In this day and age where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. For educational purposes project ideas, artistic or just adding a personal touch to your space, Income Tax Rebate Under Section 80e are now an essential resource. For this piece, we'll dive into the world of "Income Tax Rebate Under Section 80e," exploring what they are, where you can find them, and the ways that they can benefit different aspects of your life.

Get Latest Income Tax Rebate Under Section 80e Below

Income Tax Rebate Under Section 80e

Income Tax Rebate Under Section 80e - Income Tax Rebate Under Section 80eea, Income Tax Rebate Under Section 80e, Income Tax Rebate Under Section 80ee, Income Tax Deduction Under Section 80eea, Income Tax Deduction Under Section 80ee, Income Tax Deduction Under Section 80e, Income Tax Exemption Under Section 80e, Income Tax Deduction Under Section 80eeb, Income Tax Deduction Under Section 80gg, Income Tax Exemption Under Section 80gg

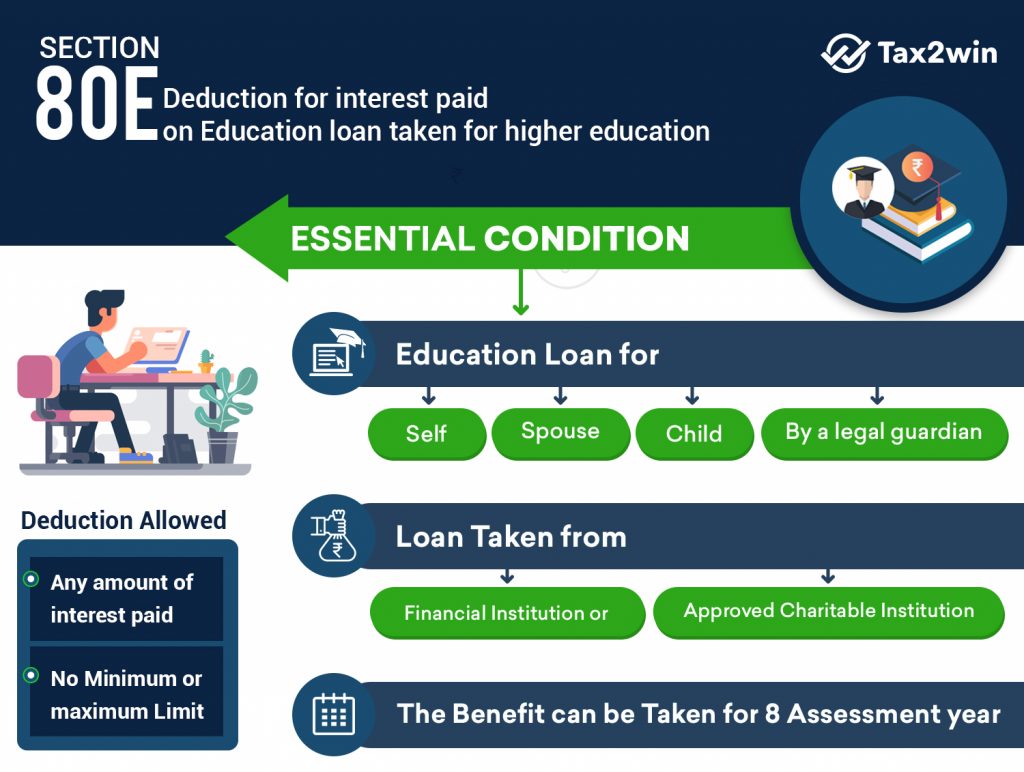

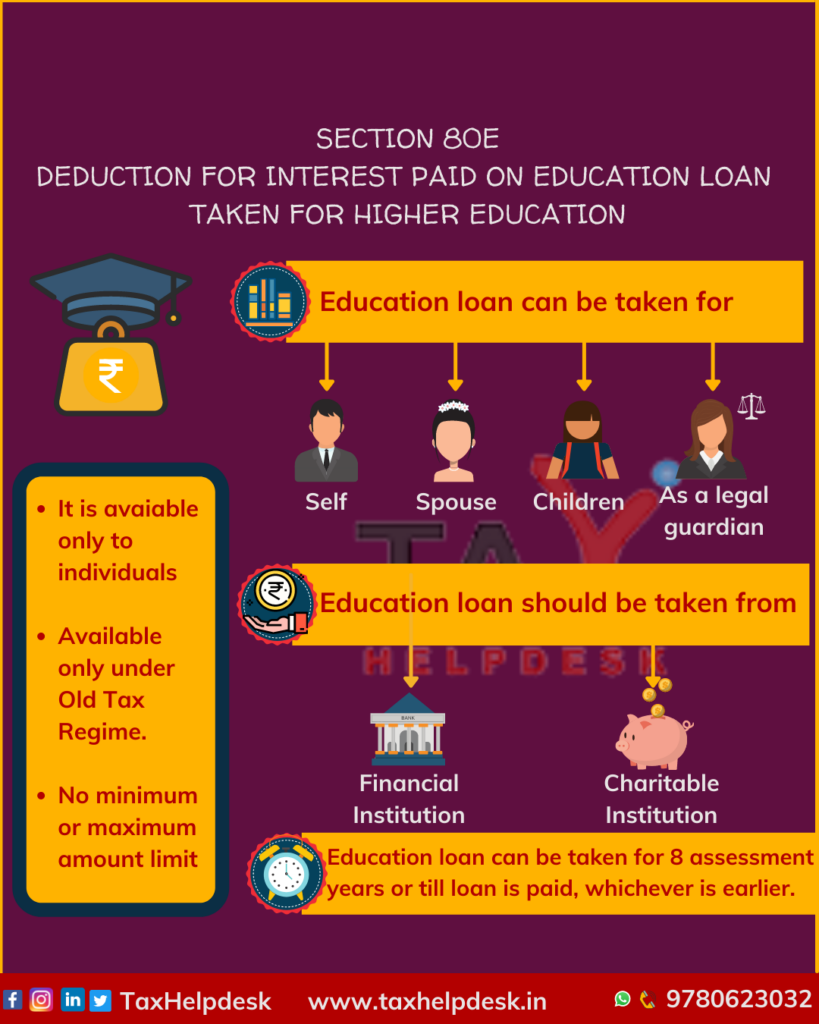

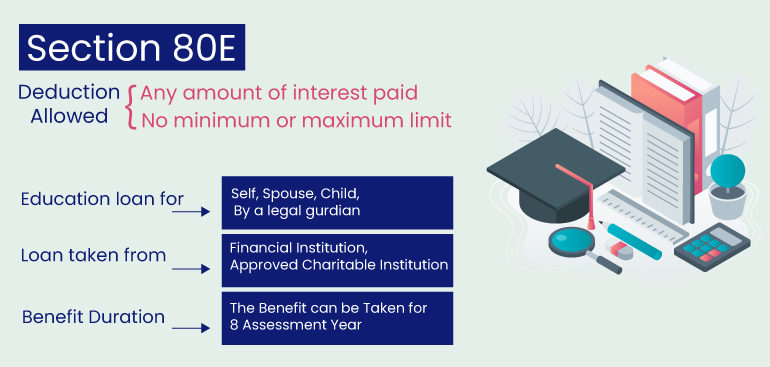

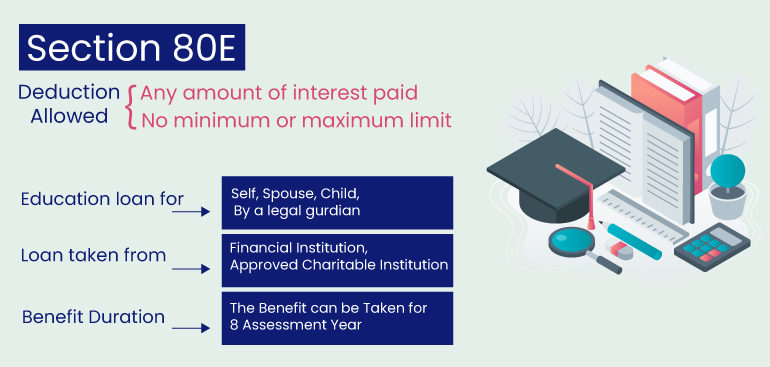

Web Section 80E Income Tax Deduction for Education Loan Since 2009 Section 80E Income Tax Deduction for Education Loan As per the Income Tax Act a taxpayer is allowed to claim deduction under Chapter VI A for

Web 30 mars 2023 nbsp 0183 32 According to Section 80E of income tax you must request an education loan from reputable financial institutions such as a bank an NBFC or a charitable

Income Tax Rebate Under Section 80e encompass a wide range of downloadable, printable materials that are accessible online for free cost. These resources come in many formats, such as worksheets, coloring pages, templates and more. One of the advantages of Income Tax Rebate Under Section 80e lies in their versatility and accessibility.

More of Income Tax Rebate Under Section 80e

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Web 26 juin 2018 nbsp 0183 32 Section 80E Deduction available if Interest is been paid during the previous year and was paid out of income chargeable to tax which means if repayment is made

Web 23 sept 2019 nbsp 0183 32 Section 80C of the Income Tax Act provides deduction in respect of the tuition fees paid for the education However section 80E of the Income Tax Act

Income Tax Rebate Under Section 80e have gained a lot of popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Individualization We can customize designs to suit your personal needs when it comes to designing invitations to organize your schedule or decorating your home.

-

Educational Impact: Free educational printables are designed to appeal to students of all ages, which makes them a valuable tool for teachers and parents.

-

Easy to use: The instant accessibility to many designs and templates, which saves time as well as effort.

Where to Find more Income Tax Rebate Under Section 80e

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Web Education Loan Tax 80E Rebate Calculator Most accurate calculator for section 80E education loan income Tax exemption The easiest and the quickest way to calculate your education loan income tax benefits as

Web According to Section 80E of the Income Tax Act 1961 you can claim a tax deduction on the interest paid on your education loans taken to pursue higher education This tax

Now that we've ignited your curiosity about Income Tax Rebate Under Section 80e, let's explore where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Income Tax Rebate Under Section 80e for various objectives.

- Explore categories like interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- It is ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- These blogs cover a wide array of topics, ranging ranging from DIY projects to party planning.

Maximizing Income Tax Rebate Under Section 80e

Here are some new ways that you can make use use of Income Tax Rebate Under Section 80e:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets for teaching at-home or in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate Under Section 80e are a treasure trove filled with creative and practical information which cater to a wide range of needs and passions. Their availability and versatility make them an invaluable addition to both personal and professional life. Explore the plethora of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate Under Section 80e truly completely free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I utilize free templates for commercial use?

- It's contingent upon the specific terms of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright violations with Income Tax Rebate Under Section 80e?

- Some printables may come with restrictions in their usage. You should read these terms and conditions as set out by the creator.

-

How can I print Income Tax Rebate Under Section 80e?

- Print them at home with either a printer or go to an area print shop for the highest quality prints.

-

What software do I require to view printables that are free?

- The majority are printed in the format PDF. This is open with no cost programs like Adobe Reader.

Section 80E Deduction For Interest On Education Loan Tax2win

Deduction Under Section 80E Interest Paid On Higher Education

Check more sample of Income Tax Rebate Under Section 80e below

Section 80C Deduction Under Section 80C In India Paisabazaar

![]()

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Section 80E

Deduction Under Section 80E Of Income Tax Act YouTube

Section 80D Income Tax Deduction For Medical Insurance Preventive

Tax Benefit Related To Interest Paid On Education Loan Blog

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 According to Section 80E of income tax you must request an education loan from reputable financial institutions such as a bank an NBFC or a charitable

https://navi.com/blog/section-80e-income-tax-act

Web 12 janv 2022 nbsp 0183 32 You can claim tax deductions under Section 80E of the Income Tax Act while you file your ITR You do not need to attach any documentary proof for availing of

Web 30 mars 2023 nbsp 0183 32 According to Section 80E of income tax you must request an education loan from reputable financial institutions such as a bank an NBFC or a charitable

Web 12 janv 2022 nbsp 0183 32 You can claim tax deductions under Section 80E of the Income Tax Act while you file your ITR You do not need to attach any documentary proof for availing of

Deduction Under Section 80E Of Income Tax Act YouTube

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Section 80D Income Tax Deduction For Medical Insurance Preventive

Tax Benefit Related To Interest Paid On Education Loan Blog

9 Section 80E SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Income Tax Deductions 1 Section 80D 80DD 80DDB 80E 80G 80GG 80U 80CCD1B