Today, where screens have become the dominant feature of our lives The appeal of tangible printed materials hasn't faded away. Whether it's for educational purposes and creative work, or simply to add personal touches to your area, Tax Benefit On Home Loan Under Construction are now a useful source. In this article, we'll take a dive in the world of "Tax Benefit On Home Loan Under Construction," exploring their purpose, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Tax Benefit On Home Loan Under Construction Below

Tax Benefit On Home Loan Under Construction

Tax Benefit On Home Loan Under Construction - Tax Benefit On Home Loan Under Construction, Tax Exemption On Home Loan Under Construction, Tax Benefit On Home Loan Interest Under Construction, Tax Benefit On Second Home Loan Under Construction, Tax Exemption On Housing Loan Under Construction, Income Tax Benefit On Second Home Loan Under Construction, Income Tax Benefit On Home Loan Under New Tax Regime, Can I Get Tax Benefit On Home Loan For Under Construction Property, Under Construction Home Loan Tax Benefits India, Home Loan Tax Benefit On Under Construction Property

This video is about home loan benefit on under construction pre constructed property How to claim tax deduction on interest portion u s 24 and principle por

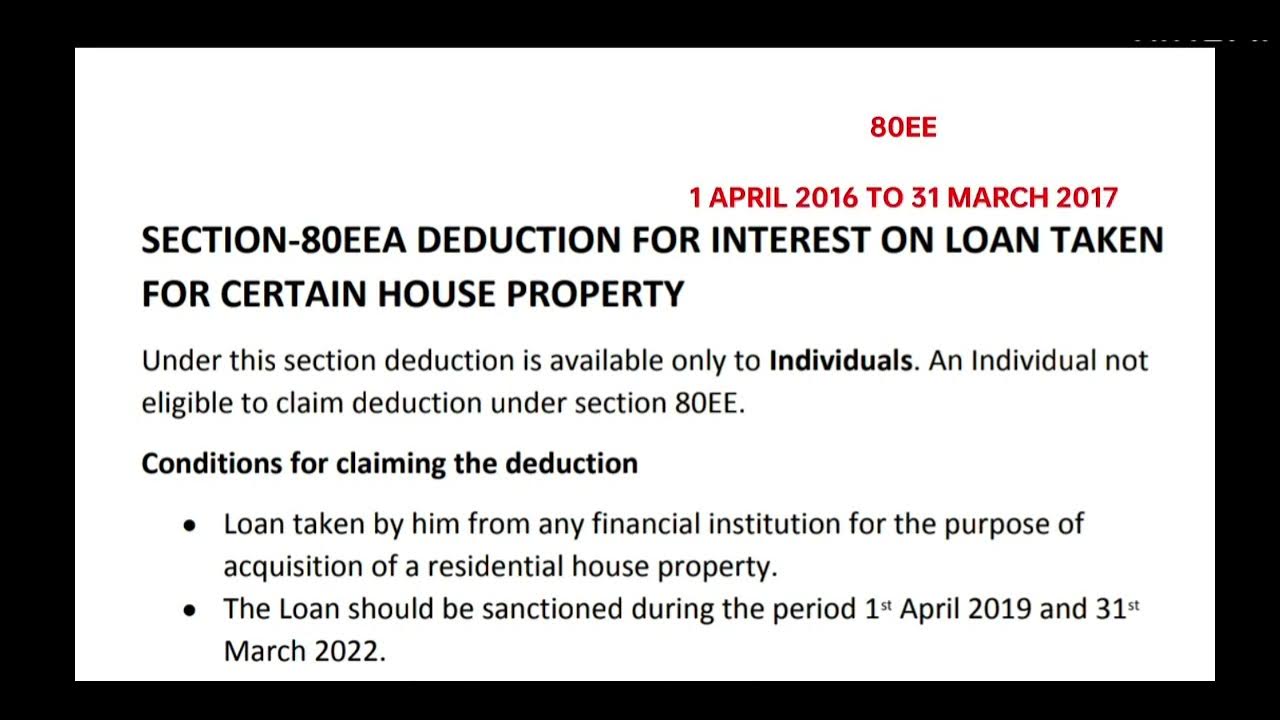

Home Loan Tax Benefit Summary Deduction for interest paid on housing loan under Section 24 A home loan must be taken for the purchase or construction of

Tax Benefit On Home Loan Under Construction include a broad selection of printable and downloadable materials that are accessible online for free cost. They are available in a variety of types, like worksheets, templates, coloring pages and much more. The benefit of Tax Benefit On Home Loan Under Construction lies in their versatility as well as accessibility.

More of Tax Benefit On Home Loan Under Construction

How To Claim Tax Benefits On Home Loan Bleu Finance

How To Claim Tax Benefits On Home Loan Bleu Finance

Total interest on home loan is Rs 72 000 for FY 2020 21 Since the property is rented out he can claim the entire interest as a deduction Also prakash can claim a deduction for

Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan

The Tax Benefit On Home Loan Under Construction have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization The Customization feature lets you tailor printables to your specific needs whether you're designing invitations making your schedule, or even decorating your house.

-

Educational Value: Printing educational materials for no cost offer a wide range of educational content for learners of all ages, which makes them a vital instrument for parents and teachers.

-

Accessibility: Quick access to an array of designs and templates reduces time and effort.

Where to Find more Tax Benefit On Home Loan Under Construction

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Here are the tax benefits that you can avail yourself when you take a home loan for an under construction property 1 As under construction properties are

2 min read A home loan for under construction property can get tax deductions up to Rs 2 lakhs on interest paid in a year and up to 1 5 lakhs for principal paid under Section

In the event that we've stirred your interest in Tax Benefit On Home Loan Under Construction Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Tax Benefit On Home Loan Under Construction for various motives.

- Explore categories such as decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free, flashcards, and learning tools.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs covered cover a wide selection of subjects, ranging from DIY projects to planning a party.

Maximizing Tax Benefit On Home Loan Under Construction

Here are some inventive ways how you could make the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Tax Benefit On Home Loan Under Construction are a treasure trove of fun and practical tools that satisfy a wide range of requirements and passions. Their availability and versatility make them an essential part of both professional and personal lives. Explore the plethora of Tax Benefit On Home Loan Under Construction today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I use the free printables to make commercial products?

- It's dependent on the particular terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using Tax Benefit On Home Loan Under Construction?

- Some printables may have restrictions on their use. Always read the terms and condition of use as provided by the creator.

-

How do I print Tax Benefit On Home Loan Under Construction?

- Print them at home using an printer, or go to any local print store for superior prints.

-

What software will I need to access printables for free?

- The majority of printed documents are in the PDF format, and can be opened with free programs like Adobe Reader.

Tax Benefits How To Use Home Loan Interest To Benefit Of Tax

The Deduction Of Interest On Mortgages Is More Delicate With The New

Check more sample of Tax Benefit On Home Loan Under Construction below

SECTION 80EEA ADDITIONAL BENEFIT ON HOME LOAN RBGCONSULTANTS

Tax Benefit For Interest On Home Loan Under Income Tax Section 24

Maui Loan

Home Loan Tax Benefits As Per Union Budget 2020

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

How To Avail Max Home Loan Tax Benefit In India In 2022 Crazyhoja

https://cleartax.in/s/home-loan-tax-benefits

Home Loan Tax Benefit Summary Deduction for interest paid on housing loan under Section 24 A home loan must be taken for the purchase or construction of

https://tax2win.in/guide/under-construction-property-tax-benefit

Explore the valuable tax benefits of home loans for under construction properties Maximize your savings and make informed financial decisions with

Home Loan Tax Benefit Summary Deduction for interest paid on housing loan under Section 24 A home loan must be taken for the purchase or construction of

Explore the valuable tax benefits of home loans for under construction properties Maximize your savings and make informed financial decisions with

Home Loan Tax Benefits As Per Union Budget 2020

Tax Benefit For Interest On Home Loan Under Income Tax Section 24

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

How To Avail Max Home Loan Tax Benefit In India In 2022 Crazyhoja

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

Income Tax Benefit On Home Construction Loan HomeFirst

Income Tax Benefit On Home Construction Loan HomeFirst

Know How You Can Get Tax Benefits On Home Loan