In this age of electronic devices, when screens dominate our lives, the charm of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply to add an extra personal touch to your area, Energy Tax Credit Form 5695 Instructions have proven to be a valuable source. The following article is a dive into the world of "Energy Tax Credit Form 5695 Instructions," exploring what they are, where they are, and how they can enhance various aspects of your life.

Get Latest Energy Tax Credit Form 5695 Instructions Below

Energy Tax Credit Form 5695 Instructions

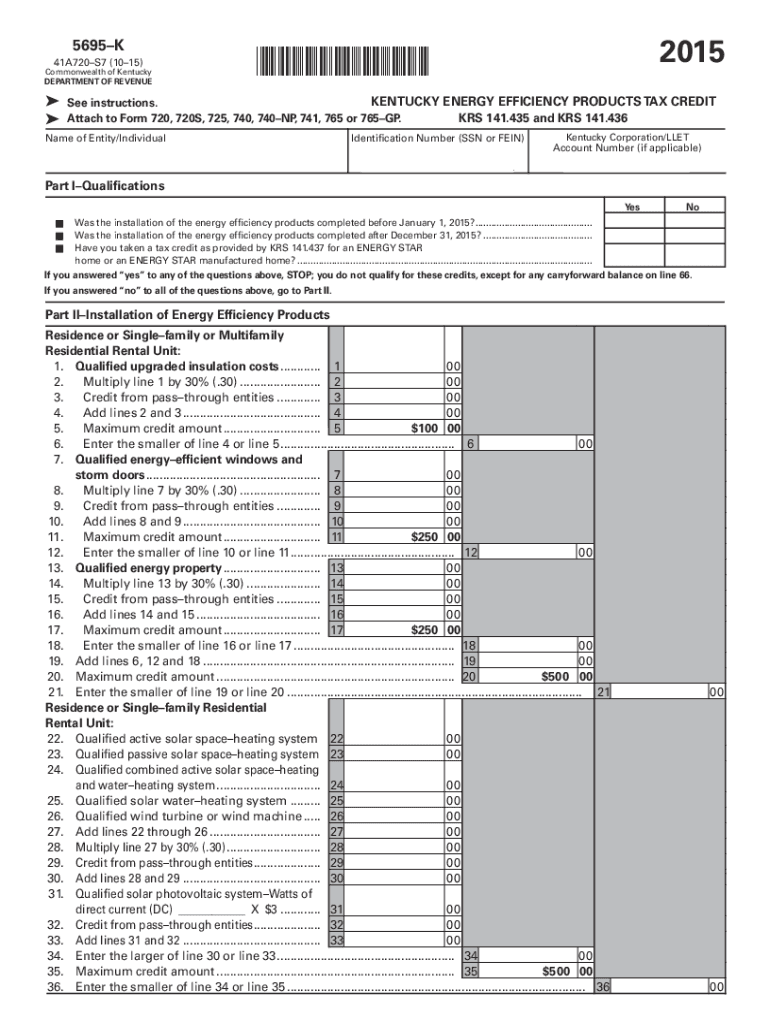

Energy Tax Credit Form 5695 Instructions - Energy Tax Credit Form 5695 Instructions, What Is Form 5695 Residential Energy Credit, Residential Energy Credit Form 5695 Instructions, What Qualifies For Energy Tax Credit

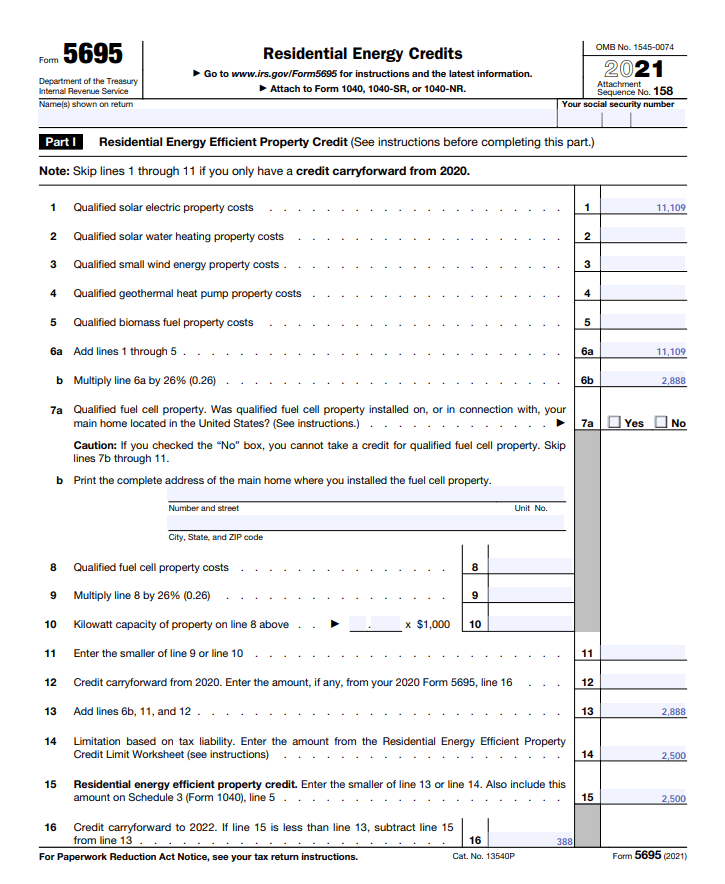

1 Determine if you re eligible 2 Complete IRS Form 5695 3 Add to Schedule 3 and Form 1040 Disclaimer Find out what solar panels cost in your area in 2024 100 free to use 100 online Access the lowest prices from installers near you Unbiased Energy Advisors ready to help Key takeaways

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

Printables for free cover a broad assortment of printable items that are available online at no cost. They come in many styles, from worksheets to coloring pages, templates and more. The beauty of Energy Tax Credit Form 5695 Instructions is their flexibility and accessibility.

More of Energy Tax Credit Form 5695 Instructions

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

OVERVIEW You must complete IRS Form 5695 if you qualify to claim the non business energy property credit or the residential energy efficient property credit TABLE OF CONTENTS Home improvement credits Nonbusiness Energy Property credit through 2022 Energy Efficient Home Improvement credit for 2023 through 2032 Click to

Per IRS Instructions for Form 5695 on page 1 Purpose of Form Use Form 5695 to figure and take your residential energy credits The residential energy credits are The residential energy efficient property credit and The nonbusiness energy property credit

Energy Tax Credit Form 5695 Instructions have garnered immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization We can customize printing templates to your own specific requirements, whether it's designing invitations, organizing your schedule, or even decorating your house.

-

Educational Impact: Printables for education that are free are designed to appeal to students from all ages, making them a vital instrument for parents and teachers.

-

Affordability: Access to an array of designs and templates saves time and effort.

Where to Find more Energy Tax Credit Form 5695 Instructions

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

2023 Form 5695 5695 Part I Residential Clean Energy Credit See instructions before completing this part Note Skip lines 1 through 11 if you only have a credit carryforward from 2022 Enter the complete address of the home where you installed the property and or technology associated with lines 1 through 4 and 5b

The residential energy credits are The residential clean energy credit and The energy efficient home improvement credit Also use Form 5695 to take any residential clean energy credit carryforward from 2022 Form 5695 or to carry the unused portion of the residential clean energy credit to 2024 Who Can Take the Credits

Now that we've piqued your interest in printables for free, let's explore where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Energy Tax Credit Form 5695 Instructions suitable for many needs.

- Explore categories such as home decor, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free including flashcards, learning materials.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a wide spectrum of interests, that includes DIY projects to party planning.

Maximizing Energy Tax Credit Form 5695 Instructions

Here are some new ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Energy Tax Credit Form 5695 Instructions are a treasure trove of fun and practical tools that cater to various needs and interest. Their availability and versatility make them a wonderful addition to your professional and personal life. Explore the vast world of Energy Tax Credit Form 5695 Instructions and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes you can! You can print and download these files for free.

-

Does it allow me to use free printables for commercial uses?

- It's determined by the specific usage guidelines. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with Energy Tax Credit Form 5695 Instructions?

- Some printables may come with restrictions regarding their use. Be sure to read the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- Print them at home using printing equipment or visit a local print shop to purchase more high-quality prints.

-

What program do I require to open printables free of charge?

- The majority of printed documents are in PDF format, which can be opened with free programs like Adobe Reader.

Form 5695 Fill Out And Sign Printable PDF Template SignNow

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

Check more sample of Energy Tax Credit Form 5695 Instructions below

Form 5695 Instructions 2023 Printable Forms Free Online

5695 Form 2023 Printable Forms Free Online

IRS Form 5695 Instructions Residential Energy Credits

How To File IRS Form 5695 To Claim Your Renewable Energy Credits

How To Claim The Federal Solar Tax Credit SAVKAT Inc

Filing For The Solar Tax Credit Wells Solar

https://www.irs.gov/forms-pubs/about-form-5695

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

https://www.teachmepersonalfinance.com/irs-form-5695-instructions

Table of contents How do I complete IRS Form 5695 Part I Residential Clean Energy Credit Part II Energy Efficient Home Improvement Credit Impact of the inflation Reduction Act on Renewable Energy Tax Credits What tax credits can I claim with IRS form 5695 Tax credit limitations Residential clean energy credit limits

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

Table of contents How do I complete IRS Form 5695 Part I Residential Clean Energy Credit Part II Energy Efficient Home Improvement Credit Impact of the inflation Reduction Act on Renewable Energy Tax Credits What tax credits can I claim with IRS form 5695 Tax credit limitations Residential clean energy credit limits

How To File IRS Form 5695 To Claim Your Renewable Energy Credits

5695 Form 2023 Printable Forms Free Online

How To Claim The Federal Solar Tax Credit SAVKAT Inc

Filing For The Solar Tax Credit Wells Solar

Form 5695 Instructions Claiming The Solar Tax Credit EnergySage

Tax Computation Worksheet 2020 2021 Federal Income Tax

Tax Computation Worksheet 2020 2021 Federal Income Tax

Irs 1040 Form Line 14 Form 5695 Instructions Claiming The Solar Tax