In this age of technology, where screens have become the dominant feature of our lives and the appeal of physical printed objects hasn't waned. Whatever the reason, whether for education, creative projects, or simply adding an element of personalization to your space, Inflation Reduction Act Ev Rebates have proven to be a valuable source. Through this post, we'll dive through the vast world of "Inflation Reduction Act Ev Rebates," exploring what they are, where you can find them, and how they can enhance various aspects of your lives.

Get Latest Inflation Reduction Act Ev Rebates Below

Inflation Reduction Act Ev Rebates

Inflation Reduction Act Ev Rebates - Inflation Reduction Act Ev Rebates, Inflation Reduction Act Ev Rebate Effective Date, Inflation Reduction Act Ev Charger Rebate, Inflation Reduction Act Ev Tax Credit Effective Date, Inflation Reduction Act Ev Charger Tax Credit, Inflation Reduction Act Ev Tax Credit Income Limit, Inflation Reduction Act Used Ev Tax Credit, Inflation Reduction Act Ev Tax Credit 2023, Inflation Reduction Act Ev Tax Credit Tesla, Irs Inflation Reduction Act Ev Tax Credit

Web 19 ao 251 t 2022 nbsp 0183 32 As a result these electric cars are ineligible for a credit under the new inflation law Chevrolet Bolt EV and EUV GMC Hummer Pickup and SUV and Tesla

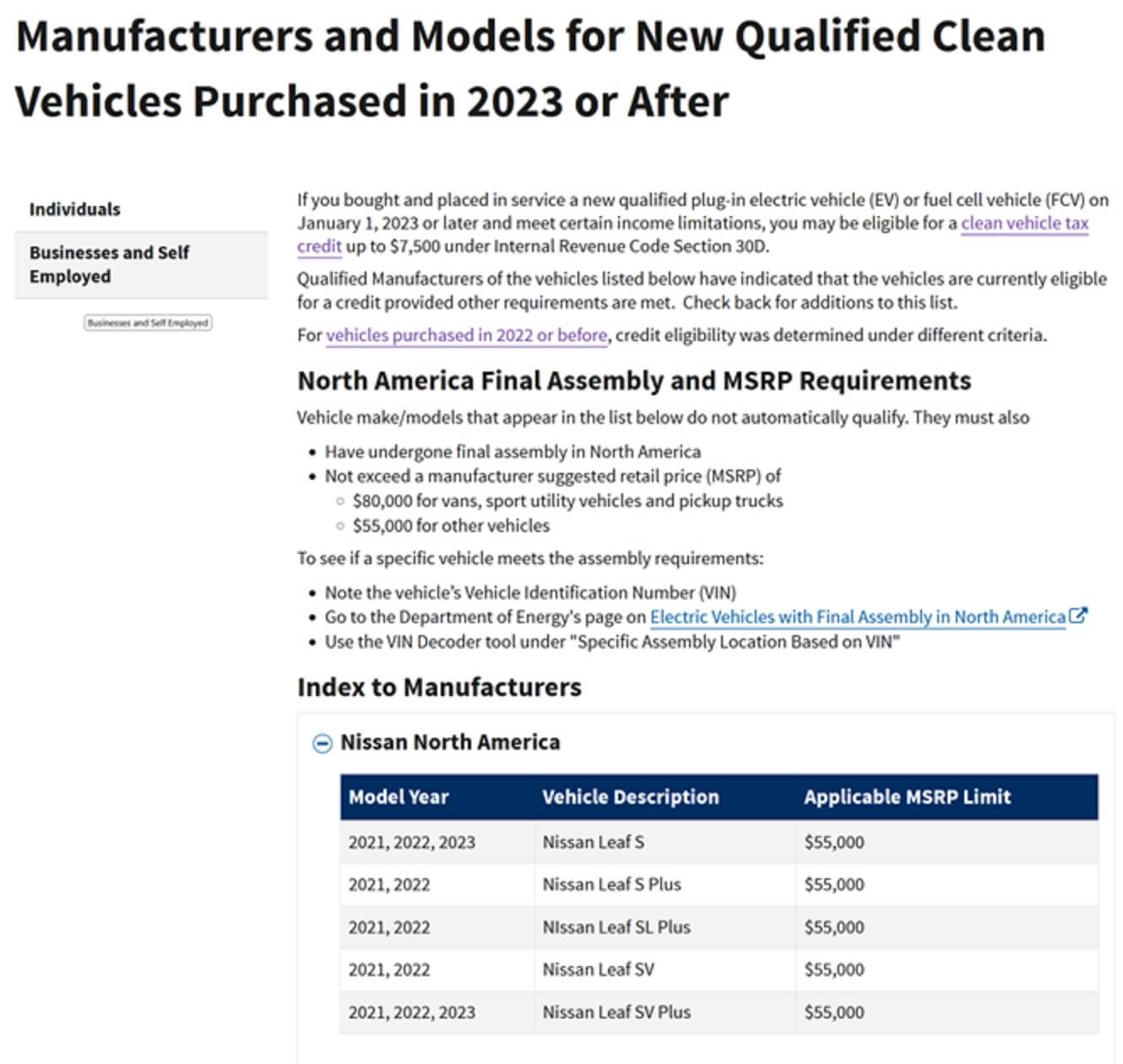

Web 17 ao 251 t 2022 nbsp 0183 32 Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The

Inflation Reduction Act Ev Rebates offer a wide range of downloadable, printable resources available online for download at no cost. These resources come in various types, like worksheets, coloring pages, templates and many more. The value of Inflation Reduction Act Ev Rebates is their versatility and accessibility.

More of Inflation Reduction Act Ev Rebates

Inflation Reduction Act Appliance Rebates Samsung US

Inflation Reduction Act Appliance Rebates Samsung US

Web the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America Further

Web 10 ao 251 t 2022 nbsp 0183 32 Under the Inflation Reduction Act which received Senate approval on Sunday and is expected to clear the House this week a tax credit worth up to 7 500

Inflation Reduction Act Ev Rebates have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Individualization It is possible to tailor the templates to meet your individual needs, whether it's designing invitations for your guests, organizing your schedule or even decorating your house.

-

Education Value Free educational printables provide for students of all ages. This makes them a vital instrument for parents and teachers.

-

It's easy: Instant access to many designs and templates reduces time and effort.

Where to Find more Inflation Reduction Act Ev Rebates

What s In The Inflation Reduction Act And What s Next For Its

What s In The Inflation Reduction Act And What s Next For Its

Web 29 juil 2022 nbsp 0183 32 The new Inflation Reduction Act promises major changes to the federal incentive program for electric cars and trucks 270639 no title EV rebates Inflation

Web The Inflation Reduction Act also extended the tax break for residential charging systems through 2032 and made it retroactive to Jan 1 2022 It s worth 1 000 or 30 of the

We've now piqued your curiosity about Inflation Reduction Act Ev Rebates and other printables, let's discover where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Inflation Reduction Act Ev Rebates suitable for many objectives.

- Explore categories like design, home decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a broad variety of topics, including DIY projects to planning a party.

Maximizing Inflation Reduction Act Ev Rebates

Here are some creative ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars with to-do lists, planners, and meal planners.

Conclusion

Inflation Reduction Act Ev Rebates are an abundance of creative and practical resources catering to different needs and passions. Their access and versatility makes them a fantastic addition to any professional or personal life. Explore the wide world of Inflation Reduction Act Ev Rebates today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Inflation Reduction Act Ev Rebates really free?

- Yes, they are! You can download and print these items for free.

-

Do I have the right to use free printables for commercial purposes?

- It's based on the usage guidelines. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright rights issues with Inflation Reduction Act Ev Rebates?

- Certain printables may be subject to restrictions regarding their use. Be sure to read the terms and regulations provided by the creator.

-

How can I print printables for free?

- Print them at home using your printer or visit an in-store print shop to get premium prints.

-

What program do I require to view printables that are free?

- The majority of PDF documents are provided in the PDF format, and can be opened with free software such as Adobe Reader.

What The Inflation Reduction Act Could Mean For The Economy

Inflation Reduction Act Home Energy Rebate Program Moves Forward

Check more sample of Inflation Reduction Act Ev Rebates below

Inflation Reduction Act For Homeowners In 2022 Energy Retrofit

2022 Inflation Reduction Act News And Events For Air Inc Heating And

MSH PRESENTS HOW TO SAVE ENERGY WITH CREDITS REBATES FROM THE

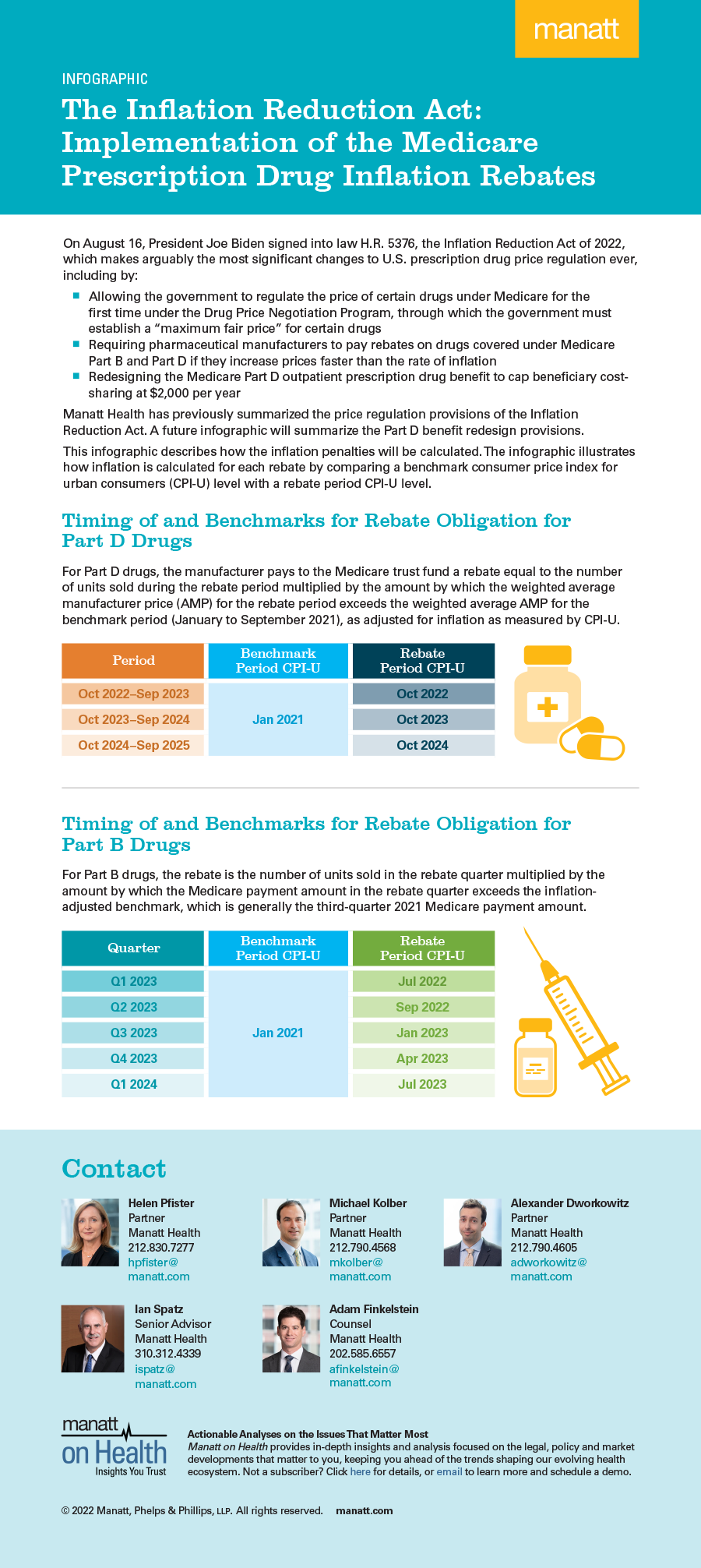

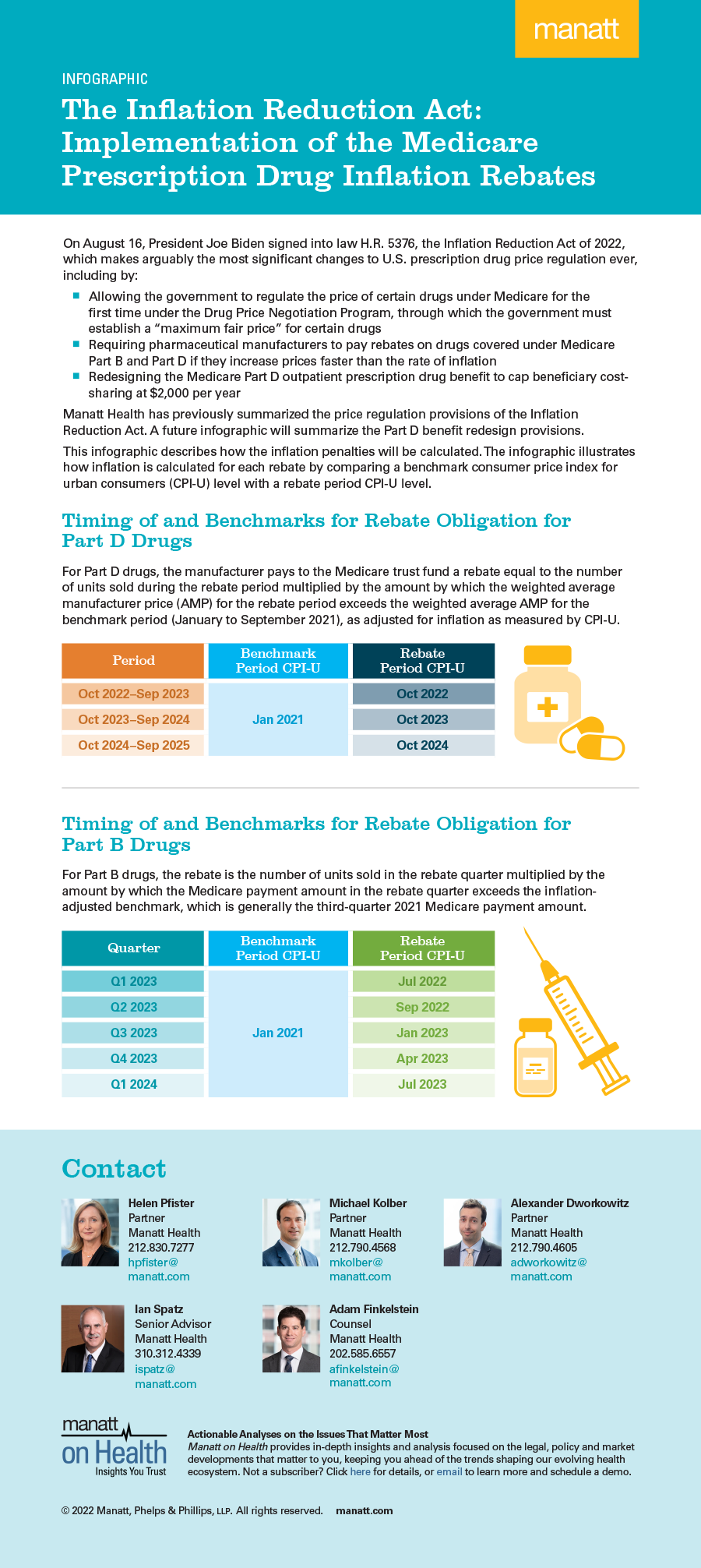

The Inflation Reduction Act Implementation Of The Medicare

Inflation Reduction Act Health Insurance Broker Raleigh

EVs Eligible For 7 500 EV Tax Credit In Inflation Reduction Act

https://www.theverge.com/23310457/inflatio…

Web 17 ao 251 t 2022 nbsp 0183 32 Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Web 17 ao 251 t 2022 nbsp 0183 32 Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

The Inflation Reduction Act Implementation Of The Medicare

2022 Inflation Reduction Act News And Events For Air Inc Heating And

Inflation Reduction Act Health Insurance Broker Raleigh

EVs Eligible For 7 500 EV Tax Credit In Inflation Reduction Act

Inflation Reduction Act Appliance Rebates Samsung US

Inflation Reduction Act Healthcare Provisions

Inflation Reduction Act Healthcare Provisions

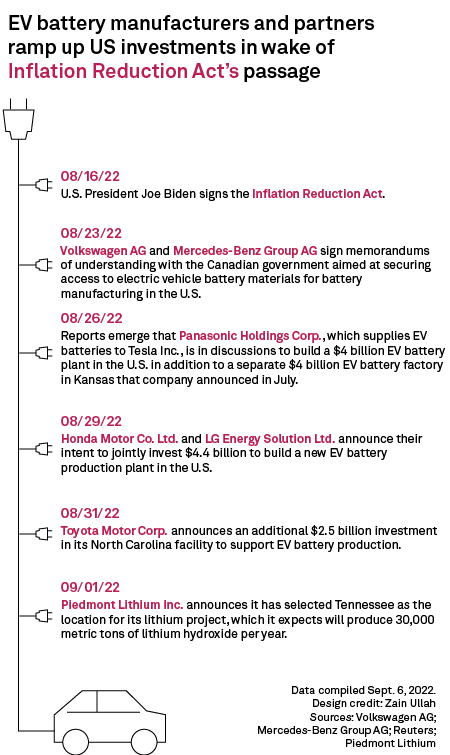

EV Announcements Snowballing Post Inflation Reduction Act S P Global