In this age of technology, when screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. Whatever the reason, whether for education in creative or artistic projects, or simply adding an element of personalization to your home, printables for free can be an excellent source. Through this post, we'll dive through the vast world of "Tax Exemption For Salaried Employees In Budget 2023," exploring the benefits of them, where to find them and how they can be used to enhance different aspects of your lives.

Get Latest Tax Exemption For Salaried Employees In Budget 2023 Below

Tax Exemption For Salaried Employees In Budget 2023

Tax Exemption For Salaried Employees In Budget 2023 - Tax Exemption For Salaried Employees In Budget 2023

Union Budget 2023 Today LIVE Limit of Rs 3 lakh for tax exemption on leave encashment Increased to Rs 25 lakh

As part of the fifth announcement the budget proposed extension of limit of tax exemption on leave encashment to Rs 25 lakh on retirement of non government salaried employees in line with the

Tax Exemption For Salaried Employees In Budget 2023 provide a diverse assortment of printable material that is available online at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages and much more. The beauty of Tax Exemption For Salaried Employees In Budget 2023 lies in their versatility as well as accessibility.

More of Tax Exemption For Salaried Employees In Budget 2023

Budget 2023 Standard Deduction For Salaried Employees Should Be

Budget 2023 Standard Deduction For Salaried Employees Should Be

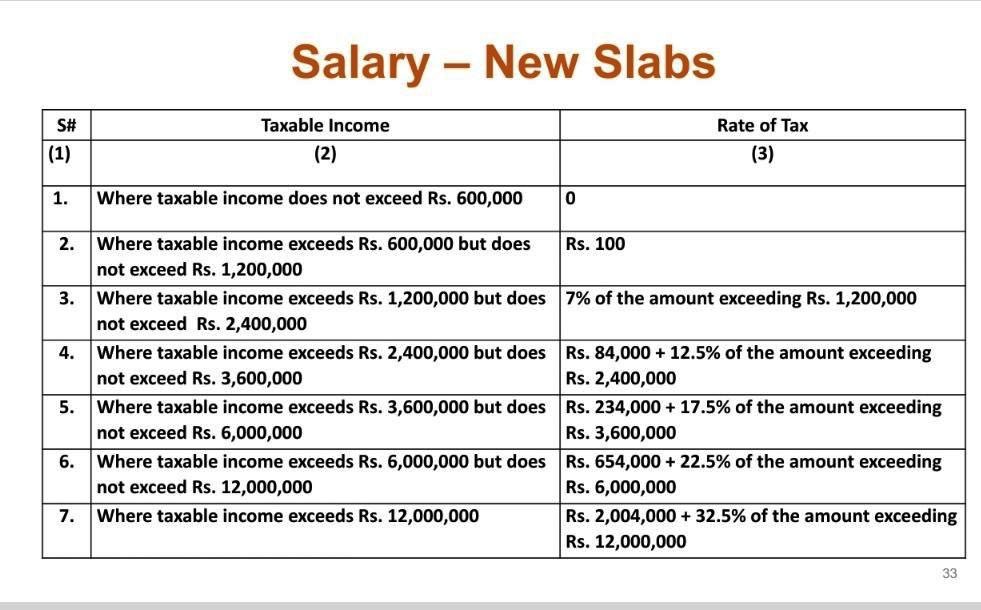

Budget 2023 Live Updates In a major announcement FM says those earning up to 7 lakh per annum will not have to pay any tax under new regime Limit extended from 5 lakh per

Salaried employees expectation from union budget 2023 The exemption threshold of Rs 2 5 lakh has not changed since FY 2014 15 so salaried taxpayers expect that under both old and new tax

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Individualization We can customize print-ready templates to your specific requirements be it designing invitations planning your schedule or even decorating your house.

-

Educational value: The free educational worksheets can be used by students of all ages, which makes the perfect tool for teachers and parents.

-

Affordability: instant access various designs and templates saves time and effort.

Where to Find more Tax Exemption For Salaried Employees In Budget 2023

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Income Tax Slabs Year 2022 23 Info Ghar Educational News

These individuals have the highest expectations from the Union Budget 2023 24 since according to the income tax department salaried professionals

The salaried employees who are the major taxpayers are expecting that in this year s Union Budget the government will raise the basic tax exemption from Rs 2 5

Now that we've ignited your interest in Tax Exemption For Salaried Employees In Budget 2023 Let's see where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of applications.

- Explore categories like furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs covered cover a wide spectrum of interests, starting from DIY projects to planning a party.

Maximizing Tax Exemption For Salaried Employees In Budget 2023

Here are some inventive ways in order to maximize the use of Tax Exemption For Salaried Employees In Budget 2023:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home and in class.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Exemption For Salaried Employees In Budget 2023 are a treasure trove of innovative and useful resources which cater to a wide range of needs and desires. Their access and versatility makes these printables a useful addition to each day life. Explore the many options of Tax Exemption For Salaried Employees In Budget 2023 and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Exemption For Salaried Employees In Budget 2023 truly gratis?

- Yes you can! You can print and download these documents for free.

-

Does it allow me to use free printables in commercial projects?

- It is contingent on the specific terms of use. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables could have limitations on usage. Be sure to review the terms and condition of use as provided by the creator.

-

How can I print Tax Exemption For Salaried Employees In Budget 2023?

- Print them at home using an printer, or go to a local print shop to purchase more high-quality prints.

-

What software do I need to run printables for free?

- The majority are printed in the PDF format, and is open with no cost software, such as Adobe Reader.

Income Tax Return Filing For Salaried Employees AY 2022 23 Section 80C

Budget 2023 Income Tax Slab Change Expectations Salaried Employees

Check more sample of Tax Exemption For Salaried Employees In Budget 2023 below

CBDT Increases Income Tax Exemption Limit On Leave Encashment For Non

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Salaried Employees Alert Income Tax Exemption Limit Likely To Be

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

HRA Exemption Calculator House Rent Allowance Calculation EXCEL

Salary Survey For The South African Legal Sector 2017 2018

https:// taxguru.in /income-tax/budget-20…

As part of the fifth announcement the budget proposed extension of limit of tax exemption on leave encashment to Rs 25 lakh on retirement of non government salaried employees in line with the

https://www. financialexpress.com /money/income-tax...

Tax incentives for salaried class Salaried employees can expect that the Budget 2023 will incentivize them as no significant benefits were there for them in the

As part of the fifth announcement the budget proposed extension of limit of tax exemption on leave encashment to Rs 25 lakh on retirement of non government salaried employees in line with the

Tax incentives for salaried class Salaried employees can expect that the Budget 2023 will incentivize them as no significant benefits were there for them in the

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

HRA Exemption Calculator House Rent Allowance Calculation EXCEL

Salary Survey For The South African Legal Sector 2017 2018

Increased Limit For Tax Exemption On Leave Encashment For Non govt

Income Tax Exemption List For Salaried Employees In AY 2021 22 Blog

Income Tax Exemption List For Salaried Employees In AY 2021 22 Blog

Increased Limit Tax Exemption On Leave Encashment For Salaried Employees