In this day and age with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. Whatever the reason, whether for education as well as creative projects or just adding some personal flair to your area, Energy Tax Credit Form are a great source. The following article is a dive through the vast world of "Energy Tax Credit Form," exploring the different types of printables, where to get them, as well as how they can add value to various aspects of your daily life.

Get Latest Energy Tax Credit Form Below

Energy Tax Credit Form

Energy Tax Credit Form - Energy Tax Credit Form, Energy Tax Credit Form 2022, Energy Tax Credit Form 5695 Instructions, Energy Star Tax Credit Form 2023, Direct Energy Tax Exemption Form, Duke Energy Tax Exemption Form, Atmos Energy Tax Exemption Form, Jackson Energy Tax Exemption Form, Business Energy Credit Tax Form, What Is Energy Tax Credit

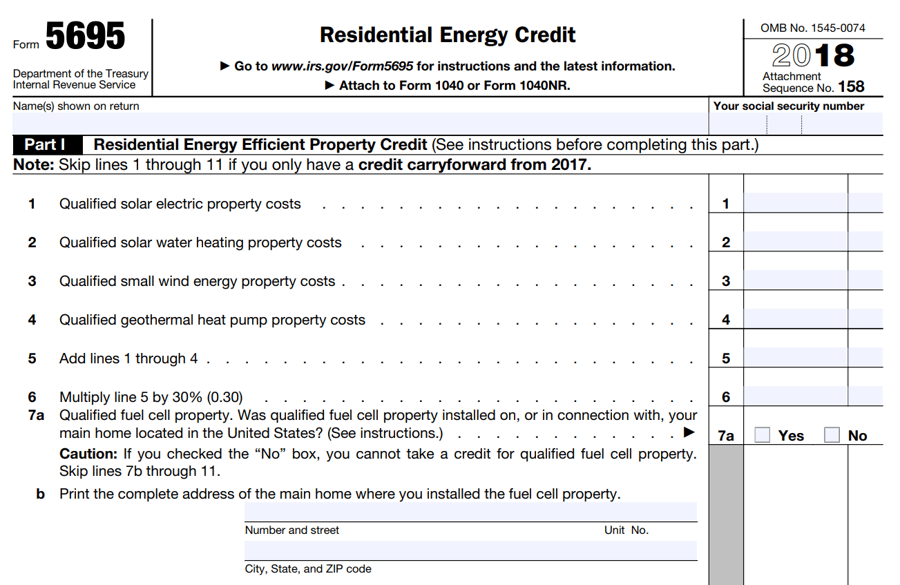

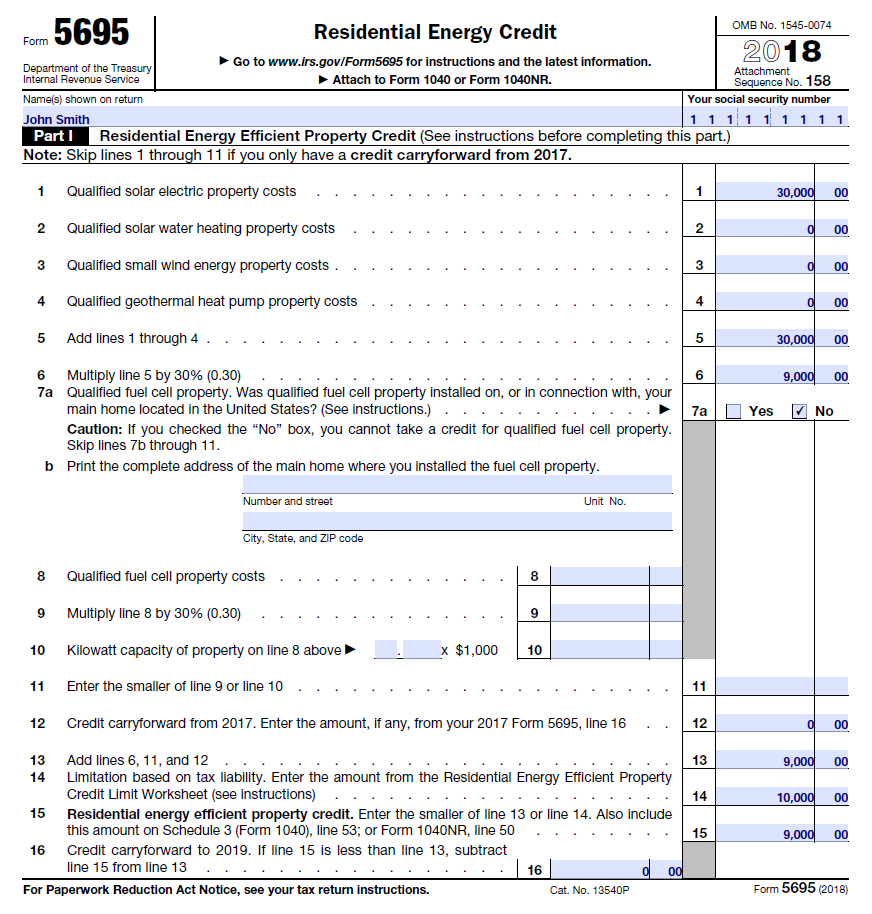

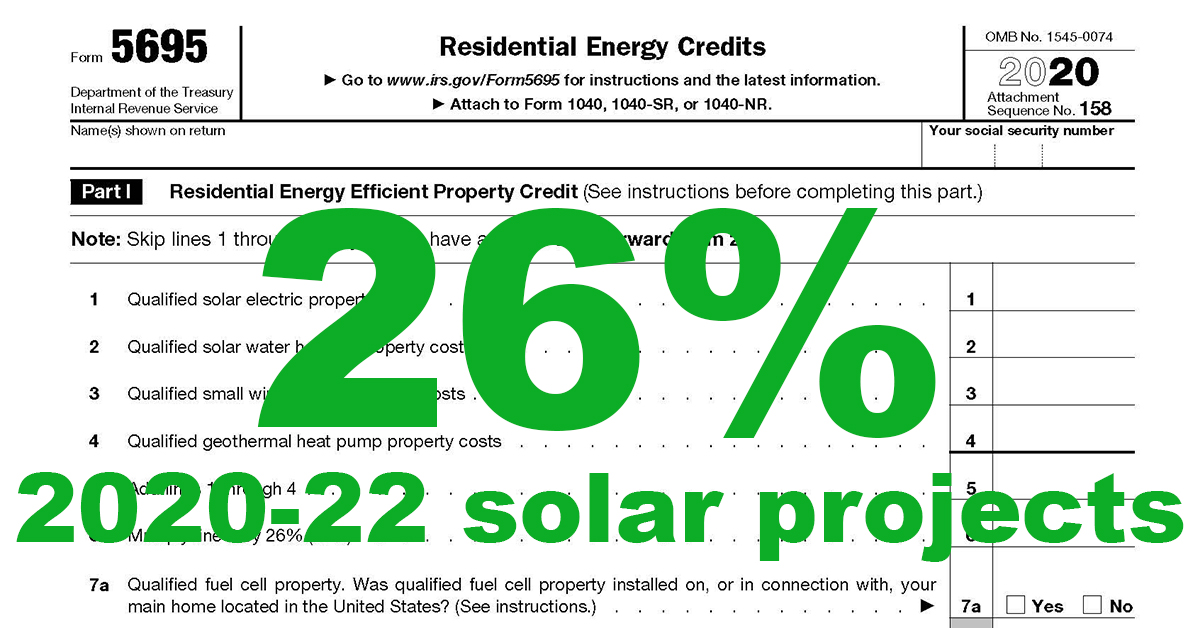

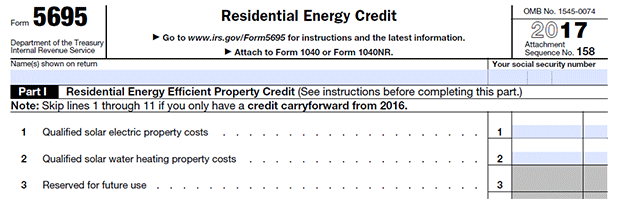

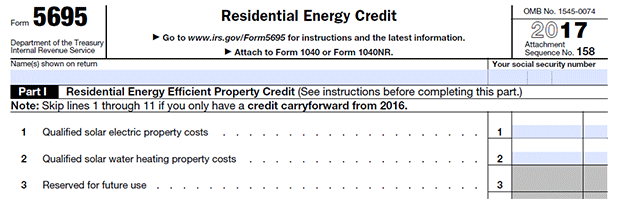

Verkko 19 lokak 2023 nbsp 0183 32 You must complete IRS Form 5695 if you qualify to claim the non business energy property credit or the residential energy efficient property credit TABLE OF CONTENTS Home improvement credits Nonbusiness Energy Property credit through 2022 Energy Efficient Home Improvement credit for 2023 through

Verkko Department of the Treasury Internal Revenue Service Residential Energy Credits Go to www irs gov Form5695 for instructions and the latest information Attach to Form

Energy Tax Credit Form provide a diverse assortment of printable, downloadable materials that are accessible online for free cost. These printables come in different styles, from worksheets to templates, coloring pages and more. One of the advantages of Energy Tax Credit Form lies in their versatility and accessibility.

More of Energy Tax Credit Form

Home Energy Tax Credit Documentation

Home Energy Tax Credit Documentation

Verkko The energy efficient home improvement credit Also use Form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023

Verkko 1 tammik 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

The Energy Tax Credit Form have gained huge appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization: Your HTML0 customization options allow you to customize printables to fit your particular needs whether it's making invitations, organizing your schedule, or decorating your home.

-

Educational Use: Education-related printables at no charge can be used by students of all ages. This makes the perfect instrument for parents and teachers.

-

It's easy: Instant access to the vast array of design and templates will save you time and effort.

Where to Find more Energy Tax Credit Form

Puget Sound Solar LLC

Puget Sound Solar LLC

Verkko 21 marrask 2023 nbsp 0183 32 Late last week the Internal Revenue Service IRS and Department of the Treasury released the long awaited proposed regulations the Proposed Regulations relating to investment tax credits under Section 48 of the Code the ITC These regulations help to clarify what qualifies as energy property that is eligible for

Verkko 300 150 N A Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost 30 of cost 30 of cost up to 2 000 per year 30 of cost 30 of cost up to 600 30 of cost up to 600 30 of cost up to 600 Subject to cap of 1 200 year

Now that we've ignited your curiosity about Energy Tax Credit Form Let's take a look at where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of motives.

- Explore categories such as design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs are a vast range of interests, everything from DIY projects to party planning.

Maximizing Energy Tax Credit Form

Here are some ideas in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home also in the classes.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Energy Tax Credit Form are a treasure trove of practical and imaginative resources that can meet the needs of a variety of people and pursuits. Their availability and versatility make them an essential part of any professional or personal life. Explore the wide world of Energy Tax Credit Form and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Energy Tax Credit Form really absolutely free?

- Yes they are! You can download and print these documents for free.

-

Do I have the right to use free printables in commercial projects?

- It's contingent upon the specific conditions of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in Energy Tax Credit Form?

- Some printables could have limitations on their use. You should read the terms and condition of use as provided by the creator.

-

How can I print Energy Tax Credit Form?

- Print them at home with printing equipment or visit an area print shop for the highest quality prints.

-

What software will I need to access printables at no cost?

- The majority of PDF documents are provided with PDF formats, which can be opened using free software, such as Adobe Reader.

Filing For The Solar Tax Credit Wells Solar

Solar Tax Credits Solar Tribune

Check more sample of Energy Tax Credit Form below

ITC Solar Tax Credit NATiVE

Heated Up February 2018

Irs Standard Deduction Worksheet

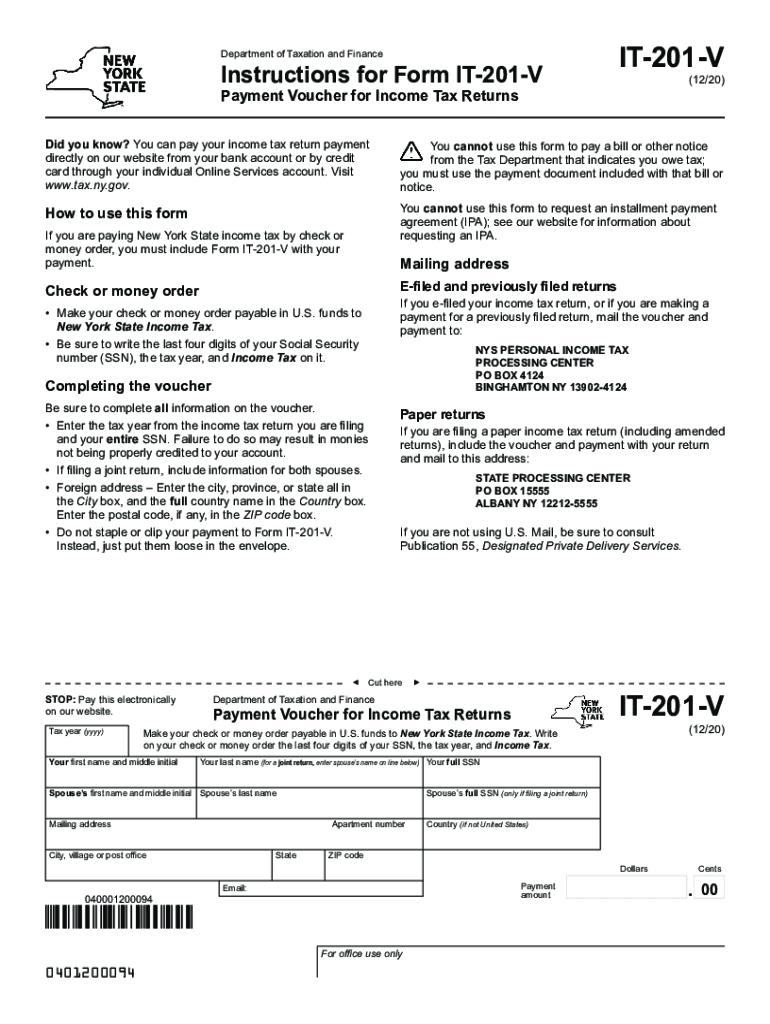

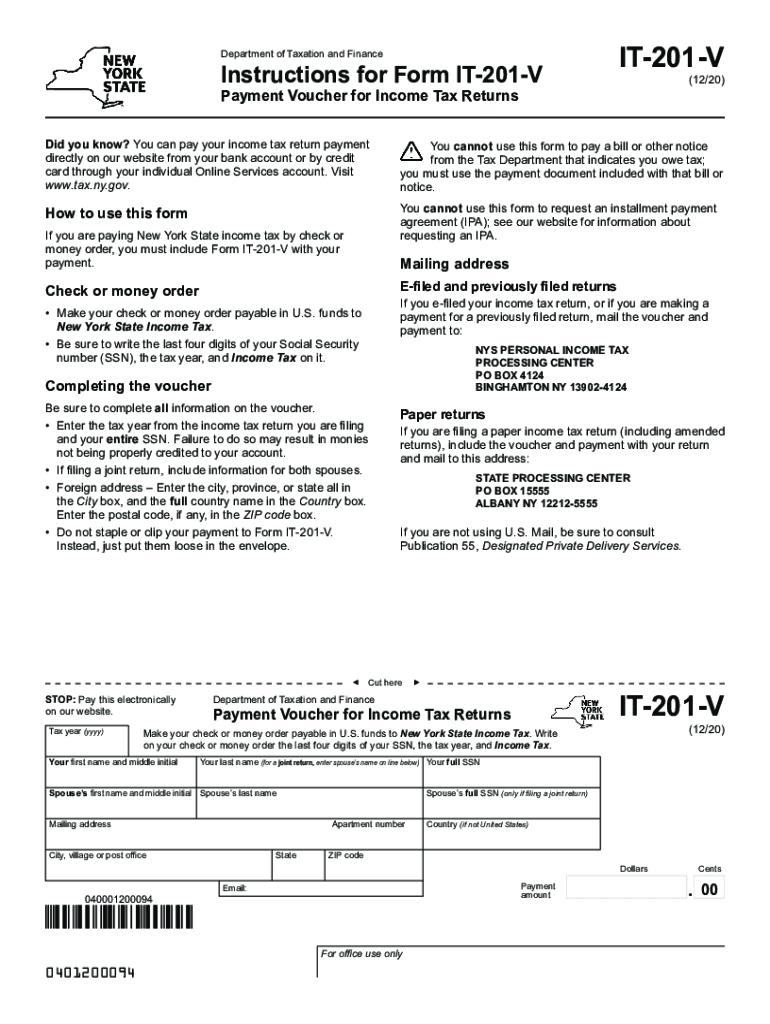

It 201 Nys Form Fill Out Sign Online DocHub

Form 5695 Residential Energy Credits 2014 Free Download

Energy Tax Credit 2011 Not What It Used To Be Darwin s Money

https://www.irs.gov/pub/irs-pdf/f5695.pdf

Verkko Department of the Treasury Internal Revenue Service Residential Energy Credits Go to www irs gov Form5695 for instructions and the latest information Attach to Form

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Verkko 25 lokak 2023 nbsp 0183 32 Home Energy Tax Credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Verkko Department of the Treasury Internal Revenue Service Residential Energy Credits Go to www irs gov Form5695 for instructions and the latest information Attach to Form

Verkko 25 lokak 2023 nbsp 0183 32 Home Energy Tax Credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

It 201 Nys Form Fill Out Sign Online DocHub

Heated Up February 2018

Form 5695 Residential Energy Credits 2014 Free Download

Energy Tax Credit 2011 Not What It Used To Be Darwin s Money

Solar Energy Tax Credit Andrews Tax Accounting

2017 Geothermal Tax Credit Instructions Are Here

2017 Geothermal Tax Credit Instructions Are Here

For 346PRODUCTION Www directingactors