In this digital age, when screens dominate our lives and the appeal of physical, printed materials hasn't diminished. It doesn't matter if it's for educational reasons, creative projects, or simply adding an extra personal touch to your home, printables for free are a great resource. The following article is a dive through the vast world of "Tax Exemption On Interest On Fixed Deposit," exploring what they are, where they are available, and how they can enrich various aspects of your daily life.

Get Latest Tax Exemption On Interest On Fixed Deposit Below

Tax Exemption On Interest On Fixed Deposit

Tax Exemption On Interest On Fixed Deposit - Tax Exemption On Interest On Fixed Deposit, Tax Exemption On Interest On Fixed Deposit For Senior Citizens, Income Tax Rebate On Interest On Fixed Deposit, Tax Free Interest On Fixed Deposit, Tax Exemption On Term Deposit Interest, Is Interest On Fixed Deposits Taxable, Is Interest On Fixed Deposit Exempt, When To Pay Tax On Fixed Deposit Interest, Does Fixed Deposit Have Tax Exemption

Last Updated Jan 27 2023 11 09 a m This article provides an overview of how to pay income tax on FD interest income earned from fixed deposits It outlines the process of

Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account Some of its features are A lock in

Tax Exemption On Interest On Fixed Deposit encompass a wide collection of printable material that is available online at no cost. These resources come in many styles, from worksheets to coloring pages, templates and many more. The great thing about Tax Exemption On Interest On Fixed Deposit lies in their versatility and accessibility.

More of Tax Exemption On Interest On Fixed Deposit

Income Tax Malaysia 2022 Deadline Extension Latest News Update

Income Tax Malaysia 2022 Deadline Extension Latest News Update

Your allowances for earning interest before you have to pay tax on it include your Personal Allowance starting rate for savings Personal Savings Allowance You get

Tax Exemption on Interest The interest earned on fixed deposits is generally taxable as per the individual s income tax slab However there are certain

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Flexible: You can tailor designs to suit your personal needs in designing invitations planning your schedule or decorating your home.

-

Educational Impact: The free educational worksheets offer a wide range of educational content for learners from all ages, making the perfect aid for parents as well as educators.

-

Accessibility: Access to an array of designs and templates helps save time and effort.

Where to Find more Tax Exemption On Interest On Fixed Deposit

How To Calculate Interest On Fixed Deposits With Example Fixed

How To Calculate Interest On Fixed Deposits With Example Fixed

The taxation and tax exemptions on fixed deposits have many nuances that regular investors must be aware of So you need to understand taxes on FD

Budget 2021 update It has been proposed to exempt the senior citizens from filing income tax returns if pension income and interest income are their only annual income source

We've now piqued your interest in printables for free and other printables, let's discover where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection in Tax Exemption On Interest On Fixed Deposit for different motives.

- Explore categories such as decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free, flashcards, and learning materials.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs are a vast spectrum of interests, starting from DIY projects to party planning.

Maximizing Tax Exemption On Interest On Fixed Deposit

Here are some unique ways create the maximum value of Tax Exemption On Interest On Fixed Deposit:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Tax Exemption On Interest On Fixed Deposit are a treasure trove of creative and practical resources catering to different needs and passions. Their accessibility and versatility make they a beneficial addition to each day life. Explore the vast collection of Tax Exemption On Interest On Fixed Deposit today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can print and download these resources at no cost.

-

Do I have the right to use free printables for commercial uses?

- It depends on the specific terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues when you download Tax Exemption On Interest On Fixed Deposit?

- Certain printables may be subject to restrictions in use. Make sure you read the terms and conditions set forth by the author.

-

How do I print Tax Exemption On Interest On Fixed Deposit?

- You can print them at home with your printer or visit an area print shop for higher quality prints.

-

What software do I require to open Tax Exemption On Interest On Fixed Deposit?

- The majority of PDF documents are provided in PDF format. They can be opened with free software like Adobe Reader.

Can I Get Monthly Interest On Fixed Deposit Koshex Blog

TDS On Fixed Deposits FD Interest A Detailed Guide For TDS On FD

Check more sample of Tax Exemption On Interest On Fixed Deposit below

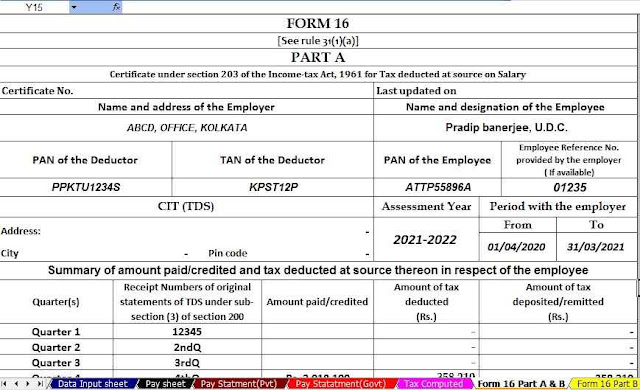

Exemption U s 80C As Per Income Tax Act With Automated Income Tax

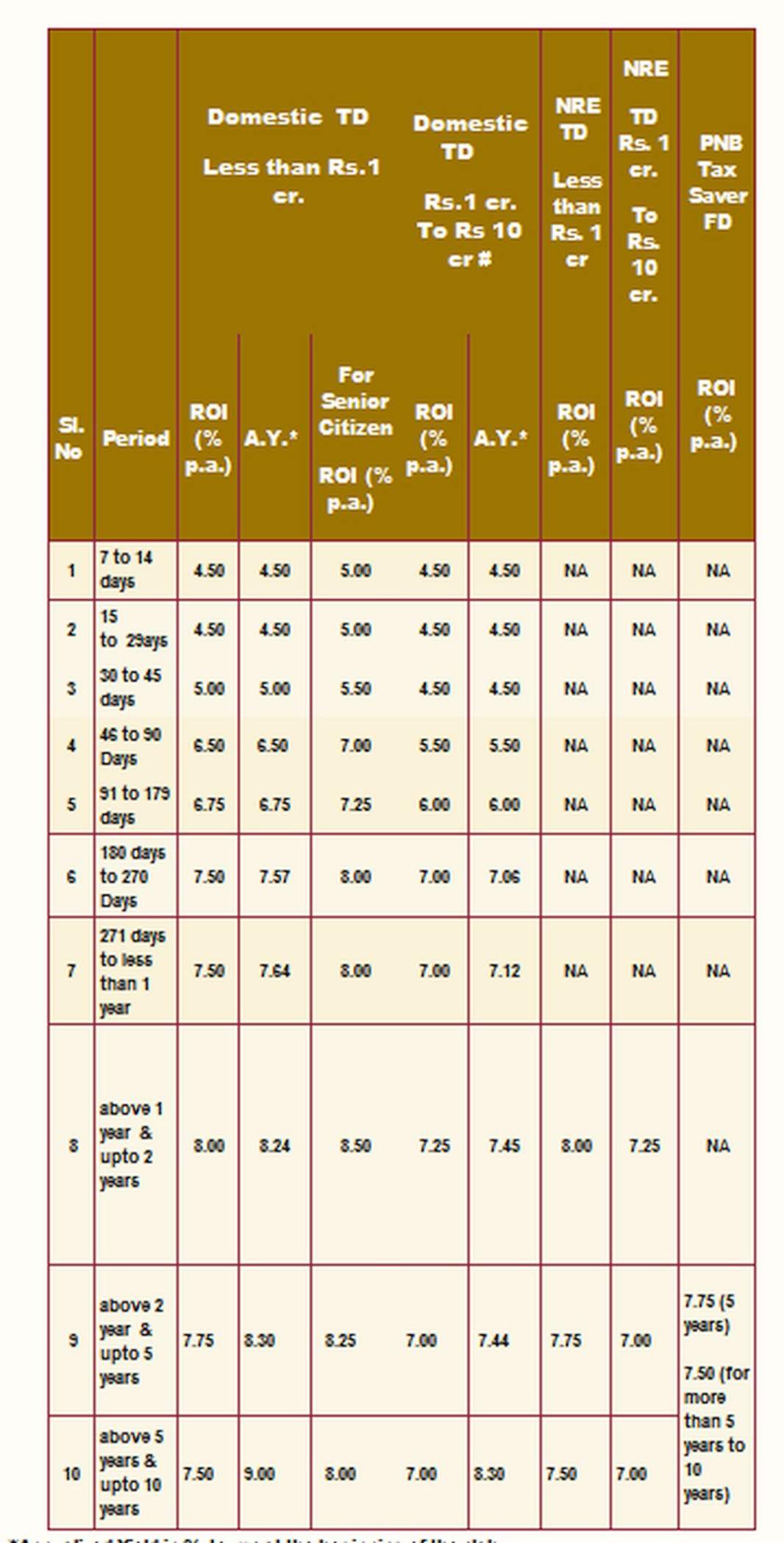

SBI Vs HDFC Vs Post Office Vs ICICI Bank Compare Interest Rates Of

Tax Exemption On Income Through Sovereign Wealth Funds IT Dept

Section 194A Fixed Deposit Interest TDS TDS On

How To Avoid TDS On Interest On Fixed Deposits Bank FD Wealth18

Section 80E Tax Exemption On Interest On Education Loan With Automated

https://cleartax.in/s/tax-saving-fd-fixed-deposits

Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account Some of its features are A lock in

https://freefincal.com/tax-on-fixed-deposits

After Budget 2019 TDS is deducted by your bank at the rate of 10 if your interest income from FDs in a year exceeds Rs 40 000 This rate increases to 20 if

Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account Some of its features are A lock in

After Budget 2019 TDS is deducted by your bank at the rate of 10 if your interest income from FDs in a year exceeds Rs 40 000 This rate increases to 20 if

Section 194A Fixed Deposit Interest TDS TDS On

SBI Vs HDFC Vs Post Office Vs ICICI Bank Compare Interest Rates Of

How To Avoid TDS On Interest On Fixed Deposits Bank FD Wealth18

Section 80E Tax Exemption On Interest On Education Loan With Automated

PPT Section 80E Tax Exemption On Interest On Education Loan

FD TDS On Fixed Deposit In Bank

FD TDS On Fixed Deposit In Bank

Fixed Deposit Calculator Banking Tides Cara Pengiraan Bank Rakyat