In this age of electronic devices, where screens rule our lives however, the attraction of tangible printed objects hasn't waned. For educational purposes project ideas, artistic or just adding the personal touch to your space, Is Fuel Tax Credit Taxable Income Ato are a great source. We'll take a dive deep into the realm of "Is Fuel Tax Credit Taxable Income Ato," exploring what they are, where you can find them, and how they can be used to enhance different aspects of your life.

Get Latest Is Fuel Tax Credit Taxable Income Ato Below

Is Fuel Tax Credit Taxable Income Ato

Is Fuel Tax Credit Taxable Income Ato - Is Fuel Tax Credit Taxable Income Ato, Is Fuel Tax Credit Taxable Income

Last updated 21 February 2023 Print or Download You can use the following methods when working out your fuel tax credits for heavy vehicles General method for heavy vehicles Basic method for heavy vehicles Simplified method for calculating fuel used in heavy vehicles with auxiliary equipment

Fuels eligible for fuel tax credits To be eligible for claiming fuel tax credits a fuel must be taxable That is fuel tax excise or customs duty must be paid on it You can use our Fuel tax credit eligibility tool to check if your fuel and activities are eligible See when you can claim fuel tax credits for liquid fuels and gaseous

Printables for free cover a broad selection of printable and downloadable materials that are accessible online for free cost. They come in many designs, including worksheets templates, coloring pages and more. The great thing about Is Fuel Tax Credit Taxable Income Ato is in their variety and accessibility.

More of Is Fuel Tax Credit Taxable Income Ato

Claim For Work Expenses Karis Tax And Accounting

Claim For Work Expenses Karis Tax And Accounting

Fuel tax credits you claimed for fuel you used to generate domestic electricity are not assessable income and you do not need to include them in your tax return Fuel tax credits you claimed for fuel your non profit organisation used to operate emergency vehicles or vessels are assessable income

The credit amount depends on when you acquire the fuel what fuel you use the activity you use it in Fuel tax credits rates change regularly so it s important to check the rates each time you do your BAS Before you can make a claim you must be registered for GST and fuel tax credits

The Is Fuel Tax Credit Taxable Income Ato have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Customization: It is possible to tailor print-ready templates to your specific requirements in designing invitations and schedules, or even decorating your home.

-

Educational Benefits: Free educational printables are designed to appeal to students of all ages. This makes these printables a powerful tool for parents and teachers.

-

Accessibility: Fast access various designs and templates reduces time and effort.

Where to Find more Is Fuel Tax Credit Taxable Income Ato

ATO

ATO

Last updated 5 July 2021 Print or Download On this page Simplified methods for claims less than 10 000 each year Simplified methods for all claims You may be able to use simplified methods to keep records and calculate your fuel tax credit claim You ll need to be registered for and eligible to claim fuel tax credits

1 Check if you re eligible for fuel tax credits Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their business activities You can claim for taxable fuel that you purchase manufacture or import Just make sure it s used in your business Taxable fuels include liquid fuels fuel blends

In the event that we've stirred your interest in printables for free Let's take a look at where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Is Fuel Tax Credit Taxable Income Ato designed for a variety objectives.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- These blogs cover a broad range of interests, starting from DIY projects to party planning.

Maximizing Is Fuel Tax Credit Taxable Income Ato

Here are some creative ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print free worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Is Fuel Tax Credit Taxable Income Ato are a treasure trove of useful and creative resources that can meet the needs of a variety of people and desires. Their availability and versatility make them a fantastic addition to both professional and personal life. Explore the vast array of Is Fuel Tax Credit Taxable Income Ato to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes they are! You can print and download these resources at no cost.

-

Can I download free printables for commercial use?

- It's contingent upon the specific usage guidelines. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may come with restrictions on usage. Be sure to review these terms and conditions as set out by the creator.

-

How do I print printables for free?

- Print them at home using printing equipment or visit a local print shop for premium prints.

-

What software do I need to run printables that are free?

- The majority of PDF documents are provided in the format of PDF, which is open with no cost software, such as Adobe Reader.

Is The Ertc Tax Credit Taxable Income

Is The Employee Retention Tax Credit Taxable The Lake Law Firm

Check more sample of Is Fuel Tax Credit Taxable Income Ato below

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Is The ERC Tax Credit Taxable

Is The Employee Retention Credit Taxable Income ERC Bottom Line Savings

Is The Employee Retention Credit Taxable Income TPG Can Help

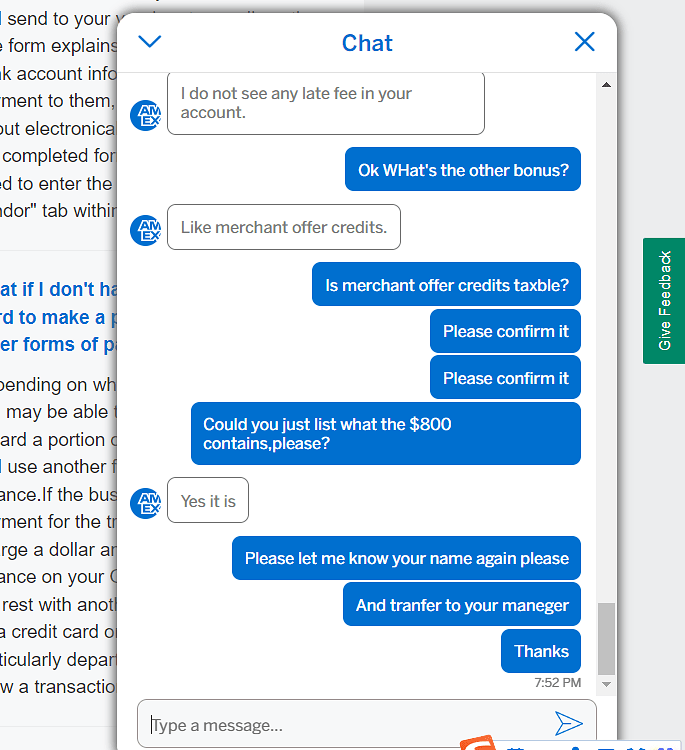

AMEX Merchant Offer Credit Is Taxable

Is The Employee Retention Tax Credit Taxable Authentic Information

https://www.ato.gov.au/.../fuel-tax-credits-business/eligibility/eligible-fuels

Fuels eligible for fuel tax credits To be eligible for claiming fuel tax credits a fuel must be taxable That is fuel tax excise or customs duty must be paid on it You can use our Fuel tax credit eligibility tool to check if your fuel and activities are eligible See when you can claim fuel tax credits for liquid fuels and gaseous

https://www.ato.gov.au/.../fuel-schemes/fuel-tax-credits-business

Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in light vehicles travelling off public roads or on private roads

Fuels eligible for fuel tax credits To be eligible for claiming fuel tax credits a fuel must be taxable That is fuel tax excise or customs duty must be paid on it You can use our Fuel tax credit eligibility tool to check if your fuel and activities are eligible See when you can claim fuel tax credits for liquid fuels and gaseous

Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in light vehicles travelling off public roads or on private roads

Is The Employee Retention Credit Taxable Income TPG Can Help

Is The ERC Tax Credit Taxable

AMEX Merchant Offer Credit Is Taxable

Is The Employee Retention Tax Credit Taxable Authentic Information

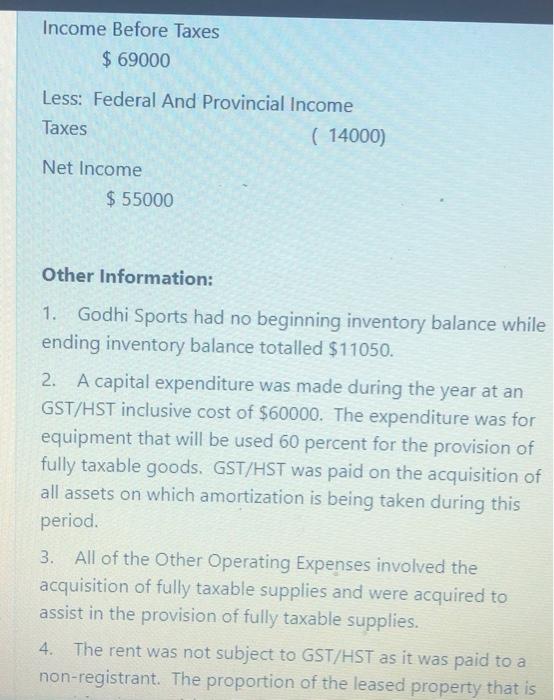

Solved George Godhi Has A Sole Proprietorship Called Godhi Chegg

Are Refunds From Employee Retention Tax Credit Taxable

Are Refunds From Employee Retention Tax Credit Taxable

Is The Employee Retention Tax Credit Taxable Income Trapper Industries