted with the Latest Income Tax Slab for FY 2023 24 and the Income Tax changes made in the Budget 2023 Income Tax Slabs for FY 2023 24 AY 2024 25 New Income Tax Slab is allowed in the Budget 2023 The new tax slab would be default tax slab

The Income Tax Deduction On Salary 2023 24 have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization The Customization feature lets you tailor printed materials to meet your requirements such as designing invitations and schedules, or even decorating your house.

-

Educational Use: These Income Tax Deduction On Salary 2023 24 cater to learners from all ages, making the perfect source for educators and parents.

-

Convenience: Quick access to a variety of designs and templates will save you time and effort.

Where to Find more Income Tax Deduction On Salary 2023 24

New Income Tax Slab 2023 24

New Income Tax Slab 2023 24

GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF REVENUE CENTRAL BOARD OF DIRECT TAXES DEDUCTION OF TAX AT SOURCE INCOME TAX DEDUCTION FROM SALARIES UNDER SECTION 192 OF THE INCOME TAX ACT 1961 DURING THE FINANCIAL YEAR 2022 23 CIRCULAR NO 24 2022 NEW

Your PF is deducted at 12 of your basic salary It is usually a large portion of your total salary House Rent Allowance Salaried individuals who live in a rented house apartment can claim house rent allowance or HRA to lower tax outgo This can be partially or completely exempt from taxes

Since we've got your curiosity about Income Tax Deduction On Salary 2023 24 Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and Income Tax Deduction On Salary 2023 24 for a variety motives.

- Explore categories like decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a broad selection of subjects, from DIY projects to party planning.

Maximizing Income Tax Deduction On Salary 2023 24

Here are some innovative ways of making the most of Income Tax Deduction On Salary 2023 24:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Utilize free printable worksheets to aid in learning at your home and in class.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Deduction On Salary 2023 24 are an abundance of useful and creative resources which cater to a wide range of needs and needs and. Their availability and versatility make these printables a useful addition to both professional and personal life. Explore the endless world of Income Tax Deduction On Salary 2023 24 today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes you can! You can print and download these files for free.

-

Can I download free printables to make commercial products?

- It's dependent on the particular conditions of use. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using Income Tax Deduction On Salary 2023 24?

- Certain printables might have limitations on their use. You should read the terms and conditions offered by the designer.

-

How do I print printables for free?

- Print them at home using printing equipment or visit an in-store print shop to get more high-quality prints.

-

What software will I need to access printables free of charge?

- The majority of printed documents are in the PDF format, and is open with no cost software such as Adobe Reader.

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Standard Deduction On Salary For AY 2022 23 New Tax Route

Check more sample of Income Tax Deduction On Salary 2023 24 below

Tax Rates Absolute Accounting Services

Income Tax Slab For Ay 2023 24 Deduction Printable Forms Free Online

TDS On Salary Calculation Tax Deduction On Salary FinCalC

2023 Tax Tables Australia IMAGESEE

Standard Deduction Limits 2023 24 Archives FinCalC Blog

2023 Payroll Withholding Calculator LesleyMehek

https://www.incometax.gov.in/iec/foportal/help/...

Tax Slabs for AY 2023 24 Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Tax Regime

https://tax2win.in/guide/deductions

Income Tax Deductions List Deductions on Section 80C 80CCC 80CCD 80D FY 2023 24 AY 2024 25 Updated on 01 Mar 2024 07 09 PM The Income Tax Department recognizing the significance of fostering savings and investments has incorporated a comprehensive set of deductions under Chapter VI A of the Income Tax Act

Tax Slabs for AY 2023 24 Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Tax Regime

Income Tax Deductions List Deductions on Section 80C 80CCC 80CCD 80D FY 2023 24 AY 2024 25 Updated on 01 Mar 2024 07 09 PM The Income Tax Department recognizing the significance of fostering savings and investments has incorporated a comprehensive set of deductions under Chapter VI A of the Income Tax Act

2023 Tax Tables Australia IMAGESEE

Income Tax Slab For Ay 2023 24 Deduction Printable Forms Free Online

Standard Deduction Limits 2023 24 Archives FinCalC Blog

2023 Payroll Withholding Calculator LesleyMehek

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

10 Calculate Tax Return 2023 For You 2023 VJK

10 Calculate Tax Return 2023 For You 2023 VJK

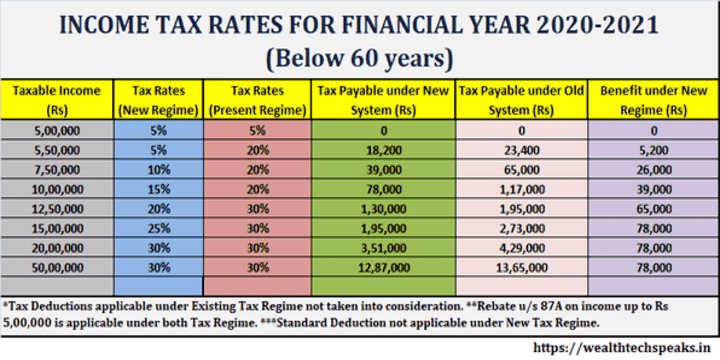

Income Tax Rates For Fy 2021 22 How To Choose Between Old Regime And