In this age of electronic devices, with screens dominating our lives however, the attraction of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons for creative projects, simply adding a personal touch to your area, Irs Tax Credit Air Conditioner are now a vital source. We'll take a dive deeper into "Irs Tax Credit Air Conditioner," exploring their purpose, where they are available, and how they can add value to various aspects of your daily life.

Get Latest Irs Tax Credit Air Conditioner Below

Irs Tax Credit Air Conditioner

Irs Tax Credit Air Conditioner - Irs Tax Credit Air Conditioner, Irs Tax Credit For New Air Conditioner, Irs Air Conditioner Tax Credit 2023, Irs Air Conditioner Tax Credit 2022, Does My Air Conditioner Qualify For Tax Credit, Can I Claim A Tax Credit For A New Air Conditioner, What Ac Units Qualify For Tax Credit, How Do I Know If My Air Conditioner Qualifies For A Tax Credit

Credits Deductions Frequently asked questions about energy efficient home improvements and residential clean energy property credits Energy Efficient Home Improvement Credit Qualifying Expenditures and Credit Amount Updated FAQs were released to the public in Fact Sheet 2024 15 PDF April 17 2024 Q1

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Irs Tax Credit Air Conditioner offer a wide selection of printable and downloadable content that can be downloaded from the internet at no cost. These resources come in various designs, including worksheets templates, coloring pages, and many more. The benefit of Irs Tax Credit Air Conditioner is in their variety and accessibility.

More of Irs Tax Credit Air Conditioner

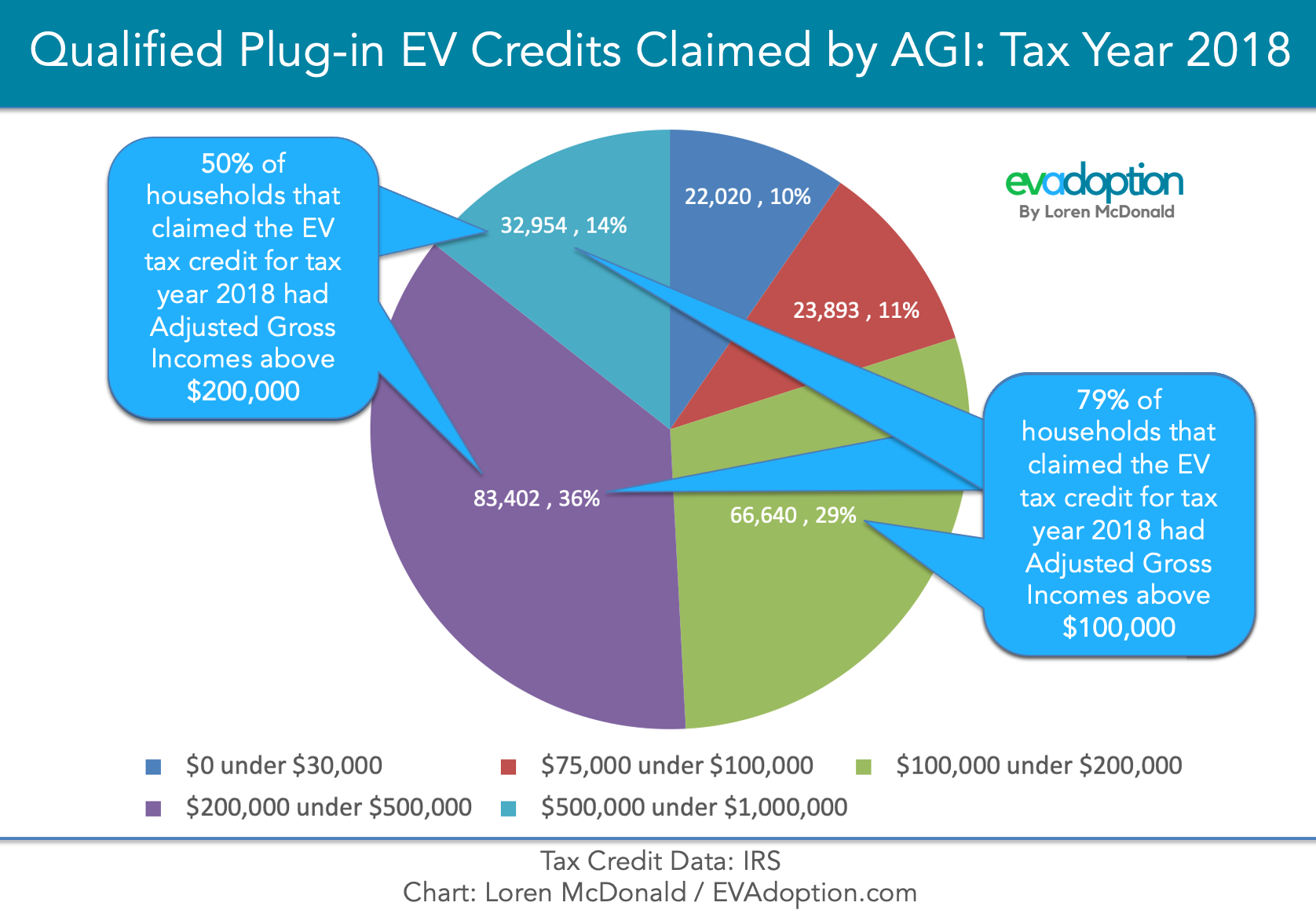

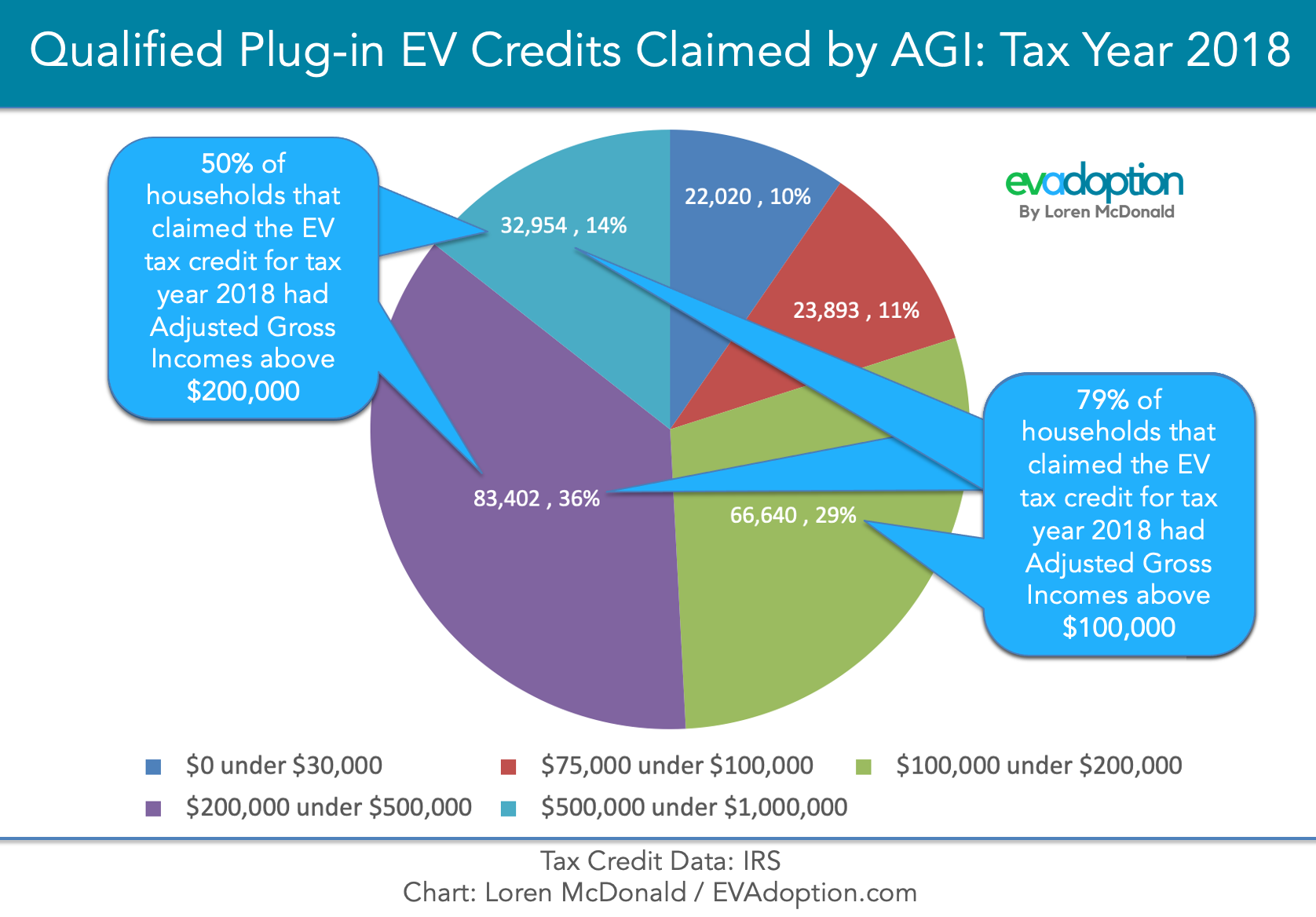

IRS Tax credit by Household AGI 2018 updated FINAL2 EVAdoption

IRS Tax credit by Household AGI 2018 updated FINAL2 EVAdoption

Exterior doors windows and skylights insulation materials or systems and air sealing materials or systems the home must be located in the United States and must be owned and used by the taxpayer as the taxpayer s principal residence 1

Central air conditioners Natural gas propane or oil water heaters Natural gas propane or oil furnaces and hot water boilers Heat pumps water heaters biomass stoves and boilers Home energy audits of a main home The maximum credit that can be claimed each year is

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

customization: The Customization feature lets you tailor the design to meet your needs whether it's making invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value: Free educational printables are designed to appeal to students of all ages. This makes them a great source for educators and parents.

-

An easy way to access HTML0: Access to various designs and templates cuts down on time and efforts.

Where to Find more Irs Tax Credit Air Conditioner

Irs Form 5695 Instructions 2023 Printable Forms Free Online

Irs Form 5695 Instructions 2023 Printable Forms Free Online

Central air conditioning 300 for air conditioners recognized as ENERGY STAR Most Efficient Air source heat pumps 300 for ENERGY STAR certified heat pumps Natural gas propane or oil furnace 150 for ENERGY STAR certified gas furnaces except those certified for U S South only

Eficient air conditioners Eficient heating equipment Eficient water heating equipment Other Energy Eficiency Upgrades Electric panel or circuit upgrades for new electric equipment N A 300 150 N A Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost up to 2 000 per year 30 of cost up to 600

We've now piqued your interest in Irs Tax Credit Air Conditioner We'll take a look around to see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Irs Tax Credit Air Conditioner for various applications.

- Explore categories such as decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- It is ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a wide variety of topics, starting from DIY projects to party planning.

Maximizing Irs Tax Credit Air Conditioner

Here are some ideas to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print worksheets that are free for teaching at-home and in class.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Irs Tax Credit Air Conditioner are a treasure trove of creative and practical resources which cater to a wide range of needs and interests. Their accessibility and flexibility make them a wonderful addition to the professional and personal lives of both. Explore the vast collection of Irs Tax Credit Air Conditioner right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes, they are! You can print and download the resources for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's based on specific rules of usage. Be sure to read the rules of the creator before using printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables may be subject to restrictions regarding their use. Check these terms and conditions as set out by the creator.

-

How do I print printables for free?

- You can print them at home with any printer or head to an in-store print shop to get superior prints.

-

What program do I need to run Irs Tax Credit Air Conditioner?

- The majority of PDF documents are provided in the PDF format, and is open with no cost programs like Adobe Reader.

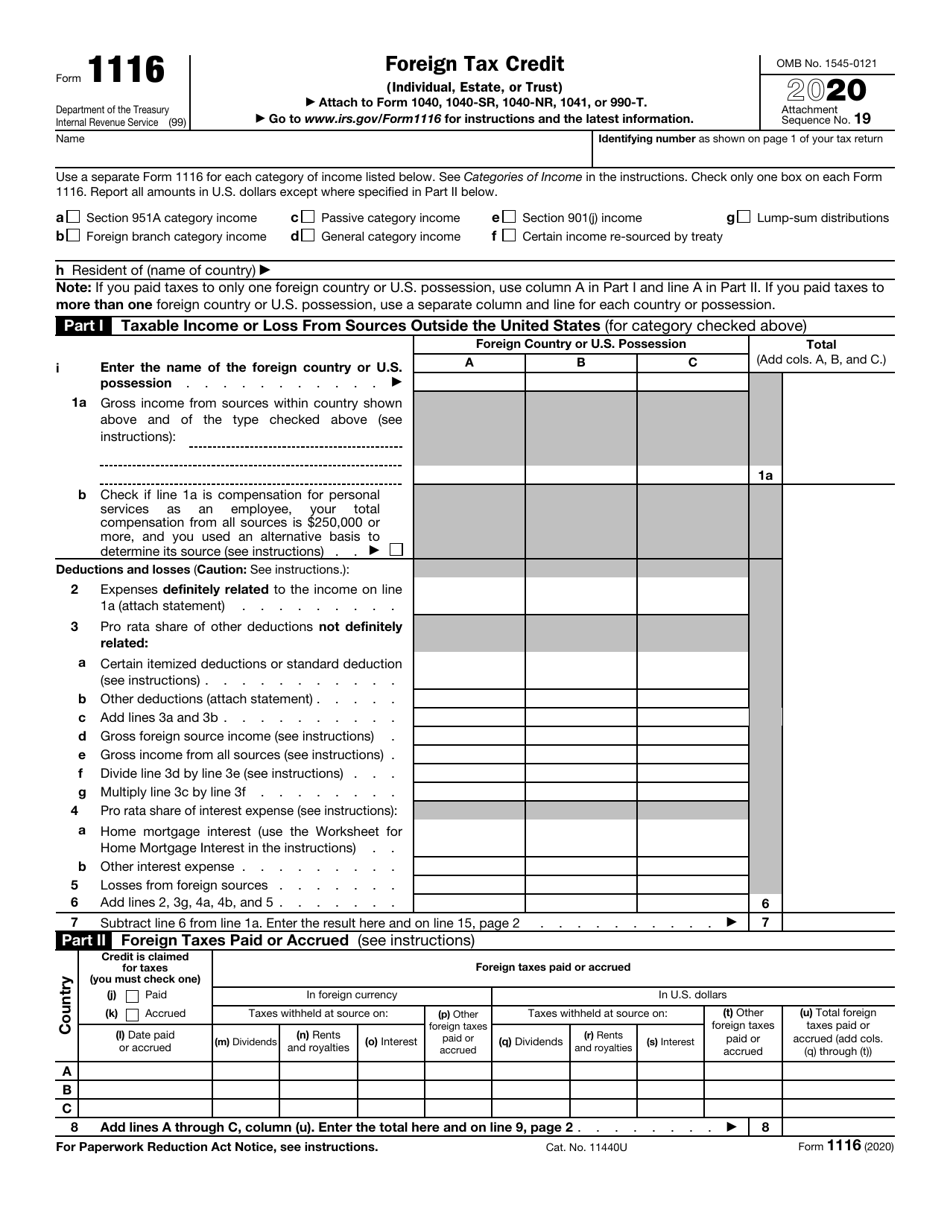

Irs Form 1116 Printable Printable Forms Free Online

For 346PRODUCTION Www directingactors

Check more sample of Irs Tax Credit Air Conditioner below

The Central Board Of Direct Tax CBDT Modified The Provisions Of The

2023 Home Energy Federal Tax Credits Rebates Explained

Income Tax 2022 Irs Latest News Update

Cost To Install A Heat Pump 2023 Cost Guide Inch Calculator

Form 5695 Instructions 2023 Printable Forms Free Online

Federal Tax Credits

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.energystar.gov/about/federal-tax...

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

Cost To Install A Heat Pump 2023 Cost Guide Inch Calculator

2023 Home Energy Federal Tax Credits Rebates Explained

Form 5695 Instructions 2023 Printable Forms Free Online

Federal Tax Credits

Solar Tax Credit And Your Boat Updated Blog

Goodman Rebates

Goodman Rebates

Does 15 Seer AC Qualify For Tax Credit Revealed