In a world when screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons or creative projects, or simply adding an individual touch to your space, Married Filing Separately Recovery Rebate Credit are now an essential resource. Here, we'll dive in the world of "Married Filing Separately Recovery Rebate Credit," exploring the different types of printables, where they are available, and how they can add value to various aspects of your lives.

Get Latest Married Filing Separately Recovery Rebate Credit Below

Married Filing Separately Recovery Rebate Credit

Married Filing Separately Recovery Rebate Credit - Married Filing Separately Recovery Rebate Credit, Can Married Filing Separately Claim Recovery Rebate Credit, Can Married Filing Separately Get Recovery Rebate Credit

Web 14 janv 2022 nbsp 0183 32 The 2021 EIP recovery rebate credit has the same income phaseout thresholds as for 2020 75 000 for single filers and 150 000 for married couples filing

Web 13 janv 2022 nbsp 0183 32 If spouses file separately the spouse who has an SSN may claim the 2021 Recovery Rebate Credit the other spouse without a valid SSN will not qualify unless

Married Filing Separately Recovery Rebate Credit encompass a wide range of downloadable, printable documents that can be downloaded online at no cost. They come in many types, like worksheets, templates, coloring pages and much more. The appeal of printables for free lies in their versatility and accessibility.

More of Married Filing Separately Recovery Rebate Credit

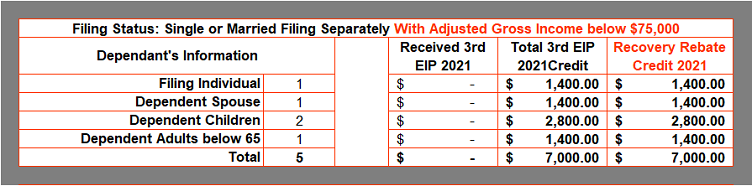

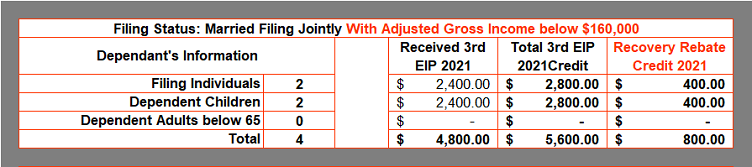

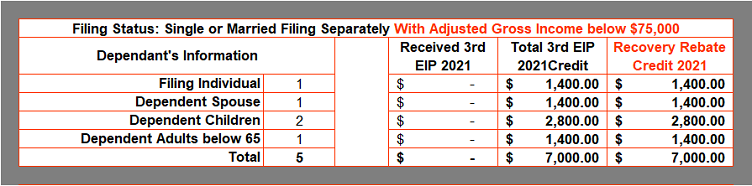

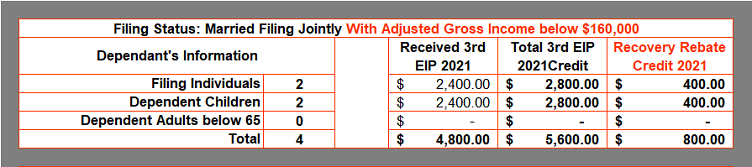

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Web 2021 Recovery Rebate Credit Questions and Answers Background If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021

Web 1 juil 2020 nbsp 0183 32 Married filing separately may be an option In most situations it is better for a married couple to file a joint return rather than file separately However the phaseout of the recovery rebates credit may

The Married Filing Separately Recovery Rebate Credit have gained huge popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization: This allows you to modify the design to meet your needs, whether it's designing invitations or arranging your schedule or even decorating your house.

-

Educational Worth: Free educational printables provide for students of all ages. This makes the perfect instrument for parents and teachers.

-

An easy way to access HTML0: Instant access to various designs and templates cuts down on time and efforts.

Where to Find more Married Filing Separately Recovery Rebate Credit

Fillable Online Claiming The Recovery Rebate Credit If Your Filing

Fillable Online Claiming The Recovery Rebate Credit If Your Filing

Web 27 nov 2022 nbsp 0183 32 I am married filing separately and claimed the recovery rebate credit in 2021 IRS disallowed and and had to repay it Why would this be I met the income

Web 18 janv 2022 nbsp 0183 32 At first glance it looks like filing Married Filing Separately will result in an additional 877 in taxes for the couple However Michelle s return will also contain an Recovery Rebate Credit of 4 200 meaning

Since we've got your curiosity about Married Filing Separately Recovery Rebate Credit Let's take a look at where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Married Filing Separately Recovery Rebate Credit to suit a variety of needs.

- Explore categories like the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets with flashcards and other teaching tools.

- Great for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- The blogs covered cover a wide selection of subjects, that includes DIY projects to party planning.

Maximizing Married Filing Separately Recovery Rebate Credit

Here are some inventive ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Married Filing Separately Recovery Rebate Credit are a treasure trove of innovative and useful resources catering to different needs and passions. Their accessibility and versatility make them a great addition to each day life. Explore the vast collection of Married Filing Separately Recovery Rebate Credit now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes you can! You can print and download the resources for free.

-

Can I use the free printables for commercial purposes?

- It's based on the rules of usage. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns with Married Filing Separately Recovery Rebate Credit?

- Some printables could have limitations regarding their use. Be sure to review the conditions and terms of use provided by the designer.

-

How can I print Married Filing Separately Recovery Rebate Credit?

- You can print them at home using the printer, or go to a print shop in your area for high-quality prints.

-

What program is required to open printables for free?

- A majority of printed materials are as PDF files, which can be opened using free software such as Adobe Reader.

The Recovery Rebate Credit Calculator ShauntelRaya

Can A Married Couple File Single They Can Contribute To A Roth Ira As

Check more sample of Married Filing Separately Recovery Rebate Credit below

Recovery Rebate Credit Married In 2023 Recovery Rebate

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Cares Act Recovery Rebate Credit Recovery Rebate

Recovery Credit Printable Rebate Form

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 If spouses file separately the spouse who has an SSN may claim the 2021 Recovery Rebate Credit the other spouse without a valid SSN will not qualify unless

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 The credit amount begins to be reduced at the same income thresholds as the 2020 Recovery Rebate Credits for example with adjusted gross income of more

Web 13 janv 2022 nbsp 0183 32 If spouses file separately the spouse who has an SSN may claim the 2021 Recovery Rebate Credit the other spouse without a valid SSN will not qualify unless

Web 17 f 233 vr 2022 nbsp 0183 32 The credit amount begins to be reduced at the same income thresholds as the 2020 Recovery Rebate Credits for example with adjusted gross income of more

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

Cares Act Recovery Rebate Credit Recovery Rebate

Recovery Credit Printable Rebate Form

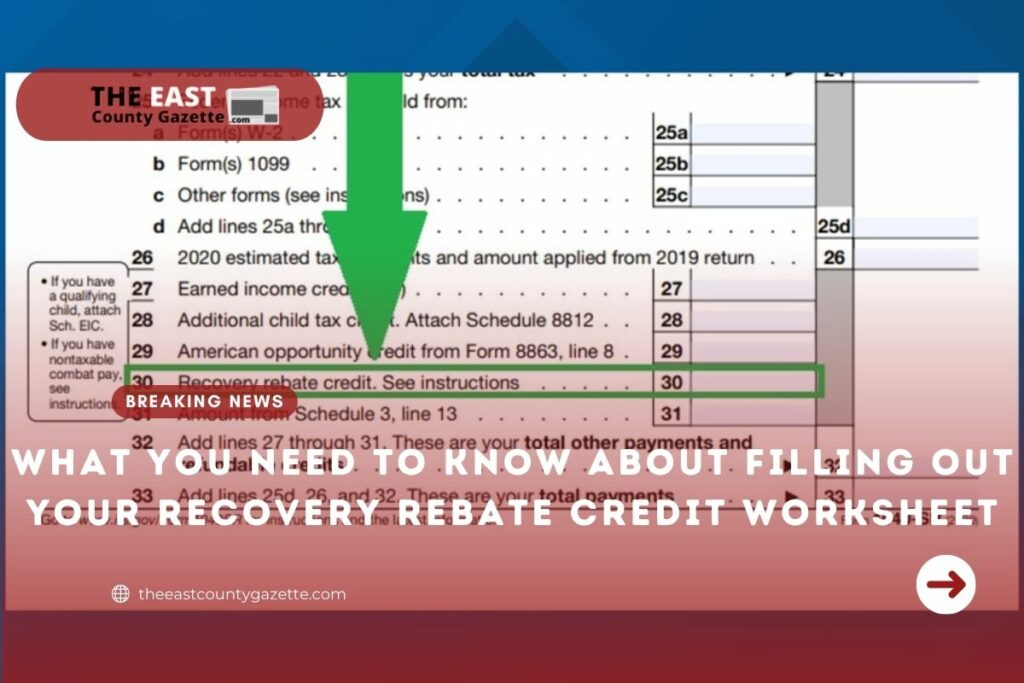

What You Need To Know About Filling Out Your Recovery Rebate Credit

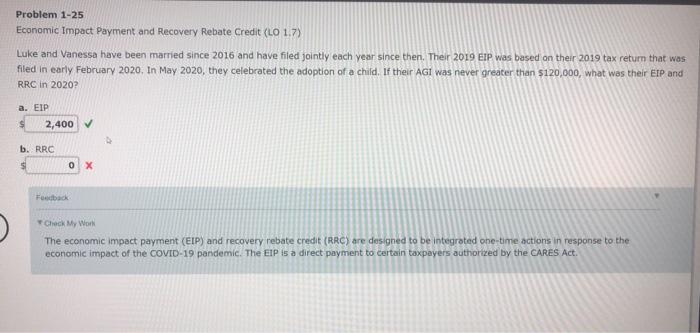

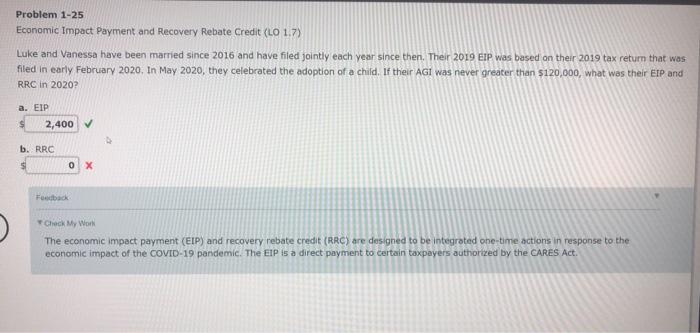

Solved Problem 1 25 Economic Impact Payment And Recovery Chegg

Solved Problem 1 25 Economic Impact Payment And Recovery Chegg

Recovery Rebate Credit Married Filing Separately Recovery Rebate