In this age of technology, where screens have become the dominant feature of our lives however, the attraction of tangible printed materials isn't diminishing. If it's to aid in education such as creative projects or simply to add an element of personalization to your space, Education Loan Tax Benefits India are now a vital resource. Through this post, we'll dive to the depths of "Education Loan Tax Benefits India," exploring their purpose, where you can find them, and how they can enhance various aspects of your life.

Get Latest Education Loan Tax Benefits India Below

Education Loan Tax Benefits India

Education Loan Tax Benefits India - Education Loan Tax Benefits India, Student Loan Tax Benefits India, Education Loan Tax Exemption India, Education Loan Interest Tax Benefit India, Can I Get Tax Benefit On Education Loan, Is Education Loan Tax Free, Can Education Loan Be Used For Tax Exemption, Is Education Loan Taxable, Is Education Loan Tax Deductible

Updated on 16 Jan 2024 05 49 PM With the growth in the economy the spending on education has also increased The education sector is evolving daily increasing the burden on the wallet of middle class

What is Section 80E In India Section 80E of the Income Tax Act 1961 allows you to claim a deduction of the interest on Education Loan from taxable income

Education Loan Tax Benefits India provide a diverse assortment of printable, downloadable resources available online for download at no cost. These printables come in different designs, including worksheets coloring pages, templates and much more. The value of Education Loan Tax Benefits India is in their versatility and accessibility.

More of Education Loan Tax Benefits India

Stratus Financial Blog Managing Your Student Loan Tax Benefits And

Stratus Financial Blog Managing Your Student Loan Tax Benefits And

Here s what you need to know about tax benefits on education loan 2022 Eligibility As per the regulations only an individual can claim a tax benefit and no

Education loans in addition to alleviating financial burdens come with tax benefits that can further reduce the pressure This To help ease this load the

The Education Loan Tax Benefits India have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

The ability to customize: It is possible to tailor printing templates to your own specific requirements in designing invitations and schedules, or even decorating your house.

-

Educational Benefits: Educational printables that can be downloaded for free can be used by students from all ages, making these printables a powerful aid for parents as well as educators.

-

Accessibility: The instant accessibility to numerous designs and templates is time-saving and saves effort.

Where to Find more Education Loan Tax Benefits India

Tax Benefits On Housing Loan Thdailymagazine

Tax Benefits On Housing Loan Thdailymagazine

10 08 2023 9min Read 30sec Snapshot Education loan tax benefits can be a game changer for Indian students and their families providing valuable financial relief during

4 Loans from approved institutions only qualify for a deduction under Section 80E Section 80E allows tax deductions for the interest paid on education loans

If we've already piqued your curiosity about Education Loan Tax Benefits India Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Education Loan Tax Benefits India suitable for many motives.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs are a vast variety of topics, from DIY projects to planning a party.

Maximizing Education Loan Tax Benefits India

Here are some ideas ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities to build your knowledge at home for the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Education Loan Tax Benefits India are a treasure trove of practical and innovative resources that meet a variety of needs and passions. Their accessibility and versatility make them a wonderful addition to the professional and personal lives of both. Explore the wide world of Education Loan Tax Benefits India and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes they are! You can print and download the resources for free.

-

Can I make use of free printables to make commercial products?

- It is contingent on the specific terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may come with restrictions on use. Always read the terms and conditions set forth by the designer.

-

How can I print Education Loan Tax Benefits India?

- Print them at home with the printer, or go to an area print shop for premium prints.

-

What software must I use to open Education Loan Tax Benefits India?

- The majority of PDF documents are provided in PDF format. These is open with no cost software such as Adobe Reader.

Maximizing Home Loan Tax Benefits In India 2023

5 Things You Must Know About Education Loan Tax Benefits In 2022 Tata

Check more sample of Education Loan Tax Benefits India below

Home Loan Tax Benefit 8 Ways To Avail Tax Benefits On Home Loans

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

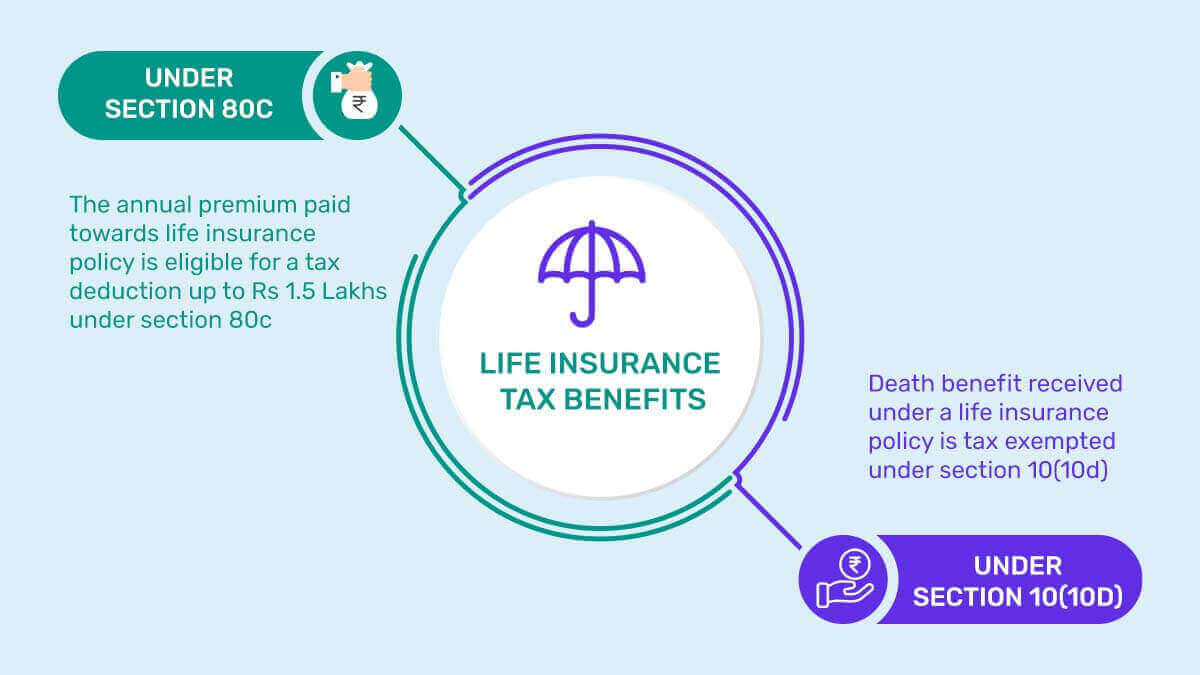

Life Insurance Tax Benefits In India 2023 PolicyBachat

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

ABCs Of Education Loan Tax Benefit From India Smart Debt Smarter Taxes

Tax Benefits On Car Loan What Is It How To Claim Tax Benefits

https://www.axisbank.com/progress-with-us-articles/...

What is Section 80E In India Section 80E of the Income Tax Act 1961 allows you to claim a deduction of the interest on Education Loan from taxable income

https://www.etmoney.com/blog/education-loa…

Education Loans interest allows tax deduction u s 80E of the Income Tax Act Know the tax benefits deductions you can avail on an Education Loan One time Offer Get ET Money Genius at 80 OFF at 249 49

What is Section 80E In India Section 80E of the Income Tax Act 1961 allows you to claim a deduction of the interest on Education Loan from taxable income

Education Loans interest allows tax deduction u s 80E of the Income Tax Act Know the tax benefits deductions you can avail on an Education Loan One time Offer Get ET Money Genius at 80 OFF at 249 49

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

ABCs Of Education Loan Tax Benefit From India Smart Debt Smarter Taxes

Tax Benefits On Car Loan What Is It How To Claim Tax Benefits

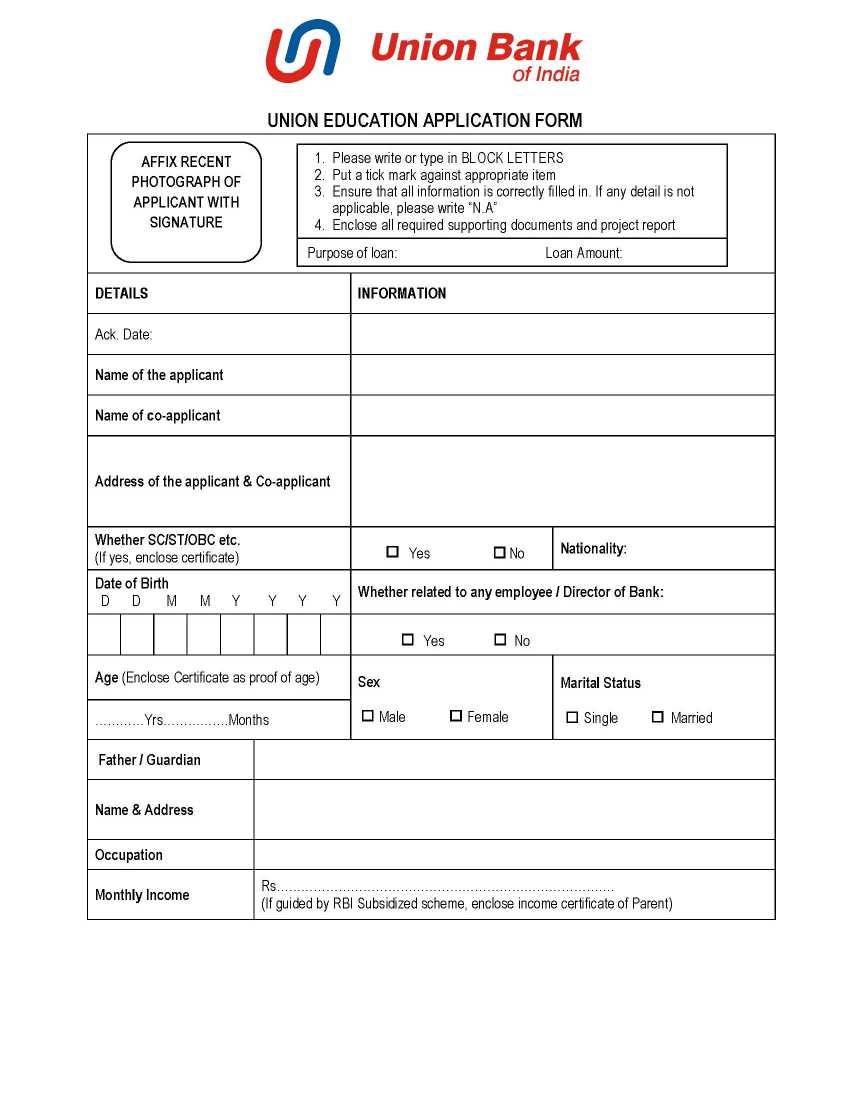

Union Bank Of India Education Loan Online Application Form 2023 2024

Education Loan EMI Calculator Formula And Apply Online

Education Loan EMI Calculator Formula And Apply Online

Education Loan