In the age of digital, in which screens are the norm, the charm of tangible printed materials hasn't faded away. Whatever the reason, whether for education for creative projects, simply adding the personal touch to your home, printables for free are now a vital source. This article will take a dive into the world of "New Home Construction Tax Credits 2022," exploring what they are, where to find them and ways they can help you improve many aspects of your daily life.

Get Latest New Home Construction Tax Credits 2022 Below

New Home Construction Tax Credits 2022

New Home Construction Tax Credits 2022 - New Home Construction Tax Credits 2022, Home Building Tax Credits 2022, Tax Credits For Building A New Home, Can You Claim Energy Tax Credit New Construction

EPA has updated the ENERGY STAR Tax Credits for Home Builders webpage based on new guidance for taxpayers on the 45L New Energy Efficient

Are you looking to build a new home A range of tax credits for new home construction can alleviate some of the associated costs There are two types of tax breaks available to you tax deductions

New Home Construction Tax Credits 2022 provide a diverse variety of printable, downloadable materials online, at no cost. These printables come in different types, such as worksheets coloring pages, templates and more. The appealingness of New Home Construction Tax Credits 2022 is in their variety and accessibility.

More of New Home Construction Tax Credits 2022

Clean Vehicle Tax Credits 2022 Inflation Act Innovative CPA Group

Clean Vehicle Tax Credits 2022 Inflation Act Innovative CPA Group

The Inflation Reduction Act of 2022 features tax credits for consumers and businesses that save money on energy bills create jobs make homes and buildings

The Inflation Reduction Act of 2022 IRA amended Internal Revenue Code Section 45L to provide eligible contractors with a tax credit for eligible new or substantially

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Customization: We can customize the templates to meet your individual needs whether it's making invitations for your guests, organizing your schedule or decorating your home.

-

Educational Worth: Downloads of educational content for free can be used by students of all ages, which makes them an essential instrument for parents and teachers.

-

Convenience: instant access an array of designs and templates cuts down on time and efforts.

Where to Find more New Home Construction Tax Credits 2022

China s Urban Maintenance And Construction Tax Key Points

China s Urban Maintenance And Construction Tax Key Points

For 2022 the old credit rules have been retroactively extended providing a 2 000 tax credit for site built homes and a 1 000 or 2 000 tax credit for manufactured

The Inflation Reduction Act of 2022 IRA amended the existing credit for energy efficient home improvements under section 25C and the credit for residential energy property under section 25D of the

In the event that we've stirred your interest in New Home Construction Tax Credits 2022 Let's find out where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of New Home Construction Tax Credits 2022 designed for a variety purposes.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets along with flashcards, as well as other learning materials.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a wide range of interests, including DIY projects to party planning.

Maximizing New Home Construction Tax Credits 2022

Here are some ways of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

New Home Construction Tax Credits 2022 are an abundance of fun and practical tools catering to different needs and preferences. Their accessibility and versatility make them a great addition to the professional and personal lives of both. Explore the vast world of New Home Construction Tax Credits 2022 to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are New Home Construction Tax Credits 2022 really free?

- Yes you can! You can print and download these tools for free.

-

Can I use the free printables in commercial projects?

- It's based on specific conditions of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright issues with New Home Construction Tax Credits 2022?

- Certain printables could be restricted on usage. Make sure to read the terms and condition of use as provided by the creator.

-

How do I print New Home Construction Tax Credits 2022?

- Print them at home using the printer, or go to a print shop in your area for better quality prints.

-

What software do I need in order to open New Home Construction Tax Credits 2022?

- The majority of printables are in the format of PDF, which can be opened with free programs like Adobe Reader.

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Tax Abatement And Construction Tax Nochumson P C

Check more sample of New Home Construction Tax Credits 2022 below

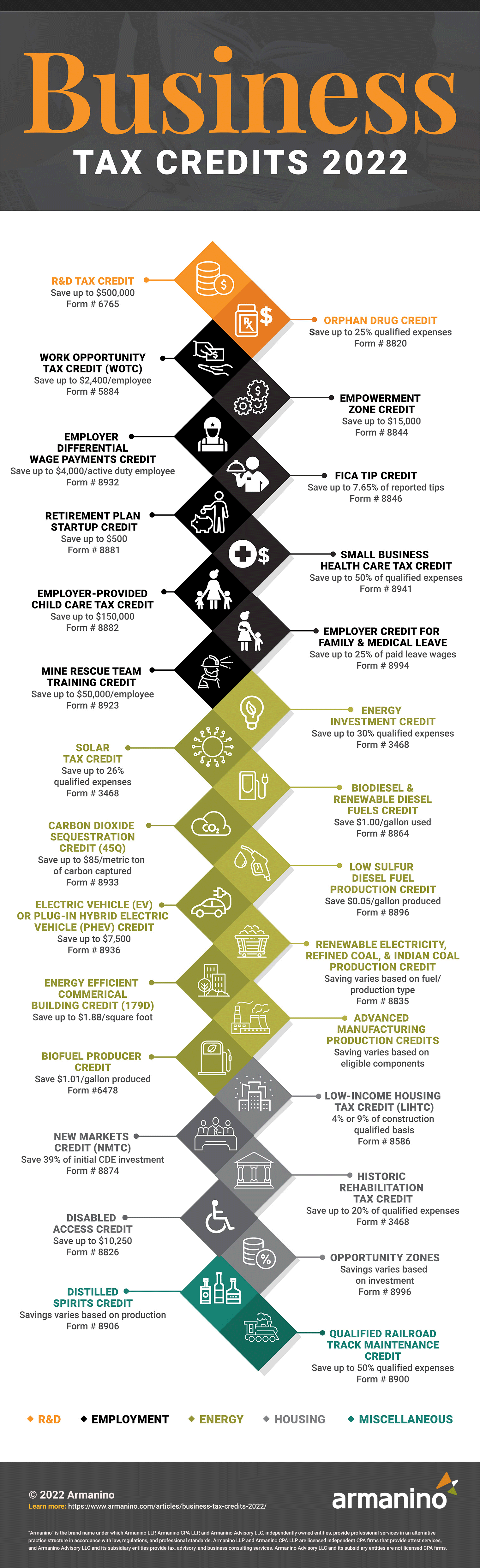

2022 Business Tax Credits Armanino

W4 Printable Forms 2022 Printable Explained 2022 W 4 Form

Elm Ridge Senior Living St Louis Equity Fund Inc

Generous ERC Construction Tax Credits Claim Now 2023

The Most Shocking Construction Tax Fraud Cases Eque2 Construction

2022 Education Tax Credits Are You Eligible

https:// nationaltaxreports.com /tax-credit-ne…

Are you looking to build a new home A range of tax credits for new home construction can alleviate some of the associated costs There are two types of tax breaks available to you tax deductions

https:// ics-tax.com /news/inlfation-reduction-act...

The House of Representatives is expected to return Friday August 12 to vote on the bill and the president is expected to sign it This highly valuable tax credit has rewarded

Are you looking to build a new home A range of tax credits for new home construction can alleviate some of the associated costs There are two types of tax breaks available to you tax deductions

The House of Representatives is expected to return Friday August 12 to vote on the bill and the president is expected to sign it This highly valuable tax credit has rewarded

Generous ERC Construction Tax Credits Claim Now 2023

W4 Printable Forms 2022 Printable Explained 2022 W 4 Form

The Most Shocking Construction Tax Fraud Cases Eque2 Construction

2022 Education Tax Credits Are You Eligible

How Does A Construction Company Qualify For The R D Tax Credit KPT

New 2022 IRS Income Tax Brackets And Phaseouts Spinella Consulting

New 2022 IRS Income Tax Brackets And Phaseouts Spinella Consulting

4 Tax Credits Your Home Construction Business May Be Eligible For