In this day and age where screens rule our lives The appeal of tangible printed materials isn't diminishing. Whether it's for educational purposes in creative or artistic projects, or simply adding some personal flair to your area, Ppf Rebate Under Section are now a useful source. With this guide, you'll dive to the depths of "Ppf Rebate Under Section," exploring the different types of printables, where they are available, and how they can enrich various aspects of your lives.

Get Latest Ppf Rebate Under Section Below

Ppf Rebate Under Section

Ppf Rebate Under Section - Ppf Rebate Under Section, Ppf Deduction Under Section, Ppf Deduction Under Section 80c, Ppf Interest Rebate Under Section, Ppf Interest Deduction Under Section 80c, Maximum Ppf Deduction Under Section 80c, What Is Ppf Under 80c, Does Ppf Account Comes Under 80c, Does Ppf Comes Under 80c

Interest on PPF is completely tax free without any limit It is not taxable at the time of accrual nor at the time of receipt under Section 10 11 Maturity as well as premature withdrawal is also exempt from tax under Section 10 11

Deposits made in a PPF account are eligible for tax deductions under Section 80C Eligibility Can be opened by Resident Indian individuals salaried and non salaried individuals A HUF cannot open a PPF account

Ppf Rebate Under Section offer a wide range of printable, free documents that can be downloaded online at no cost. These resources come in various forms, like worksheets templates, coloring pages, and many more. The benefit of Ppf Rebate Under Section lies in their versatility and accessibility.

More of Ppf Rebate Under Section

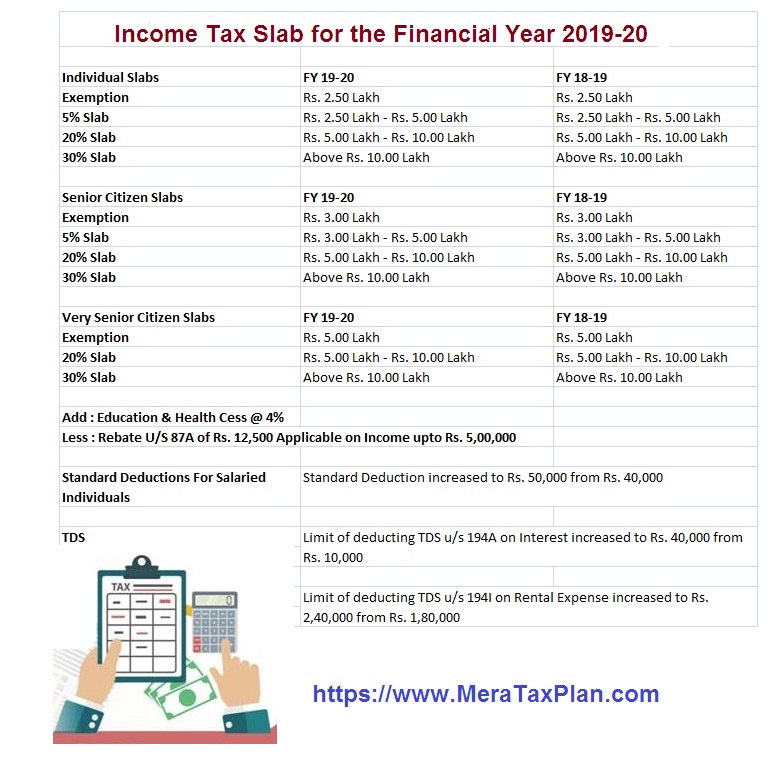

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Public Provident Fund PPF is considered as most important and safe amongst all tax saving investments schemes This scheme is falls under the EEE category i e Exempt Exempt and Exempt which means if you invest in it you will get a deduction u s 80C on your income

Public Provident Fund PPF and Employee Provident Fund EPF are investments with long term retirement benefits Both investments are entitled to deduction under Section 80C of the income tax law However the operating mechanism is different for both the schemes

The Ppf Rebate Under Section have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

customization You can tailor designs to suit your personal needs for invitations, whether that's creating them or arranging your schedule or decorating your home.

-

Education Value Printing educational materials for no cost provide for students of all ages. This makes them a valuable tool for teachers and parents.

-

Accessibility: Quick access to many designs and templates reduces time and effort.

Where to Find more Ppf Rebate Under Section

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Any contribution towards the Public Provident Fund PPF can be filed for tax deduction under Section 80C Public Provident Funds come with a maximum deposit limit of Rs 1 50 000 allowing an investor to claim the entire deposited amount as an exemption under this Income Tax Act

PPF offers a maximum tax deduction of up to Rs 1 5 lakh for investments made in each financial year under section 80C of the Income tax Act 1961 Under which section of the Income Tax Act can PPF deposits be deducted

Since we've got your interest in Ppf Rebate Under Section we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Ppf Rebate Under Section for various motives.

- Explore categories such as decorating your home, education, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free including flashcards, learning tools.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs are a vast variety of topics, everything from DIY projects to planning a party.

Maximizing Ppf Rebate Under Section

Here are some ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print out free worksheets and activities to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Ppf Rebate Under Section are an abundance with useful and creative ideas catering to different needs and pursuits. Their accessibility and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the plethora of Ppf Rebate Under Section now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes they are! You can download and print these resources at no cost.

-

Do I have the right to use free printables for commercial uses?

- It's based on the rules of usage. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues with Ppf Rebate Under Section?

- Some printables may come with restrictions regarding their use. Check the terms and regulations provided by the creator.

-

How can I print Ppf Rebate Under Section?

- Print them at home using either a printer or go to an area print shop for high-quality prints.

-

What software do I require to view printables free of charge?

- Many printables are offered in PDF format, which is open with no cost software such as Adobe Reader.

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Check more sample of Ppf Rebate Under Section below

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Invest In Tax saving MFs To Enjoy Dual Benefits

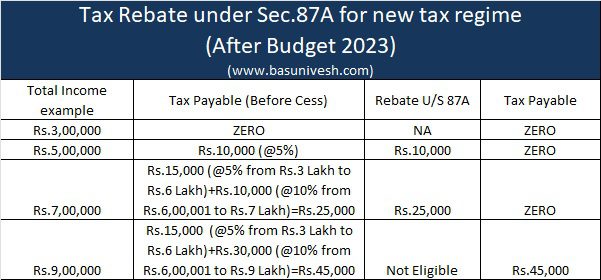

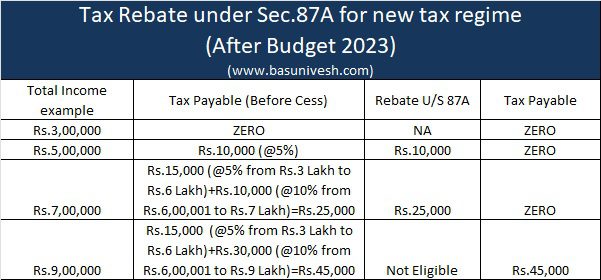

Section 87A How Is Income Up To Seven Lakhs Tax free BasuNivesh

Income Tax Rebate To PPF Top 5 Budget 2022 Announcements Expected Mint

https://cleartax.in/s/80C-Deductions

Deposits made in a PPF account are eligible for tax deductions under Section 80C Eligibility Can be opened by Resident Indian individuals salaried and non salaried individuals A HUF cannot open a PPF account

https://cleartax.in/s/80c-80-deductions

A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual which means HUF and firms cannot claim this rebate

Deposits made in a PPF account are eligible for tax deductions under Section 80C Eligibility Can be opened by Resident Indian individuals salaried and non salaried individuals A HUF cannot open a PPF account

A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual which means HUF and firms cannot claim this rebate

Invest In Tax saving MFs To Enjoy Dual Benefits

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Section 87A How Is Income Up To Seven Lakhs Tax free BasuNivesh

Income Tax Rebate To PPF Top 5 Budget 2022 Announcements Expected Mint

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

What Is Rebate Under Section 87A And Who Can Claim It

What Is Rebate Under Section 87A And Who Can Claim It

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate