In the age of digital, with screens dominating our lives, the charm of tangible printed products hasn't decreased. No matter whether it's for educational uses and creative work, or simply adding an individual touch to the area, Child Care Tax Deduction have become an invaluable source. Here, we'll dive in the world of "Child Care Tax Deduction," exploring the benefits of them, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Child Care Tax Deduction Below

Child Care Tax Deduction

Child Care Tax Deduction - Child Care Tax Deduction, Child Care Tax Deduction 2023, Child Care Tax Deduction Canada, Child Care Tax Deduction 2022, Child Care Tax Deduction Australia, Child Care Tax Deduction Calculator, Child Care Tax Deduction California, Child Care Tax Deduction Switzerland, Child Care Tax Deduction Income Limit, Is Child Daycare Tax Deductible

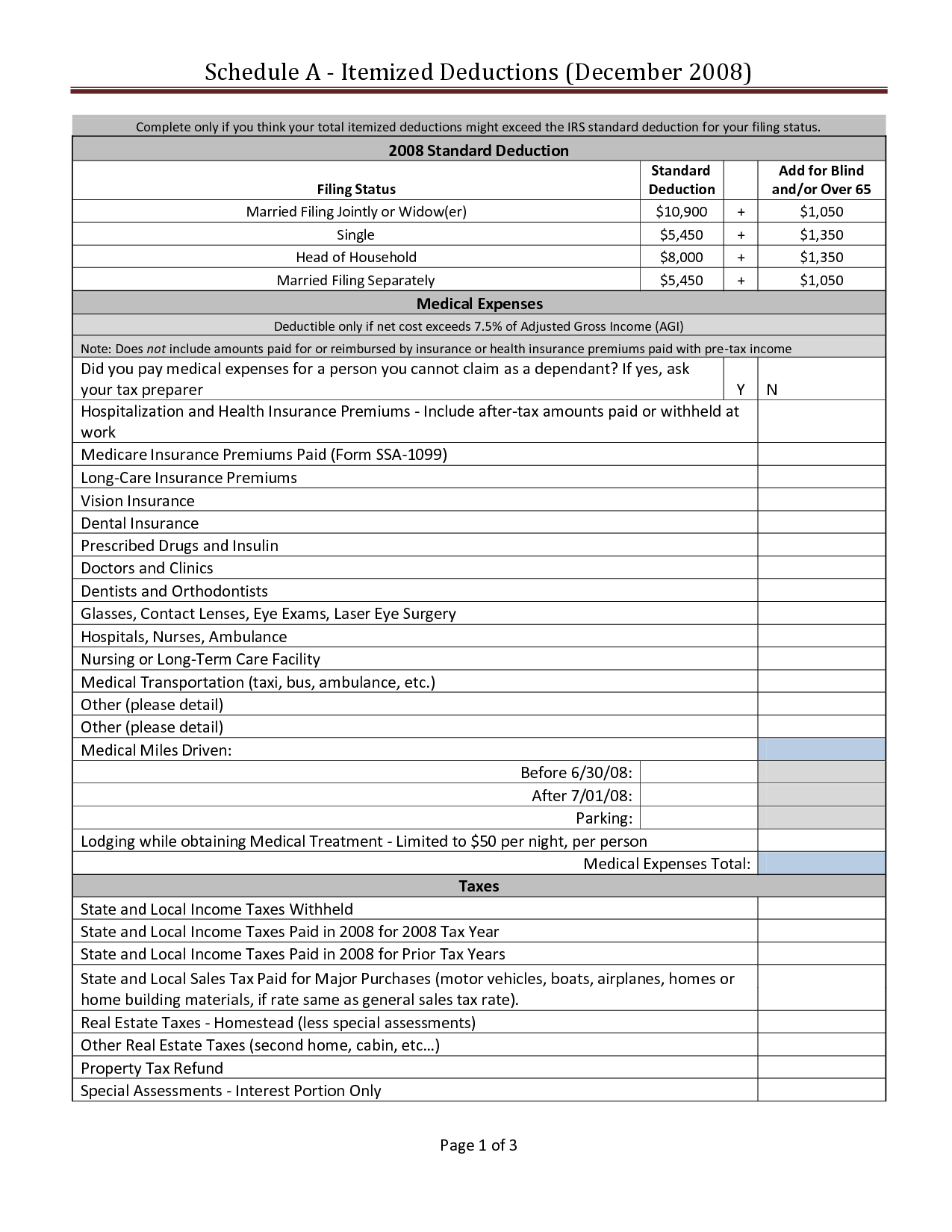

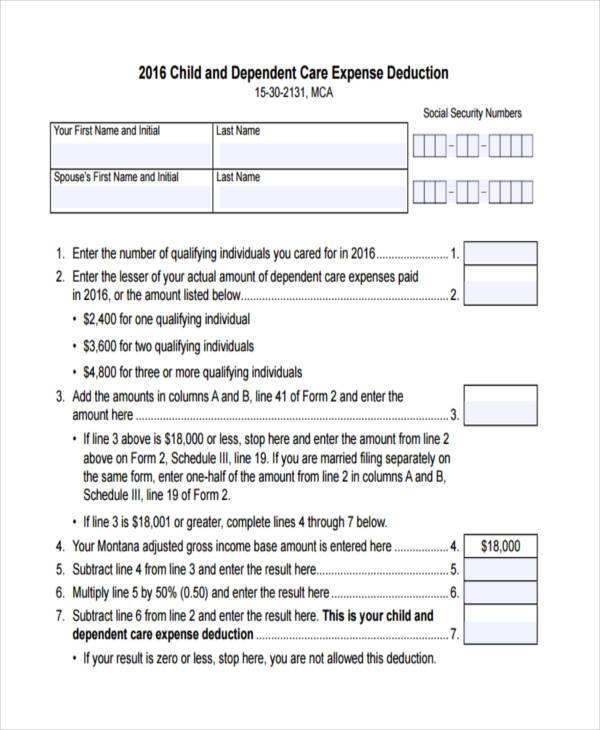

A qualifying individual for the child and dependent care credit is An individual who was physically or mentally incapable of self care lived with you for more than half of the year and either a was your dependent or b could have been your dependent except that he or she received gross income of 4 700 or more or filed a joint return

Deduction for the production of income when costs are less than 750 Earned income allowance Employment income credit Basic allowance Pension income deduction Disability credit if your municipality of domicile is on land Deduction for study grants Tax credit for student loans Deduction for seafarer s income

Child Care Tax Deduction offer a wide range of printable, free content that can be downloaded from the internet at no cost. These printables come in different designs, including worksheets templates, coloring pages and more. The value of Child Care Tax Deduction is in their variety and accessibility.

More of Child Care Tax Deduction

The Big List Of Home Daycare Tax Deductions For Family Child Care

The Big List Of Home Daycare Tax Deductions For Family Child Care

The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum

Line 21400 Child care expenses Child care expenses are amounts you or another person paid to have someone else look after an eligible child so you could earn income go to school or carry on research under a grant If eligible you can claim certain child care expenses as a deduction on your personal income tax return

Child Care Tax Deduction have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Modifications: Your HTML0 customization options allow you to customize printing templates to your own specific requirements for invitations, whether that's creating them, organizing your schedule, or decorating your home.

-

Educational Value Free educational printables are designed to appeal to students of all ages, which makes them a useful device for teachers and parents.

-

Affordability: Instant access to a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Child Care Tax Deduction

Campbell Offers Amendment To Create Child Care Tax Deduction Indiana

Campbell Offers Amendment To Create Child Care Tax Deduction Indiana

For 2024 taxes filed in 2025 the child tax credit will be worth 2 000 per qualifying dependent child if your MAGI is 400 000 or below married filing jointly or 200 000 or below all other

Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the child and dependent care credit works if you qualify and

Since we've got your interest in Child Care Tax Deduction Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection with Child Care Tax Deduction for all applications.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a broad array of topics, ranging including DIY projects to party planning.

Maximizing Child Care Tax Deduction

Here are some fresh ways to make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print out free worksheets and activities to enhance learning at home and in class.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Child Care Tax Deduction are a treasure trove of innovative and useful resources which cater to a wide range of needs and interests. Their accessibility and flexibility make they a beneficial addition to both personal and professional life. Explore the many options of Child Care Tax Deduction today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Child Care Tax Deduction really are they free?

- Yes you can! You can download and print these materials for free.

-

Can I download free printables for commercial uses?

- It's all dependent on the terms of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Do you have any copyright issues when you download Child Care Tax Deduction?

- Some printables may contain restrictions concerning their use. Check the terms and conditions provided by the author.

-

How do I print Child Care Tax Deduction?

- Print them at home with either a printer or go to a local print shop for superior prints.

-

What software must I use to open Child Care Tax Deduction?

- The majority of printables are in PDF format. They is open with no cost software like Adobe Reader.

The BIG List Of Common Tax Deductions For Home Daycare Home Daycare

OREGON ASSOCIATION OF INDEPENDENT ACCOUNTS

Check more sample of Child Care Tax Deduction below

Home Daycare Tax Deductions For Child Care Providers Where

Trump Child Care Tax Deduction Has Nothing To Do With Child Care

Types Of Deductions Archives Child Care Tax Specialists

5 Best Photos Of Child Care Provider Tax Form Daycare Provider Tax Db

Child Care Tax Deduction YouTube

Home Office Deduction Worksheet 2021

https://www.vero.fi/en/individuals/deductions/what-can-I-deduct

Deduction for the production of income when costs are less than 750 Earned income allowance Employment income credit Basic allowance Pension income deduction Disability credit if your municipality of domicile is on land Deduction for study grants Tax credit for student loans Deduction for seafarer s income

https://www.irs.gov/publications/p503

The temporary special rules for dependent care flexible spending arrangements FSAs have expired The temporary special rules under Section 214 of the Taxpayer Certainty and Disaster Relief Act of 2020 that allowed employers to amend their dependent care plan to carry forward unused amounts from 2020 and or 2021 to be used in a subsequent year have expired For

Deduction for the production of income when costs are less than 750 Earned income allowance Employment income credit Basic allowance Pension income deduction Disability credit if your municipality of domicile is on land Deduction for study grants Tax credit for student loans Deduction for seafarer s income

The temporary special rules for dependent care flexible spending arrangements FSAs have expired The temporary special rules under Section 214 of the Taxpayer Certainty and Disaster Relief Act of 2020 that allowed employers to amend their dependent care plan to carry forward unused amounts from 2020 and or 2021 to be used in a subsequent year have expired For

5 Best Photos Of Child Care Provider Tax Form Daycare Provider Tax Db

Trump Child Care Tax Deduction Has Nothing To Do With Child Care

Child Care Tax Deduction YouTube

Home Office Deduction Worksheet 2021

Does The Child And Dependent Care Credit Phase Out Completely Latest

Brilliant Tax Write Off Template Stores Inventory Excel Format

Brilliant Tax Write Off Template Stores Inventory Excel Format

FREE 8 Sample Child Care Expense Forms In PDF MS Word