In this day and age where screens rule our lives, the charm of tangible printed material hasn't diminished. If it's to aid in education or creative projects, or simply adding an individual touch to the space, Student Loan Tax Benefits India are a great resource. This article will take a dive through the vast world of "Student Loan Tax Benefits India," exploring what they are, where they are available, and how they can be used to enhance different aspects of your lives.

Get Latest Student Loan Tax Benefits India Below

Student Loan Tax Benefits India

Student Loan Tax Benefits India -

An education loan tax benefit is a provision that allows individuals to claim a tax deduction on the interest paid on a loan taken for higher education This tax benefit is available in many countries including India where it is provided under Section 80E of the Income Tax Act Section 80E Deduction

If the taxpayer is earning Children s Education Allowance Hostel allowance the exemption can be claimed up to Rs 100 per month Rs 300 per month respectively Find out the Tax Benefits of Education Loan under Section 80E Income Tax deductions See if you are eligible to claim this deduction

Printables for free cover a broad array of printable materials online, at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and many more. One of the advantages of Student Loan Tax Benefits India is in their variety and accessibility.

More of Student Loan Tax Benefits India

Tax Benefits On Housing Loan Thdailymagazine

Tax Benefits On Housing Loan Thdailymagazine

Education loan tax benefits can be a game changer for Indian students and their families providing valuable financial relief during the pursuit of higher education By taking advantage of deductions credits and exemptions offered by the tax code borrowers can substantially reduce their tax liabilities and ultimately ease the burden of

Total interest paid The amount an individual needs to pay as interest on Education Loan this will vary as per the interest rate and amount of loan availed by the individual Total tax rebate The amount of Income Tax an individual can save by availing of iSMART Education Loan from ICICI Bank

Printables for free have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Personalization Your HTML0 customization options allow you to customize designs to suit your personal needs for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your house.

-

Educational Value: Education-related printables at no charge provide for students of all ages, which makes them an essential tool for parents and educators.

-

It's easy: Quick access to numerous designs and templates reduces time and effort.

Where to Find more Student Loan Tax Benefits India

Home Loan Tax Benefits

Home Loan Tax Benefits

Top 5 Tax benefits on Education Loan WHO ARE COVERED Under Section 80E of the Income Tax Act 1961 an individual can avail of tax benefit if he she has taken an education loan to support higher studies of self spouse children or for the student of he she is the legal guardian

A comphrehensive guide on education loan tax benefits under section 80 E of income tax this is over the Rs 1 5 lakh deduction permitted under Section 80C

If we've already piqued your interest in Student Loan Tax Benefits India and other printables, let's discover where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection with Student Loan Tax Benefits India for all applications.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs covered cover a wide spectrum of interests, that range from DIY projects to party planning.

Maximizing Student Loan Tax Benefits India

Here are some inventive ways for you to get the best of Student Loan Tax Benefits India:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home also in the classes.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Student Loan Tax Benefits India are an abundance of practical and innovative resources for a variety of needs and desires. Their accessibility and versatility make these printables a useful addition to both professional and personal life. Explore the endless world of Student Loan Tax Benefits India today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes, they are! You can print and download these tools for free.

-

Can I utilize free printables for commercial uses?

- It's based on specific rules of usage. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues when you download Student Loan Tax Benefits India?

- Some printables may come with restrictions concerning their use. You should read these terms and conditions as set out by the author.

-

How can I print printables for free?

- Print them at home using an printer, or go to the local print shops for the highest quality prints.

-

What software do I require to view printables for free?

- The majority are printed in the format PDF. This can be opened with free software like Adobe Reader.

Maximizing Home Loan Tax Benefits In India 2023

Home Loan Tax Benefits You Need To Know KS Group

Check more sample of Student Loan Tax Benefits India below

Understanding Home Loan Tax Benefits A Comprehensive Guide

Home Loan Tax Benefit 8 Ways To Avail Tax Benefits On Home Loans

How To Stop Student Loan Tax Garnishment Credible

Student Loan Tax Deduction Milliken Perkins Brunelle

Tax Benefits On Car Loan What Is It How To Claim Tax Benefits

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://cleartax.in/s/section-80e-deduction-interest-education-loan

If the taxpayer is earning Children s Education Allowance Hostel allowance the exemption can be claimed up to Rs 100 per month Rs 300 per month respectively Find out the Tax Benefits of Education Loan under Section 80E Income Tax deductions See if you are eligible to claim this deduction

https://www.bankbazaar.com/tax/tax-benefits-for-education-loan.html

Benefits of Education Loans The other benefits of an Education loan include You do not have to pay any early repayment fees for your student loan Infact interest rates decrease if your bank finds that you are paying loan repayments on time

If the taxpayer is earning Children s Education Allowance Hostel allowance the exemption can be claimed up to Rs 100 per month Rs 300 per month respectively Find out the Tax Benefits of Education Loan under Section 80E Income Tax deductions See if you are eligible to claim this deduction

Benefits of Education Loans The other benefits of an Education loan include You do not have to pay any early repayment fees for your student loan Infact interest rates decrease if your bank finds that you are paying loan repayments on time

Student Loan Tax Deduction Milliken Perkins Brunelle

Home Loan Tax Benefit 8 Ways To Avail Tax Benefits On Home Loans

Tax Benefits On Car Loan What Is It How To Claim Tax Benefits

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Section 80D Of Income Tax Act Deductions Under 80D Forbes Advisor INDIA

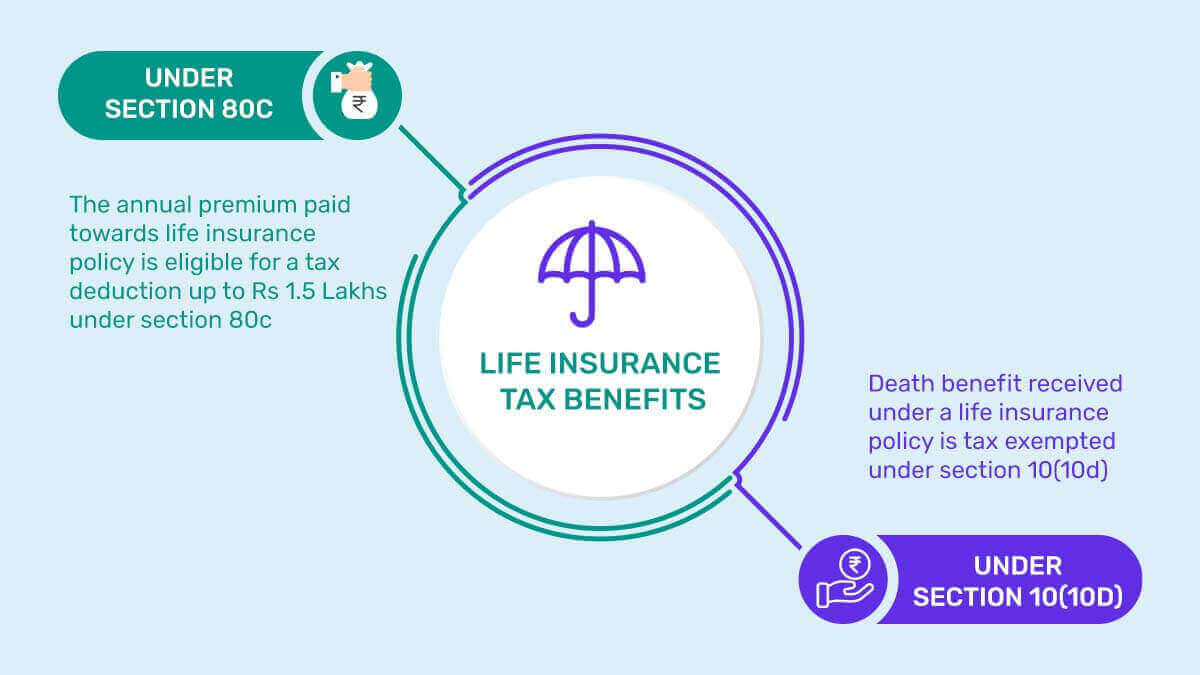

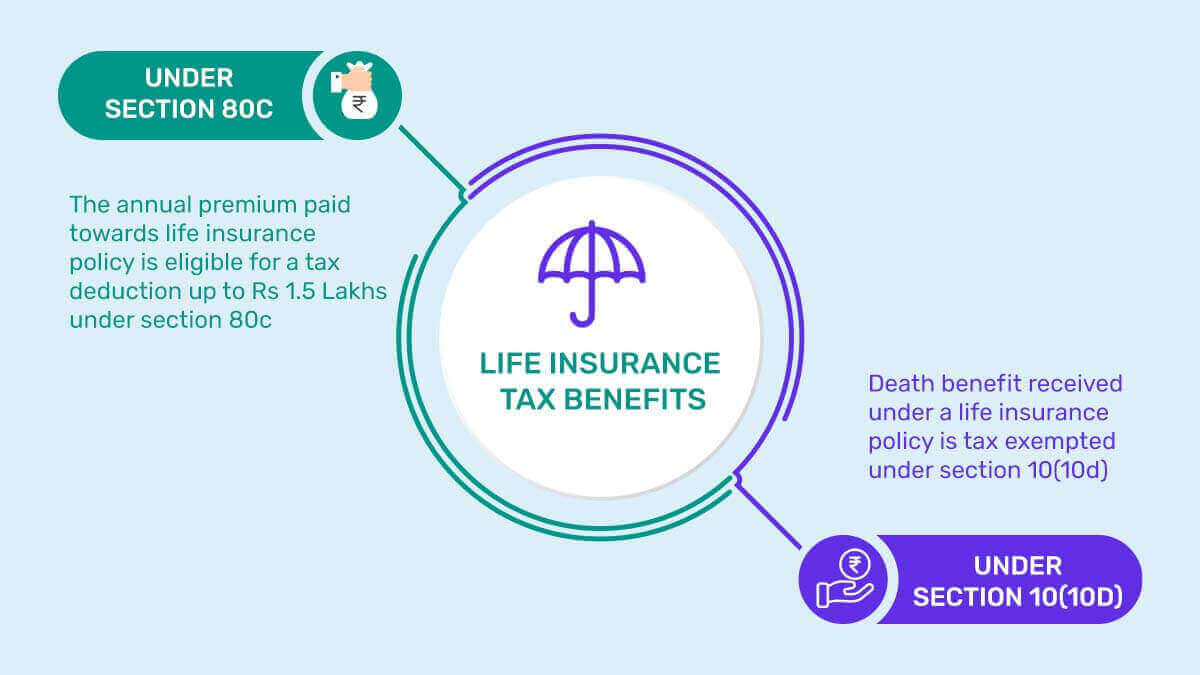

Life Insurance Tax Benefits In India 2023 PolicyBachat

Life Insurance Tax Benefits In India 2023 PolicyBachat

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits