In this digital age, where screens rule our lives yet the appeal of tangible printed material hasn't diminished. Whatever the reason, whether for education such as creative projects or just adding some personal flair to your home, printables for free are now a useful resource. With this guide, you'll take a dive deeper into "Income Tax Exemption On Higher Education Fees," exploring what they are, how to find them and how they can enrich various aspects of your lives.

Get Latest Income Tax Exemption On Higher Education Fees Below

Income Tax Exemption On Higher Education Fees

Income Tax Exemption On Higher Education Fees -

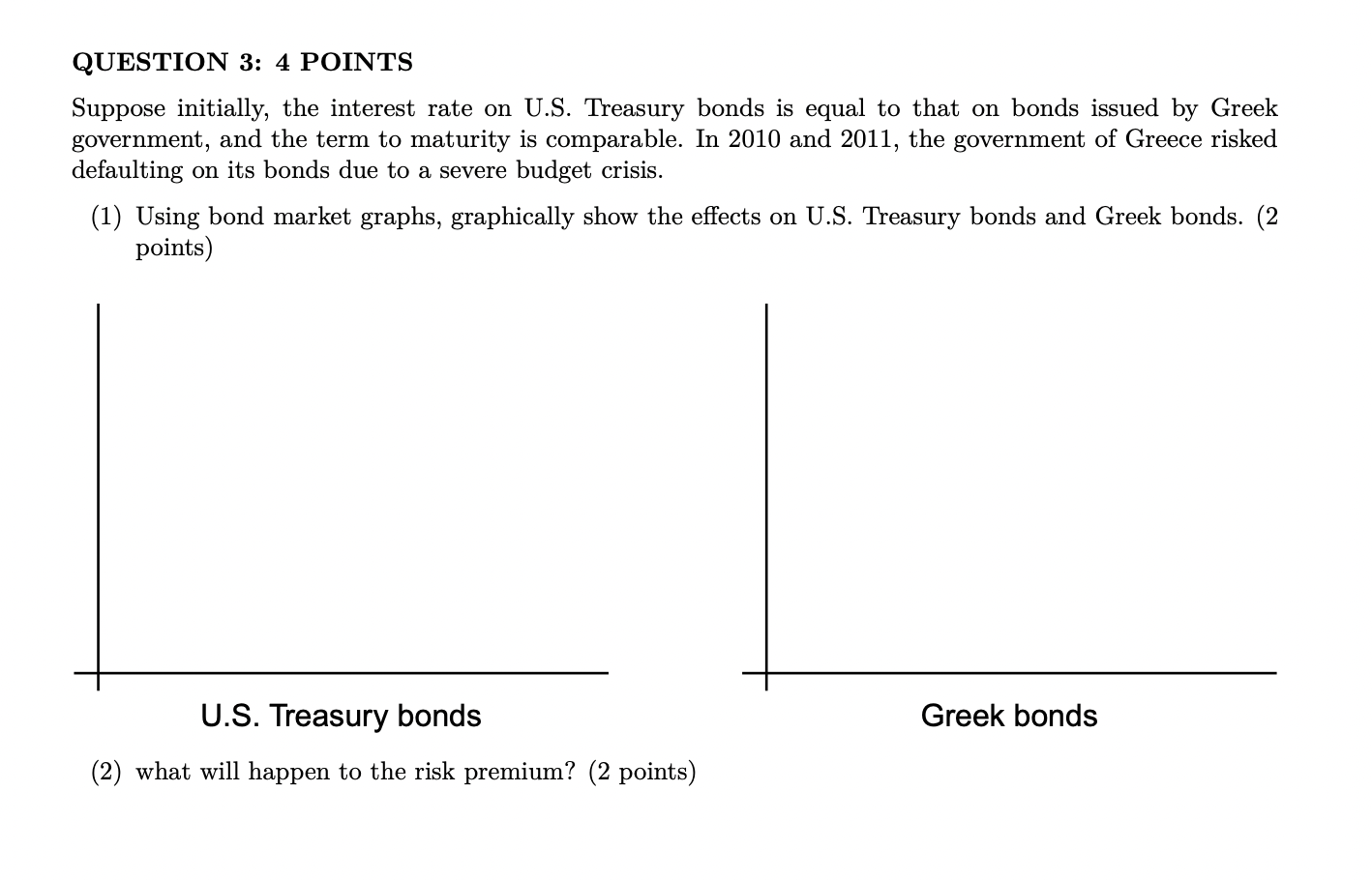

The Income Tax Act allows tax benefits for a loan taker for higher education when certain conditions are metTax benefits have been laid down under Section 80E of

Ii Income earned by any university or educational institution existing solely for educational purposes and not for profit purpose shall exempt from tax u s 10 23C iiiad

Income Tax Exemption On Higher Education Fees cover a large array of printable materials online, at no cost. These resources come in many types, such as worksheets coloring pages, templates and many more. The attraction of printables that are free is their versatility and accessibility.

More of Income Tax Exemption On Higher Education Fees

Higher Education Fees And Finance UCEN Manchester

Higher Education Fees And Finance UCEN Manchester

OVERVIEW The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to 4 000 from your income for qualifying tuition

Taxpayers seeking tuition fees exemption in income tax 2022 23 must ensure they meet the following criteria Individual Assesse The tuition fee tax deduction is only available to individual taxpayers and

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization It is possible to tailor the templates to meet your individual needs be it designing invitations and schedules, or decorating your home.

-

Educational Impact: Education-related printables at no charge offer a wide range of educational content for learners of all ages, making these printables a powerful aid for parents as well as educators.

-

It's easy: Access to numerous designs and templates saves time and effort.

Where to Find more Income Tax Exemption On Higher Education Fees

Towards A Sustainable Solution To The Higher Education Fees Challenge

Towards A Sustainable Solution To The Higher Education Fees Challenge

An individual can get tax deductions on the interest paid for educational laon taken for higher studies This tax benefits on education loan can be claimed under

The exempted income equals INR 159600 after adding CEA Hostel Allowance and Tuition fee limit i e 1 5 lakhs Hence you can avail of the total benefit of INR 159600 If you fall under a 5 tax slab

We hope we've stimulated your interest in Income Tax Exemption On Higher Education Fees and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection in Income Tax Exemption On Higher Education Fees for different objectives.

- Explore categories like home decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- The blogs covered cover a wide variety of topics, ranging from DIY projects to planning a party.

Maximizing Income Tax Exemption On Higher Education Fees

Here are some new ways that you can make use of Income Tax Exemption On Higher Education Fees:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home and in class.

3. Event Planning

- Invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Exemption On Higher Education Fees are an abundance filled with creative and practical information that meet a variety of needs and pursuits. Their accessibility and flexibility make them an essential part of both professional and personal life. Explore the endless world that is Income Tax Exemption On Higher Education Fees today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes you can! You can print and download these materials for free.

-

Can I use free printouts for commercial usage?

- It's dependent on the particular terms of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright rights issues with Income Tax Exemption On Higher Education Fees?

- Some printables may have restrictions regarding usage. Be sure to check the terms and conditions offered by the designer.

-

How can I print printables for free?

- Print them at home with either a printer or go to an area print shop for the highest quality prints.

-

What software do I need in order to open printables at no cost?

- The majority are printed in the format PDF. This is open with no cost programs like Adobe Reader.

5 Policies You And Your Infant Should Follow To Manage Their Higher

Income Tax Exemption On Gratuity Income Castuff

Check more sample of Income Tax Exemption On Higher Education Fees below

Gratuity Under Income Tax Act All You Need To Know

Master Of Research Business Administration Queen Margaret University

Tax Exemption On Loan For Abroad Education U S 80E SAG Infotech Tax

Income Tax Exemption For Startups How To Apply For Income Tax

CBDT Notifies Income Tax Exemption On California Public Employees

Form 15H Amended Senior Citizens To Get Higher TDS Exemption On

https://taxguru.in/income-tax/exemption...

Ii Income earned by any university or educational institution existing solely for educational purposes and not for profit purpose shall exempt from tax u s 10 23C iiiad

https://www.vero.fi/en/detailed-guidance/guidance/86049

Under the provisions of the treaties signed with Japan Morocco and France the Finnish tax authority can include the amounts of income that are exempted in Finland in the

Ii Income earned by any university or educational institution existing solely for educational purposes and not for profit purpose shall exempt from tax u s 10 23C iiiad

Under the provisions of the treaties signed with Japan Morocco and France the Finnish tax authority can include the amounts of income that are exempted in Finland in the

Income Tax Exemption For Startups How To Apply For Income Tax

Master Of Research Business Administration Queen Margaret University

CBDT Notifies Income Tax Exemption On California Public Employees

Form 15H Amended Senior Citizens To Get Higher TDS Exemption On

Solved QUESTION 2 4 POINTS Suppose The Income Tax Exemption Chegg

Child Higher Education Fees Budgeting Finances Investing Money

Child Higher Education Fees Budgeting Finances Investing Money

Income Tax Exemption On Electric Vehicle Deduction On Electric Vehicle