In the digital age, where screens dominate our lives it's no wonder that the appeal of tangible printed objects isn't diminished. In the case of educational materials for creative projects, simply to add the personal touch to your area, What Energy Efficient Improvements Are Tax Deductible have become a valuable resource. We'll take a dive through the vast world of "What Energy Efficient Improvements Are Tax Deductible," exploring the benefits of them, where to find them and how they can enrich various aspects of your life.

Get Latest What Energy Efficient Improvements Are Tax Deductible Below

What Energy Efficient Improvements Are Tax Deductible

What Energy Efficient Improvements Are Tax Deductible - What Energy Efficient Improvements Are Tax Deductible, What Energy Efficient Improvements Are Tax Deductible In 2022, What Energy Efficient Home Improvements Are Tax Deductible, What Energy Efficient Items Are Tax Deductible, What Home Energy Improvements Are Tax Deductible

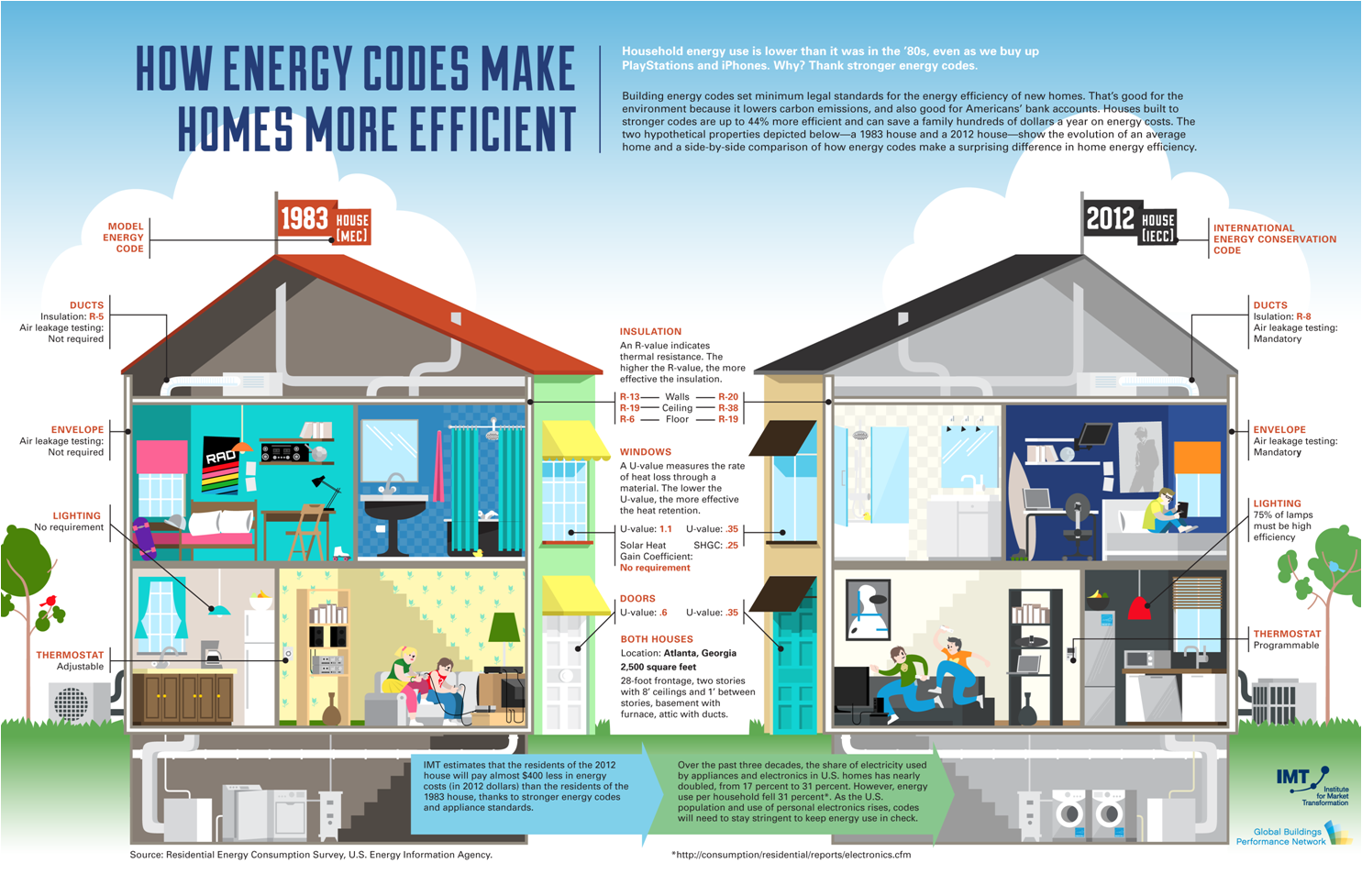

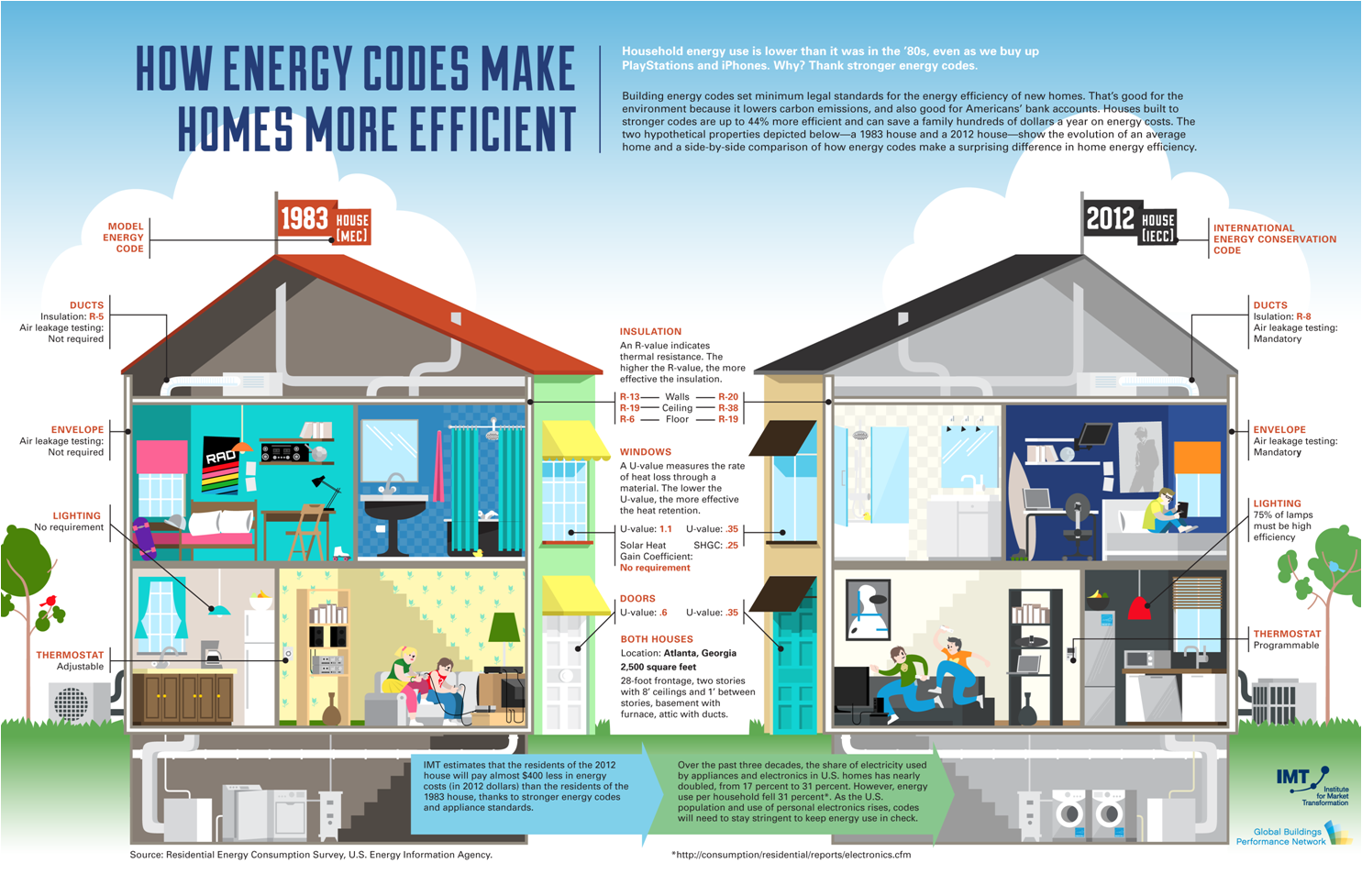

Getty In the U S several tax credits are designed to make boosting energy efficiency more attractive to homeowners developers manufacturers and various types of business owners Some of these

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

What Energy Efficient Improvements Are Tax Deductible encompass a wide range of downloadable, printable materials online, at no cost. They are available in a variety of forms, like worksheets coloring pages, templates and much more. The value of What Energy Efficient Improvements Are Tax Deductible lies in their versatility as well as accessibility.

More of What Energy Efficient Improvements Are Tax Deductible

Are Home Improvements Tax Deductible AppliancePartsPros Blog

Are Home Improvements Tax Deductible AppliancePartsPros Blog

The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2023 to 2032 The maximum credit amount is 1 200 for home improvements

Energy efficient home upgrades can make you eligible for a tax deduction You can claim a tax credit for energy efficient improvements to your home through Dec 31 2021 which include energy efficient windows doors skylights roofs and insulation says Washington

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Customization: There is the possibility of tailoring printables to fit your particular needs, whether it's designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Worth: Printables for education that are free are designed to appeal to students from all ages, making them a vital tool for parents and educators.

-

Simple: Access to various designs and templates saves time and effort.

Where to Find more What Energy Efficient Improvements Are Tax Deductible

Are Home Improvements Tax Deductible LendingTree

Are Home Improvements Tax Deductible LendingTree

Qualifying energy saving improvements made to a personal residence after December 31 2019 and before January 1 2023 can get a credit equal to 26 of the cost of the equipment installed Your

When making upgrades most homeowners ask Are home improvements tax deductible Broadly speaking no However there can be exceptions Home improvements can potentially reduce your tax burden such as capital improvements and upgrades related to medical care or energy efficiency

Now that we've ignited your interest in printables for free, let's explore where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of What Energy Efficient Improvements Are Tax Deductible designed for a variety objectives.

- Explore categories such as decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a wide range of interests, all the way from DIY projects to planning a party.

Maximizing What Energy Efficient Improvements Are Tax Deductible

Here are some unique ways to make the most of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets for reinforcement of learning at home as well as in the class.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

What Energy Efficient Improvements Are Tax Deductible are a treasure trove of creative and practical resources that satisfy a wide range of requirements and preferences. Their availability and versatility make them a wonderful addition to both professional and personal lives. Explore the world of What Energy Efficient Improvements Are Tax Deductible to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes you can! You can print and download these tools for free.

-

Can I use free printables to make commercial products?

- It depends on the specific rules of usage. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues in What Energy Efficient Improvements Are Tax Deductible?

- Some printables may have restrictions in their usage. Make sure to read the terms and regulations provided by the author.

-

How do I print What Energy Efficient Improvements Are Tax Deductible?

- Print them at home using printing equipment or visit a print shop in your area for top quality prints.

-

What program do I need to run printables at no cost?

- The majority of PDF documents are provided in PDF format. They can be opened with free software like Adobe Reader.

Energy Efficient Improvements Prime Energy Solar

Are Home Improvements Tax Deductible 2023

Check more sample of What Energy Efficient Improvements Are Tax Deductible below

What Capital Improvements Are Tax Deductible Tax Deductions Home

Are Home Improvements Tax Deductible Rayne Water

Energy Efficient Home Improvements That Offer Best ROI Land

Capital Improvements Elmer McDuffy

Energy Saving Archives Texas Home Improvement

Making Your Home Energy Efficient Is Tax Deductible Finerpoints

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.irs.gov/newsroom/energy-incentives-for...

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500

Capital Improvements Elmer McDuffy

Are Home Improvements Tax Deductible Rayne Water

Energy Saving Archives Texas Home Improvement

Making Your Home Energy Efficient Is Tax Deductible Finerpoints

North MSP frustrated By Lack Of Firms Registered To Carry Out Energy

Are Home Improvements Tax Deductible

Are Home Improvements Tax Deductible

Energy Efficient Home Improvements That Save Money