In the age of digital, with screens dominating our lives however, the attraction of tangible printed objects hasn't waned. Whether it's for educational purposes for creative projects, simply adding personal touches to your home, printables for free have become an invaluable source. Through this post, we'll take a dive into the world "South Dakota Sales Tax Return," exploring what they are, how to get them, as well as how they can add value to various aspects of your lives.

Get Latest South Dakota Sales Tax Return Below

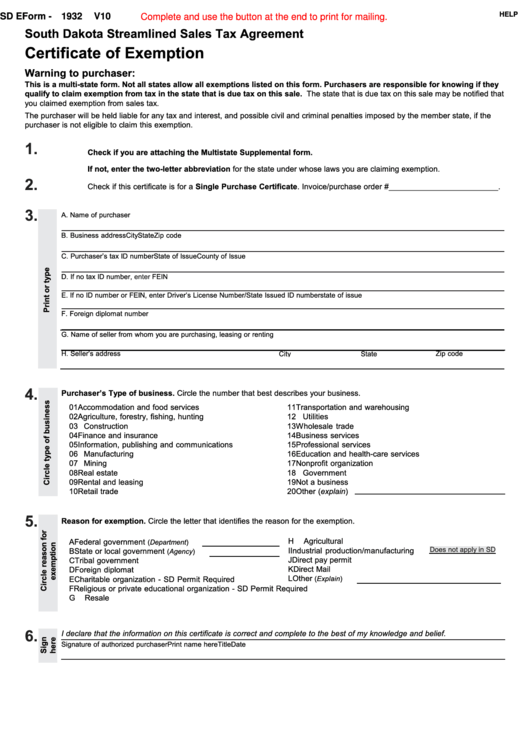

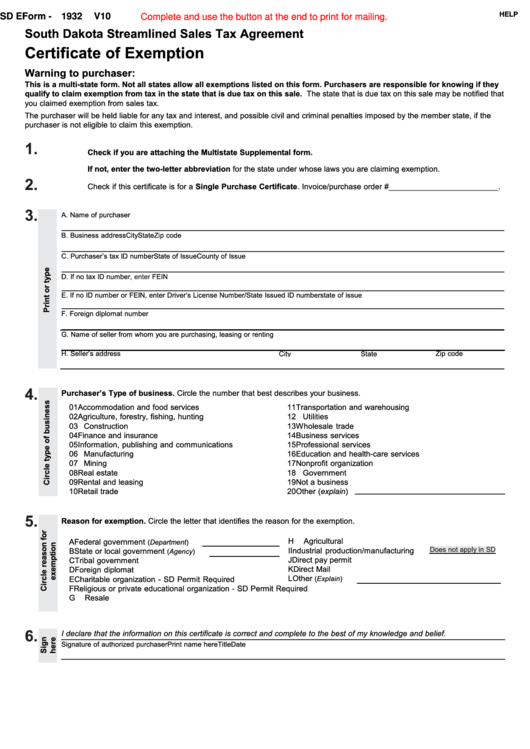

South Dakota Sales Tax Return

South Dakota Sales Tax Return - South Dakota Sales Tax Return, South Dakota Sales Tax Return Due Date, North Dakota Sales Tax Return, North Dakota Sales Tax Return Due Date, South Dakota Sales Tax Filing Frequency, South Dakota Sales Tax Refund, South Dakota Sales Tax Filing Online, South Dakota Sales Tax Refund Claim, South Dakota Sales Tax Filing Deadlines, South Dakota Amended Sales Tax Return

To file sales tax in South Dakota you must begin by reporting gross sales for the reporting period and calculate the total amount of sales tax due from this period The state of South Dakota provides all taxpayers with several choices for filing their taxes

Information for Individuals Sales tax applies to the gross sales or transactions including selling renting or leasing products or services including products delivered electronically into South Dakota Use tax applies when sales tax has not been paid on products and services including products delivered electronically that are used or

Printables for free include a vast range of printable, free items that are available online at no cost. They are available in a variety of kinds, including worksheets coloring pages, templates and much more. The value of South Dakota Sales Tax Return is in their variety and accessibility.

More of South Dakota Sales Tax Return

Bill Introduced To End South Dakota Sales Tax On Food

Bill Introduced To End South Dakota Sales Tax On Food

Filing a South Dakota sales tax return is a two step process comprised of submitting the required sales data filing a return and remitting the collected tax dollars if any to the South Dakota DOR The filing process forces you to detail your total sales in the state the amount of sales tax collected and the location of each sale

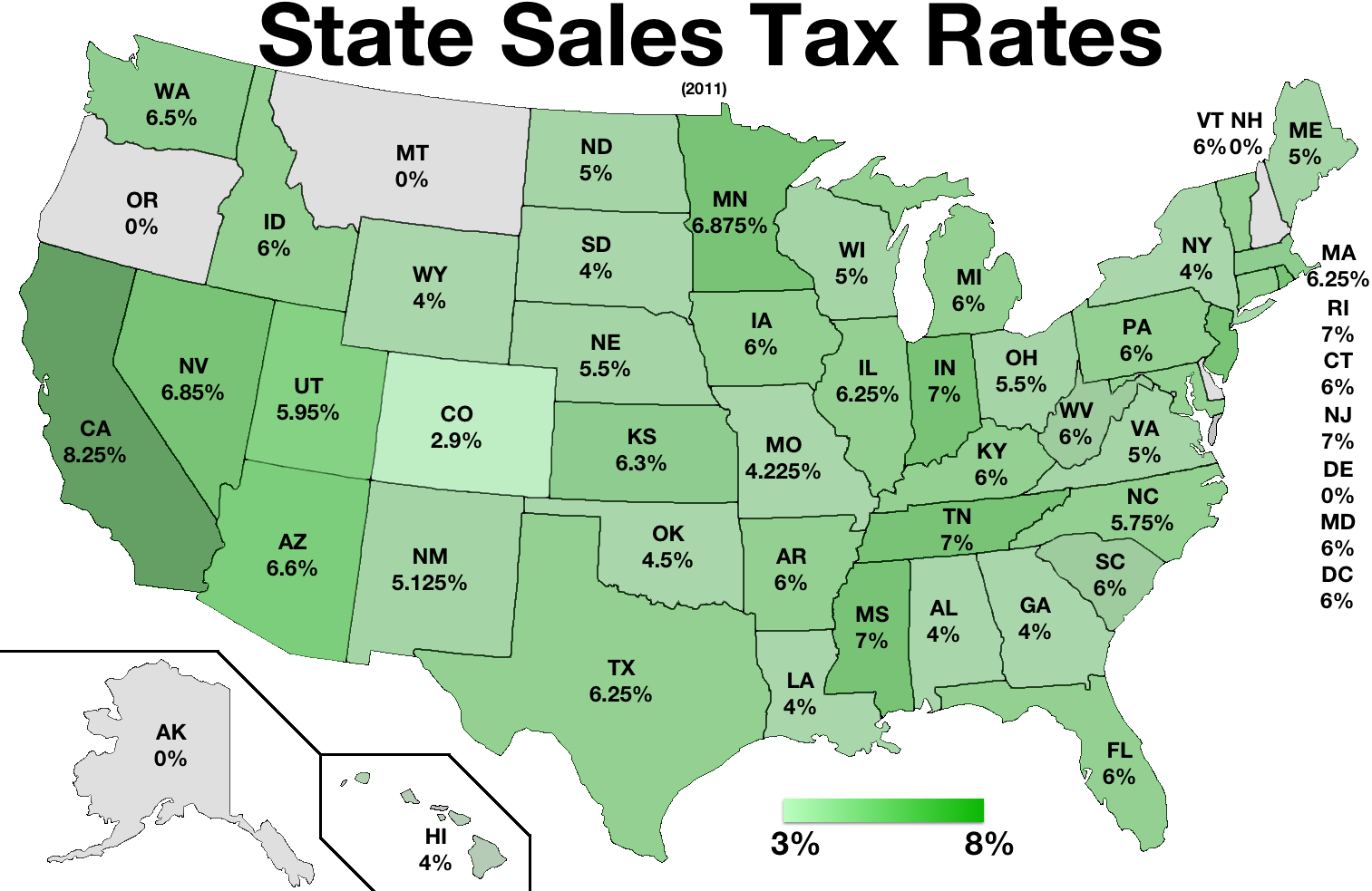

Rates updated monthly South Dakota sales tax range for 2024 4 5 6 5 Base state sales tax rate 4 5 Local rate range 0 2 Total rate range 4 5 6 5 Rates are rounded to the nearest hundredth Due to varying local sales tax rates we strongly recommend our lookup and calculator tools on this page for the most accurate rates

South Dakota Sales Tax Return have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

The ability to customize: You can tailor the templates to meet your individual needs for invitations, whether that's creating them making your schedule, or even decorating your home.

-

Educational Impact: Printables for education that are free cater to learners of all ages. This makes these printables a powerful device for teachers and parents.

-

It's easy: Fast access numerous designs and templates cuts down on time and efforts.

Where to Find more South Dakota Sales Tax Return

Preview South Dakota Sales Tax Appeal SDPB

Preview South Dakota Sales Tax Appeal SDPB

800 829 9188 South Dakota Sales Tax Calculator Calculate Rates are for reference only may not include all information needed for filing Try the API demo or contact Sales for filing ready details Results Total Sales Tax Rate Do you need to collect sales tax in South Dakota

Effective July 1 2023 South Dakota decreased its statewide sales tax rate from 4 5 to 4 2 No other recent statewide sales tax changes have occurred However local jurisdictions can adjust their rates at any time FAQs How do you calculate South Dakota sales tax To calculate South Dakota sales tax use this formula

Now that we've ignited your interest in South Dakota Sales Tax Return Let's see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection with South Dakota Sales Tax Return for all reasons.

- Explore categories such as decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a broad spectrum of interests, from DIY projects to party planning.

Maximizing South Dakota Sales Tax Return

Here are some inventive ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print worksheets that are free to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

South Dakota Sales Tax Return are a treasure trove of innovative and useful resources that cater to various needs and interests. Their accessibility and flexibility make them a great addition to each day life. Explore the endless world of South Dakota Sales Tax Return today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are South Dakota Sales Tax Return really cost-free?

- Yes they are! You can print and download these documents for free.

-

Are there any free printables to make commercial products?

- It is contingent on the specific terms of use. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables could be restricted on use. Make sure you read the terms and conditions offered by the creator.

-

How can I print South Dakota Sales Tax Return?

- Print them at home using a printer or visit an in-store print shop to get high-quality prints.

-

What program do I require to open printables that are free?

- The majority of PDF documents are provided in PDF format, which can be opened with free software such as Adobe Reader.

South Dakota Sales Tax Guide

Dual 3150 Loader This Item Is Located In South Dakota Therefore South

Check more sample of South Dakota Sales Tax Return below

South Dakota Excise Tax Vs Sales Tax Jannie Grigsby

South Dakota Sales Tax Small Business Guide TRUiC

Surpreme Court Rules In South Dakota V Wayfair And What That May Mean

South Dakota Sales Tax Guide

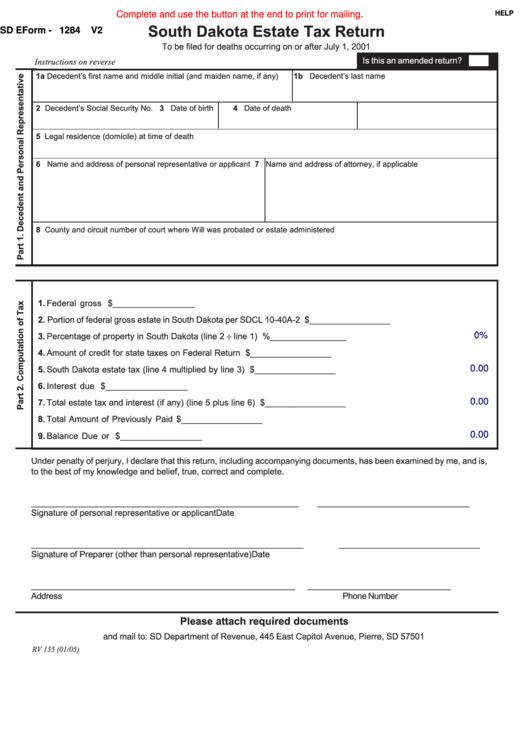

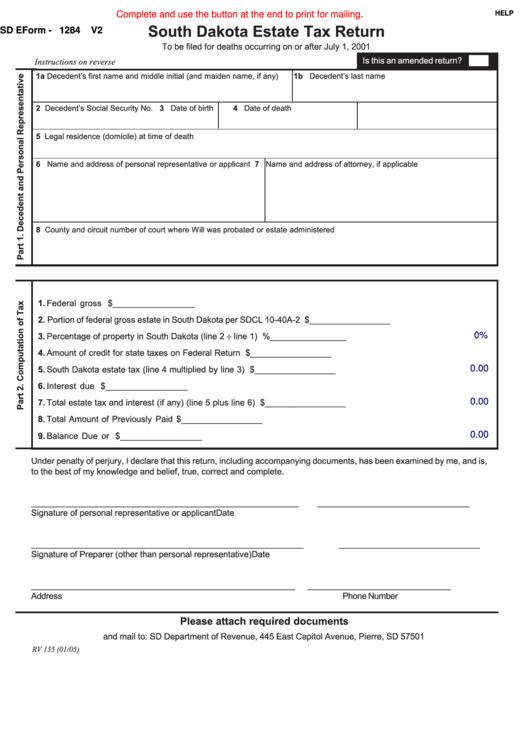

Fillable Sd Eform 1284 V2 South Dakota Estate Tax Return Form

South Dakota Sales Tax Guide For Businesses

https://dor.sd.gov/individuals/taxes/sales-use-tax

Information for Individuals Sales tax applies to the gross sales or transactions including selling renting or leasing products or services including products delivered electronically into South Dakota Use tax applies when sales tax has not been paid on products and services including products delivered electronically that are used or

https://dor.sd.gov/businesses/taxes/sales-use-tax/...

File a Sales and Use Tax Return Update Account View History Upload Return Guide Upload User Defined Schedule Guide Collection Allowances Payment Options Electronic payments may be submitted using a credit card ACH Debit you provide your bank information and the account is swept or ACH Credit wire transfers

Information for Individuals Sales tax applies to the gross sales or transactions including selling renting or leasing products or services including products delivered electronically into South Dakota Use tax applies when sales tax has not been paid on products and services including products delivered electronically that are used or

File a Sales and Use Tax Return Update Account View History Upload Return Guide Upload User Defined Schedule Guide Collection Allowances Payment Options Electronic payments may be submitted using a credit card ACH Debit you provide your bank information and the account is swept or ACH Credit wire transfers

South Dakota Sales Tax Guide

South Dakota Sales Tax Small Business Guide TRUiC

Fillable Sd Eform 1284 V2 South Dakota Estate Tax Return Form

South Dakota Sales Tax Guide For Businesses

South Dakota Sales Tax Guide For Businesses

How SOUTH DAKOTA Taxes Retirees YouTube

How SOUTH DAKOTA Taxes Retirees YouTube

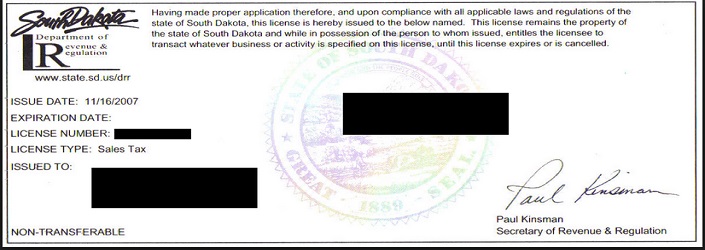

Register Sales Tax Permit South Dakota