In the digital age, when screens dominate our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. Be it for educational use for creative projects, simply to add an element of personalization to your space, Child Care Tax Deduction Canada have become a valuable resource. The following article is a dive into the world "Child Care Tax Deduction Canada," exploring their purpose, where to find them, and how they can add value to various aspects of your lives.

Get Latest Child Care Tax Deduction Canada Below

Child Care Tax Deduction Canada

Child Care Tax Deduction Canada - Child Care Tax Deduction Canada, Child Care Tax Credit Canada, Child Care Tax Credit Canada Calculator, Child Care Expense Deduction Canada, Child Care Tax Credit Canada 2022, Child Care Tax Benefits Canada, Day Care Tax Credit Canada, Child Care Expense Deduction Calculator Canada, Child Care Expenses Tax Return Canada, How Much Can You Claim For Child Care Expenses In Canada

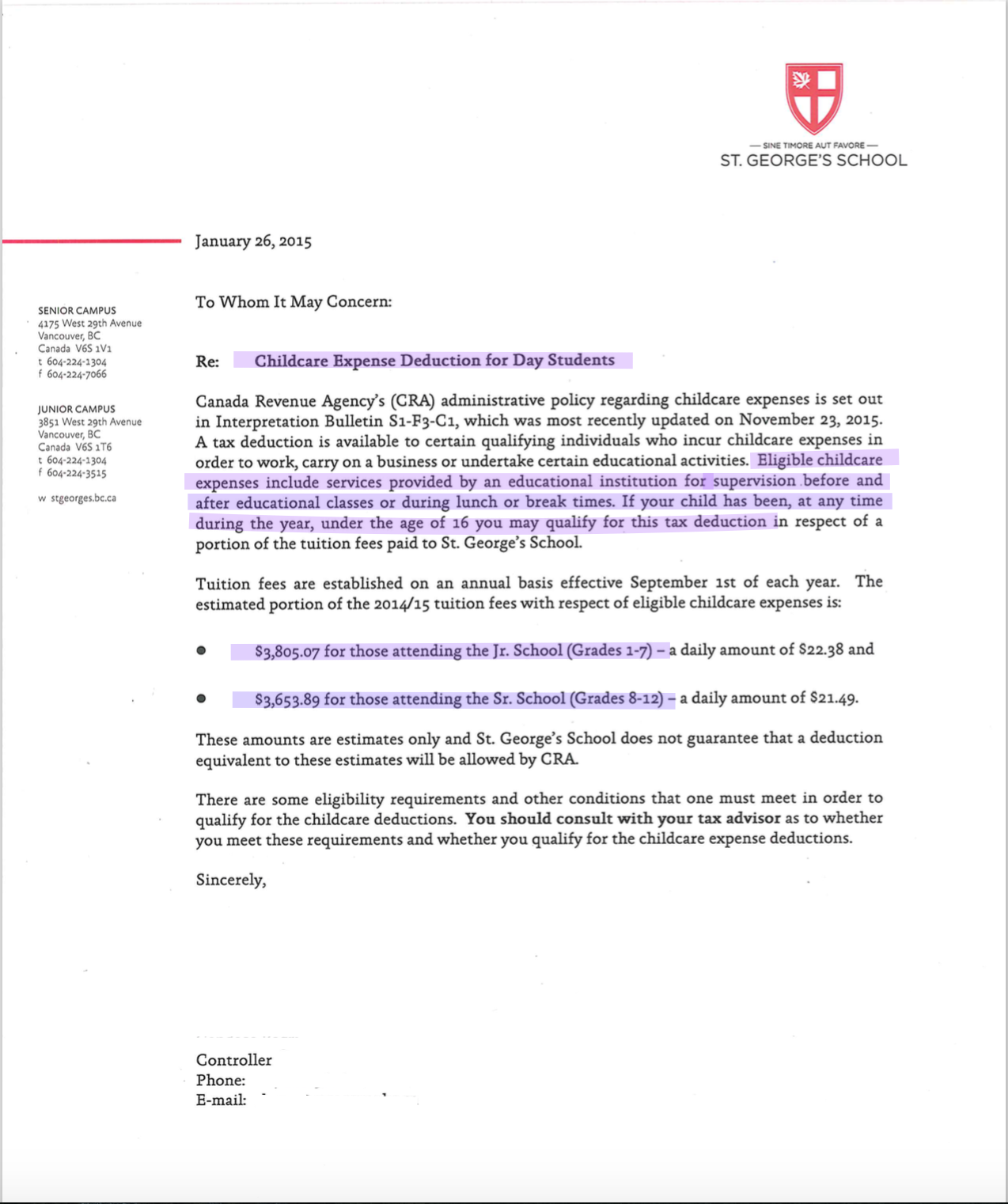

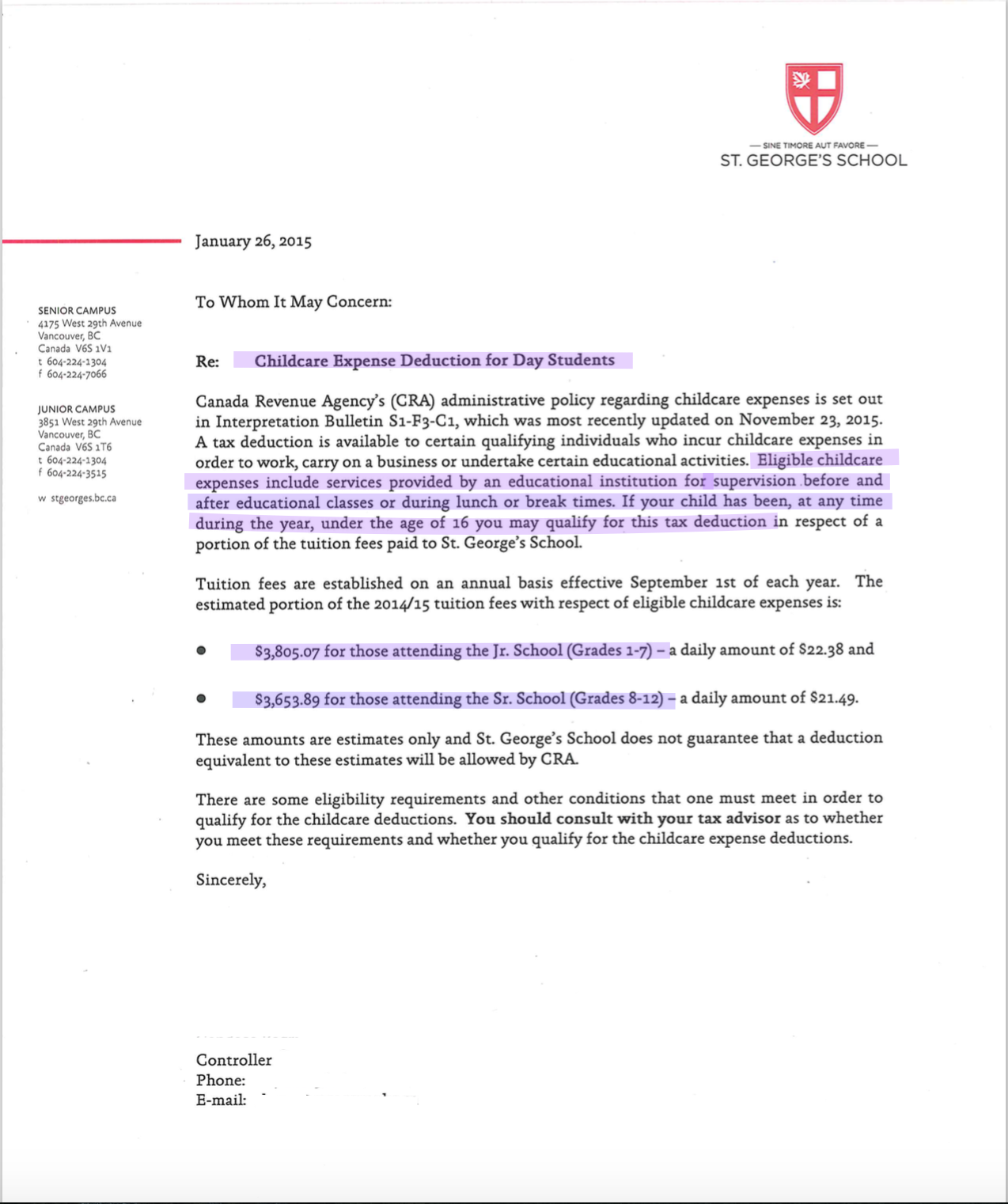

Canadian taxpayers can claim up to 8 000 per child for children under the age of 7 years at the end of the year 5 000 per child for children aged 7 to 16 years

Allowable expenses you can claim You may include payments made to any of the following individuals or institutions caregivers providing child care services day nursery schools

Child Care Tax Deduction Canada offer a wide assortment of printable, downloadable documents that can be downloaded online at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and many more. The appealingness of Child Care Tax Deduction Canada is their versatility and accessibility.

More of Child Care Tax Deduction Canada

The Big List Of Home Daycare Tax Deductions For Family Child Care

The Big List Of Home Daycare Tax Deductions For Family Child Care

You can claim the expenses you incurred while the eligible child was living with you You will need to fill out Form T778 Child Care Expenses Deduction for 2023 to calculate

Child Care Costs are Deducted From Income Child care costs are not claimed as a non refundable tax credit but as a deduction from income on the personal

Child Care Tax Deduction Canada have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: We can customize the templates to meet your individual needs when it comes to designing invitations planning your schedule or even decorating your home.

-

Educational Impact: Downloads of educational content for free can be used by students from all ages, making the perfect aid for parents as well as educators.

-

Easy to use: instant access numerous designs and templates cuts down on time and efforts.

Where to Find more Child Care Tax Deduction Canada

Trump Child Care Tax Deduction Has Nothing To Do With Child Care

Trump Child Care Tax Deduction Has Nothing To Do With Child Care

Child care expenses 101 Daycare summer camp nurseries and nanny services are all deductible expenses for parents but the tax deduction must be claimed by the parent in the lower tax bracket There

Chapter 1 Child Care Expense Deduction Summary The purpose of the legislative provisions regarding child care expenses is to provide some relief for taxpayers who

Since we've got your interest in Child Care Tax Deduction Canada Let's look into where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of applications.

- Explore categories like decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a broad array of topics, ranging from DIY projects to planning a party.

Maximizing Child Care Tax Deduction Canada

Here are some new ways to make the most of Child Care Tax Deduction Canada:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home and in class.

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Child Care Tax Deduction Canada are an abundance filled with creative and practical information catering to different needs and interests. Their access and versatility makes them a wonderful addition to every aspect of your life, both professional and personal. Explore the many options of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes you can! You can download and print these materials for free.

-

Are there any free printables for commercial uses?

- It's dependent on the particular usage guidelines. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may have restrictions on their use. Make sure to read the terms and condition of use as provided by the author.

-

How do I print Child Care Tax Deduction Canada?

- Print them at home using the printer, or go to a local print shop to purchase superior prints.

-

What software is required to open printables free of charge?

- Most PDF-based printables are available with PDF formats, which can be opened using free software such as Adobe Reader.

Day Care Tax Deductions Starting A Daycare Childcare Business

5 Itemized Tax Deduction Worksheet Worksheeto

Check more sample of Child Care Tax Deduction Canada below

Brilliant Tax Write Off Template Stores Inventory Excel Format

OREGON ASSOCIATION OF INDEPENDENT ACCOUNTS

Take Advantage Of The Child Care Tax Credit Care HomePay

The BIG List Of Common Tax Deductions For Home Daycare Home Daycare

Home Office Renovation Tax Deduction Canada Bedrock Construction Calgary

Does CRA Have Discretion To Adjust Child care Expense Tax Deduction 20

https://www.canada.ca/en/revenue-agency/services/...

Allowable expenses you can claim You may include payments made to any of the following individuals or institutions caregivers providing child care services day nursery schools

https://www.canada.ca/en/revenue-agency/services/...

How to claim Who is eligible You or another person may be eligible to claim child care expenses you incurred to look after a child in your care Eligibility checklist To

Allowable expenses you can claim You may include payments made to any of the following individuals or institutions caregivers providing child care services day nursery schools

How to claim Who is eligible You or another person may be eligible to claim child care expenses you incurred to look after a child in your care Eligibility checklist To

The BIG List Of Common Tax Deductions For Home Daycare Home Daycare

OREGON ASSOCIATION OF INDEPENDENT ACCOUNTS

Home Office Renovation Tax Deduction Canada Bedrock Construction Calgary

Does CRA Have Discretion To Adjust Child care Expense Tax Deduction 20

Proof Of Child Care Payment Letter Payment Proof 2020

Home Based Business Ideas Dubai Time Home Business Tax Deduction Canada

Home Based Business Ideas Dubai Time Home Business Tax Deduction Canada

T778 Child Care Expenses Deduction H R Block Canada