In the age of digital, where screens have become the dominant feature of our lives, the charm of tangible printed objects isn't diminished. In the case of educational materials such as creative projects or just adding personal touches to your space, Residential Energy Credit Form 5695 Instructions are now a vital source. This article will take a dive deep into the realm of "Residential Energy Credit Form 5695 Instructions," exploring what they are, where to find them and how they can improve various aspects of your lives.

Get Latest Residential Energy Credit Form 5695 Instructions Below

Residential Energy Credit Form 5695 Instructions

Residential Energy Credit Form 5695 Instructions -

Part I of Form 5695 Residential Energy Eficient Property Credit is available for taxpayers who purchased qualified residential alternative energy equipment such as solar hot water heaters stoves that burn biomass fuel geothermal heat pumps and wind turbines This part of the form is Out of Scope

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

Printables for free include a vast selection of printable and downloadable material that is available online at no cost. They come in many designs, including worksheets templates, coloring pages and many more. The great thing about Residential Energy Credit Form 5695 Instructions is in their variety and accessibility.

More of Residential Energy Credit Form 5695 Instructions

Residential Energy Efficient Property Credit Qualification Form 5695

Residential Energy Efficient Property Credit Qualification Form 5695

You must complete IRS Form 5695 if you qualify to claim the non business energy property credit or the residential energy efficient property credit TABLE OF CONTENTS Home improvement credits Nonbusiness Energy Property credit through 2022 Energy Efficient Home Improvement credit for 2023 through 2032 Click to expand

What s new for Form 5695 for tax year 2023 Energy efficient home improvement credit The nonbusiness energy property credit has changed to the energy efficient home improvement credit The credit is extended to property placed in service through December 31 2022 See here for more information

Residential Energy Credit Form 5695 Instructions have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Customization: This allows you to modify printables to your specific needs such as designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Benefits: Printing educational materials for no cost provide for students of all ages. This makes these printables a powerful source for educators and parents.

-

It's easy: The instant accessibility to various designs and templates reduces time and effort.

Where to Find more Residential Energy Credit Form 5695 Instructions

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Geothermal heat pumps Qualified fuel cells up to 500 per 1 2 kilowatt of cell capacity For energy efficient property placed into service in 2020 the credit is worth 26 of the improvement costs The residence can also be new construction and installation expenses are eligible for the credit The residential energy credit is limited by your

Use Form 5695 to Take Your Residential Energy Credits TaxAct The residential energy efficient property credit and The nonbusiness energy property credit 10 of the amount paid or incurred for qualified energy efficiency improvements installed during 2020 and Any residential energy property costs paid or incurred in 2020

Now that we've piqued your curiosity about Residential Energy Credit Form 5695 Instructions Let's take a look at where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Residential Energy Credit Form 5695 Instructions for various goals.

- Explore categories like design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free including flashcards, learning materials.

- Ideal for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- The blogs covered cover a wide range of interests, that range from DIY projects to planning a party.

Maximizing Residential Energy Credit Form 5695 Instructions

Here are some inventive ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Utilize free printable worksheets to build your knowledge at home (or in the learning environment).

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Residential Energy Credit Form 5695 Instructions are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and interests. Their accessibility and versatility make them a wonderful addition to each day life. Explore the many options that is Residential Energy Credit Form 5695 Instructions today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes, they are! You can download and print these materials for free.

-

Can I utilize free printables for commercial purposes?

- It is contingent on the specific rules of usage. Always check the creator's guidelines before using printables for commercial projects.

-

Do you have any copyright violations with Residential Energy Credit Form 5695 Instructions?

- Certain printables could be restricted in use. Make sure to read the terms and condition of use as provided by the author.

-

How do I print printables for free?

- Print them at home using any printer or head to a local print shop to purchase more high-quality prints.

-

What software will I need to access printables that are free?

- The majority are printed in PDF format. These is open with no cost programs like Adobe Reader.

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Residential Energy Efficient Property Credit Limit Worksheet

Check more sample of Residential Energy Credit Form 5695 Instructions below

Form 5695 Instructions 2023 Printable Forms Free Online

Irs Form 5695 Instructions 2023 Printable Forms Free Online

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

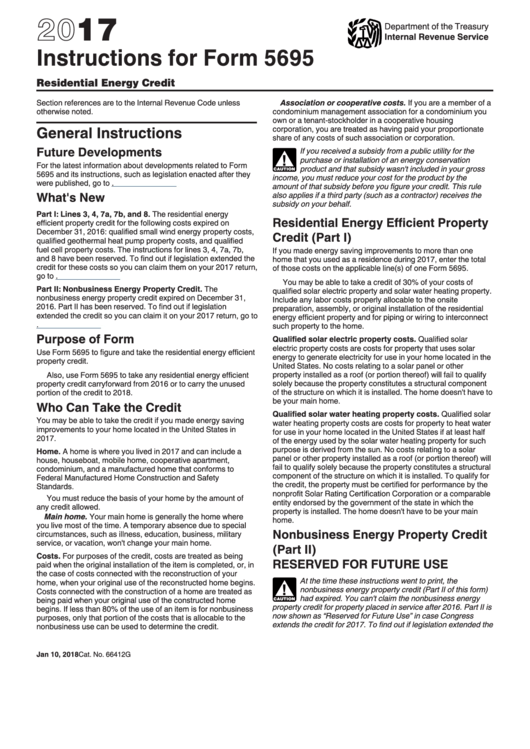

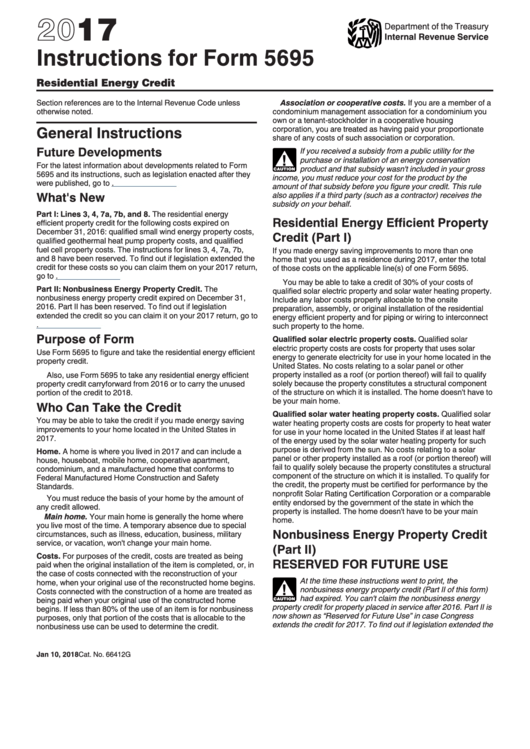

Instructions For Form 5695 Residential Energy Credit 2017 Printable

IRS Form 5695 Instructions Residential Energy Credits

IRS Form 5695 Residential Energy Credits Forms Docs 2023

https://www.irs.gov/forms-pubs/about-form-5695

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

https://www.irs.gov/pub/irs-pdf/f5695.pdf

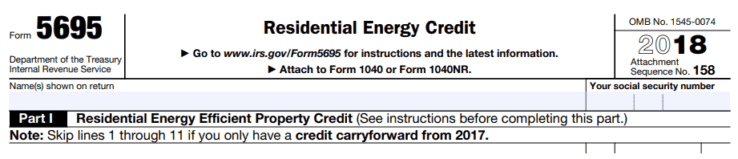

Form 5695 Department of the Treasury Internal Revenue Service Residential Energy Credits Go to www irs gov Form5695 for instructions and the latest information Attach to Form 1040 1040 SR or 1040 NR OMB No 1545 0074

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

Form 5695 Department of the Treasury Internal Revenue Service Residential Energy Credits Go to www irs gov Form5695 for instructions and the latest information Attach to Form 1040 1040 SR or 1040 NR OMB No 1545 0074

Instructions For Form 5695 Residential Energy Credit 2017 Printable

Irs Form 5695 Instructions 2023 Printable Forms Free Online

IRS Form 5695 Instructions Residential Energy Credits

IRS Form 5695 Residential Energy Credits Forms Docs 2023

How To File IRS Form 5695 To Claim Your Renewable Energy Credits

IRS Form 5695 Download Fillable PDF 2018 Residential Energy Credit

IRS Form 5695 Download Fillable PDF 2018 Residential Energy Credit

Everything You Need To Know About The Federal Solar Tax Credit