In this age of electronic devices, where screens rule our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. In the case of educational materials and creative work, or just adding an individual touch to the home, printables for free have become a valuable source. The following article is a take a dive deeper into "Tax Rebate Mortgage Interest," exploring what they are, how they are available, and ways they can help you improve many aspects of your life.

Get Latest Tax Rebate Mortgage Interest Below

Tax Rebate Mortgage Interest

Tax Rebate Mortgage Interest - Tax Rebate Mortgage Interest, Tax Relief Mortgage Interest, Tax Deduction Mortgage Interest Calculator, Tax Refund Mortgage Interest Netherlands, Tax Relief Mortgage Interest Buy To Let, Tax Return Mortgage Interest Uk, Tax Deduction Mortgage Interest Second Home, Tax Return Mortgage Interest Rental Property, Tax Relief Mortgage Interest Uk, Tax Rebate Home Loan Interest

Web One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income when filing their taxes This calculator estimates your tax savings after a house

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

Tax Rebate Mortgage Interest offer a wide array of printable resources available online for download at no cost. They come in many forms, including worksheets, templates, coloring pages, and more. The great thing about Tax Rebate Mortgage Interest is in their variety and accessibility.

More of Tax Rebate Mortgage Interest

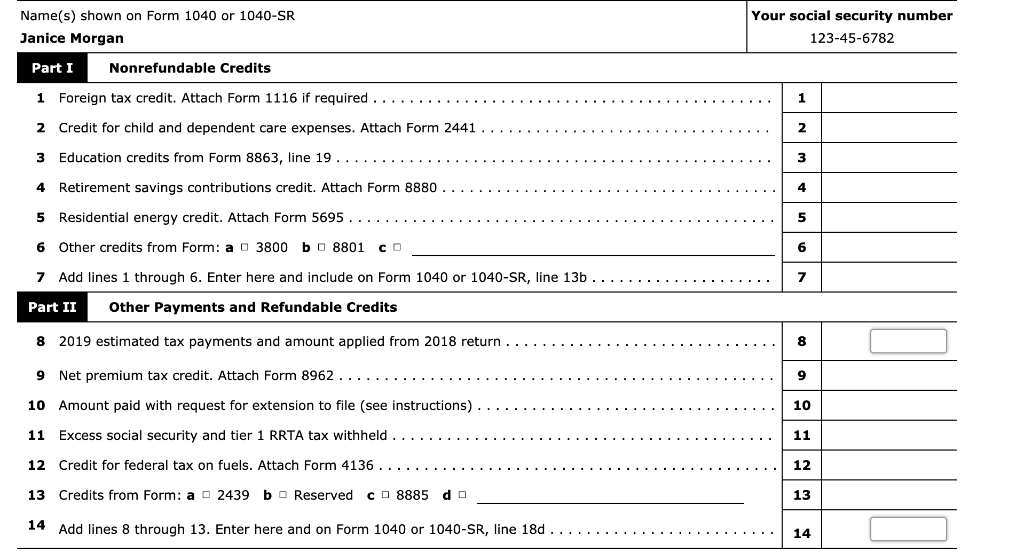

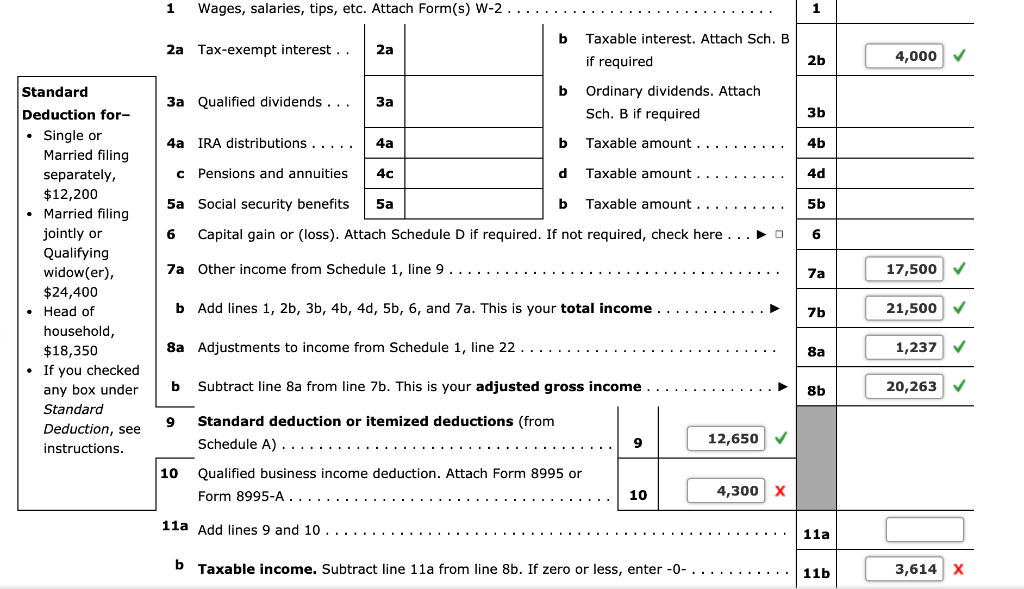

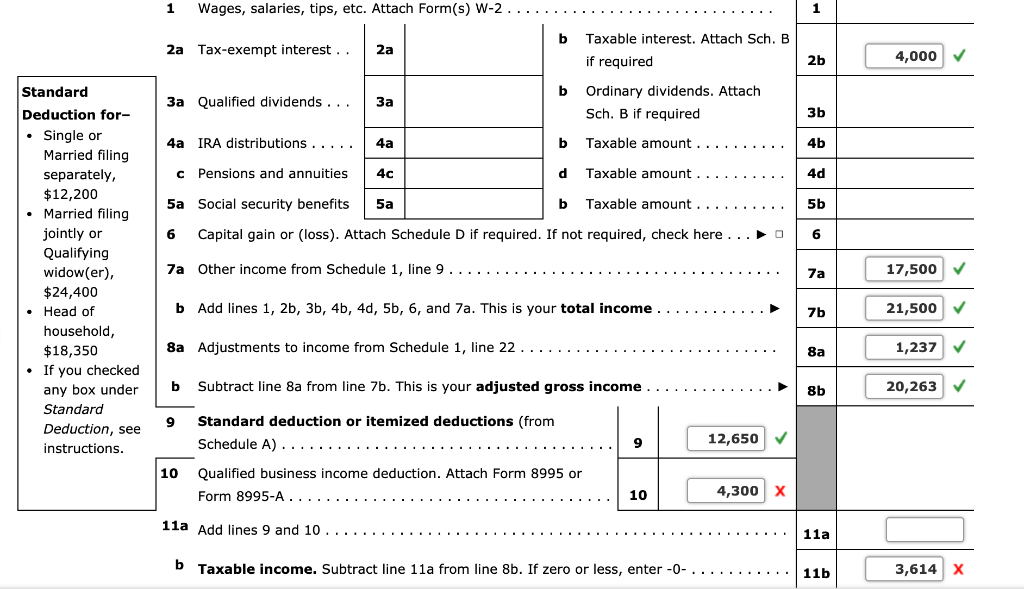

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Web 18 juil 2023 nbsp 0183 32 Deductible interest for new loans for your personal residence is limited to principal amounts 750 000 Mortgage interest deduction When you repay a mortgage

Web 30 avr 2023 nbsp 0183 32 Using our 12 000 mortgage interest example a married couple in the 24 tax bracket would get a 27 700 standard deduction in 2023 25 900 in 2022 which is

Tax Rebate Mortgage Interest have gained a lot of appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization They can make the design to meet your needs for invitations, whether that's creating them, organizing your schedule, or even decorating your house.

-

Educational Benefits: Printables for education that are free cater to learners of all ages, which makes the perfect tool for parents and educators.

-

Simple: Quick access to many designs and templates can save you time and energy.

Where to Find more Tax Rebate Mortgage Interest

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers

Web 1 sept 2023 nbsp 0183 32 Is mortgage interest tax deductible In a nutshell yes If you have a home loan the mortgage interest deduction allows you to reduce your taxable income by the amount of interest paid on the

In the event that we've stirred your curiosity about Tax Rebate Mortgage Interest we'll explore the places you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection in Tax Rebate Mortgage Interest for different goals.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets as well as flashcards and other learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a broad range of topics, all the way from DIY projects to party planning.

Maximizing Tax Rebate Mortgage Interest

Here are some fresh ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Tax Rebate Mortgage Interest are an abundance of practical and innovative resources which cater to a wide range of needs and desires. Their availability and versatility make them a fantastic addition to the professional and personal lives of both. Explore the vast array of Tax Rebate Mortgage Interest today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes they are! You can download and print these documents for free.

-

Can I utilize free printables for commercial purposes?

- It is contingent on the specific conditions of use. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright violations with Tax Rebate Mortgage Interest?

- Some printables may contain restrictions in their usage. Be sure to check the terms and regulations provided by the author.

-

How can I print Tax Rebate Mortgage Interest?

- Print them at home using any printer or head to the local print shop for higher quality prints.

-

What software must I use to open printables that are free?

- Many printables are offered in PDF format, which can be opened with free software such as Adobe Reader.

Solved Janice Morgan Age 24 Is Single And Has No Chegg

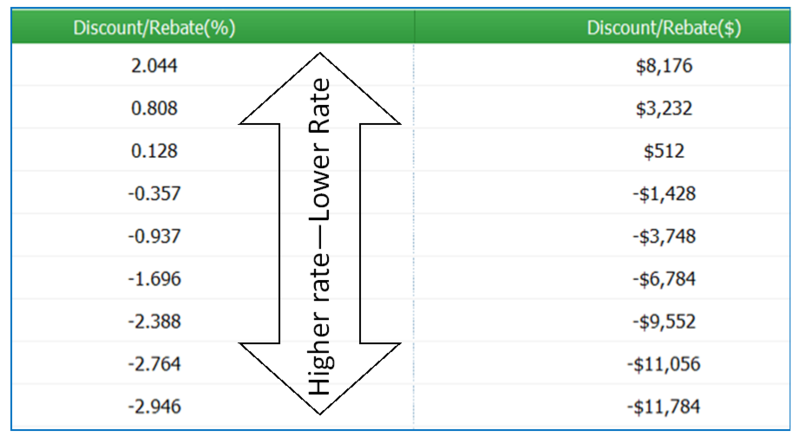

34 Mortgage Interest Deduction Taxes NairnMykenzi

Check more sample of Tax Rebate Mortgage Interest below

Solved Janice Morgan Age 24 Is Single And Has No Chegg

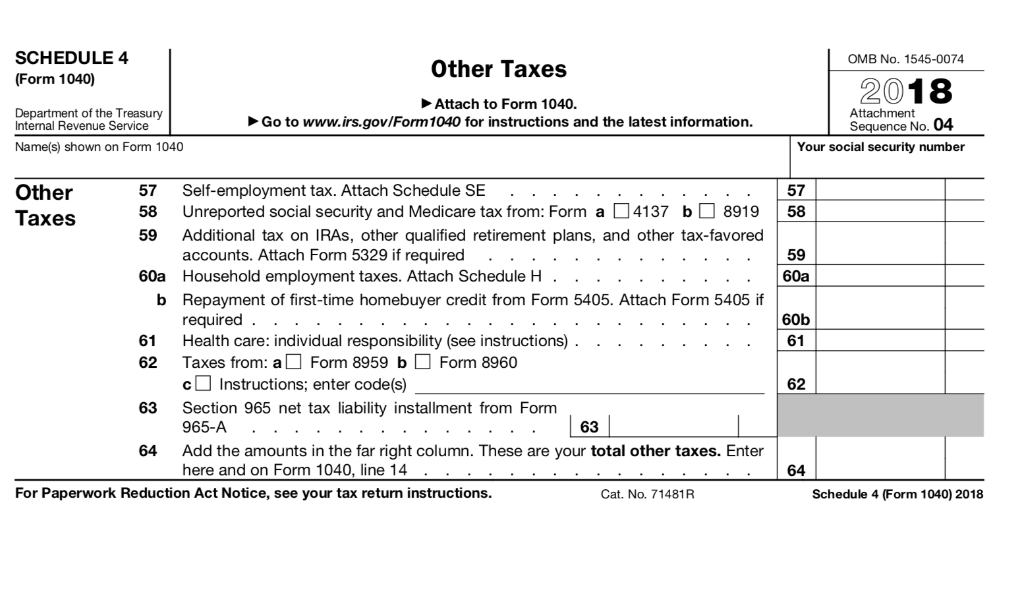

Form 11 Mortgage Interest Deduction Understand The Background Of Form

Tax Law Flowchart Can You Deduct Your Mortgage Interest Mortgage

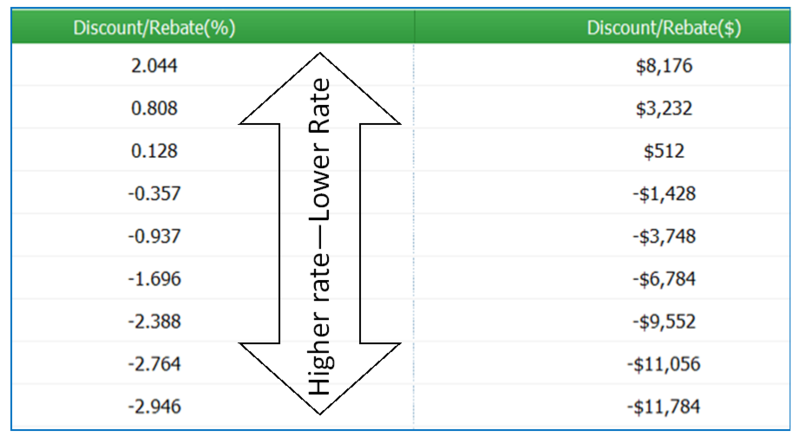

Using Rebate Pricing To Reduce Closing Cost On Your Refi Or Home Purchase

Deduct Mortgage Interest On Taxes Stock Image Image Of Federal

37 Standard Deduction Mortgage Interest EphraEmelyah

https://www.abnamro.nl/.../mortgage-interest-deductions.html

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

https://www.gov.uk/guidance/changes-to-tax-relief-for-residential...

Web 20 juil 2016 nbsp 0183 32 In the tax year 2021 to 2022 Brian s salary is 163 36 000 and his rental income is 163 24 000 His mortgage interest is still 163 15 000 and he has other allowable expenses

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

Web 20 juil 2016 nbsp 0183 32 In the tax year 2021 to 2022 Brian s salary is 163 36 000 and his rental income is 163 24 000 His mortgage interest is still 163 15 000 and he has other allowable expenses

Using Rebate Pricing To Reduce Closing Cost On Your Refi Or Home Purchase

Form 11 Mortgage Interest Deduction Understand The Background Of Form

Deduct Mortgage Interest On Taxes Stock Image Image Of Federal

37 Standard Deduction Mortgage Interest EphraEmelyah

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Famous Greenline Loans Interest Rates References

Famous Greenline Loans Interest Rates References

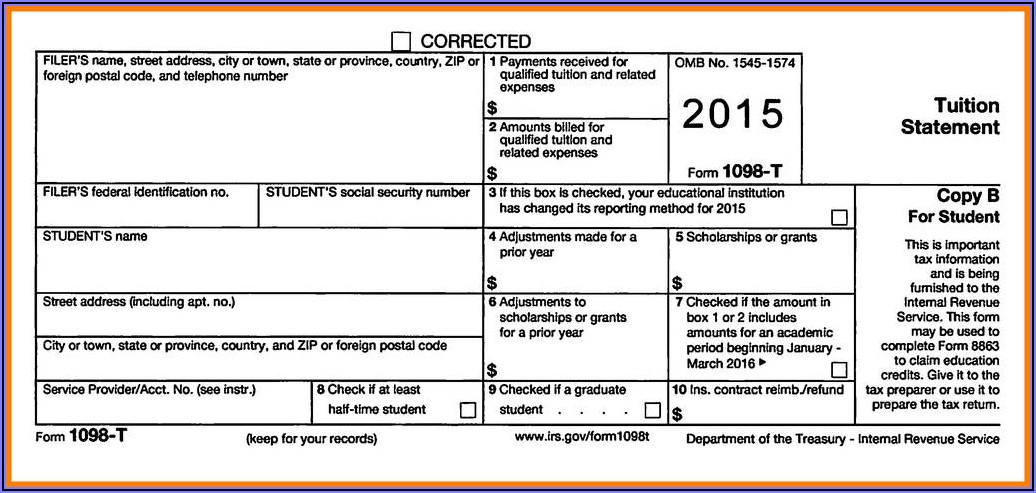

1098 Mortgage Interest Tax Form Form Resume Examples GM9Oo5O39D