In the digital age, where screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons and creative work, or simply adding an extra personal touch to your space, Tax Rebate Other Than 80c are now a useful resource. The following article is a take a dive through the vast world of "Tax Rebate Other Than 80c," exploring the different types of printables, where to find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Tax Rebate Other Than 80c Below

Tax Rebate Other Than 80c

Tax Rebate Other Than 80c - Tax Rebate Other Than 80c, Tax Saving Other Than 80c And 80d, Income Tax Saving Other Than 80c, Tax Saving Ideas Other Than 80c, Tax Saving Methods Other Than 80c, What Are All Covered Under 80c, What Are The Deductions In 80c, Tax Benefit Other Than 80c, How Much Tax Exemption Under 80c

Web Section 80C is the most well known provision of the Income Tax Act of 1961 under which a rebate of up to Rs 1 5 Lakh is granted on several loan products and other investment

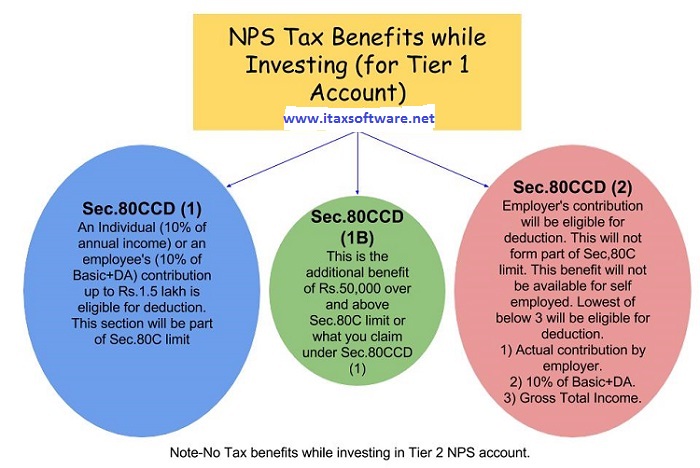

Web 26 d 233 c 2022 nbsp 0183 32 Best 10 Tax Saving Investment Options Other Than 80C 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing up to

Tax Rebate Other Than 80c cover a large collection of printable materials available online at no cost. The resources are offered in a variety styles, from worksheets to coloring pages, templates and more. The great thing about Tax Rebate Other Than 80c lies in their versatility as well as accessibility.

More of Tax Rebate Other Than 80c

What Are The Tax Saving Options Other Than 80 C 80C

What Are The Tax Saving Options Other Than 80 C 80C

Web 24 mars 2017 nbsp 0183 32 The tax rebate is limited to Rs 12 500 This means if your total tax payable is less than Rs 12 500 then you will not have to pay any tax However if you opt for the

Web 4 f 233 vr 2023 nbsp 0183 32 Income tax calculator In National Pension System NPS scheme an earning individual is given an additional 50 000 tax deduction under Section 80CCD 1B

Tax Rebate Other Than 80c have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

customization It is possible to tailor the templates to meet your individual needs whether you're designing invitations or arranging your schedule or even decorating your house.

-

Educational Value These Tax Rebate Other Than 80c cater to learners of all ages, which makes these printables a powerful tool for parents and educators.

-

The convenience of You have instant access a variety of designs and templates reduces time and effort.

Where to Find more Tax Rebate Other Than 80c

Income Tax Saving Options Other Than 80C In Hindi Future Generali

Income Tax Saving Options Other Than 80C In Hindi Future Generali

Web 27 avr 2023 nbsp 0183 32 How to save tax other than section 80C Apart from 80C various other provisions allow deductions to taxpayer as follows 80D for medical insurance premium

Web How to Save Tax Other Than 80c Section 80C of the Income Tax Act allows you to claim a deduction of up to Rs 1 5 lac from your total taxable income This is an excellent way to

Since we've got your curiosity about Tax Rebate Other Than 80c Let's take a look at where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of objectives.

- Explore categories like furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- The blogs are a vast spectrum of interests, starting from DIY projects to planning a party.

Maximizing Tax Rebate Other Than 80c

Here are some unique ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to build your knowledge at home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Tax Rebate Other Than 80c are a treasure trove of fun and practical tools that meet a variety of needs and preferences. Their accessibility and versatility make them a fantastic addition to your professional and personal life. Explore the vast world of Tax Rebate Other Than 80c and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can download and print these resources at no cost.

-

Do I have the right to use free printables to make commercial products?

- It's based on the conditions of use. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may contain restrictions in use. Always read the terms and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home with any printer or head to an area print shop for more high-quality prints.

-

What software do I require to view printables at no cost?

- The majority are printed with PDF formats, which can be opened using free software like Adobe Reader.

Tax Savings Options Other Than Sec 80C For FY 2017 18 BasuNivesh

Illinois Tax Rebate Tracker Rebate2022

Check more sample of Tax Rebate Other Than 80c below

Save Tax Other Than 80C Tips And Tricks To Save Tax Legally

How To Save Tax Other Than Section 80C 80 C

Tax Savings Options Other Than Sec 80C For FY 2017 18 With Automated

Tax Saving Options Other Than 80C Investments YouTube

Income Tax Calculator Top 5 Tax Saving Tips Other Than Section 80C Benefit

Budget 2014 Impact On Money Taxes And Savings

https://www.etmoney.com/learn/saving-schemes/beyond-section-80c-10...

Web 26 d 233 c 2022 nbsp 0183 32 Best 10 Tax Saving Investment Options Other Than 80C 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing up to

https://cleartax.in/s/how-to-save-tax-other-than-80c

Web 3 avr 2023 nbsp 0183 32 Under Section 80C you will be able to claim up to Rs 1 50 000 for your contribution an additional deduction of Rs 50 000 under Section 80CCD makes it a total

Web 26 d 233 c 2022 nbsp 0183 32 Best 10 Tax Saving Investment Options Other Than 80C 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing up to

Web 3 avr 2023 nbsp 0183 32 Under Section 80C you will be able to claim up to Rs 1 50 000 for your contribution an additional deduction of Rs 50 000 under Section 80CCD makes it a total

Tax Saving Options Other Than 80C Investments YouTube

How To Save Tax Other Than Section 80C 80 C

Income Tax Calculator Top 5 Tax Saving Tips Other Than Section 80C Benefit

Budget 2014 Impact On Money Taxes And Savings

Reduce Your Tax Liability Beyond Section 80C Jupiter

TAX BENEFITS OTHER THAN 80C Mohindra Investments

TAX BENEFITS OTHER THAN 80C Mohindra Investments

Income Tax Saving Options 80C