Today, where screens rule our lives The appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses or creative projects, or just adding an element of personalization to your area, Income Tax Rebate On Higher Education Fees have proven to be a valuable source. This article will dive in the world of "Income Tax Rebate On Higher Education Fees," exploring what they are, how they are, and how they can be used to enhance different aspects of your daily life.

Get Latest Income Tax Rebate On Higher Education Fees Below

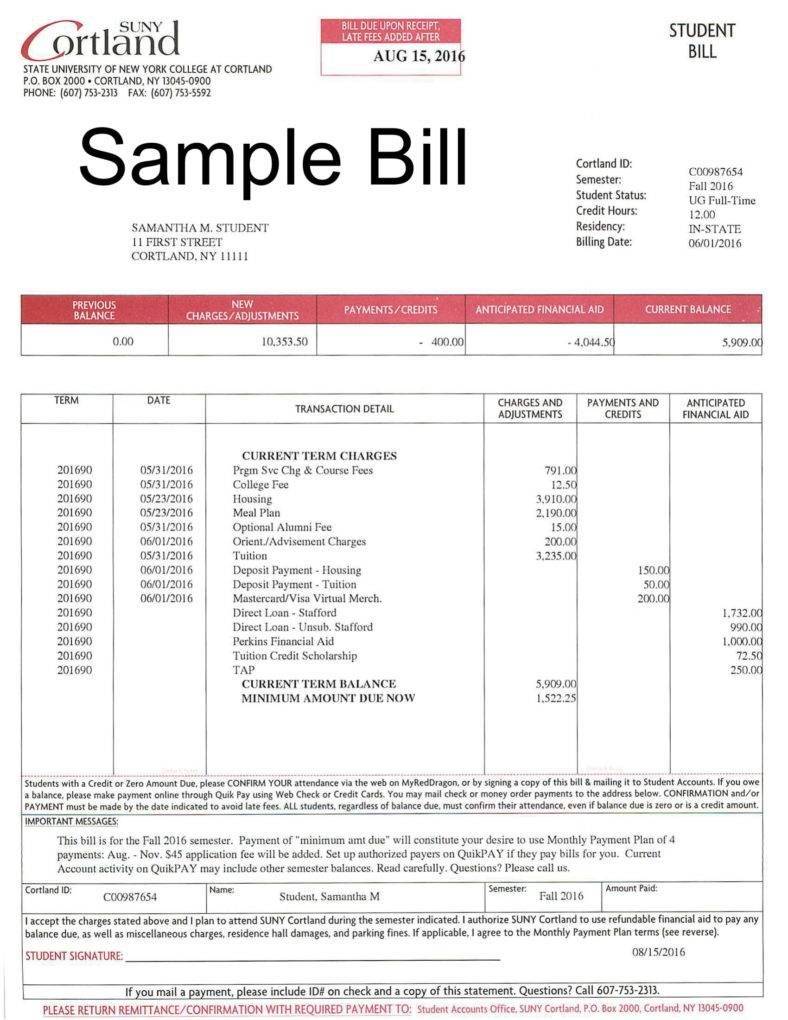

Income Tax Rebate On Higher Education Fees

Income Tax Rebate On Higher Education Fees - Income Tax Rebate On Higher Education Fees, Income Tax Exemption On Higher Education Fees, Income Tax Rebate On College Fees, Tax Rebate On Education Fees, Tuition Fee Tax Rebate Section, Tax Rebate On School Fees, Income Tax Rebate On Child School Fees

Web 14 sept 2019 nbsp 0183 32 The Income Tax Act allows tax benefits for a loan taker for higher education when certain conditions are met Tax benefits have been laid down under

Web 5 janv 2023 nbsp 0183 32 Taxpayers seeking tuition fees exemption in income tax 2022 23 must ensure they meet the following criteria Individual Assesse The tuition fee tax deduction

Income Tax Rebate On Higher Education Fees include a broad range of printable, free content that can be downloaded from the internet at no cost. These materials come in a variety of styles, from worksheets to coloring pages, templates and many more. The appealingness of Income Tax Rebate On Higher Education Fees is in their variety and accessibility.

More of Income Tax Rebate On Higher Education Fees

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Web 17 f 233 vr 2017 nbsp 0183 32 Let us say you fall in the highest income bracket and you pay 31 2 per cent as tax and you pay Rs 80 000 a year as schools fees Here the tax saved will amount

Web 7 janv 2020 nbsp 0183 32 The fees should be paid to university college school or other educational institution No deduction available for fees paid for private tuition s coaching courses for

Income Tax Rebate On Higher Education Fees have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Modifications: We can customize designs to suit your personal needs in designing invitations, organizing your schedule, or even decorating your home.

-

Educational Use: Free educational printables cater to learners of all ages. This makes these printables a powerful instrument for parents and teachers.

-

Easy to use: The instant accessibility to various designs and templates reduces time and effort.

Where to Find more Income Tax Rebate On Higher Education Fees

More Tax Credits More Rebates Education Magazine

More Tax Credits More Rebates Education Magazine

Web 16 oct 2020 nbsp 0183 32 You can claim tax deductions on education loans as tuition fees paid to any college university or other educational institution under Section 80E of the Income Tax

Web Any individual who has applied for a loan for higher education can avail the benefits of tax saving provided by Section 80E of the Income Tax Act 1961 Even if an individual has

After we've peaked your interest in Income Tax Rebate On Higher Education Fees, let's explore where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Income Tax Rebate On Higher Education Fees to suit a variety of applications.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free including flashcards, learning materials.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs are a vast range of topics, ranging from DIY projects to party planning.

Maximizing Income Tax Rebate On Higher Education Fees

Here are some unique ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Rebate On Higher Education Fees are a treasure trove of practical and innovative resources for a variety of needs and hobbies. Their accessibility and flexibility make them an essential part of your professional and personal life. Explore the vast array of Income Tax Rebate On Higher Education Fees right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes you can! You can download and print the resources for free.

-

Can I use the free printables for commercial purposes?

- It's determined by the specific usage guidelines. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Are there any copyright problems with Income Tax Rebate On Higher Education Fees?

- Some printables may come with restrictions in their usage. Always read these terms and conditions as set out by the author.

-

How can I print Income Tax Rebate On Higher Education Fees?

- Print them at home with a printer or visit the local print shop for the highest quality prints.

-

What software do I require to open printables at no cost?

- The majority of printables are with PDF formats, which can be opened using free software like Adobe Reader.

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Excellent School Fee Receipt Template In Html Cheap Receipt Templates

Check more sample of Income Tax Rebate On Higher Education Fees below

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Individual Income Tax Rebate

Rebate Checks Social Security Income Tax Cuts Plus New Taxes And Fees

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate Under Section 87A

https://instafiling.com/tuition-fees-exemption-in-income-tax-2022-23

Web 5 janv 2023 nbsp 0183 32 Taxpayers seeking tuition fees exemption in income tax 2022 23 must ensure they meet the following criteria Individual Assesse The tuition fee tax deduction

https://okcredit.in/blog/is-education-fee-exempted-from-tax-in-india

Web 25 f 233 vr 2021 nbsp 0183 32 Not only investments but also expenditures like tuition fees are allowed a deduction under the Income Tax Act The following article provides detailed information

Web 5 janv 2023 nbsp 0183 32 Taxpayers seeking tuition fees exemption in income tax 2022 23 must ensure they meet the following criteria Individual Assesse The tuition fee tax deduction

Web 25 f 233 vr 2021 nbsp 0183 32 Not only investments but also expenditures like tuition fees are allowed a deduction under the Income Tax Act The following article provides detailed information

Rebate Checks Social Security Income Tax Cuts Plus New Taxes And Fees

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate Under Section 87A

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate