In this digital age, in which screens are the norm, the charm of tangible printed materials hasn't faded away. Whether it's for educational purposes or creative projects, or simply adding a personal touch to your home, printables for free have proven to be a valuable source. We'll dive to the depths of "Tax Rebate 80c," exploring the benefits of them, where they are available, and how they can improve various aspects of your life.

Get Latest Tax Rebate 80c Below

Tax Rebate 80c

Tax Rebate 80c - Tax Rebate 80c, Tax Rebate 80cc, Tax Deduction 80c To 80u, Tax Deduction 80ccd, Tax Exemption 80ccd, Tax Exemption 80ccd2, Tax Benefit 80ccd, Tax Exemption 80ccc, Tax Rebate Section 80c, Income Tax Rebate 80cc

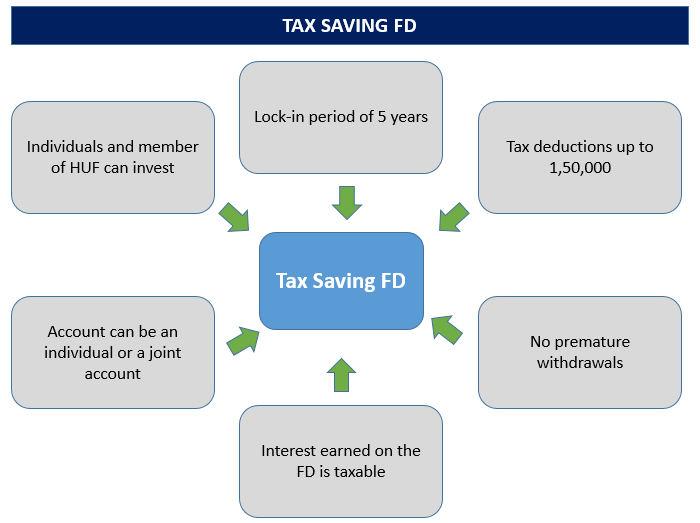

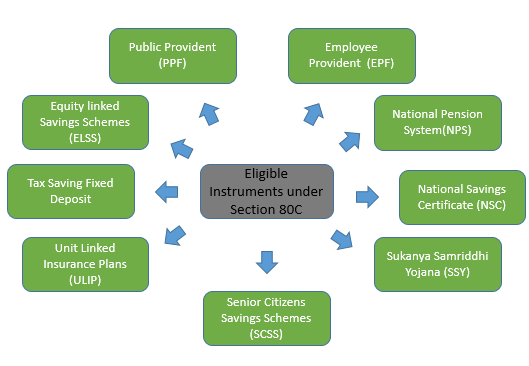

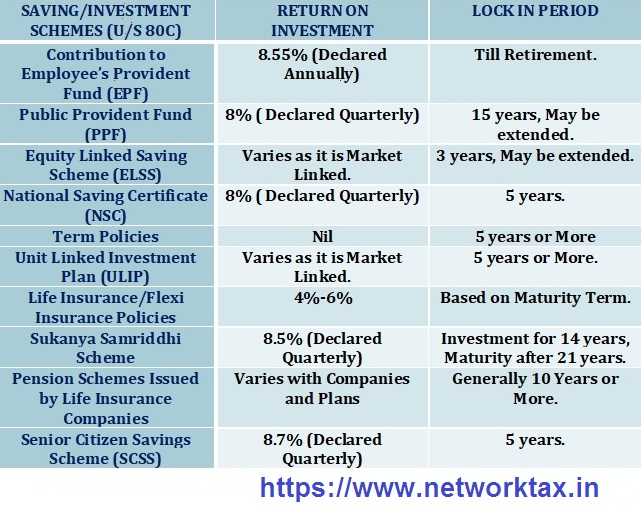

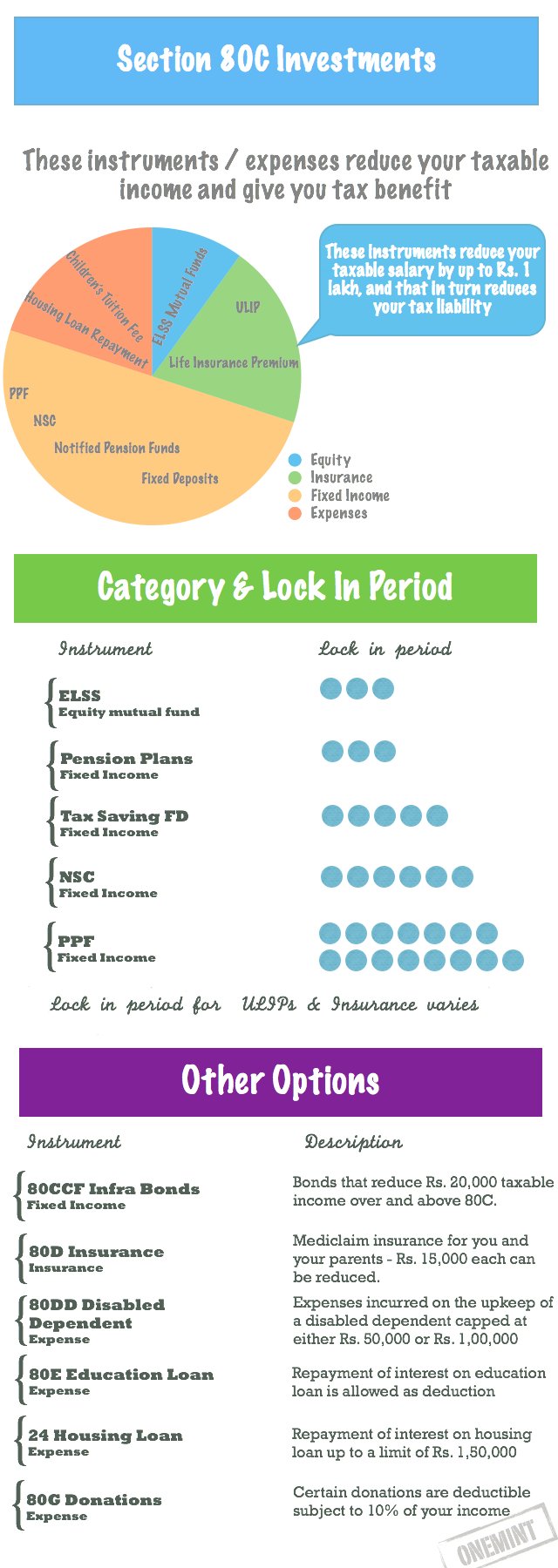

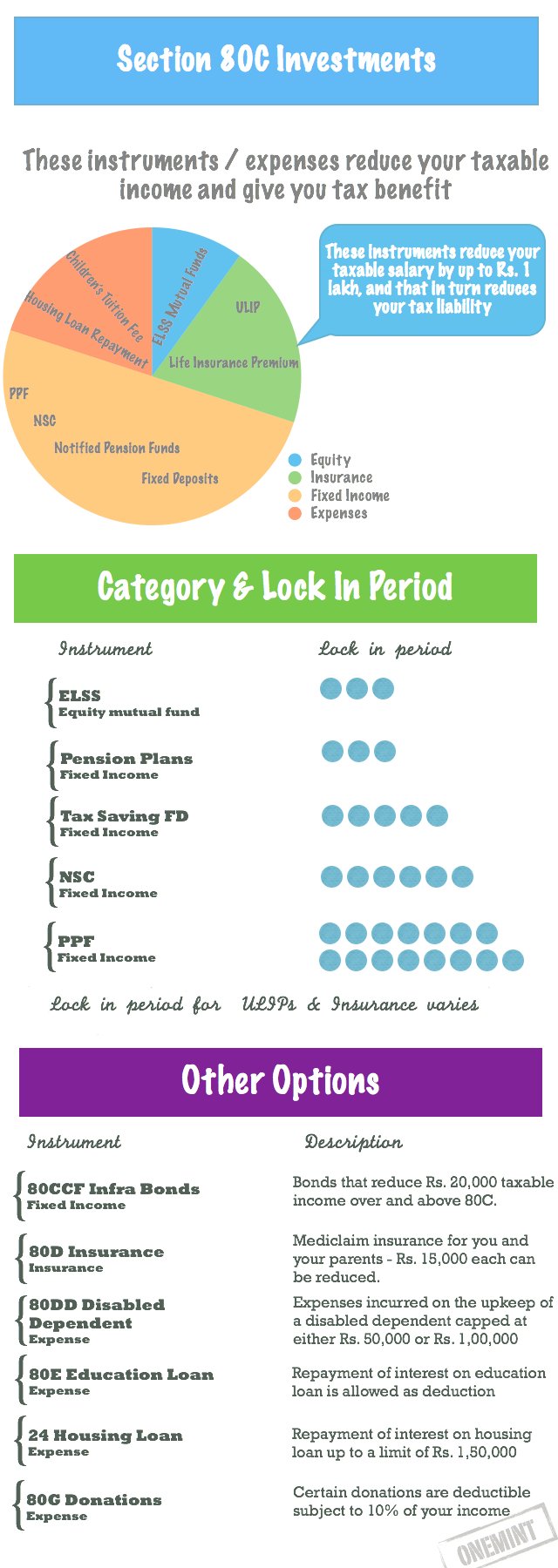

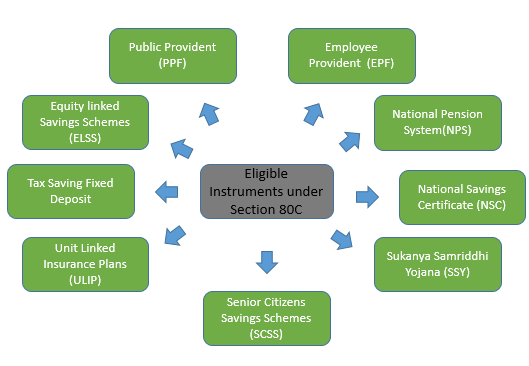

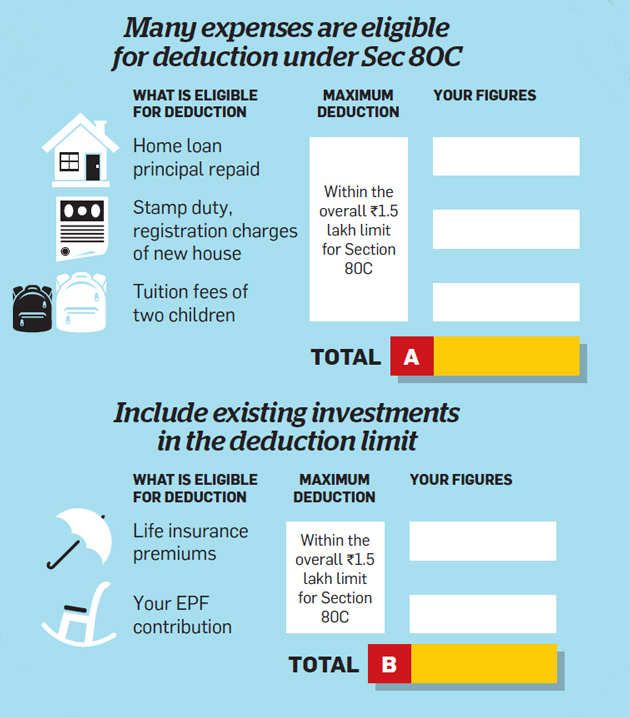

Web 3 ao 251 t 2023 nbsp 0183 32 Features of Income Tax Deduction u s 80 Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed

Web Section 80C is a tax saving provision under the Indian Income Tax Act 1961 It allows taxpayers to claim deductions on specified investments and expenses such as Public Provident Fund PPF Employee Provident

Printables for free include a vast assortment of printable, downloadable material that is available online at no cost. They come in many forms, like worksheets templates, coloring pages, and more. The value of Tax Rebate 80c is their versatility and accessibility.

More of Tax Rebate 80c

DEDUCTION UNDER SECTION 80C TO 80U PDF

DEDUCTION UNDER SECTION 80C TO 80U PDF

Web 3 janv 2023 nbsp 0183 32 Rebate under section 80C is only available for HUF and individuals Apart from 80C there are other options available under the

Web Section 80C Investment in ELSS Fund or Tax Saving Mutual Fund is considered as the best tax saving option These funds are specially designed to give you dual benefit of saving taxes and getting higher

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Modifications: They can make printables to fit your particular needs be it designing invitations and schedules, or decorating your home.

-

Educational Use: Downloads of educational content for free can be used by students from all ages, making the perfect device for teachers and parents.

-

Accessibility: instant access many designs and templates will save you time and effort.

Where to Find more Tax Rebate 80c

80C TO 80U DEDUCTIONS LIST PDF

80C TO 80U DEDUCTIONS LIST PDF

Web 6 f 233 vr 2022 nbsp 0183 32 Ways to get the Section 80C tax rebate by Taxtimes February 6 2022 It is that time of the year again when many taxpayers go shopping for tax saving investment

Web 12 juil 2023 nbsp 0183 32 Under Section 80C a taxpayer can claim an exemption for the investments made and expenses incurred up to Rs 1 5 lakh in a financial year The investments

Now that we've piqued your interest in Tax Rebate 80c Let's find out where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of goals.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- The blogs covered cover a wide range of topics, including DIY projects to planning a party.

Maximizing Tax Rebate 80c

Here are some unique ways of making the most use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home also in the classes.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Tax Rebate 80c are a treasure trove of practical and imaginative resources which cater to a wide range of needs and needs and. Their availability and versatility make them an essential part of your professional and personal life. Explore the vast array of Tax Rebate 80c right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes you can! You can download and print these documents for free.

-

Can I utilize free printouts for commercial usage?

- It's determined by the specific rules of usage. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables could have limitations on use. Always read the terms and conditions offered by the author.

-

How can I print printables for free?

- Print them at home using either a printer or go to an area print shop for the highest quality prints.

-

What program do I require to open Tax Rebate 80c?

- The majority of PDF documents are provided in the PDF format, and can be opened with free software, such as Adobe Reader.

80ccc Pension Plan Investor Guruji

How To Calculate Tax Rebate On Home Loan Grizzbye

Check more sample of Tax Rebate 80c below

List Of Deductions Under Section 80C Finserv MARKETS

TAX DEDUCTION UNDER SECTION 80C Subrata Tax Blog

Common Tax Benefits Under Section 80C Of Income Tax Act 1961 With

Section 80C Tax Saving Instruments Infographic OneMint

Exemption In Lieu Of 80C Tax Benefits

Income Tax Act Tax Saving Under Section 80C Deduction Bare Act

https://www.etmoney.com/blog/guide-to-secti…

Web Section 80C is a tax saving provision under the Indian Income Tax Act 1961 It allows taxpayers to claim deductions on specified investments and expenses such as Public Provident Fund PPF Employee Provident

https://www.livemint.com/money/personal-finance/seven-ways-to-get-the...

Web 30 janv 2022 nbsp 0183 32 Premium qualifies for deduction under section 80C maturity proceeds or death claim is tax free when the annual premium does not exceed 2 5 lakh and

Web Section 80C is a tax saving provision under the Indian Income Tax Act 1961 It allows taxpayers to claim deductions on specified investments and expenses such as Public Provident Fund PPF Employee Provident

Web 30 janv 2022 nbsp 0183 32 Premium qualifies for deduction under section 80C maturity proceeds or death claim is tax free when the annual premium does not exceed 2 5 lakh and

Section 80C Tax Saving Instruments Infographic OneMint

TAX DEDUCTION UNDER SECTION 80C Subrata Tax Blog

Exemption In Lieu Of 80C Tax Benefits

Income Tax Act Tax Saving Under Section 80C Deduction Bare Act

Income Tax For Under Construction House The Property Files

12 Ways To Save Taxes Other Than 80C Omozing

12 Ways To Save Taxes Other Than 80C Omozing

Have You Utilised The Sec 80C Tax Saving Limit Fully Find Out The