In this age of technology, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. If it's to aid in education project ideas, artistic or just adding an extra personal touch to your home, printables for free are a great source. Through this post, we'll dive through the vast world of "Who Are Eligible For Deduction Under Section 80c," exploring their purpose, where to find them and ways they can help you improve many aspects of your lives.

Get Latest Who Are Eligible For Deduction Under Section 80c Below

Who Are Eligible For Deduction Under Section 80c

Who Are Eligible For Deduction Under Section 80c -

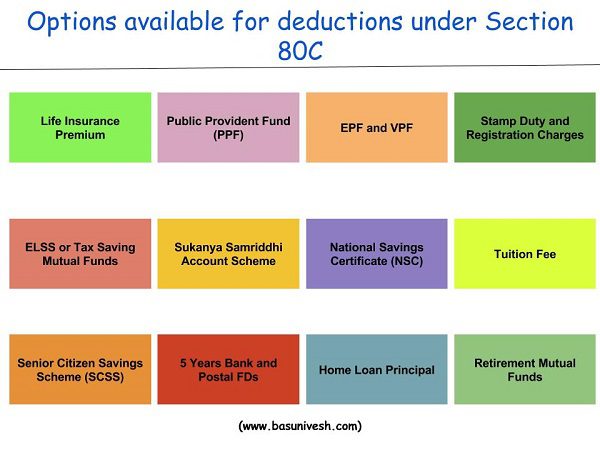

Who are eligible to claim section 80C deduction Individuals Indian residents and Non Resident Indians are eligible HUFs Who are cannot claim deduction under section 80C Companies Partnership Firms LLPs

Eligibility of Deduction Under 80C of Income Tax Act Individuals and HUFs are both eligible for Section 80C deductions This section also applies to both Indian residents and non resident

Who Are Eligible For Deduction Under Section 80c provide a diverse range of downloadable, printable materials that are accessible online for free cost. They are available in a variety of types, like worksheets, templates, coloring pages, and much more. The benefit of Who Are Eligible For Deduction Under Section 80c is their flexibility and accessibility.

More of Who Are Eligible For Deduction Under Section 80c

98 Deductions Deduction Under Section 80G Donations Eligible For

98 Deductions Deduction Under Section 80G Donations Eligible For

Section 80C of the Income Tax Act provides deduction towards specified investment and specified expenses Importantly only individuals and Hindu Undivided

Section 80CCD allows deductions for contributions to the National Pension Scheme NPS or Atal Pension Yojana Understanding these 80C subsections can help taxpayers make

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Customization: There is the possibility of tailoring printables to fit your particular needs in designing invitations making your schedule, or even decorating your home.

-

Educational Benefits: Printables for education that are free offer a wide range of educational content for learners of all ages, making them a great aid for parents as well as educators.

-

Accessibility: Instant access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Who Are Eligible For Deduction Under Section 80c

Section 80C Deductions List To Save Income Tax FinCalC Blog

Section 80C Deductions List To Save Income Tax FinCalC Blog

Yes contributions to the National Pension System NPS are eligible for deduction under Section 80C Additionally an extra deduction of 50 000 is available under Section 80CCD 1B for NPS contributions over

Section 80C of the IT Act provides a deduction of up to INR 1 5 lakh from the total taxable income of individuals and HUFs Here s all you need to know

Since we've got your interest in Who Are Eligible For Deduction Under Section 80c Let's see where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Who Are Eligible For Deduction Under Section 80c for various purposes.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free as well as flashcards and other learning materials.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- The blogs are a vast range of interests, starting from DIY projects to planning a party.

Maximizing Who Are Eligible For Deduction Under Section 80c

Here are some fresh ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home also in the classes.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Who Are Eligible For Deduction Under Section 80c are a treasure trove of practical and innovative resources that satisfy a wide range of requirements and interests. Their availability and versatility make them a great addition to any professional or personal life. Explore the many options of Who Are Eligible For Deduction Under Section 80c now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes they are! You can print and download these resources at no cost.

-

Can I use free templates for commercial use?

- It's contingent upon the specific rules of usage. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may contain restrictions on usage. Check the conditions and terms of use provided by the creator.

-

How can I print Who Are Eligible For Deduction Under Section 80c?

- Print them at home using an printer, or go to an in-store print shop to get the highest quality prints.

-

What software will I need to access printables at no cost?

- The majority of printables are in the PDF format, and is open with no cost programs like Adobe Reader.

Deduction Under Section 80C Its Allied Sections

Section 80C Deduction Under Section 80C In India Paisabazaar

Check more sample of Who Are Eligible For Deduction Under Section 80c below

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80C Deduction For School College Education Fees

Section 80GGA Deduction Income Tax IndiaFilings

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Smart Things To Know Deduction Under Section 80C For Tuition Fee

https://groww.in › tax

Eligibility of Deduction Under 80C of Income Tax Act Individuals and HUFs are both eligible for Section 80C deductions This section also applies to both Indian residents and non resident

https://cleartax.in

Persons paying any sum fees towards the education of their children can claim tax deduction under Section 80C subject to the satisfaction of certain conditions which have

Eligibility of Deduction Under 80C of Income Tax Act Individuals and HUFs are both eligible for Section 80C deductions This section also applies to both Indian residents and non resident

Persons paying any sum fees towards the education of their children can claim tax deduction under Section 80C subject to the satisfaction of certain conditions which have

Section 80GGA Deduction Income Tax IndiaFilings

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Smart Things To Know Deduction Under Section 80C For Tuition Fee

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Step For Claiming Deduction Under Section 80JJAA

Step For Claiming Deduction Under Section 80JJAA

Section 80C Deduction For Tax Saving Investments Learn By Quicko