In the digital age, where screens dominate our lives however, the attraction of tangible printed products hasn't decreased. If it's to aid in education project ideas, artistic or simply adding the personal touch to your area, Development Tax Deduction Under Which Section are a great source. Here, we'll dive into the world of "Development Tax Deduction Under Which Section," exploring the different types of printables, where they are, and how they can enrich various aspects of your lives.

Get Latest Development Tax Deduction Under Which Section Below

Development Tax Deduction Under Which Section

Development Tax Deduction Under Which Section - Development Tax Deduction Under Which Section, Who Are Eligible For Deduction Under Section 80c

Under Section 80IA of the Income Tax Act there are tax deductions available for businesses involved in developing maintaining or operating Read the

Payment of Tax under Punjab State Development Tax Act and Rules 2018 Section 10 Employees tax can be deducted and paid monthly or quarterly If the

Development Tax Deduction Under Which Section provide a diverse selection of printable and downloadable material that is available online at no cost. They are available in numerous styles, from worksheets to templates, coloring pages, and more. The benefit of Development Tax Deduction Under Which Section is in their versatility and accessibility.

More of Development Tax Deduction Under Which Section

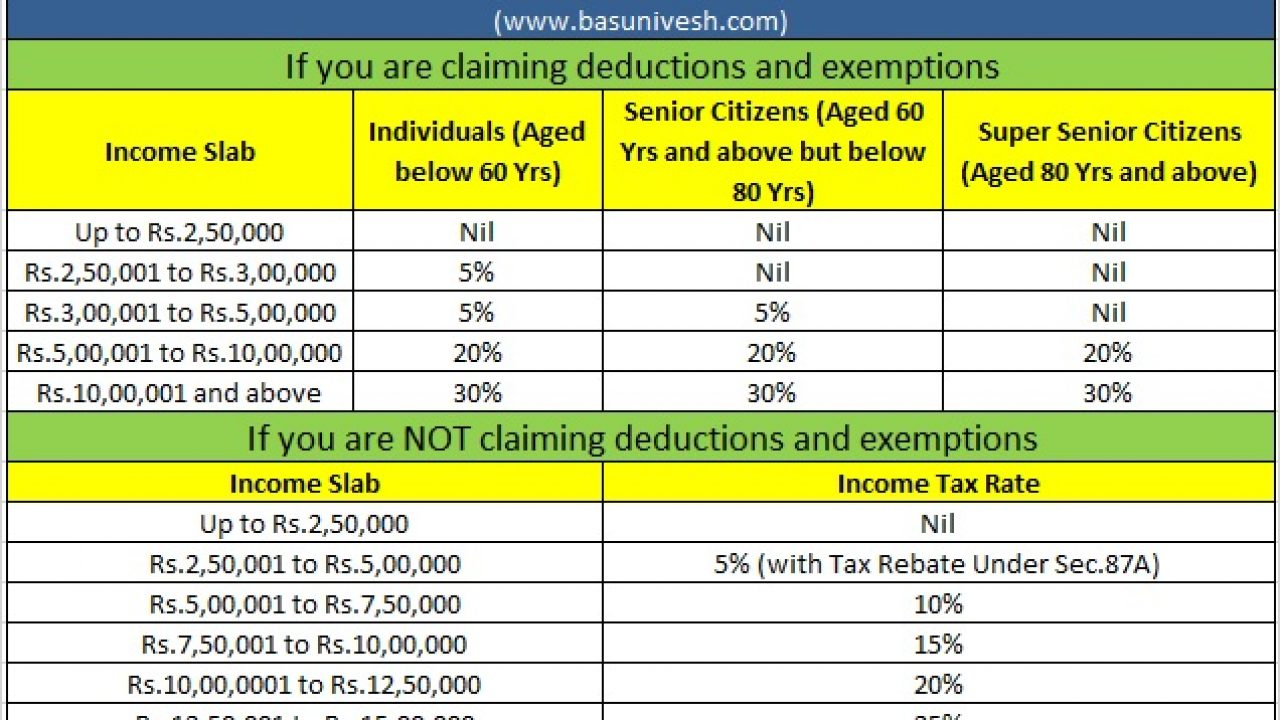

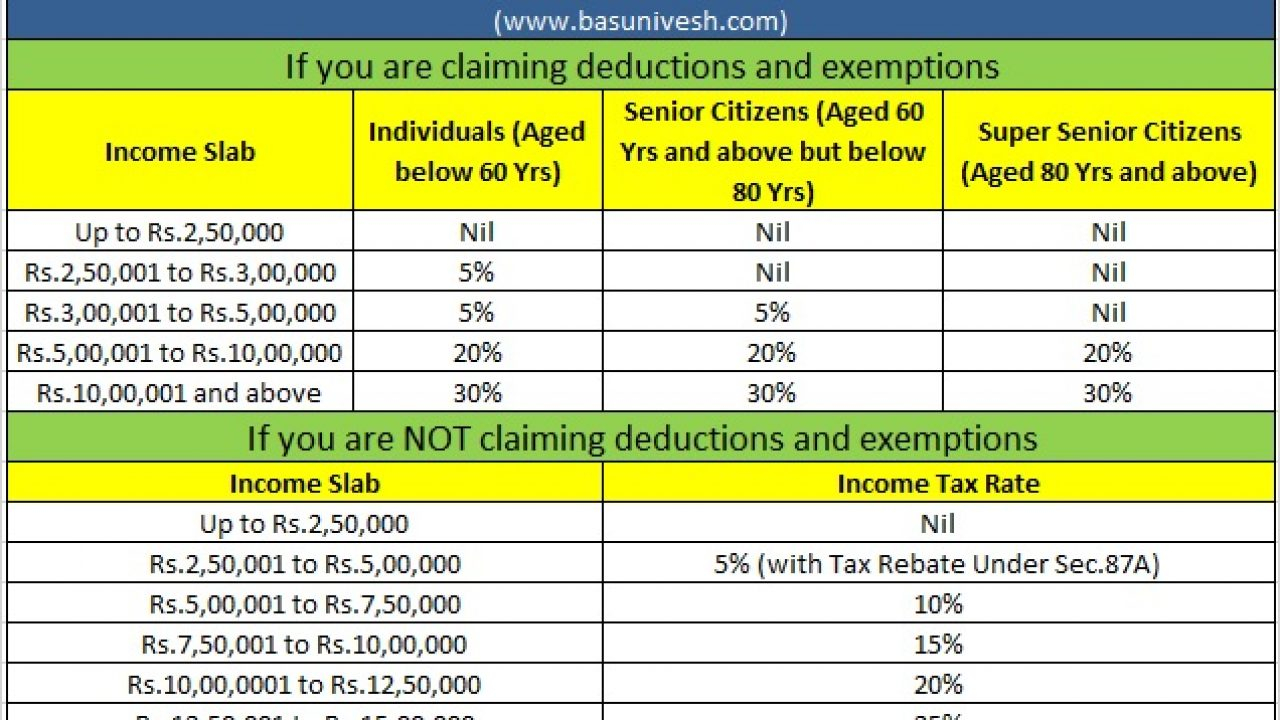

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

What is the limit to deduct TDS under Section 194J TDS is required to be deducted under Section 194J if the payment towards professional or technical services covered

The new PR explains the tax incentives available for R D expenditures on qualifying R D activities under Sections 34A 34B and 34 7 of the ITA including the conditions and mechanisms for claiming the deductions

Development Tax Deduction Under Which Section have risen to immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Personalization They can make printing templates to your own specific requirements whether you're designing invitations, organizing your schedule, or even decorating your home.

-

Educational Worth: The free educational worksheets offer a wide range of educational content for learners of all ages. This makes the perfect tool for teachers and parents.

-

Easy to use: immediate access an array of designs and templates helps save time and effort.

Where to Find more Development Tax Deduction Under Which Section

Section 80GGA Deduction Income Tax IndiaFilings

Section 80GGA Deduction Income Tax IndiaFilings

For businesses that incur research and development R D costs there is an important tax change occurring for 2022 Prior to 2022 Section 174 a allowed a

Annex D Quantum of qualifying expenditure eligible for deduction under sections 14C and 14D 1 50 Annex E Manner of set off for qualifying R D expenditure 57

We hope we've stimulated your curiosity about Development Tax Deduction Under Which Section Let's take a look at where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection in Development Tax Deduction Under Which Section for different objectives.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free including flashcards, learning tools.

- Great for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a broad array of topics, ranging everything from DIY projects to party planning.

Maximizing Development Tax Deduction Under Which Section

Here are some new ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free to enhance learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Development Tax Deduction Under Which Section are a treasure trove of useful and creative resources that meet a variety of needs and desires. Their availability and versatility make them a great addition to both professional and personal life. Explore the endless world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes, they are! You can print and download these documents for free.

-

Can I use free templates for commercial use?

- It is contingent on the specific rules of usage. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright problems with Development Tax Deduction Under Which Section?

- Some printables could have limitations regarding their use. Check the terms and regulations provided by the designer.

-

How do I print printables for free?

- Print them at home using the printer, or go to the local print shop for high-quality prints.

-

What program will I need to access printables at no cost?

- The majority of printed documents are in PDF format, which can be opened using free software like Adobe Reader.

How To Calculate Tax Deduction From Salary Malaysia Printable Forms

Deduction Under Section 80D Ultimate Guide

Check more sample of Development Tax Deduction Under Which Section below

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Deduction Under Section 80C Its Allied Sections

Income Tax Deduction Under Section 80C For Tax Saving

Section 80C Deduction Under Section 80C In India Paisabazaar

![]()

https://taxguru.in/goods-and-service-tax/detailed...

Payment of Tax under Punjab State Development Tax Act and Rules 2018 Section 10 Employees tax can be deducted and paid monthly or quarterly If the

https://www.caclubindia.com/forum/professional...

Section 10 14 i of the Income Tax Act 1961 provides for certain exemptions from tax for allowances granted to employees Rule 2BB of the Income Tax

Payment of Tax under Punjab State Development Tax Act and Rules 2018 Section 10 Employees tax can be deducted and paid monthly or quarterly If the

Section 10 14 i of the Income Tax Act 1961 provides for certain exemptions from tax for allowances granted to employees Rule 2BB of the Income Tax

Deduction Under Section 80C Its Allied Sections

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Income Tax Deduction Under Section 80C For Tax Saving

Section 80C Deduction Under Section 80C In India Paisabazaar

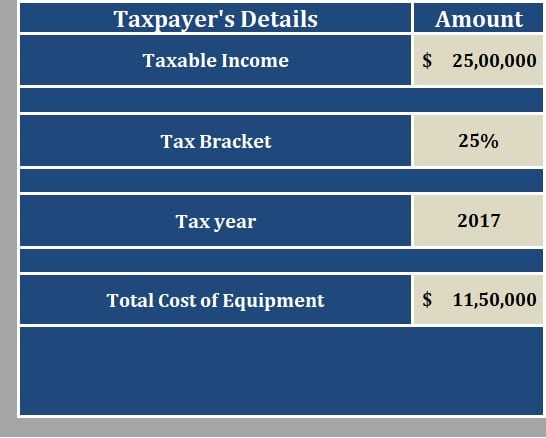

Download Section 179 Deduction Calculator Excel Template ExcelDataPro

Standard Deduction 2020 Self Employed Standard Deduction 2021

Standard Deduction 2020 Self Employed Standard Deduction 2021

Section 80CCC Tax Deductions On Pension Fund Contributions Tax2win