In this age of technology, with screens dominating our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. Be it for educational use, creative projects, or just adding an individual touch to the home, printables for free have become an invaluable resource. The following article is a dive deeper into "What Qualifies For Energy Tax Credit 2022," exploring their purpose, where to locate them, and ways they can help you improve many aspects of your life.

Get Latest What Qualifies For Energy Tax Credit 2022 Below

What Qualifies For Energy Tax Credit 2022

What Qualifies For Energy Tax Credit 2022 - What Qualifies For Energy Tax Credit 2022, What Seer Qualifies For Energy Tax Credit 2022, What Appliances Qualify For Energy Tax Credit 2022, What Windows Qualify For Energy Tax Credit 2022, Do Windows Qualify For Energy Tax Credit 2022, What Qualifies For Energy Tax Credit, What Qualifies For Federal Energy Tax Credit

For example if you purchased a 20 000 rooftop solar system and it qualifies for the 30 tax credit you can get a 6 000 credit toward your taxes The

The nonbusiness energy tax credit can be claimed on your 2022 taxes via Form 5695 Also when you claim the credit make sure to reference

What Qualifies For Energy Tax Credit 2022 provide a diverse variety of printable, downloadable material that is available online at no cost. They are available in a variety of forms, like worksheets templates, coloring pages, and many more. One of the advantages of What Qualifies For Energy Tax Credit 2022 lies in their versatility and accessibility.

More of What Qualifies For Energy Tax Credit 2022

Accounting For Energy Tax Credits

Accounting For Energy Tax Credits

If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified

Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Modifications: It is possible to tailor printables to your specific needs whether it's making invitations, organizing your schedule, or even decorating your house.

-

Education Value Printables for education that are free are designed to appeal to students from all ages, making them a great tool for teachers and parents.

-

It's easy: Access to many designs and templates is time-saving and saves effort.

Where to Find more What Qualifies For Energy Tax Credit 2022

What Qualifies For Long Term Disability DisabilityTalk

What Qualifies For Long Term Disability DisabilityTalk

Key Takeaways The Energy Efficient Home Improvement Credit provides tax credits for the purchase of qualifying equipment home improvements and energy

Key Takeaways An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit

We hope we've stimulated your curiosity about What Qualifies For Energy Tax Credit 2022 we'll explore the places they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of needs.

- Explore categories such as home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- These blogs cover a broad range of topics, that includes DIY projects to planning a party.

Maximizing What Qualifies For Energy Tax Credit 2022

Here are some innovative ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

What Qualifies For Energy Tax Credit 2022 are an abundance of fun and practical tools catering to different needs and interest. Their availability and versatility make them a valuable addition to any professional or personal life. Explore the endless world of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes, they are! You can print and download these items for free.

-

Can I download free printables for commercial uses?

- It's determined by the specific rules of usage. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues when you download What Qualifies For Energy Tax Credit 2022?

- Some printables could have limitations concerning their use. Make sure to read the terms and regulations provided by the author.

-

How do I print printables for free?

- You can print them at home using either a printer or go to an in-store print shop to get top quality prints.

-

What software is required to open printables free of charge?

- The majority of PDF documents are provided in the format PDF. This is open with no cost software such as Adobe Reader.

What Home Improvements Qualify For Tax Credit Energy Texas

Are You Eligible For R D Tax Credit Find Out Using This Infographic

Check more sample of What Qualifies For Energy Tax Credit 2022 below

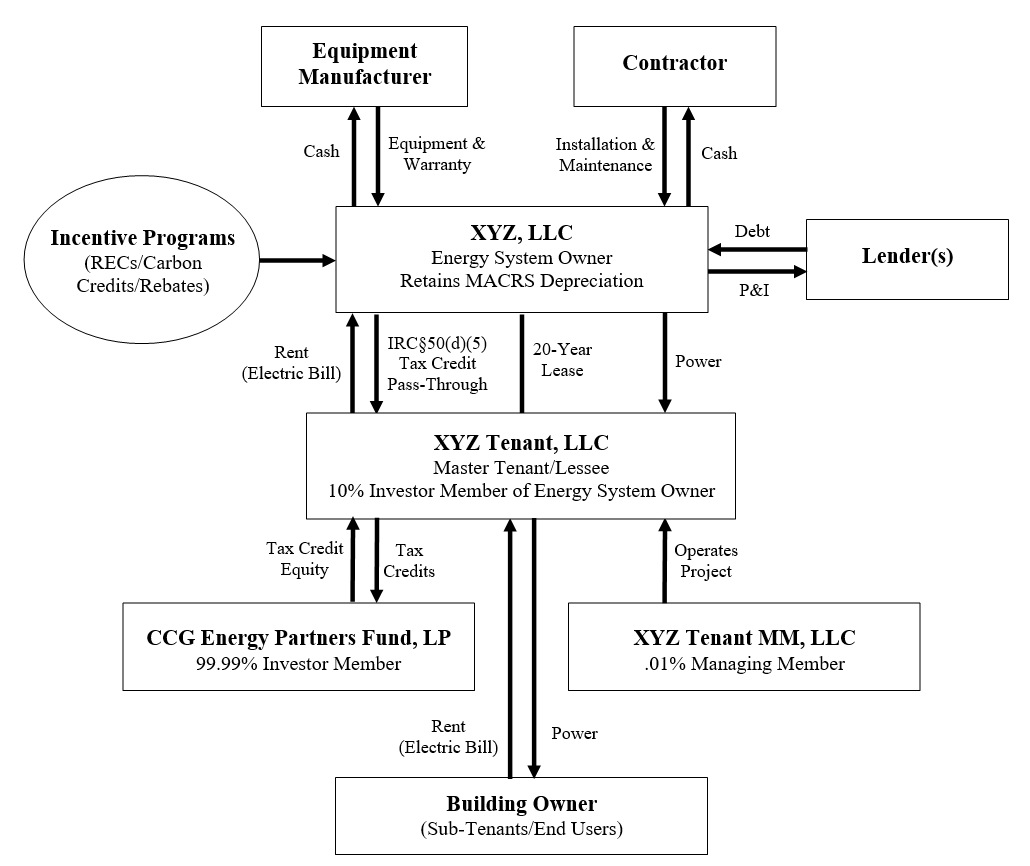

Solar Energy Transactional Structures CityScape Capital Group The

2023 Wood Stove And Pellet Heater Tax Credit

Rheem Heat Pump Reviews And Prices 2021 Trend Repository

MRCOOL GeoCool 48K BTU 4 Ton Vertical Two Stage CuNi Coil Right

Who Qualifies For A Business Credit Card Flipboard

MRCOOL GeoCool 36K BTU 3 Ton Horizontal Two Stage CuNi Coil Right

https://www.hrblock.com/tax-center/filing/cre…

The nonbusiness energy tax credit can be claimed on your 2022 taxes via Form 5695 Also when you claim the credit make sure to reference

https://www.irs.gov/credits-deductions/frequently...

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit

The nonbusiness energy tax credit can be claimed on your 2022 taxes via Form 5695 Also when you claim the credit make sure to reference

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit

MRCOOL GeoCool 48K BTU 4 Ton Vertical Two Stage CuNi Coil Right

2023 Wood Stove And Pellet Heater Tax Credit

Who Qualifies For A Business Credit Card Flipboard

MRCOOL GeoCool 36K BTU 3 Ton Horizontal Two Stage CuNi Coil Right

What Qualifies For The Residential Energy Tax Credit Boston Standard

Who Qualifies For The Electric Vehicle Tax Credit Electric Vehicle List

Who Qualifies For The Electric Vehicle Tax Credit Electric Vehicle List

Slurry Storage Costs What Qualifies For Capital Allowances