In the age of digital, where screens dominate our lives yet the appeal of tangible printed products hasn't decreased. Be it for educational use for creative projects, simply adding a personal touch to your home, printables for free have proven to be a valuable resource. We'll dive into the world "Tax Deduction Benefits," exploring the different types of printables, where to find them, and how they can be used to enhance different aspects of your lives.

Get Latest Tax Deduction Benefits Below

Tax Deduction Benefits

Tax Deduction Benefits - Tax Deduction Benefits, Tax Deduction Benefits To Employees, Tax Deduction Benefits Meaning, Tax Deduction Benefits Of Owning A Home, Tax Deduction Benefits India, Tax Deduction Benefits Australia, Tax Deductible Benefits Uk, Tax Deductible Benefits Canada, Tax Credit Benefits, Tax Relief Benefits

Here s what that means If you earned 75 000 in 2023 and file as a single taxpayer taking the standard deduction of 13 850 will reduce your taxable income to 61 150 Standard Deduction

Fringe benefits from employment Any additional benefits you receive from your employer in addition to your pay are taxed as wage income The value of these fringe benefits is added to your wage income The Tax Administration issues an official decision each year on the valuation of different fringe benefits

Tax Deduction Benefits include a broad range of printable, free items that are available online at no cost. They are available in numerous types, such as worksheets templates, coloring pages, and much more. The great thing about Tax Deduction Benefits is their flexibility and accessibility.

More of Tax Deduction Benefits

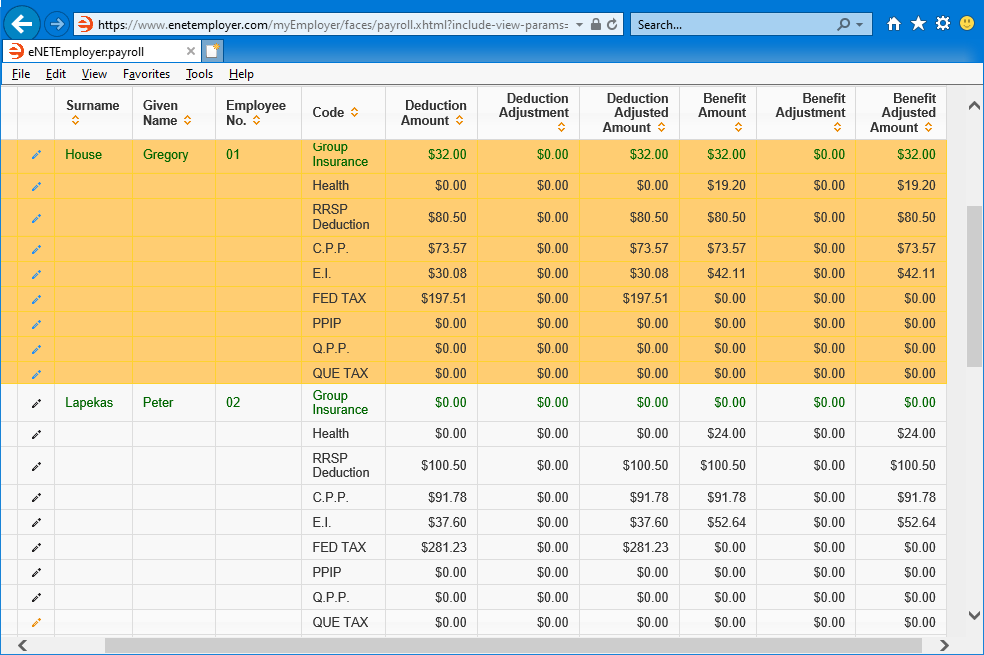

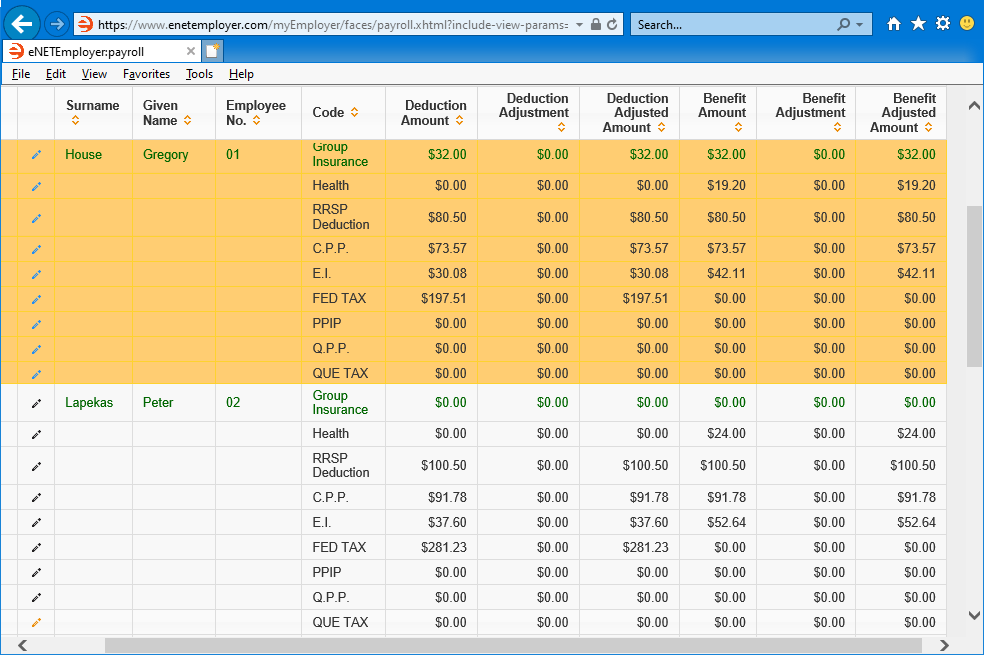

Working With An Employee s Year to Date Deductions And Benefits

Working With An Employee s Year to Date Deductions And Benefits

Updated December 10 2023 Reviewed by Janet Berry Johnson Fact checked by Yarilet Perez What Is a Tax Benefit The term tax benefit refers to any tax law that helps you reduce your

Entertainment and fringe benefit deduction Employees parking mass transit or commuting expenses deduction Domestic production activities deduction Local lobbying expenses deduction

Tax Deduction Benefits have garnered immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

customization There is the possibility of tailoring printables to your specific needs in designing invitations making your schedule, or decorating your home.

-

Educational Value: Downloads of educational content for free can be used by students from all ages, making them a valuable tool for parents and educators.

-

An easy way to access HTML0: Quick access to a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Tax Deduction Benefits

Tax Planning Tax Deduction Benefits YouTube

Tax Planning Tax Deduction Benefits YouTube

Credits An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you may get a refund There are two education credits available the American Opportunity Tax Credit and the Lifetime Learning Credit Who can claim an education

Tax deductions are expenses that can be subtracted from an individual s taxable income effectively reducing the amount of income subject to taxation Tax deductions can help individuals lower their overall tax liability by decreasing their taxable income which in turn may result in a lower tax bill

Now that we've piqued your curiosity about Tax Deduction Benefits we'll explore the places they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of uses.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free as well as flashcards and other learning materials.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- The blogs covered cover a wide variety of topics, that range from DIY projects to planning a party.

Maximizing Tax Deduction Benefits

Here are some unique ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Deduction Benefits are a treasure trove filled with creative and practical information for a variety of needs and interest. Their access and versatility makes these printables a useful addition to each day life. Explore the plethora of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes they are! You can download and print these tools for free.

-

Can I download free printables for commercial uses?

- It's based on the terms of use. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using Tax Deduction Benefits?

- Certain printables could be restricted on usage. Always read the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- You can print them at home using your printer or visit the local print shops for the highest quality prints.

-

What software will I need to access printables for free?

- The majority of printables are in PDF format. They is open with no cost software such as Adobe Reader.

Sanjiv Gupta CPA Firm Business Taxes Personal Taxes Tax

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Check more sample of Tax Deduction Benefits below

BOC Life Deferred Annuity Fixed Term Apply Via Mobile Banking

Who Benefits From The Deduction For Charitable Contributions Tax

57026141 Tax Deduction Business Concept Cartoon Illustration The

Bonus 20 Tax Deduction On Worx Inductions Boost Your Safety

Living Donor Laws Federal And State By State American Transplant

Tax Deductions For Businesses BUCHBINDER TUNICK CO

https://www.vero.fi/en/individuals/tax-cards-and...

Fringe benefits from employment Any additional benefits you receive from your employer in addition to your pay are taxed as wage income The value of these fringe benefits is added to your wage income The Tax Administration issues an official decision each year on the valuation of different fringe benefits

https://cleartax.in/s/income-tax-allowances-and-deductions

A Total HRA received from your employer b Rent paid less than 10 of basic salary DA c 40 of salary Basic salary DA for non metros and 50 of salary Basic salary DA for metros Note Employees need to submit the PAN details of the house owner if the rent payment exceeds 1 lakh per annum

Fringe benefits from employment Any additional benefits you receive from your employer in addition to your pay are taxed as wage income The value of these fringe benefits is added to your wage income The Tax Administration issues an official decision each year on the valuation of different fringe benefits

A Total HRA received from your employer b Rent paid less than 10 of basic salary DA c 40 of salary Basic salary DA for non metros and 50 of salary Basic salary DA for metros Note Employees need to submit the PAN details of the house owner if the rent payment exceeds 1 lakh per annum

Bonus 20 Tax Deduction On Worx Inductions Boost Your Safety

Who Benefits From The Deduction For Charitable Contributions Tax

Living Donor Laws Federal And State By State American Transplant

Tax Deductions For Businesses BUCHBINDER TUNICK CO

Pin On Business Template

2022 Tax Brackets Irs Calculator

2022 Tax Brackets Irs Calculator

Income Tax Deductions For The FY 2019 20 ComparePolicy